Canara Robeco Bluechip Equity Fund: Showcasing Stable Long-term Performance

Divya Grover

Apr 13, 2023 / Reading Time: Approx. 10 mins

Listen to Canara Robeco Bluechip Equity Fund: Showcasing Stable Long-term Performance

00:00

00:00

Large Cap Mutual Funds invest in market leaders across diverse industries that have the ability to generate stable returns even during phases of weak economic growth. So, as a mutual fund investor, Large Cap Mutual Funds are a must in your portfolio.

During uncertain and highly volatile market conditions, Large Cap Funds tend to offer stability and witness lower downside risk compared to Mid Cap Funds and Small Cap Funds. Thus, when you invest in Large Cap Mutual Funds, you benefit from the steady growth of capital over the long run without exposing your portfolio to high risk.

To know about Large Cap Mutual Funds in detail, click here.

Canara Robeco Bluechip Equity Fund is a rising star in the Large Cap Fund segment that has shown high growth potential and has clearly outpaced many of its giant-sized peers in the last few years.

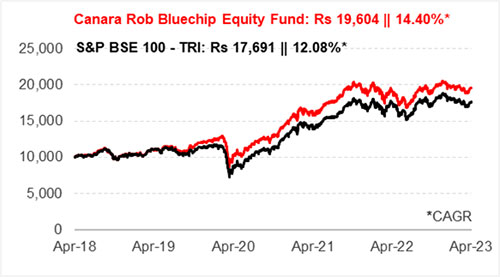

Graph 1: Growth of Rs 10,000 if invested in Canara Robeco Bluechip Equity Fund 5 years ago

Canara Robeco Bluechip Equity Fund is a relatively small-sized scheme in the Large Cap Fund category. It has recorded superior growth over the last few years and has caught the attention of investors. Launched over a decade back in August 2010, Canara Robeco Bluechip Equity Fund was an average performer in the Large Cap Fund category and remained mute for a major tenure of its existence. While the fund previously managed to deliver returns nearly in line with the category average, it has shown a complete turnaround performance in the last few years and registered an extraordinary phase to make it to the list of category outperformers. The fund managers' strategy of sticking to index heavyweights that have been driving the index over the last few years has turned in its favour and paid off investors with superior returns. During the 2020 market crash, the fund managed to limit the downside, generating an alpha of over 7.5 percentage points when compared to the index, while it also performed reasonably in the ensuing bull phase, thus improving its overall performance. Over the last 5-years, Canara Robeco Bluechip Equity Fund has registered a compounded annualised growth of around 14.4%, as against about 12.1% CAGR delivered by its benchmark S&P BSE 100 – TRI index. Clearly, CRBEF’s extraordinary performance in the last couple of years, supported by its ability to limit the downside, helped it find a space in the list of top category performers.

Past performance is not an indicator of future returns

Past performance is not an indicator of future returns

April 11, 2023

(Source: ACE MF)

