The 6 Ultimate Secrets that Helped Beat the Market By A Whopping 75%!

Learn the Simplest and Potentially the Best Way

To Grow Your Portfolio Value Significantly...

While You Sleep Peacefully, Without Any Worries At Night.

We love mutual funds.

We have been studying them for over 15 years now and this has turned into our profession from our passion over time...

Having said that...Let us tell you a secret.

As per a study by our research team in the past, as much as 32 percent of the mutual funds are WORTHLESS investments.

That means over one out of every four mutual funds you put your money in is not able to beat the stock market, namely the BSE-200 index.

That means over one out of every four mutual funds regularly give you returns even lower than the index as a whole.

That means over one out of every four mutual funds are underpaying you for the risk that you are undertaking in the investment.

In short, you may be losing money on your investment!

But that's not all.

The team also found out that as much as 40 percent of the mutual funds outperform the market by a CAGR of meager 5%!

When you count in the expense ratio of around 2%, you are left almost with nothing!

In other words, almost one out of every two mutual funds is really going to disappoint you if you are looking for high returns.

Is it really worth taking all that risk and paying hefty fees to the fund manager for what mostly turns out to be a very poor performance?

...Of course not!

So to sum it up, around 3 out of 4 mutual fund investments are NOT worth your money.

All their expensive research...frequent trading costs...high fund management fees...everything almost amounts to zero.

This gives the whole mutual fund industry a bad name and most of the average investors are led to believe that low-cost index funds might be a lot better for them.

But having said that, does that mean mutual funds are not good for higher returns?

Yes they are.

How?

Well, what we don't see is...

One out of four funds routinely beats the market...by a wide spread.

One out of four funds performs consistently across several market cycles.

One out of four funds is a long-term value creator for your money, unlike the rest.

One out of those four mutual funds has the ability to make you wealthy!

And if you invest in those particular funds, you will reap benefits like you have never imagined before.

But how do you find these "best of the best" funds that have the potential to earn you not just normal profits, but Extraordinary Gains over the long term?

That's where FundSelect comes in...

A Time Tested Way that Helped Beat the Market...

By As Much As 75%!

FundSelect is our premier equity mutual fund recommendation service that aims to help you discover those exclusive fund investments, out of the over 400 equity mutual funds out there in the market, which come with solid potential to make money in long run.

FundSelect focuses primarily on two goals, viz. consistently higher returns and significantly lower costs, coupled with a b process-driven fund selection methodology, thus maximizing your gains over time.

We believe there is no sense in investing otherwise.

And how we do it? Here is our...

The Ultimate 6 Secrets...

REVEALED!

Every month, our FundSelect service brings to you an insightful and practical guidance on which funds to buy, hold or sell, thus assisting you in creating the ultimate portfolio that not only has the potential to beat the market by a margin of over fifty percent in the long-term but also lets you sleep peacefully at night.

To do that, we follow 6 simple secrets to selecting the most reliable and top performing mutual funds in the market.

And for that, we answer six important questions before we choose any fund.

1. Who Is The Fund Manager?

Because when you are choosing a mutual fund, you are essentially "hiring" an expert to select the stocks for you!

Only degrees and qualifications are not enough, remember. A qualified fund manager should be well-experienced (in our view, at least over 5 years of experience) in the industry and have an extensive knowledge about the capital market.

A smart fund manager has an innate sense of the market movements and knows when to be fearful in a heady market, and when to be greedy when no one else is buying stocks...

And most importantly, he should NOT be overburdened with more than 5 funds. In fact, in the previous few years, equity schemes of some reputed fund houses did not make it to our recommendation list because they scored zero in this regard.

According to our research, the very few fund houses (read "fund managers") that pass this test almost certainly beat the market, and their peers, by big margins over long periods of time.

Because they know how to zero in on the right investments and discern an optimum portfolio that not only performs when the market goes up but also when it goes down!

2. Is There A Steady Investment Strategy?

Many fund managers would try to do extra-ordinary stuff in the race to beat their peers and garner more AUM. But the most reliable are those who do it in the right way. We would not prefer fund managers who are involved in excess churning and trading, as it may increase market risk as well as trading cost. Several fund houses are on our negative list due to high inconsistency in their investment strategies for most of the equity schemes. Filled with unnecessary loop holes in their investment systems and processes, in our view they have performed rather poorly in the past. And thus, these funds struggle to get a place in our recommendation list. What we rather look for is fund manager who has solid conviction, long term vision and sticks to the investment process and systems irrespective of market conditions. Generally, a fund manager who can breach the fund's investment mandate may not be reliable, except in particular circumstances

3. How Much Expense Ratio Are You Paying?

As they say, your return depends on your cost.

