This does not constitute investment advice. Returns mentioned herein are in no way a guarantee or promise of future returns. Mutual Fund investments are subject to market risks.

Time Tested Mutual Fund Portfolios With Solid Wealth Multiplying Potential

Get Quick Access To High-Performing, Readymade Portfolios With A Track Record Of Beating The Markets By Over 80%

Decade Old Wealth Creating Solution Catering To Both Equity And Debt Fund Investors

Dear Reader,

It seems like yesterday that we came up with a great plan to make investing uber-easy for you.

We figured that investing in mutual funds had been a complex issue then. It was rather hard to find out which funds to invest in.

And even if you knew through our premium mutual fund research service ‘FundSelect’, the whole process of asset allocation and diversification was rather foreign to most investors in those days.

“Hey, can I just invest in a single mutual fund scheme? Would that be too risky?”

“I am looking for some aggressive investments. Isn’t it rather better to invest in only one equity mutual fund with huge growth potential?”

“Wait! Should it be 40 percent for equity and 60 percent for debt or vice versa?”

We had come across a lot of questions like these.

And we are not really surprised that we did. The mutual fund investing process was rather tricky then. (To be honest, though situations have turned for the better since then, it is STILL tricky.)

At this stage, one day...

During our intense brainstorming sessions, one of our team members came up with a great idea.

“Why not give them a ready portfolio of mutual funds? Something that is suitable for their risk appetite and specific financial need — aggressive, conservative or time-based investment portfolio? Perhaps, separately for the equity and debt investors?”

And so was born one of our most successful and highly sought after service, FundSelect Plus - A Ready to invest model mutual fund portfolio service.

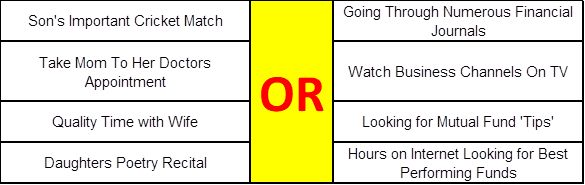

We wanted to provide our readers with a unique way to create high-performing portfolios right off the bat WITHOUT wasting their precious time and energy on:

✔ Regularly sifting through hundreds of financial journals (well, almost, isn’t?)

✔ Wasting hours in front of the TV for a few scheme names from so-called “experts”.

✔ Asking close relatives for their favorite mutual fund at the family party.

Yes, things can get crazy at times, when we are talking about something as serious as Financial Freedom.

To relieve them of such pain, FundSelect Plus exists today.

If you’re looking for high risk and high reward investments, we have it ready for you.

If you’re looking for lower risk stable investments, we have it too.

FundSelect Plus is the ANSWER to the fast, crazy world of mutual fund investing. If you are an investor who “likes to have everything ready beforehand”, WITHOUT any effort on your part whatsoever, FundSelect Plus is for you.

Well that’s what we intended FundSelect Plus to be when it was launched in 2007.

But, did we succeed?

FundSelect Plus is the flagship research product of PersonalFN, and over the years we have received overwhelming response from our subscribers from across the country.

Here's what some of them have to say:

"One good thing I find with PersonalFN is that they work on Fee based model and there are very few chances.

Also with the FundSelect Plus Service, they have launched a good concept of model portfolios. Now for my short term goals, I can align them with Conservative Equity portfolio or Debt portfolio for 3 months. This is really a great flexibility where one can assign each of his goal, according to short/long term nature with a relevant portfolio model.

With this service I feel like a portfolio manager without taking hassel or investing much time."

~ Brij Pandey - ( IT Consultant - Singapore)

The truth is, we envisaged FundSelect Plus to be the “ready portfolio advisor” for our smart Indian investors.

At PersonalFN, we always endeavoured to empower investors in their journey toward Financial Freedom.

We know that it is not an easy one...

...more so, for someone who is bogged down with personal and professional responsibilities.

It’s a plethora of tough choices…

We understand you.

FundSelect Plus was our teamed effort to make the whole investing process easier for you.

FundSelect Plus strove to offer you with immense power to build readymade portfolios that bring in potentially double or even TRIPLE digit returns in the long run without any extra work on your part whatsoever!

Well, did it perform as we expected?

Our Recommended Portfolios Outperformed The Markets By As Much As Over 80%

To start with, we prepared 6 portfolios in total.

Three of them were focused on equity investments and the rest were for debt investments.

Let's look at how each of them performed over time.

Starting with our Aggressive Portfolio....

This is high risk and high reward equity mutual fund portfolio, and primarily aimed at investors with ABOVE AVERAGE risk appetite.

But you see, we follow a stringent and time-tested methodology of selecting mutual funds for you to consider investing in...or in simpler words, this portfolio is well optimized to curtail market risk to the minimum possible.

But still investing in growth-oriented equity mutual funds can be risky just as they can be supremely lucrative if done with a clever investment strategy.

However, our stringent process helps us select right funds and frankly speaking, it has fared very well for us till now.

How good you ask?

(Performance from 2-July-2007 to 29-June-2018; Source: ACEMF, PersonalFN Research)

The FundSelect Plus - Aggressive Portfolio has returned an absolute 260.3% since inception, compared to 154.6% of S&P BSE-200 Index.

So, for every Rs 100 invested in the Aggressive Portfolio in 2007, it would have total to Rs 360 today. Isn’t that amazing?

Well, let’s take a look at the Moderate Portfolio of FundSelect Plus now.

The Moderate Portfolio is meant for the risk-averse investors who can tolerate moderate risk in hope of higher investment returns than average.

This is highly optimized portfolio that takes lot of “tinkering” to get the RIGHT BALANCE of risk and returns.

And we succeeded!

(Performance from 2-July-2007 to 29-June-2018; Source: ACEMF, PersonalFN Research)

The FundSelect Plus - Moderate Portfolio returned 230% in the last 11 years, compared to 154% of S&P BSE-200 Index.

That's 76 Percent Over that of the S&P BSE-200 Index!

Do we have something to boast about? Well, our loyal followers (thanks to you, guys!) say so.

"I am obliged to PFN for educating me in management of personal finance. I have designed my MF portfolio taking guidance from PFN. I appreciate prompt responsiveness of PFN team to subscriber queries, and their approach to take onboard subscriber requests and feedback. In particular, I liked research reports for a couple of funds which clearly guide investors not to invest in spite of high returns, due to underlying risk and doubtful sustainability of returns in the long term. This differentiates PFN from other MF research services."

~ Rasesh Choksi (FundSelect and FundSelect Plus subscriber since Oct 2012)

We really appreciate the good words and feel that we have achieved a LOT just by empowering you in your journey to Financial Freedom.

But wait! Have we neglected our Conservative Investor friends?

Of course, not!

Here comes the Conservative Portfolio— the one for the investors who want to invest in equity but don’t want to bear significant market risk.

Trust us when we say that we took extra pains with this portfolio. Creating a portfolio that delivers high investment returns yet at nominal risk is hard, to be honest. It needs constant attention and care to be of any good to our investors.

How good are our results? Check it out for yourselves.

(Performance from 2-July-2007 to 29-June-2018; Source: ACEMF, PersonalFN Research)

Yes, you are right.

The FundSelect Plus - Conservative Portfolio fetched investors an absolute return of around 242% in 11 years time, compared to the meagre 154% of S&P BSE 200 Index.

Not conservative at all, right?

Our recommended portfolio has grown at around 11.8% CAGR compared to S&P BSE 200 Index’s 8.9% CAGR. For all those who put their faith on us and staked their capital in our portfolio, they gained an extra Rs 80 on every Rs 100 they invested. Not bad, eh?

Well, in our set of equity portfolios, we also added a special “Strategic Long Term” Portfolio in the year 2012, which is different from the other portfolios we mentioned above.

Why?

Well, this Strategic Portfolio is purely meant for long term investors.

It is based on a proven and time-tested investment technique that lets you ensure long-term capital growth and even enjoy short-term rewarding opportunities.

This portfolio is special because:

This portfolio consists of carefully selected stable and consistent diversified equity mutual funds (in India), which are designed to benefit from the growth potential of the Indian economy.

While building this portfolio, we followed a pure long term portfolio building strategy.

It is diversified across investment style and fund management, while each fund is true to its investment style and mandate.

It contains right number of schemes in the right proportion. In short it carries the most optimum allocation to each scheme and investment style

Moreover, it is based on ‘Core + Satellite’ theory of investing and contains four core holding funds and three satellite holding funds

The Strategic Portfolio is an exclusive portfolio that is built…

…On differentiated investment styles with greater focus on optimum portfolio allocation.

(Performance from 1-April-2012 to 29-June-2018; Source: ACEMF, PersonalFN Research)

Even when the portfolio was optimized to move with the economy for enhanced stability and boosted returns, it brought in decent returns above that of S&P BSE 200 Index!

That is, if you invested Rs 1,00,000 in capital in this portfolio, 6 years back, it would have grown to around Rs 227,000, compared to Rs 213,000 in the broader market index.

In case you are wondering, as a FundSelect Plus subscriber, you would get access to ALL these recommended equity fund portfolios, closely monitored by PersonalFN’s Research Team, for full one year.

Wait!

There’s more.

We surely didn’t ignore our Debt Investors,

3 months, 3-12 months, and more than 12 months.

As you would already know, a debt mutual fund is for the retirees, pensioners and other investors who prefer relatively safe and stable income investments. And keeping that in mind, we prepared three portfolios that are constructed to serve as a steady income source for the investors.

They needed to serve two purposes, viz. bring in higher than returns provided by risk-free assets and be more or less steady throughout the investment period.

And we mean returns FAR higher than that of fixed deposits.

Here’s the statistics.

(Calculated based on NAV as on 29-June-2018, Return from 02-Jul-2007 to 29-June-2018;

Source: PersonalFN Research)

As you can see above, if we compare the performance of our recommended debt portfolios vis-à-vis Crisil Composite Bond Fund Index over a period of 11 years, two of our recommended debt portfolios slightly outperformed it, while our “More-than-12-months”Debt Portfolio surpassed the Crisil Composite Bond Fund Index by over 27 percent!.

With all the debt portfolios generating returns in the range of around 8-9% CAGR, not only have they provided higher returns than the market average (an incredible achievement for a Debt Investment, trust us)...

...They have also been steadily doing so for A DECADE!

Nevertheless, FundSelect Plus also offers recommendation on prominent Tax Saving mutual funds.

With a special Tax Saving Funds Portfolio, FundSelect Plus will also provide you a list of our top recommended tax saving funds that you can consider investing in for your tax saving needs in a financial year.

Isn’t that amazing?

So, to recap once again:-

As a FundSelect Plus subscriber, you would have ALL these 7 ready-to-invest premium mutual fund portfolios with high performance potential at your disposal.

Think about it.

Portfolios that have already generated up to NINETY PERCENT higher returns than the market over a decade.

Portfolios those are closely tracked and monitored by our research team.

So, whether you are an equity or debt investor, you could have taken your pick and allocated your capital in the right proportion for optimum results.

All you needed to do was just take action!

But since you are reading this letter now, we are going to assume that you missed your golden opportunity already...we mean, once.

Are you going to lose it again?

Of course not, right?

We thought so.

Perhaps, you didn’t take investing seriously before.

Perhaps, you couldn’t decide whether to go with us or not.

Perhaps, you weren’t ready.

But now you are.

So, don’t miss this chance AGAIN!

Wouldn’t you want to be one of those lucky investors who could boast of their investment gains in the years to come?

Click Here To Subscribe To FundSelect Plus

For A Successful Wealth Creating Journey Ahead...

For A Successful Wealth Creating Journey Ahead...

Still thinking?

We understand that investing in anything requires some serious thought.

And when it’s about your Financial Freedom, you surely don’t want to commit any mistake.

Well, here’s a takeaway for you.

Our research tells us that the next decade is going to be interesting (and in financial language, it means “highly lucrative”).

For a quick snapshot, here are a few notable points:

“India is poised to remain as the fastest growing large economy in the world. In 2018, we expect India to grow at over 7.4 per cent,”

~ Subhash Chandra Garg, Economic Affairs Secretary;

(at 97th meeting of the Development Committee of the World Bank)India takes a big leap in World Bank's Ease of Doing Business rankings, moving up from 142 in 2014 to 100 in 2017. This is an external recognition of the government's relentless efforts in making the country an easier place to do business.

India has a surging middle-class population with better access to technology, higher literacy rate and increase expendable income.

The Modi-led NDA Government is all set to increase the governmental capital expenditure in the coming few years.

With solid growth expectations, India, Inc. too is poised well to grow in the 8-10 years and that means, we, as investors, have more than one reason to rejoice.

If you were ever thinking of starting to invest or taking investing more seriously, here’s our suggestion.

The time is NOW.

Even if you don’t subscribe to FundSelect Plus today, we want you to keep this in mind.

Because our qualitative and quantitative analysis of the domestic and the global economies, says...

If you invest in the RIGHT mutual funds, you might have a strong chance of beating the market by potentially double or even TRIPLE digit returns in the next 8-10 years!

But, only if you invest in the “ones worth investing”.

So, don’t miss this great wave of investment success. Who knows you might retire in the next 10 years and be enjoying your life of freedom?

We do hope so for you.

And in case you need a portfolio to invest in and you don’t know how to build one, why look any further?

FundSelect Plus is what you are looking for.

To be honest, we want to help you with our financial knowledge and experience that we have gathered in the last 18 years (since the day PersonalFN was born).

Our existence is for one purpose only.

To take you toward Financial Freedom.

Yes, we do charge a fee in return but we hope you understand that it is only nominal for the immense value that we aim to provide you with.

Currently, the FundSelect Plus service is worth Rs 10,000 every year.

But what do you get in return?

“Seven long-term top-performing mutual funds with HUGE growth potential.”

Okay, that doesn’t sound too convincing?

How about this?

A Few Extra Benefits For You!

With FundSelect Plus subscription, you also get:

New Fund Offer (NFO) Research:

With the change in market sentiments, a lot of equity funds, whether open-ended or close-ended, are cropping up every day.

We will assess each one of those New Fund Offers (NFOs) and examine their viability as an investment avenue through our NFO Reports.

And that comes for FREE with your subscription!

Investment Ideas Notes (Monthly)

Let us accept a stark fact today.

There is simply too much noise around. Most of the brokerage houses, media, financial portals and various finance blogs...all are ready with their "expert" views and opinions on what's going on in the market.

But can you really trust all of them? Probably no. In fact, we, at PersonalFN, believe that your chance of losing money multiplies when you follow someone else's bad advice, instead of doing a bit of research yourself.

That is why we ensure that our monthly investment ideas provide a well-studied and factual opinion of the markets, cutting out the unnecessary noise around and help the investor make smart choices every day.

We are not done yet.

We also want you to benefit from a rare opportunity of creating a SIP-Worthy Portfolio!

Therefore, in your subscription, we will add a copy of our latest special report…

‘The Super Investment Portfolio’

This special portfolio comprises of 5 SIP-worthy equity mutual funds that together come with solid potential of market-beating returns on your investment in future.

These time-tested, lucrative SIP-Worthy funds can be invested in either separately or as a portfolio.

And what sets them apart is...

They are chosen across differentiated investment styles.

They have a strong and consistent track record.

They follow steady investment strategies.

They do not overlap with each other.

They are managed by competent and experienced fund managers.

And above all...

Each of these funds has been carefully selected for their SIP-worthiness.

Overall, it is an ultimate solution for SIP investors.

Though this report is worth Rs 2,000, considering the HUGE benefit that it will render to its users, we have decided to offer it for ‘Free’ to our new FundSelect Plus subscribers.

Amazing, isn't it?

Wait a minute

As a FundSelect Plus subscriber, we also want you to make the right decisions...always.

That comes with complete knowledge of the science and art of mutual fund investing.

And that's why we have brought to you our exclusive guide on mutual fund investing.

10 Lessons To Master Mutual Fund Investing

Inside this latest guide, we have attempted to cover almost ALL the crucial questions you might have about mutual fund investing.

And we are quite sure that these questions, while unknown to most rookie investors, might baffle even the experienced ones.

Are you a mutual fund investor? Then, this guide is going to be a treat for you, whether you are just starting to invest in mutual funds or have been doing so for the last 10 years.

Want a peek at the questions that are adequately answered inside the guide? Here are just a few below:

How You Can Judge If Your Fund Manager Is A Trader?

What Are The 3 Vital Points That Make For A Superstar Fund?

What Are The Myths About Dividends Declared By Mutual Funds?

Should You Invest In A Mutual Fund Scheme Looking At Its NAV?

How You Can Manage Short-Term Liquidity?

And many more...

And as a FundSelect Plus subscriber, you can get it for FREE…without any charge at all!

Isn’t that great?

So that means, in return of the nominal price mentioned above, you are getting:

4 High-Potential Equity Portfolios

3 Steady-Income Debt Portfolios

A Special Tax Saving Funds Portfolio

Complete Access To Our NFO Research

Free Monthly Subscription To Investment Ideas Notes

Free Special Report — "The Super Investment Portfolio"

Free Exclusive Guide — "10 Lessons To Master Mutual Fund Investing"

However, if you would ask us, all these do not matter more than the peace of mind that you get in return.

Not spending hours in front of the TV.

Not scouring through the financial journals.

No fear of building a sub-par portfolio with NO good prospects.

No fear of failing your financial goals.

FundSelect Plus relieves you of the limitations and paves a smooth and easier way for you to start investing today.

What would a few thousand rupees be worth if it could make you sleep peacefully at nights, knowing that your tomorrow is going to be happy and blissful?

You, being an investor, would better understand.

But...

We want to make it more special for our loyal followers like you?

So, if you were thinking of reaching in your pocket for ten grand now to make the best investment of your life, hold on right now.

We have something special for you.

Something that would make this once in a lifetime opportunity for you.

What?

How About a Special Discount of

50% on the 1st Year Subscription Fee?

That’s right.

Though the usual subscription fee is valued at Rs 10,000 per year, we make it even more affordable for you.

For a one full year of subscription, you have to pay Rs 4,950 only.

Yes, by signing up right now, you can straight away save Rs 5,050 on your first year’s subscription fee.

Even though the initial price is not high in itself, we wanted to make it even more special for you.

And honestly speaking, this is our way of showing our appreciation to your steady love and support that you have shown all these years.

Let’s be clear about one thing.

We are because of you.

We exist only to make your life happier and more successful.

And we decided that curtailing the subscription fee might be a great opportunity for all our readers who always wished to try FundSelect Plus but shied away because of the price.

Nothing should stop you from availing this golden opportunity now.

Look, you really don’t want to start on square one every year complaining that you are helpless and clueless, and that you don’t know how to invest for market-beating gains?

We are offering you this exclusive chance to build your financial future for better security and stability.

We are offering you full and unrestricted 1-year access to our recommended SEVEN top-performing readymade portfolios with extreme growth potential.

What are you still waiting for?

Click Here To Subscribe To FundSelect Plus Right Now

What’s more?If you subscribe right now, we are going to offer you...

Extra 3 Months Subscription For FREE — No Charge At All!

You read it correctly.

You get a full year subscription at the heavily discounted price and it doesn’t end there.

We would also be adding in another 3 months to your subscription. So, instead of a 12-months subscription, you will get 15-months subscription at the SAME price!

FundSelect Plus Offer!

1 Year Access

Price: Rs 10,000 Rs 4,950

(A Massive Discount of over 50%)

Additional 3 Months Access

Absolutely Free!

Fair enough?

So, if you do the math, it comes to a heavy discount of over 50 PERCENT!

Do you know why?

Over the years We have seen how other investors make the right decision and go for this little investment and in turn, reap insanely huge gains over the years.

Here’s what they say:

"I was reviewing my portfolio today. I am happy to note that all my investments have outperformed market both in down as well as up market condition. The recommendations of PersonalFN are unbiased and generally have a long term views suitable for common investor like me.

"When I look back, the timely advise and assurances of PFN, quite contrary to experts on TV during the last years downturn not only saved me from huge loss, it helped to maximise my return in the cycle. I once again thank you all in PersonalFN for educating common investors and unbiased advice."

- Anup Kumar Guru, Mumbai

Now, we don’t want you to miss this great opportunity. You could’ve been one of those smart investors, right?

And now you can.

Try FundSelect Plus With

30-Days Full Money Back Guarantee

Want to give it a try?

See how much you like it.

Don’t worry. You have the option to try FundSelect Plus absolutely risk-free for 30 days from the date of your subscription.

If you are not satisfied, just contact us within the 31st day and we will refund your money back — No quibble, no hassle!

But tell you what, we are sure you won’t.

Because this is the ticket to a better financial tomorrow.

This is a not just any financial product or a service.

We are offering you an once-in-a-lifetime opportunity to build your path to Financial Freedom.

Accomplish your financial goals.

Secure your financial life.

Enjoy your life with your family and friends.

Be happy...above all.

Are you ready?

Click Here To Sign Up to FundSelect Plus

Get Over 50% Discount on FundSelect Plus + 3 Months of Bonus Access & Secure Your Financial Future with “7 Top-Performing Readymade Portfolios”

Remember, opportunity doesn’t knock twice!

Are you willing to take action?

If you said yes, there’s nothing stopping you from attaining Financial Freedom.

Wish you best of luck.

To your wealth,

Team PersonalFN

P. S. This is time-limited offer. It’s now or never! Click Here to Avail A Massive Discount of Over 50% on Your 1 Year Subscription Fee Of FundSelect Plus. Hurry today!

P. P. S. Whether you are an equity or debt investor, take your pick from these top-performing, well-optimized SEVEN readymade portfolios and start reaping investment gains in the long term.

P. P. P. S. This is not a personalized portfolio recommendation service. Subscribers are supposed to do their due diligence like analysing their risk appetite and consider their time horizon before making any investment decision. In case you are not sure about it, you may take the opinion of your investment advisor.

Click here to subscribe.

Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement.

Disclaimer: Quantum Information Services Pvt. Limited (PersonalFN) is not providing any investment advice through this service and, does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. All content and information is provided on an 'As Is' basis by PersonalFN. Information herein is believed to be reliable but PersonalFN does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. PersonalFN and its employees, personnel, directors will not be responsible for any direct / indirect loss or liability incurred by the user as a consequence of him or any other person on his behalf taking any investment decisions based on the contents and information provided herein. Use of this information is at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. The performance data quoted represents past performance and does not guarantee future results. As a condition to accessing PersonalFN's content and website, you agree to our Terms and Conditions of Use, available here.

Quantum Information Services Pvt. Ltd. Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021

Corp. Office: 103, Regent Chambers, Nariman Point, Mumbai 400 021. Tel: +91 22 6136 1200 Fax: +91 22 6136 1222 Website : www.personalfn.com Email: info@personalfn.com CIN: U65990MH1989PTC054667

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013