This does not constitute investment advice. Returns mentioned herein are in no way a guarantee or promise of future returns. Mutual Fund investments are subject to market risks

The latest brain-child of our expert research team that has over 20 years of experience...

Get Your FREE Copy Today!

INSIDE: You Will Find 5 High Potential Equity Funds, Still Undiscovered and Off The Market Radar...

Dear Reader,

What we are about to share with you is not common knowledge.

It's actually known only to a few successful investors.

But not anymore...

Because today we are going to unveil a very less known method to gain potentially super

A method allowing smart investors to get the absolute most out of their money. Regardless of their age, ability, or financial status.

How they invest in unknown or undiscovered funds that very few people know about, to make the most out of them.

In the next five minutes, you can come to know about 5 Undiscovered Equity Funds that very few investors know about and have the potential to increase your returns exponentially.

All of which YOU can invest in right away, to begin building the kind of wealth that ensures TRUE financial freedom

If the idea of milking Undiscovered Equity Funds To Get High Returns excites you, then you've come to the right place.

Because we are giving away our latest report that will give you access to 5 High Rewarding Equity Funds that have still not caught investors attention.

It's called 5 Undiscovered Equity Funds, and I want to send you access to it ABSOLUTELY FREE.

We'll tell you exactly why in a moment.

But first, here's a little sample of what you'll find inside...

Undiscovered Fund #1

Launched with the objective of benefiting from extra-ordinary growth opportunities prevailing across stocks and sectors, this fund has been capable of capturing on such opportunities and has beaten the broader markets over longer time period.

In the last 5 years, the fund has generated returns at around 12.3% CAGR and has beaten its benchmark by a CAGR of 2.5 percentage points.

Undiscovered Fund #2

This fund comes with a mandate to hold exposure across both large caps and midcaps, but carries a large cap bias.

Despite a history of over a decade dominated by a track record of stable performance, the fund has gone unnoticed by investors. It has a corpus of just about Rs 1,000 crore, that has more than doubled in the last one year.

Undiscovered Fund #3

This fund has always eyed for growth. It held just about Rs 220 Crore in 2013, which shows it was not well known and not trusted by many. Still, it turned out to be a well managed fund and has even stood among the top performers in its category

Despite giving a market beating performance over the past 5 years, the fund size stands at just about Rs 725 crore

Undiscovered Fund #4

In the last 5 years, this less popular fund has shown a stellar performance and has grown at a CAGR of 11.3%. An investment of Rs 1 Lakh in the fund (made in Jan 2015) would have appreciated to Rs 1.70 lakh.

That's an increase by 1.7 times! Just in comparison, a similar investment in its then popular peer would have grown to just about Rs 1.25 lakh.

Undiscovered Fund #5

An aggressive hybrid style fund that follows asset allocation strategy to generate capital appreciation through equities, while adds some element of stability through significant allocation to debt.

With a CAGR of around 12.8%, Rs 1 lakh invested in its NFO four and a half years back would have grown to around Rs 1.72 Lakhs!

You see, it is hidden gems like these that have the potential to make money for investors, but not many know about them!

These are the winners of tomorrow, which could make one wealthier!

And that is exactly why one should consider investing in them.

How Do We Know This?

That's a very good question.

A question which we would love to answer, but would rather keep a secret.

It will not be fair to our premium clients who have bought our services.

One simple reason we can tell you now is that finding such hidden opportunities is our bread and butter.

It is what makes us stand apart and makes us better then many out there.

After all, we are one of the oldest one in this business.

Our research team has been successfully assisting people get financially educated and wealthy for well over 20 years now.

It is our job to find such hidden opportunities and make them available to our premium subscribers exclusively.

Hence, we have decided to make this available to as many people as possible.

That is because we want every investor to have a fair chance at building wealth.

And that is exactly why we are going to give this exclusive report for ABSOLUTELY FREE!

But before we go on and tell you how you can get this report worth Rs 5000 for Free, there is something more we would want you to know.

You Are Not The Only One Losing Money!

Let me ask you a question...

On what basis do you pick the funds you invest in?

-

Unverified Personal Advisor?

-

Hearsay Tips?

-

TV Channels?

-

News Papers?

-

Internet Search?

Or the worst... "Gut Feeling".

Well, most of the investors might depend on one of the above.

And finally, they might end up losing their hard earned money!

Losing sleep and peace of mind.

So honestly, you are not the only one losing money.

Picking of funds requires a special skill set and a lot of research & analytical expertise, which not many possess in the market.

How do you suppose someone who is not qualified to pick funds, can help you make any money out of them?

We can only think of one reason such an arrangement could work... LUCK!

If that is the plan, well then all the best to you.

However, if you want to break free from the "Not happy with these returns" phenomenon, we have news for you.

And what we are about to show you now is the key to get our exclusive report

"5 Undiscovered Equity Funds With High Potential" for FREE.

Presenting 'FundSelect' Our Premium Service That Has Beaten The Market By Over 70% In A Decade.

Yes, you read it right.

There is a reason FundSelect is our most sought after premium research service.

It is one of the oldest mutual fund research services in India, with a history of over 15 years.

Yes... 15 Years!

Most entities entering financial services business then, were either getting into stock broking, or insurance selling, or mutual fund distribution.

That seemed like the easier path to take and the money to be made from commissions was enormous.

But the small investor and any guidance to them for making wealth was missing.

And that's when we thought of doing something different for the gullible investors.

It was sure a tough decision! A challenging one...

And we even faced criticism for what we were intending to do...

But somewhere we were convinced that there was a genuine demand from small investors for authentic, independent and unbiased research on Indian mutual funds.

Of course, the money managed by Indian mutual funds then was just around 5% of what it is today.

And we knew, there were still plenty of funds to be launched that needs to be researched...and avoided in the interest of investors.

That is when and why we launched "FundSelect".

And So, History Was Created!

It seems like yesterday, but FundSelect has recently completed 15 years of helping mutual fund investors...

-

Identify potentially the best mutual funds to invest in

-

Identify the dud mutual funds to avoid

The aim of this service has always been to identify the 'right' mutual funds that can meet your long term financial goals.

That's not all, we also recommend funds you must avoid at all cost (and there are many of these around right now).

This is what we have been doing for over the past 15 years, benefitting the lives of thousands of people who have been our subscribers at different points during this

And why not?

FundSelect carries the pedigree of PersonalFN, which is amongst India's leading mutual fund research and financial planning brand.

We are known for our credible, unbiased, and market-beating mutual fund research, and our subscribers would vouch for that...

I am obliged to PFN for educating me in management of personal finance. I have designed my MF portfolio taking guidance from PFN. I appreciate prompt responsiveness of PFN team to subscriber queries, and their approach to take onboard subscriber requests and feedback. In particular, I liked research reports for a couple of funds which clearly guide investors not to invest in spite of high returns, due to underlying risk and doubtful sustainability of returns in the long term. This differentiates PFN from other MF research services.

~ Rasesh Choksi

(FundSelect and FundSelect Plus subscriber since Oct 2012)

Beating The Market By Over 70%!

This is not a common occurrence!

But we can proudly boast of the same.

FundSelect is our premier equity mutual fund recommendation service that aims to help you discover those exclusive fund investments, out of the over 500 equity mutual funds out there in the market, which come with solid potential to make money in long run.

As a service, FundSelect focuses primarily on two goals,

-

consistently higher risk adjusted returns

-

superior fund management focusing on quality stock picking

Both coupled with a process-driven fund selection methodology, thus probably maximizing your gains over time.

We believe that is the only way to invest.

For FundSelect, we live by the motto: "Be steady. Be alert. Be winning."

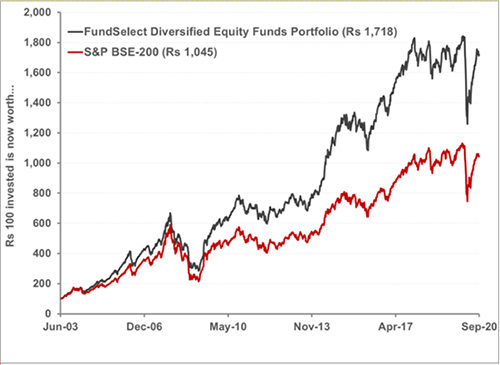

And here is the result of this motto

This shows in our long performance track record.

Source: ACEMF, PersonalFN Research

Performance as on September 30, 2020; Past performance is no guarantee of future results

Every Rs 100 invested across FundSelect recommendations since June 2003, has now worth Rs 1,718, as against Rs 1,045 for every simultaneous investment of Rs 100 in S&P BSE 200.

That's an outperformance in return, by around 70%!!

The Question is, HOW DO WE DO IT?

Well, every success as two things to it!

The Process and the Story - We have told you the story about FundSelect.

Now is the time for the process

INTRODUCING:

The "SMART SCORE MATRIX"!

We select mutual funds on the basis of 5 variable tests, viz. Systems and Process,

Market cycle performance, Asset management style, Risk-reward ratios and Performance

Track Record.

| S | M | A | R | T |

|---|---|---|---|---|

| Systems and Processes | Market Cycle Performance | Asset Management Style | Risk-Reward Ratios | Performance Track Record |

So, each fund recommended by PersonalFN has to go through our stringent process where they are tested on these five essential parameters.

It's like taking a test on five different qualities and getting scores from a very strict teacher!

And there are some stringent qualification parameters that our expert research team looks at before recommending any fund.

Like these:

-

The fund manager possesses decent experience and is not overloaded with multiple schemes. Moreover, the fund house should have well defined investment systems and process in place.

-

The fund has successfully generated positive returns across market cycles, viz. bullish and bearish. It is important the fund has the ability to limit your losses during crisis.

-

The portfolio should not be too concentrated, highly churned or low quality. It should be managed efficiently.

-

The fund must offer adequate return for the risk incurred. It should not be putting your money to unnecessary risk.

-

The track record of the fund in terms of generating return on investment over various time periods like 1 - year, 3-years, 5-years and so on.

This matrix is specially developed by the in-house research team at PersonalFN and we believe, it's probably one of the best and reliable fund selection methodologies in the industry today.

And we say this with full confidence as FundSelect has been successful in identifying long-term players, with the use of this proprietary system!

But that's just our confidence on our research and systems.

Why should you believe them?

Numbers Don't Lie...

So you might say "All this is fine, but why should I believe you?"

Honestly... DON'T!

That is what we have been telling our readers and subscribers for years.

Don't be gullible...

But we are not here to make you feel more gullible.

We will let FundSelect numbers do the talking...

And the charts below prove that our recommendations are superior.

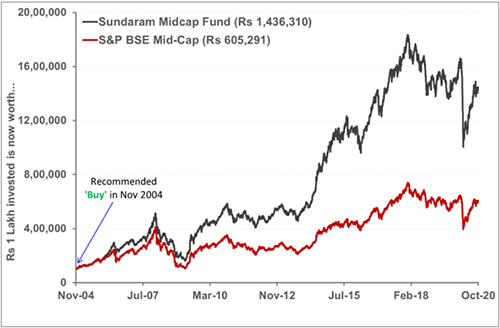

1,336% Absolute Return in 15 Years 11 Months

Source: ACEMF, PersonalFN Research

Performance calculated using NAVs for period 08-Nov-2004 to 30-Oct-2020;

Past performance is no guarantee of future results

FundSelect has been successful in identifying true long-term players.

Take the case of 'Sundaram Midcap Fund'.

We identified the wealth creating potential of the fund quite early in November 2004, and recommended it to our FundSelect subscribers.

Since then the funds value has grown by 1,336% and has created wealth for our subscribers. This is about 831% higher returns than the benchmark S&P BSE Midcap that has registered a growth of 505% in value.

Rs 1 Lakh invested in Sundaram Midcap Fund in 2004 would have by now turned to over Rs 14 Lakhs, in a period of around 15 years 7 months.

The funds potential has always remained intact and has never moved to our Sell, irrespective of market conditions.

This also signifies the ability of our research team to form a long-term view on the fund.

And there are many such funds that have been timely identified and recommended under FundSelect.

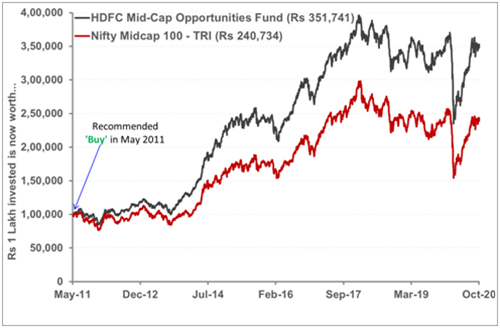

252% Absolute Return in 9 Years 5 Months

Source: ACEMF, PersonalFN Research

Performance calculated using NAVs for period 16-May-2011 to 30-Oct-2020;

Past performance is no guarantee of future results

Here is another example of our early picks on the fund. Though it took almost 4 years, for HDFC Midcap Opportunities Fund to make it to our buy list, it made a big impact in terms of performance going forward.

We tested the fund in and out to be sure about its wealth creating potential before first recommending it under FundSelect in May 2011, when its size was just about Rs 1,300 crore.

And within 7 years time, the fund became quite popular among investors to become the largest mid cap fund in the country, with its AUM crossing Rs 20,000 crore in December 2017.

In terms of wealth creation, the fund has grown 3.5 times in about 9.5 years, as against 2.4 times growth in its benchmark Nifty Midcap 100 - Total Return Index.

Rs 1 Lakh invested in HDFC Midcap Opportunities Fund in 2011 would have yielded Rs 3.51 Lakhs, in 9 Years 5 Months, as against Rs 2.40 Lakhs for the simultaneous investment in the benchmark.

233% Absolute Return in 9 Years

Source: ACEMF, PersonalFN Research

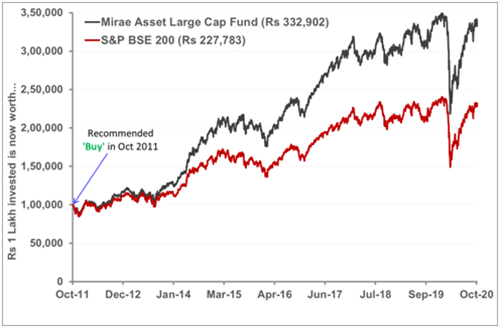

Performance calculated using NAVs for period 31-Oct-2011 to 30-Oct-2020

Past performance is no guarantee of future results

PersonalFN has always given more importance to systems and processes, instead of brand and popularity.

This can be identified from our recommendation of a fund belonging to a new and little talked about fund house - Mirae Asset Mutual Fund that had in 2011 completed just 3 years of operation in India.

After understanding the systems and processes followed at Mirae Asset Mutual Fund, we were very clear about its fund management quality and the long term potential of its funds.

Its flagship scheme, Mirae Asset India Opportunities Fund (now known as Mirae Asset Large Cap Fund), was hardly known to investors. The fund was very small with a corpus of less than Rs 200 crore, then.

This is when PersonalFN identified the early potential of this fund and recommended it to FundSelect subscribers in October 2011.

The fund did not disappoint us in terms of expectation, and has consistently rewarded investors across market conditions, beating its benchmark S&P BSE 200 by a significant margin.

We always aim to identify true long-term players...and our next fund tells you about the...

Longevity of Our Recommendations

If you think, our views can change overnight... we are glad that you may be proved wrong.

Here is the performance of HDFC Equity Fund since the time it was recommended under FundSelect in May 2004.

Source: ACEMF, PersonalFN Research

Performance calculated using NAVs for period 03-May-2004 to 30-Oct-2020

Past performance is no guarantee of future results

In the last 16 years, the fund has seen many ups and downs in terms of performance, but the fund management quality and conviction stood by its side.

This helped it grow over 10 fold in terms of value.

Rs 1 Lakh invested in the fund had grown to well over Rs 12 Lakh before we finally gave a Sell call on the fund.

So in terms of longevity of views, FundSelect won't disappoint you.

The Key Is Quality... Not popularity!

FundSelect will never try to go with the herd.

Each fund recommended under fund select goes through our stringent process, where they are tested on both quantitative as well as qualitative parameters.

Only the funds that pass through this test will make it to our recommended list.

We may not recommend a fund just because they are gaining popularity among distributors and investors.

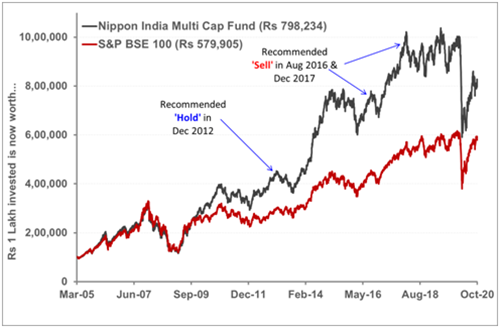

Despite being popular among investors, this fund has never made it to our Buy list- the reason being quality and its inability to limit downside risk.Similar is the case with Nippon India Multi Cap Fund (once popularly known as Reliance Equity Opportunities Fund)...

Source: ACEMF, PersonalFN Research

Performance calculated using NAVs for period 28-March-2005 to 30-Oct-2020;

Past performance is no guarantee of future results

Despite being popular among investors, this fund has never made it to our Buy list- the reason being quality and its inability to limit downside risk.

That's the reason why we did not shy away from giving a Sell call on the fund, even while it was recommended by others, based on star ratings.

FundSelect has been quite stringent when it comes to recommending high quality funds, backed by strong systems and processes.

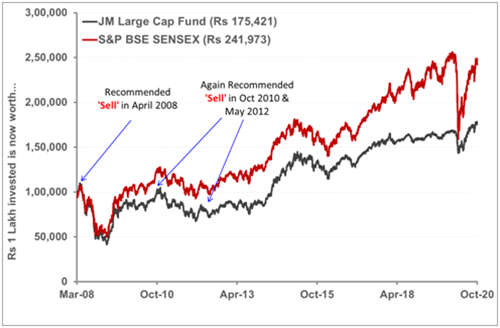

Identifying the "Portfolio Killers"

A major part of being a successful and smart investor is also staying away from what we call the "Portfolio Killers"

These are funds that are inconsistent and poorly managed!

Like we have always asked our subscribers to stay away from inconsistent and poorly managed schemes like JM Large Cap Fund (Erstwhile JM Equity Fund)

Source: ACEMF, PersonalFN Research

Performance calculated using NAVs for period 28-Mar-2008 to 30-Oct-2020

Past performance is no guarantee of future results

Over the last 10 years, rather 20 years, the fund has significantly underperformed its benchmark as well as most of its peers.

FundSelect time and again attempted to save its subscribers from entering a worthless fund.

And that is just one example...

We have many more!

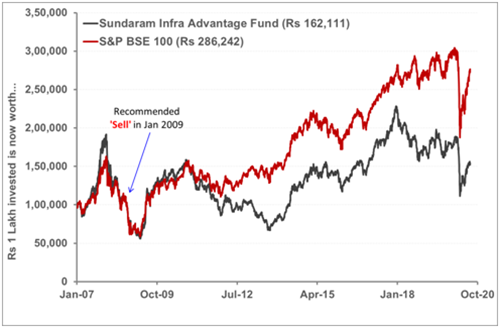

Here's another one...

Source: ACEMF, PersonalFN Research

Performance calculated using NAVs for period 02-Jan-2007 to 30-Oct-2020;

Past performance is no guarantee of future results

Have you heard about Sundaram Capex Fund? (now known as Sundaram Infra Advantage Fund)

The fund that became investor's favourite during the infrastructure and capital boom in 2007. Its AUM doubled, rather tripled within months, in the year 2007.

Unfortunately, hype doesn't sell for long in finance.

Many investors in this fund found themselves on the back foot, when the rally in the infrastructure came to a break during the 2008 subprime crisis.

Notably many stocks in this sector have not yet recovered and so has the fund.

We Make Mistakes Too!

Well, just like everyone else, we too make mistakes...

But we do not hide them.

We believe knowing your weaknesses is your biggest strength.

Some of the funds recommended under FundSelect, did not meet our expectations.

Moreover, we got the timing wrong.

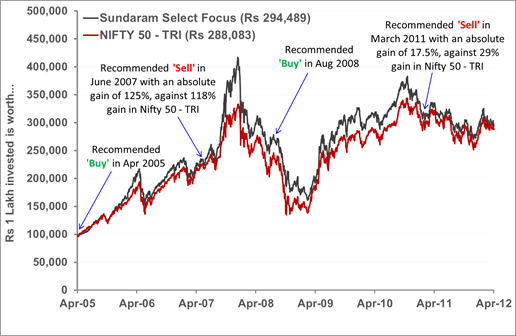

Source: ACEMF, PersonalFN Research

Performance calculated using

NAVs for period

25-Apr-2005 to 25-Apr-2012;

Past performance is no guarantee of future results

In the first phase (between April 2005 to June 2007), our recommended Sundaram Select Focus, performed nearly in line with the benchmark, while underperformed many of its peers. We got impatient with the performance and gave a Sell call on the fund.

Within next few months, the fund entered its first leg of outperformance, and the subscribers who acted on our recommendation missed the opportunity. Though it didn't last for long.

In August 2008, we gave the fund another chance.

But this time it completely disappointed on the performance front. Despite giving it, well over two good years, the fund failed to make much impact and turned out to be one of our poor recommendations.

In March 2011, we finally gave a Sell call on Sundaram Select Focus.

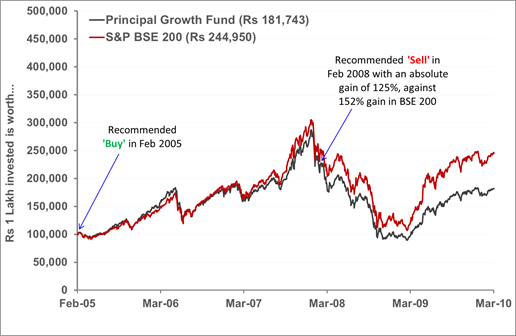

Similar was the case with Principal Multi Cap Growth Fund (earlier Principal Growth Fund).

Source: ACEMF, PersonalFN Research

Performance calculated using NAVs

for period

28-Feb-2005 to 31-Mar-2010;

Past performance is no guarantee of future results

Though fund made around 125% gain in 3 years post our recommendation in February 2005, it did underperform the benchmark S&P BSE 200 by about 27 percent point.

With the change in view on the fund, it was recommended a Sell in February 2008.

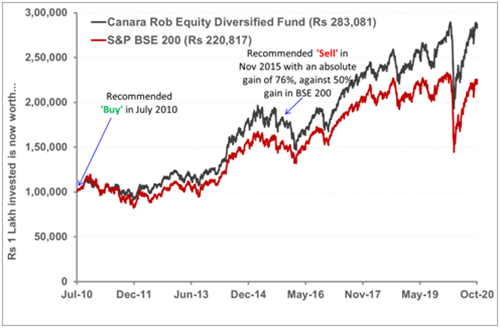

Source: ACEMF, PersonalFN Research

Performance calculated using NAVs for period 05-Jul-2010 to 30-Oct-2020;

Past performance is no guarantee of future results

Canara Robeco Equity Diversified Fund was yet another scheme recommended under FundSelect in July 2010, that didn't go down well as per our expectation in terms of returns.

Moreover, few quick changes in fund management further affected the performance

Though it outperformed the S&P BSE 200 index over 5 years' time, it trailed many of its category peers.

In November 2015, we asked our subscribers to exit the fund, while it made 76% absolute gain in a little over 5 years' time.

So, we are not infallible, to be honest.

However, you must note here that...

The success rate of FundSelect

is a whopping 70 percent!

You see, seven out of ten FundSelect recommendations go on to making solid investment You see, seven out of ten FundSelect recommendations have made solid investment gains for the investors.

Alternatively, it can be safely said that even if you happen to underperform or incur slight losses by chance, you will be more than compensated for it by the gains from other funds that you invest in.

Our fund recommendations tend to beat the market by a significant margin over long time periods.

Once you subscribe to FundSelect, you will get instant access to potentially the best mutual funds in terms of returns they offer and thus strengthen your investment portfolio in future.

Here is what one of our existing subscribers has to say:

I was reviewing my portfolio today. I am happy to note that all my investments have outperformed market both in down as well as up market condition. The recommendations of PersonalFN are unbiased and generally have a long term views suitable for common investor like me.

When I look back, the timely advise and assurances of PFN, quite contrary to experts on TV during the last years downturn not only saved me from huge loss, it helped to maximise my return in the cycle. I once again thank you all in PersonalFN for educating common investors and unbiased advice.

- Anup Kumar Guru, Mumbai

Why Choose FundSelect Today?

-

Earn Market Beating Returns - Our recommendations under FundSelect have beaten the BSE-200 index returns by over 70% in over the last 17 years, and we are working hard to ensure that the performance continues in the future as well!

-

Become a Savvy And Confident Investor - Through FundSelect, we aim to guide and educate you about the fundamentals of successful money management and the various strategies and core philosophy behind mutual fund investments. This will help you evolve into a smarter investor who can then make even better investing decisions.

-

Identify Optimum Funds For Your Portfolio - We are not just sending you fund recommendations. Through our regular Buy, Sell or Hold recommendations, we guide you to build an potentially optimum fund portfolio suited to your goals and objectives. All these funds pass through our solid research process, undergoing strict selection process including both qualitative and quantitative parameters. Moreover, as a member of FundSelect you also get access to fund recommendations across various investment styles and market caps - including large cap, midcap, multi cap, value-oriented and growth oriented. All this will help you build the portfolio that suits you best!

-

Save On Extra Commissions And Fees - Rule of the thumb, as an investor, is not to waste money. Thus, don't splurge your returns on high extra commissions and unnecessary fees. Save thousands of rupees just by selecting the right fund that cost you less. And trust us on this...over longer periods of time, the impact is even higher!

-

Keep A Close Watch On Your Investments - Forgetting about your investments once you have put your money in it is one of the most serious mistakes an investor can make. And that's where our regular performance updates on our fund recommendations is going to be of immense help to you. It will help you keep a close watch on your fund investments.

-

Employ Allocation of Your Investments - Asset allocation is a key factor in optimizing your investment portfolio according to your goals and objectives and thus gain higher returns over time. With our regular updates on the ever-changing market conditions and the promising funds in the current market, you will be able to maximize your gains and keep your risk exposure at tolerant levels - keeping in line with your long-term investment targets.

-

Save Time and Energy - We, at PersonalFN, make sure to make the investment process as seamless and tension-free as possible. Simplify your life...Save your precious time and energy with readymade information available at your fingertips every month! All you can do is follow the recommendations diligently and invest in some of the best funds out there. It doesn't get much easier than this.

And Here Is The Biggest Reason...

Yes... Over and above the ones listed, there is one more reason.

The "5 Undiscovered Equity Funds Report"...

We told you about this exclusive report earlier and what all it contains.

Now here is the key to get it for FREE!

If you become a member of FundSelect right now, you will get our exclusive report on "5 Undiscovered Equity Funds With High Potential", Absolutely FREE!

Mind you this report is worth Rs 5,000, but you will not have to pay anything for it.

So all you have to do is...

Get FundSelect Right Now!

FundSelect is an all-purpose equity mutual fund recommendation service that helps you to build wealth over the long-term in the easy going and most certain way as possible.

That's too much for a nominal yearly subscription Fee of Rs. 5,000 only

(But you don't need to pay this amount. Read On)

The timely and impactful fund recommendations every month...

The regular and exhaustive industry studies...

The occasional free notes and online materials...

5 undiscovered equity funds you could invest in right away.

The value that you get makes up for such an insignificant price to pay.

Not to mention the fact that you can potentially make a double digit portfolio return with that meager annual cost.

The Annual cost is Rs 5,000.

But as we told you, we don't want you to pay that, as we have a special "Get On-Board Offer" offer for you...

Under the special "Get On-Board Offer", you can get access to FundSelect for a year at just Rs 2,950!

Exclusive "Get On-Board" Offer

Rs 5,000 2,950

That is an instant discount of over 40%

A whopping 40%!

Now, given the potential of FundSelect and the exclusive report you will get FREE, you should not waste a second more.

Are you seriously still thinking?

We don't think you should...

But if you still are in double minds, here is a way to clear that doubt.

You Are Getting It All, Virtually FREE!

There's much more for you.

We, believe in empowering you as an investor in making the PERFECT investment decisions.

And for that, we have included a few goodies along with the package as well.

Here are some bonuses you get with your FundSelect Subscription:

Bonus #1: DebtSelect

For all those investors who want the best of both worlds, that is, equity and debt funds to invest in, it's time to rejoice.

DebtSelect, our popular debt mutual fund research services is a complimentary gift that would come along with your subscription to FundSelect.

It is one of our flagship products and we decided to make it more accessible to our valued subscribers.

If you are a debt fund investor and didn't subscribe to DebtSelect before, we believe you will derive great value from that.

Under DebtSelect, you will receive 2 Actionable and Timely Debt Mutual Fund Recommendations Per Month PLUS Regular Update on DebtSelect recommendations to let you build a stable-returns portfolio yourself.

If you are planning to invest towards your low risk goals and are looking to grow your money steadily over time, DebtSelect will be of help to you.

And as a FundSelect subscriber, not only do you get to know about the most promising equity mutual funds but also the time-tested debt mutual funds for stable returns.

What's more?

You DO NOT have to pay DebtSelect's usual subscription fee of Rs 5,000 per year.

Bonus #2: Fund Watch

Apart from the regular fund recommendations, you get an insider view of what the PersonalFN research team is tracking at present.

In fact, we are constantly on the lookout for top-performing funds that have yet not made it to FundSelect but continue to be on our radar.

Remember, NOT all top-performing funds are worth your money.

And that is why we keep a close "watch" on these attractive looking funds to ensure that they make it to the FundSelect recommendation list when they meet all the parameters in our stringent selection process.

Bonus #3: New Fund Offer (NFO) Research

With the change in market sentiments, a lot of equity funds, whether open-ended or close-ended, are cropping up almost every alternate day.

We will assess those New Fund Offers (NFOs) and examine their viability as an investment avenue through our NFO Reports.

And that comes for FREE with your subscription!

Bonus #4: Investment Ideas Notes (Monthly)

Let us accept a stark fact today.

There is simply too much noise around. Most of the brokerage houses, media, financial portals and various finance blogs...all are ready with their "expert" views and opinions on what's going on in the market.

But can you really trust all of them? Probably no. In fact, we, at PersonalFN, believe that your chance of losing money multiplies when you follow someone else's bad advice, instead of doing a bit of research yourself.

That is why we ensure that our monthly investment ideas provide a well-studied and factual opinion of the markets, cutting out the unnecessary noise around and help the investor make smart choices every day.

And as a FundSelect subscriber, you can get it for FREE without any charge at all!

So you see, you get a host of benefits along with your subscription to 'FundSelect'.

The good thing is, you don't have to pay anything extra for it.

No, nothing at all.

You get all of it - Absolutely Free!

Now if you calculate the cost of these free bonuses, you can consider your FundSelect subscription virtually FREE.

Now to forget the potential the service, the exclusive report and the free bonuses hold.

So what are you waiting for?

You got to act fast.

The benefits are huge, that you cannot afford to miss.

Get FundSelect Right Now

With 4 FREE BONUSES + 1 Exclusive Report

Don't Miss This Opportunity To Potentially Beat The Market By Double Digit Returns

As a FundSelect subscriber, we will guide you to make smart investments in mutual

Potentially the "best of the best" mutual funds, coupled with periodical performance reports...everything that will make your investment process much simpler

But all this is possible when you give it a try.

To recap, here's what you get as a FundSelect subscriber:

-

FREE instant access to our Exclusive report "5 Undiscovered Equity Funds With High Growth Potential "

-

12 FundSelect issues per year.

-

Complimentary Access to DebtSelect, our popular debt mutual fund research service

-

Free Access To - Fund Watch, an insider view of what the PersonalFN research team is tracking at present

-

Free Access To - New Fund Offer (NFO) Research,

-

Free Access To - Investment Ideas Notes (Monthly)

-

Free special Guide - Are You Investing Right?

If you still have any questions or doubts that are stopping you from subscribing to FundSelect, we will make it even simpler for you...

Try FundSelect With 30-Days Full Money-Back Guarantee

Your risk is ZERO!

...Because your subscription to FundSelect will be covered under our 30-Days - Full

Money-Back policy.

You can enjoy a 30-days trial with a full refund guarantee.

Get complete access to all our past recommendations as well as our current recommendations under FundSelect for a month.

Along with the unique monthly Investment Ideas Note, Fund Watch report(s) and so on...

If you don't like it or think it is not for you, which is very rare...

Just let us know before the 31st day of your subscription and we'll refund the entire fee you paid.

No Questions Asked!

The best part is, you will still get to keep all the free bonuses and the exclusive report.

That is how much we trust our services!

They are yours...no questions asked.

Sounds good?

It will take only a few minutes of your time and you will be well on your path to achieving your financial goals and objectives.

And we really want to.

So don't delay!

Get FundSelect Right Now

With 4 FREE BONUSES + 1 Exclusive Report

Here is where you start your journey to wealth building as a Smart, Informed and Financially educated investor.

To your wealth,

Team PersonalFN

P.S. We are not sure how long we will be able to keep this offer open. Click here to avail a discount of over 40% on your subscription fee for FundSelect. Hurry today!

P.P.S. Be a smart fund investor today and ensure that you choose potentially the "best of the best" funds out there. Be a FundSelect subscriber right now.

P.P.P.S. Sign up for FundSelect today and you will have 30 full days to decide whether or not you want to pay for this invaluable service. If not, let us know any time during that period, and you'll receive a full refund - no questions asked. That's a promise!

*Price inclusive of applicable Goods and Services tax

** The performance data quoted above represents past performance and does not guarantee future results.

© Quantum Information Services Pvt. Ltd. All rights reserved.

Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement.

Disclaimer: Quantum Information Services Pvt. Ltd. All rights reserved. Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement

Quantum Information Services Pvt. Limited (PersonalFN) is an independent Mutual Fund research house and SEBI Registered Investment Adviser (Registration No. INA000000680). All content and information is provided on an 'As Is' basis by PersonalFN. Information herein is believed to be reliable but PersonalFN does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. The Services rendered by PersonalFN are on a best effort basis. PersonalFN does not assure or guarantee the User any minimum or fixed returns. The Services are designed and provided based on the information and documentation furnished on this website/to the Personalfn by the User. The recommendations/advice made by PersonalFN are subject to several risks & other external factors not in the control of PersonalFN such as financial markets, macro and microeconomic factors, and other factors that can cause an adjustment in the User's own financial situation and the progress of the User's plan. The results may be based on certain assumptions. PersonalFN and its employees, personnel, directors will not be responsible for any direct / indirect loss or liability incurred by the user as a consequence of him or any other person on his behalf taking any investment decisions based on the contents and information provided herein. Use of this information is at the User's own risk. This is not directed for access or use by anyone in a country, especially USA, Canada or the European countries, where such use or access is unlawful or which may subject PersonalFN or its affiliates to any registration or licensing requirement. The User must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as s/he believes necessary. Past performance is no guarantee of any future results. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Quantum Information Services Private Limited (PersonalFN) may hold shares in the company/ies discussed herein. As a condition to accessing PersonalFN's content and website, User agrees to our Terms and Conditions of Use and Privacy Policy, available here.

Quantum Information Services Private Limited Regd. Office: 103, Regent Chambers,

1st Floor, Nariman Point, Mumbai - 400 021

Corp. Office: 103, Regent Chambers, Nariman Point, Mumbai 400 021.

Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222 CIN: U65990MH1989PTC054667

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013