Think about it.

Let's say, you invest Rs 1 million in a mutual fund at a NAV of Rs 10 and the expense ratio is 3% per annum. After one year the market value of the fund's portfolio shows a gain of 12%. So, the value of Rs 1 million would have gone up to Rs 1.12 million.

However, as an impact of deduction of 3% annual charge, the amount would reduce to around Rs 1.09 million, which cuts your gain by Rs 33,600.

And what's worse,

an additional expense ratio of 1% can erode as much as 50- 55% from your investment returns in 15 years!

Do we need to say more on why a lower expense ratio is absolutely essential in the quest for higher returns?

Technically, you would cringe at that.

Having said that, we must also note that expense ratio must not be the sole factor when selecting equity mutual funds.

If a couple of basis points increase in the cost is compensated by 2-3% increase in the return percentage, then the expense ratio is justified, according to us.

Yet, too high an expense ratio is still not warranted.

That is why, in FundSelect, we aim to recommend funds that have an average expense ratio of less than 2% in comparison to the industry average expense ratio of around 2.5% or the ones that have ability to adequately compensate investors.

So effectively, right from day one, you have a much better chance of beating your peers.

4. Are The Fund Houses Investor-Friendly?

A fund house needs to be investor-friendly.

Is the fund manager investing his own money in the fund?

Is the fund too big or too small?

Are the scheme information documents, investor communication or fund reports transparent, clear and consistent?

Let's face it.

With all the alleged market manipulation and market scheming going on, we understand that your money is not safe. And while it is important for you to grow your money, it is far more important NOT to lose money.

And the first step towards it is to invest in a fund that holds ethics and values above everything. That's why, when recommending a fund, we always make sure that the fund house is authentic and respectable per se.

By that, we also mean to avoid the ones that are involved in unnecessary product launches with the sole motive to garner more and more AUM. Unfortunately, our experience says, more is not better always in finance. When a fund house gets selfish and only seek to stash up money from the public, it does not serve the existing investors. We consider this unethical too!

Now that we are speaking of ethics and morality, it must also be noted that some of the big names may not be unethical but only lacking in efficient service. But that is still an issue when selecting a fund. In FundSelect, we are very strict about this and have rejected schemes of some of the premier fund houses in the past.

We believe, while high returns can be promised but proper ethical values need to be guaranteed to you as an investor.

5. Is It Diversified Enough?

Yes, although the narrow-focused sector funds definitely seem more adventurous and have better potential of providing higher returns, we believe diversified funds are the "real" mutual funds in the true sense of the term.

Why? Well, because inherently, funds carry high risk and may show high volatility in case the underlying theme or sector is out of favor.

As our research clearly proves that diversified funds tend to do far better over long periods of time and that too at reasonable risk...

So when we select funds, we look out for those that are reasonably diversified...

To add to that, we also avoid funds that are too concentrated in a few stocks, as they tend to rise sharply and reverse as sharply too...

On the contrary, well diversified equity funds tend to show a more steady performance over time, which ultimately leads to a market beating performance.

6. Is It Consistent Enough?

In FundSelect, we make it a point not to go for "trendy" funds. The main reason behind that is, trendy funds are just trying to chase investment returns.

So, what is "trendy"?

In simple words, buying stocks on themes that are currently hot, irrespective of whether they are "good" buys or not for the long term...

What we have seen over the years is that such an approach almost always results in disaster... And that's because sooner or later the trend reverses.

The thing is that such hot ideas come and go. But solid investment strategies stay forever. If you are running after returns with the latest sector update or the recent asset craze, you are probably going to lose money.

Our stringent research process only selects funds that rely on solid investment strategies, instead of petty tactics now and then.

Apart from that, we believe that one should not get carried away by seeing any funds recent performance, but look for its performance consistency in the long run.

The best way to approach fund investment is to compare the performances of various funds over numerous periods - one year, three years, five years or more. And then, judge the risk reward relationship of the fund. Lower risk with higher return, resulting in a high premium, makes for the ultimate fund choice, according to us.

Follow these six simple tactics.

Keep your eyes on long-term investment return and mutual funds can be a great way for you to build and grow wealth.

They offer convenience.

They are low risk as compared to equity shares investment.

They come in affordable amounts.

If you do it right, your return can shoot up by an additional Rs 7 million or even more!

(That is not an imaginary number conjectured from the air. Read below for an explanation.)

Do You Want An Extra Rs 7.0 Million?

That is how great funds can turn out to be.

With an extra 75% in return, you could reap higher returns (read "a lot, lot higher").

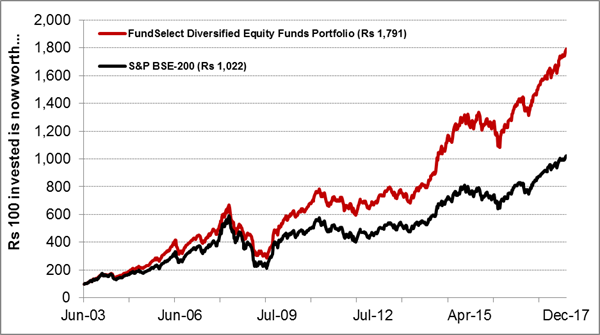

For example, let us assume that you invested Rs 1 million in our recommendations since June 2003. While the S&P BSE 200 index would have returned Rs 10.22 million, FundSelect's chosen funds would have returned a whopping Rs 17.91 million - outperformance by around 75%!

That means, by investing in funds recommended under FundSelect, you could have earned around Rs 7.69 million more on your investment of Rs 1 million.

Isn't that amazing?

Performance as of December 29, 2017 (Source: ACE MF, PersonalFN Research)

This is what makes us so different from the rest.

Potentially The Best Funds at the Click of Your Mouse Button

At PersonalFN, we make sure that each of our recommendations follows strict qualitative and quantitative parameters.

When you subscribe for FundSelect, you will get access to 12 issues of FundSelect each year; where we will recommend not only about funds you should Buy, but also about funds you should Sell or Hold... So that you can go for the few quality funds that not only have proven their worth in good times but also maintained their valuation in bad times.

In fact, the funds are carefully chosen on the basis of their quality of risk management, which means that you could not only reap higher returns during market rallies but also limit downside risk during uncertain market periods.

One of the most important characteristic of FundSelect service is that it helps you zero in on the top-performing funds across varying market caps and investment styles - be it large cap, midcap, multi cap, value-based or growth-oriented - along with the underperforming or low performing ones too.

(And remember, top-performing funds do not mean the ones that score high!)

With regular checks on our recommendations and timely calibrations according to the market, we dramatically increase the chance of delivering higher returns at low risk.

Thus, we believe FundSelect represents an easy and smooth way to achieve your financial goals and objectives, finally achieving financial freedom.

Look At The Numbers For Proof!

Hours of grueling research and intense number crunching goes into each of our recommendations.

And the numbers below prove that our recommendations are superior.

| Time Period | 1 Year | 3 Years | 5 Years | 10 Years |

|---|---|---|---|---|

| Categories | Absolute Return (in percentage) | |||

| FundSelect | 33.69 | 45.22 | 130.24 | 173.30 |

| S&P BSE 200 | 33.24 | 36.54 | 93.29 | 78.18 |

As you can see above...

Our fund recommendations tend to beat the market by a significant margin over long time periods.

Once you subscribe to FundSelect, you will get instant access to potentially the best mutual funds in terms of returns they offer and thus strengthen your investment portfolio in future.

Why Choose FundSelect Today?

-

Earn Market Beating Returns - If you want to dramatically increase your chances of beating the market, then FundSelect is the right choice for you. Our recommendations under FundSelect have beaten the BSE-200 index by over 75% in the last 15 years, and we are working hard to ensure that the b performance continues in the future as well!

-

Become a Savvy And Confident Investor - No, you don't just get fund recommendations to buy or sell. Rather we, through FundSelect, aim to guide you about the fundamentals of successful money management. Educating you about the various strategies and core philosophy behind mutual fund investments. This will help you evolve into a smarter investor who can then make even better investing decisions.