Table: Canara Robeco Bluechip Equity Fund's performance vis-á-vis category peers

| Scheme Name |

Corpus (Cr.) |

1 Year |

2 Year |

3 Year |

5 Year |

7 Year |

Std Dev |

Sharpe |

| Nippon India Large Cap Fund |

12,737 |

6.87 |

16.99 |

30.15 |

12.39 |

15.10 |

17.76 |

0.38 |

| HDFC Top 100 Fund |

22,294 |

6.05 |

14.99 |

28.29 |

11.94 |

14.38 |

17.33 |

0.37 |

| ICICI Pru Bluechip Fund |

34,679 |

3.84 |

13.64 |

27.31 |

12.32 |

14.91 |

15.70 |

0.40 |

| SBI BlueChip Fund |

34,042 |

3.59 |

10.81 |

26.77 |

11.29 |

13.36 |

16.66 |

0.36 |

| Aditya Birla SL Frontline Equity Fund |

21,126 |

1.08 |

10.86 |

25.73 |

10.62 |

12.96 |

16.34 |

0.36 |

| Mirae Asset Large Cap Fund |

32,851 |

0.01 |

9.85 |

24.87 |

12.16 |

15.25 |

16.29 |

0.35 |

| Franklin India Bluechip Fund |

6,187 |

-0.50 |

7.77 |

24.72 |

9.91 |

11.30 |

17.84 |

0.32 |

| UTI Mastershare |

10,263 |

-2.75 |

8.43 |

24.02 |

11.33 |

13.14 |

16.19 |

0.33 |

| Canara Rob Bluechip Equity Fund |

8,860 |

1.93 |

9.44 |

23.65 |

14.40 |

15.58 |

15.24 |

0.35 |

| Axis Bluechip Fund |

32,615 |

-5.20 |

5.00 |

17.26 |

11.77 |

14.18 |

15.83 |

0.22 |

| S&P BSE 100 - TRI |

|

0.28 |

10.61 |

26.39 |

12.08 |

14.17 |

16.77 |

0.36 |

Returns are point to point and in %, calculated using the Direct Plan-Growth option. Those depicted over 1-Yr are compounded annualised.

Data as on April 11, 2023

(Source: ACE MF)

*Please note, this table only represents the best-performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

Canara Robeco Bluechip Equity Fund holds a superior long-term performance track record and figures among the top quartile performers across various time periods. Even though the fund has trailed the benchmark and some of its prominent peers by a noticeable margin in the last 2-year and 3-year periods, it is not expected to have a lasting impact on its long-term fundamentals. The fund holds high growth potential and has the capability to outpace the benchmark and its prominent category peers over the long term. The fund stands among the top quartile performers over the long-term horizon of 5 years and 7 years and has also generated alpha at a CAGR of about 1.5 to 2 percentage points over the benchmark index.

This outperformance has come at a far reasonable risk when compared to the benchmark and category average. The fund's Standard Deviation (15.24%, annualised) is lower than its benchmark (16.77%) as well as the category average (16.14%). CRBEF ranks high in terms of risk-adjusted returns (as denoted by the Sharpe ratio), which is higher than many of its peers.

Image source: www.freepik.com - photo created by snowing

Image source: www.freepik.com - photo created by snowing

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

Investment strategy of Canara Robeco Bluechip Equity Fund

Categorised under Large Cap Funds, Canara Robeco Bluechip Equity Fund is mandated to invest a minimum of 80% of its assets in large-cap stocks. Accordingly, it focuses on bluechip companies and invests in stocks of companies figuring in the list of top 100 companies based on market capitalisation. While selecting stocks for the portfolio, the fund focuses on companies and sectors that are expected to perform better than the general market and uses inputs from the internal quant model to identify investable companies. Canara Robeco Bluechip Equity Fund follows a blend style of investing, i.e. it looks for high-growth stocks available at fair valuation and stays invested for a long term.

While building its portfolio, Canara Robeco Bluechip Equity Fund follows a 3-Step investment process designed to achieve the investment objective in a disciplined manner, where step 1 is idea generation from the investment universe, followed by step 2 - screening process to shortlist investible ideas, whereas finalising the portfolio in step 3. In the screening process, the fund manager gives weightage to competent management, robust business fundamentals, and reasonable valuations.

The fund manager aims to invest in large-sized companies with an established business presence, good reputation, and solid brand equity. Canara Robeco Bluechip Equity Fund usually holds about 45-50 stocks in its portfolio and follows a buy-and-hold investment strategy, which reflects the strong long-term conviction the fund management has when it picks stocks for the portfolio. The fund had a reasonable turnover ratio in the range of 30-45% in the last one year.

Graph 2: Top portfolio holdings in Canara Robeco Bluechip Equity Fund

Holding in (%) as of March 31, 2023

(Source: ACE MF)

Canara Robeco Bluechip Equity Fund usually holds a fairly-diversified portfolio of about 45 to 50 stocks. As of March 31, 2023, the fund held 43 stocks in its portfolio spread across sectors. The top 10 stock holdings accounted for about 53% of the portfolio. Index heavyweights like HDFC Bank, ICICI Bank, Infosys, Reliance Industries, and SBI currently find a place in the top 5 portfolio holdings. Axis Bank, L&T, ITC, TCS, and Bharti Airtel are among other stocks that have found a place in the core holdings of the fund's portfolio. Many of these stocks have been part of the fund's top holding for over two years now.

Canara Robeco Bluechip Equity Fund's bet on ICICI Bank, L&T, SBI, Bharti Airtel, Reliance Industries, Titan Company, Sun Pharma, and Axis Bank turned out to be rewarding for the fund in the last 2 years. HDFC Bank, Tata Steel, PI Industries, Infosys, Maruti Suzuki India, and Bajaj Finance were among the other stocks that contributed to its gains.

Among sector holdings, Canara Robeco Bluechip Equity Fund's portfolio is majorly exposed to Banking and Finance having a combined allocation of around 35.7%. Infotech, Consumption, Engineering, Petroleum, and Auto are among the other prominent sectors in the portfolio with an exposure of about 5% to 12% in each. It also holds diversification to Pharma, Telecom, and Cement, among others. The top 5 sectors in CRBEF's portfolio together account for around 64% of its assets.

Suitability

Canara Robeco Bluechip Equity Fund has registered strong performance in the last few years and has outpaced many of its large-sized peers even in depressed market conditions. Backed by a well-defined investment process, Canara Robeco Bluechip Equity Fund focuses on risk management and picking quality names having high growth potential. This strategy enables it to limit the downside risk during tough market conditions and also perform well during market uptrends.

Canara Robeco Bluechip Equity Fund showcased superior performance in the 2020 market crash and also generated reasonable returns in the ensuing bull phase. With this, Canara Robeco Bluechip Equity Fund seems to be in its growth phase. Despite its relatively smaller size, the fund is well-placed to compete with its giant-sized large-cap peers and generate superior risk-adjusted returns in the long run.

Canara Robeco Bluechip Equity Fund is suitable for long-term investors having a preference for the stability of large caps along with the potential to generate decent alpha in terms of returns.

Note: This write up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

.png)

DIVYA GROVER is the co-editor for FundSelect, the flagship research service of PersonalFN. She is also the co-editor of DebtSelect. Divya is an avid reader which helps her in analysing industry trends and producing insightful articles for PersonalFN’s popular newsletter – Daily Wealth letter, read by over 1.5 lakh subscribers.

Divya joined PersonalFN in 2019 and has since then used stringent quantitative and qualitative parameters to analyse funds to provide honest and unbiased research to investors. She endeavours to enable investors to make an informed investment decision and thereby safeguard their wealth.

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr Ajit Dayal with an objective of providing value-based information/views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc. and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of the second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, its subsidiaries and its Directors.

Terms and condition on which its offer research report

For the terms and condition for research report click here.

Details of associates

-

Money Simplified Services Private Limited;

-

PersonalFN Insurance Services India Private Limited;

-

Equitymaster Agora Research Private Limited;

-

Common Sense Living Private Limited;

-

Quantum Advisors Private Limited;

-

Quantum Asset Management Company Private Limited;

-

HelpYourNGO.com India Private Limited;

-

HelpYourNGO Foundation;

-

Natural Streets for Performing Arts Foundation;

-

Primary Real Estate Advisors Private Limited;

-

HYNGO India Private Limited;

-

Suresh Lulla;

-

I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

-

‘subject company’ is a scheme on which a buy/sell/hold view or target price is given/changed in this Research Report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have any financial interest in the subject Company;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However, any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront / annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices.

Disclosure with regard to receipt of Compensation

-

Neither QIS nor it's Associates have received any compensation from the subject Company in the past twelve months;

-

Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company;

-

Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company;

-

Neither QIS nor it's Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

-

Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

-

The Research Analyst has not served as an officer, director or employee of the subject Company.

-

QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Click here to read PersonalFN's Mutual Fund Rating Methodology

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. & Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021

Email:info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222 SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013