Coronavirus Has No Antidote. Your Bad Investments Could Have.

Listen to Coronavirus Has No Antidote. Your Bad Investments Could Have.

00:00

00:00

Almost everyone I am talking to nowadays, whether at home, office or while commuting is discussing the Coronavirus and its impact on one's health, the stock markets, and wealth.

The epidemic of Coronavirus or COVID-19 has spread faster than expected, infecting more than 90,000 people in over 75 countries. The virus has claimed thousands of lives so far and there is no cure yet.

In absence of any cure or antidote to this deadly virus, Governments across countries are struggling to protect its citizens.

The confirmation of triple Coronavirus cases registered in India early this week has made almost everyone anxious. And as I write this, the number of confirmed cases in India has risen to over 20, with 15 more Italian tourists testing positive.

Notably, India was safe until last week, even though it is neighbor to China, the epicenter of the fatal virus.

The impact can be clearly seen across the markets worldwide, with major indices correcting sharply in the last couple of weeks.

Investors are anxious about the deteriorating conditions day by day, with many preferring to sell off a significant portion of their equity investments and take refugee under Gold. Whereas many others are wondering if it is a time to sell their investments, or should they instead buy more at such discounted rates.

Well, markets have history of rewarding investors who keep their patience and make the best of such opportunities.

Remember the golden words of Investment Guru Mr Warren Buffet "Be fearful when others are greedy. Be greedy when others are fearful."

So what should your strategy be to safeguard your investments against the Coronavirus?

Will you prefer selling your stocks and equity funds or would you instead buy more gradually to benefit once markets bounce back?

Given the current circumstances, it's difficult to rightly predict where the markets are headed. However, the markets do have the potential to bounce back sharply once the conditions improve.

Photo created by freepik - www.freepik.com

Photo created by freepik - www.freepik.com

But to benefit from such bounce backs, you need to be in the game. You just can't sit on the sidelines and wait for conditions to improve. There have been many instances where the spectators have missed swift bounce back rallies to regret later.

A few questions to ask yourself:

-

Am I investing in right equity funds?

-

Is my investment portfolio healthy enough?

-

Can my portfolio withstand the market jitters?

If you nod a 'Yes' to these questions, then you need not worry. But if you have any doubts, you need to immediately get a health check-up of your portfolio.

If you are approaching your goal in the next few months or a year, you may surely consider shifting to safer avenues. But if your goal is multi-year ahead, you need not worry. Short term events like these should not have a bearing on your long term investment decision and goals.

As an investor, you should try and get rid of the bad holdings in your portfolio. Instead focus on well managed high alpha generating funds. Some process-driven funds have the ability to beat the markets under any conditions and can create significant alpha for investors.

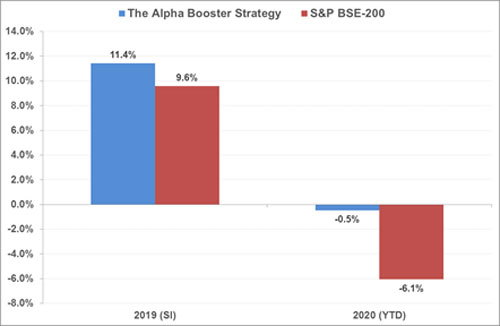

PersonalFN's The Alpha Booster Strategy is one such service that aims to identify such high alpha generating funds. It has already helped hundreds of investors pick high potential funds that may benefit them with superior returns in the long run.

Graph: Y-o-Y Performance - The Alpha Booster Strategy

SI Date: 31st July 2019, YTD: 3rd March 2020

SI Date: 31st July 2019, YTD: 3rd March 2020

(Source: ACE MF, PersonalFN Research)

Since we launched The Alpha Booster Strategy on 31st July 2019, it has managed to generate a significant lead over the benchmark S&P BSE 200 index. It has outperformed not only in rising markets, but has done well to significantly reduce the downside in the falling markets. The strategy has already generated an absolute alpha of around 8% since inception.

While the scientific researchers look for solution to cure the Coronavirus, having well-picked high alpha generators in your portfolio can be an antidote to your bad investments.

Warm Regards,

Vivek Chaurasia

Editor, FundSelect

PS: Most of the equity funds have failed to beat the markets in the last two years. Our Head of Research, Vivek Chaurasia believes it is the right time to get your hands on high alpha generating funds before the markets bounce back. Click here to know more about 'The Alpha Booster Strategy'.