-

Build An Optimum Fund Portfolio - We are not just sending you fund recommendations. Through our regular Buy, Sell or Hold recommendations, we guide you to build an potentially optimum fund portfolio suited to your goals and objectives. All these funds pass through our solid research process, undergoing strict selection process including both qualitative and quantitative parameters. Moreover, as a member of FundSelect you also get access to fund recommendations across various investment styles and market caps - including large cap, midcap, multi cap, value-oriented and growth oriented. All this will help you build the portfolio that suits you best!

-

Save On Extra Commissions And Fees - Rule of the thumb, as an investor, is not to waste money. Thus, don't splurge your returns on high extra commissions and unnecessary fees. Save thousands of rupees just by selecting the right fund that cost you less. And trust us on this...over longer periods of time, the impact is even higher!

-

Keep A Close Watch On Your Investments - Forgetting about your investments once you have put your money in it is one of the most serious mistakes an investor can make. And that's where our regular performance updates on our fund recommendations is going to be of immense help to you. It will help you keep a close watch on your fund investments.

-

Employ Allocation of Your Investments - Asset allocation is a key factor in optimizing your investment portfolio according to your goals and objectives and thus gain higher returns over time. With our regular updates on the ever-changing market conditions and the promising funds in the current market, you will be able to maximize your gains and keep your risk exposure at tolerant levels - keeping in line with your long-term investment targets.

-

Save Time and Energy - We, at PersonalFN, make sure to make the investment process as seamless and tension-free as possible. Simplify your life...Save your precious time and energy with readymade information available at your fingertips every month! All you can do is follow the recommendations diligently and build your portfolio. It doesn't get much easier than this.

In short, FundSelect is an all-purpose equity mutual fund recommendation service that helps you to build wealth over the long-term in the easy going and most certain way as possible.

That's too much for a nominal yearly subscription Fee of Rs. 2,450 only

(a MASSIVE discount of over 50%!)

The timely and impactful fund recommendations every month...

The regular and exhaustive industry studies...

The occasional free notes and online materials...

The value that you get makes up for such an insignificant price to pay.

Not to mention the fact that you can almost guarantee a double digit portfolio return with that meager annual cost.

Click here to subscribe for FundSelect right now.

To make it even more attractive, your subscription is extended by bonus three months and that too for FREE.

You don't have to pay anything at all to access our service for those extra 3 months!

You see, FundSelect is priced at Rs 5,000 for a year's subscription.

But only for a limited time period, you can subscribe to the service for Rs 2,450 only.

Plus we will also add 3 months to your subscription absolutely free!

In effect, a service that usually costs Rs 6,250 for 15 months will come to you at just Rs 2,450...or a huge discount of almost 61%!

What are you waiting for?!

Still thinking? Let's find out what MORE you get with FundSelect.

Instant Access to Your Subscription Includes...

FundSelect assists you in discovering potentially the "best of the best" equity funds in the market and thus build a solid fund portfolio through discipline investing throughout time.

When you subscribe to FundSelect, you will get access to a detailed report covering a chosen category of fund, on 20th of every month via email. If you think, you have missed our past recommendations! Do not worry. You can access the archive of our all FundSelect reports by logging in to your PersonalFN account, anytime.

Not only do you get to know about the top-performing high-quality equity mutual funds but also the underperforming or low potential funds as well.

Apart from that, you will also get access to regular updates for the recommendations we make.

Our regular updates will let you know whether our fund recommendations are really up to your expectations or not and thus calibrate your portfolio according to the ever-changing market dynamics.

Wait! That's not all.

There's much more for you. We, at PersonalFN, believe in empowering you as an investor in making the PERFECT investment decisions. And for that, we have included a few goodies along with the package as well.

With FundSelect subscription, you also get:

Fund Watch:

Apart from the regular fund recommendations, you get an insider view of what the PersonalFN research team is tracking at present.

In fact, we are constantly on the lookout for top-performing funds that have yet not made it to the FundSelect but continue to be on our radar.

Remember, NOT all top-performing funds are worth your money.

And that is why we keep a close "watch" on these attractive funds to ensure that they make it to the FundSelect recommendation list when they meet all the parameters in our stringent selection process.

New Fund Offer (NFO) Research

With the change in market sentiments, a lot of equity funds, whether open-ended or close-ended, are cropping up every day.

We will assess each one of those New Fund Offers (NFOs) and examine their viability as an investment avenue through our NFO Reports.

And that comes for FREE with your subscription!

Investment Ideas Notes (Monthly)

Let us accept a stark fact today.

There is simply too much noise around. Most of the brokerage houses, media, financial portals and various finance blogs...all are ready with their "expert" views and opinions on what's going on in the market.

But can you really trust all of them? Probably no. In fact, we, at PersonalFN, believe that your chance of losing money multiplies when you follow someone else's bad advice, instead of doing a bit of research yourself.

That is why we ensure that our monthly investment ideas provide a well-studied and factual opinion of the markets, cutting out the unnecessary noise around and help the investor make smart choices every day.

Amazing, isn't it?

Wait, that's not all.We are not done yet.

As a FundSelect subscriber, we want you to make the right decisions...always.

That comes with complete knowledge of the science and art of mutual fund investing.

And that's why we have brought to you our popular guide on mutual fund investing.

10 Lessons To Master Mutual Fund Investing

Inside this comprehensive guide, we have attempted to cover almost ALL the crucial questions you might have about mutual fund investing.

And we are quite sure that these questions, while unknown to most rookie investors, might baffle even the experienced ones.

Are you a mutual fund investor? Then, this guide is going to be a treat for you, whether you are just starting to invest in mutual funds or have been doing so for the last 10 years.

Want a peek at the questions that are adequately answered inside the guide? Here are just a few below:

How You Can Judge If Your Fund Manager Is A Trader?

What Are The 3 Vital Points That Make For A Superstar Fund?

What Are The Myths About Dividends Declared By Mutual Funds?

Should You Invest In A Mutual Fund Scheme Looking At Its NAV?

How You Can Manage Short-Term Liquidity?

And many more...

And as a FundSelect subscriber, you can get it for FREE…without any charge at all!

But don't rejoice as yet...

Because this is NOT the only gift that we have got for you.

In addition to the premium benefits mentioned above, we also have something SPECIAL for you today.

While you continue to get unbiased, honest recommendations on the right equity mutual funds to buy, hold or sell...

Here's a great opportunity for you to Create An Optimum Mutual Fund Portfolio right away.

What's so special about it?

This portfolio consists of, what in our view are potentially the "Best" mutual funds in the industry.

Presenting to you our latest exclusive report...

The Super Investment Portfolio

A SIP-Worthy Portfolio with a High Growth Potential

Not everyone is comfortable putting together lump sum money in equity markets, right?

A great solution: Systematic Investment Plans (SIPs).

Just store away a bit of your savings into a random mutual fund or two per month, and you are done.

While the plan sounds good, the strategy might need a little tweaking.

Our research team believes, instead of investing randomly in SIPs, a better and more efficient way to creating wealth via SIPs is to…

Build a SIP-Worthy Portfolio—a very special portfolio geared for market-beating returns for SIP investments.

But as an average investor probably devoid of both time and resources, how can you go on to constructing such a rare portfolio?

Well, you don't have to.

We bring to you the ready-to-invest Super Investment Portfolio – an exclusive portfolio comprised of FIVE equity mutual funds which together has the potential to beat the market when invested via SIPs.

These mutual funds scored high on our qualitative and quantitative parameters in our patented 7-Point Selection Matrix.

They have a b performance track record.

They come with solid future growth potential.

They are managed by well-experienced and competent managers.

They are diversified enough to minimize market risk.

Above all, they together bring potentially the best returns when invested via SIPs.

If you are an SIP investor, this report is the one for you.

The good thing is, you don't have to pay a rupee for it.

No, nothing at all.

As a FundSelect subscriber, you get this exclusive report worth Rs 2,000 absolutely free — at no extra cost at all.

So what are you waiting for?

Sign Up to FundSelect right now.

Oh wait, we forgot to tell you about the last and probably the BIGGEST one for that matter.

Get Access To DebtSelect

Absolutely Free…No Catch!

For all those investors who wanted the best of both worlds, that is, equity and debt, rolled into one, it's time to rejoice.

We finally made the move we were thinking of for quite some time.

DebtSelect, our popular debt mutual fund research services is now available with FundSelect. It is one of our flagship products and we decided to make it more accessible to our followers.

If you are a debt fund investor and didn't subscribe to DebtSelect before, we believe you will derive great value from that.

Under DebtSelect, you will receive 2 Actionable and Timely Debt Mutual Fund Recommendations Per Month PLUS Regular Update on DebtSelect recommendations to let you build a b stable-returns portfolio.

If you are planning to invest towards your low risk goals and are looking to grow your money steadily over time, DebtSelect will be of help to you.

And as a FundSelect subscriber, you can now avail ALL the benefits of DebtSelect too.

Not only do you get to know about the most promising equity mutual funds but also the time-tested debt mutual funds for stable returns.

What's more?

You DO NOT have to pay DebtSelect's usual subscription fee of Rs 2,500 per year.

It's available to FundSelect subscribers for FREEEEEEEEE!

But, You got to act fast.

The benefits are huge.

Beat The Market By Double Digit Returns And Sleep Peacefully At Night!

As a FundSelect subscriber, we will guide you to make smart investments in mutual funds, and thus build a solid fund portfolio for your family's future needs and your retirement.

Potentially the "best of the best" mutual funds, coupled with periodical performance reports...everything that will make your investment process much simpler and surer for you!

But all this is possible when you give it a try.

To recap, here's what you get as a FundSelect subscriber:

12 FundSelect issues per year.

One year access to all our recommendations under DebtSelect.

Free access to our exclusive report - The Super Investment Portfolio

Free copy of our special guide - 10 Lessons To Master Mutual Fund Investing

Free access to our Fund Watch Reports.

Free access to all our New Fund Offer (NFO) Research reports, over next one year.

Free access to our monthly Investment Ideas Notes

This all-in-one premium package is designed to make your investment process simpler and surer for you.

30-Days Trial with Full Money-Back Guarantee

Your risk is ZERO!

...Because now you can enjoy a 30-days trial with a complete 100% money-back guarantee. Sign up for the service.

Get complete access to all our recommendations under FundSelect for a month.

Along with the unique monthly Investment Ideas Note, Fund Watch report(s) and so on...

If you don't like it or think it is not for you, just let us know before the 31st day of your subscription and we'll refund the entire fee you paid. No quibble, No delays!

You will still get to keep:

The copy of our Special Report – The Super Investment Portfolio

PersonalFN's exclusive Guide on – 10 Lessons To Master Mutual Fund Investing

The past reports and recommendations under FundSelect

They are yours...no questions asked.

Sounds good?

It will take only a few minutes of your time and you will be well on your path to achieving your financial goals and objectives.

And we really want to.

So don't delay!

Get Fundselect Now

If you want to assure financial prosperity in your life, don't hesitate. Opportunity knocks on your door now.

To your wealth,

Team PersonalFN

P.S. Mutual Fund investments are subject to market risk. Subscribers should consider their risk appetite and understand the suitability before acting on the recommendations.

P.P.S. Be a smart fund investor today and ensure that you choose potentially the "best of the best" funds out there. Be a FundSelect subscriber right now.

P.P.P.S. Sign up for FundSelect today and you will have 30 full days to decide whether or not you want to pay for this invaluable service. If not, let us know any time during that period, and you'll receive a full refund - no questions asked. That's a promise!

P.P.P.P.S. Make smart investments today and reap higher benefits in the future. Click the link below and give FundSelect a try.

I Want To Try FundSelect And Avail The Exclusive Discounted Price of Rs 2,450 For 15 Months Right Now

** The performance data quoted above represents past performance and does not guarantee future results.

© Quantum Information Services Pvt. Ltd. All rights reserved.

Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement.

Disclaimer: Quantum Information Services Pvt. Limited (PersonalFN) is not providing any investment advice through this service and, does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. All content and information is provided on an 'As Is' basis by PersonalFN. Information herein is believed to be reliable but PersonalFN does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. PersonalFN and its employees, personnel, directors will not be responsible for any direct / indirect loss or liability incurred by the user as a consequence of him or any other person on his behalf taking any investment decisions based on the contents and information provided herein. Use of this information is at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. The performance data quoted represents past performance and does not guarantee future results. As a condition to accessing PersonalFN's content and website, you agree to our Terms and Conditions of Use, available here.

Quantum Information Services Private Limited Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021

Corp. Office: 103, Regent Chambers, Nariman Point, Mumbai 400 021.

Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222 Mob.:8422907179 Mob.:8422907179 Mob.:8422907179 CIN: U65990MH1989PTC054667

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013