Do You Own Equity Mutual Funds That Have Underperformed Their Benchmark? Read This!

Listen to Do You Own Equity Mutual Funds That Have Underperformed Their Benchmark? Read This!

00:00

00:00

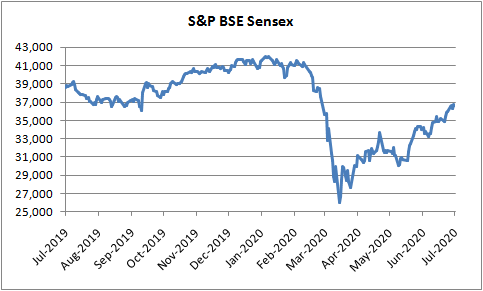

So much has changed in so little time. Investors had pinned hopes on 2020 to be the year of economic recovery and attractive corporate earnings. On the back of this, some D-Street experts believed that the S&P BSE Sensex could scale new highs of 45,000-50,000 points during the year, even though many stocks were already trading at expensive valuations.

However, the onset of COVID-19 crisis that sent global financial markets tumbling dashed these hopes. The Sensex crashed to its 4-year low level of 26,000 in March when it became obvious that the virus is set to wreak more havoc than previously anticipated.

The market has since recovered significantly on the easing of lockdown restrictions, stimulus from the government and central bank, and in hopes of a vaccine. But uncertainty and high volatility continues to grip the markets and it is yet to claim its previous year's performance levels.

The world is now staring at a grim economic outlook because of the pandemic's impact on business operations and demand in most sectors. This will take a toll on corporate earnings and equity mutual fund returns.

As the pandemic continues to spread its tentacles, there is uncertainty about how the economy will shape up in the coming quarters. Consequently, high net-worth investors are booking profits as soon as there is a market rally.

Graph: Sensex recovers from the lows, but uncertainty caps gains

Data as on July 10, 2020

(Source: ACE MF, PersonalFN Research)

Impact on equity mutual funds

All categories of equity funds registered negative returns in the range of 9-14% on an average, in the first half of 2020 amid the stock market crash, wiping out the gains of the previous years. The returns over the longer time horizon of 2-5 years have been muted as a result of the recent market crash.

Mutual funds aim to outperform the benchmark through active management of the portfolio by way of right stock/sector selection and allocating its correct weightage in the portfolio. Therefore, the performance of mutual funds may differ significantly from its benchmark.

Notably, a significant number of funds have not been able to outperform the respective benchmark index in the last 6-month to 5-year period. The fact that the market surge has been driven by rally in a narrow set of stocks could be the reason why many funds have underperformed the benchmark.

Large cap funds and multi cap funds had the most number of schemes underperforming the benchmark, followed by mid cap funds. Small cap funds fared better, outperforming the index. The outperformance rate for all categories of equity funds improved substantially over the longer investment horizon of 7 years.

Table: Many mutual funds across categories have underperformed the benchmark

| Scheme Performance |

Absolute (%) |

CAGR (%) |

| 6 Months |

1 Year |

2 Years |

3 Years |

5 Years |

7 Years |

| Large Cap Fund |

| Best performing fund |

-0.66 |

5.77 |

5.92 |

10.71 |

10.08 |

16.05 |

| Worst performing fund |

-19.05 |

-16.08 |

-4.25 |

-1.43 |

1.85 |

8.26 |

| Category average |

-10.96 |

-4.13 |

-0.09 |

2.84 |

5.98 |

11.44 |

| % of schemes underperfoming vis-à-vis benchmark |

44.83% |

41.38% |

60.71% |

78.57% |

66.67% |

18.52% |

| Multi Cap Fund |

| Best performing fund |

5.23 |

14.21 |

7.91 |

11.63 |

11.92 |

16.61 |

| Worst performing fund |

-22.84 |

-21.59 |

-7.01 |

-4.02 |

0.90 |

8.13 |

| Category average |

-10.54 |

-3.53 |

-1.05 |

2.00 |

5.91 |

12.84 |

| % of schemes underperfoming vis-à-vis benchmark |

50.00% |

42.42% |

43.33% |

57.14% |

51.85% |

21.74% |

| Mid Cap Fund |

| Best performing fund |

5.24 |

12.40 |

5.61 |

9.81 |

9.22 |

19.16 |

| Worst performing fund |

-16.51 |

-13.10 |

-10.41 |

-6.31 |

1.22 |

5.81 |

| Category average |

-7.77 |

-1.08 |

-2.92 |

-0.04 |

5.55 |

15.87 |

| % of schemes underperfoming vis-à-vis benchmark |

24.00% |

17.39% |

17.39% |

31.82% |

52.38% |

10.53% |

| Small Cap Fund |

| Best performing fund |

3.10 |

9.39 |

4.89 |

5.32 |

10.82 |

23.48 |

| Worst performing fund |

-20.44 |

-20.63 |

-18.09 |

-11.58 |

-0.41 |

2.91 |

| Category average |

-10.25 |

-5.98 |

-8.81 |

-4.62 |

4.48 |

14.80 |

| % of schemes underperfoming vis-à-vis benchmark |

23.81% |

23.81% |

13.33% |

6.67% |

7.14% |

18.18% |

Data as on July 10, 2020

(Source: ACE MF, PersonalFN Research)

What to do if your fund has underperformed?

Volatility is the very nature of equity investment. Some bets of the fund manager may not payoff in the short term due to unforeseen events, but over the long term, it can reward you with handsome gains.

As can be seen in the table above, the returns generated by funds improved with a noticeable margin with an increase in holding period. Interestingly, there is a striking difference in returns between the top performing fund and the worst performing fund in any category. Thus, selection of the right fund holds importance even if you have a long-term investment horizon.

If you have invested in a worthy fund, you need not worry about the short-term underperformance of your fund.

How to select worthy mutual funds?

Before you select any fund for investment always define your financial goals; assess your risk profile; and then move on to pick suitable funds as per your needs.

To select the best mutual funds, you need to evaluate each one on both quantitative and qualitative parameters as follows:

-

Determine the consistency of a fund's performance by comparing it to the relative performance of the benchmark index and category peers across different market phases and cycles.

-

Assess if the fund has been able to reward investors well for the risks they undertake by comparing risk-reward parameters like Standard deviation, Sharpe Ratio, Sortino Ratio, etc.

-

Check the track record of the fund manager and the efficiency of the fund house in terms of risk management, investment processes and systems.

-

Consider portfolio characteristics such as stock/sector/market cap allocation, concentration of assets, and portfolio turnover ratio, so that you pick schemes that are in congruence to your risk profile.

Yes, we know that the above list is a lot for an average investor to look at. It involves a lot of number crunching and much of the data is not easily available in one place. But if you do need to narrow down on the top funds, these factors are of utmost importance.

So if you wish to select worthy equity mutual fund schemes, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect. As a bonus, you also get access to PersonalFN's popular debt mutual fund service, DebtSelect.

At PersonalFN, we arrive at top-rated funds using our SMART Score fund selection matrix to select mutual funds based on these five variables test, viz.

-

Systems and Process

-

Market cycle performance

-

Asset management style

-

Risk-reward ratios and

-

Performance Track Record

Each fund recommended by PersonalFN goes through our stringent process involving both quantitative and qualitative parameters before providing you with Buy, Hold and Sell recommendations on equity and debt mutual fund schemes.

If you are serious about investing in rewarding mutual fund schemes, Subscribe now!

Warm Regards,

Divya Grover

Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds