Franklin Templeton Fiasco: Here Is When You Can Expect to Get the Money Back

Listen to Franklin Templeton Fiasco: Here Is When You Can Expect to Get the Money Back

00:00

00:00

Many investors park their surplus money in debt schemes in an attempt to earn higher returns than Bank FDs. However the recent incident of Franklin Templeton MF winding down six of its debt schemes has dented investor sentiment and sparked speculation about the safety of their investments.

The news came as a shocker to the investors because the six schemes, the fund house, and the fund manager had a good performance record. Investors in the wound up debt schemes of FTMF are now left with no choice but to wait for the fund house make repayments.

If you are one of them, surely you want to know about the timeline of payouts from the respective schemes.

Here is what you should know first...

Before returning the money to unitholders, the fund will have to repay the borrowings by the respective schemes that was taken to fund the heightened level of redemptions. Keep in mind that the repayment of borrowings does not impact the value of money to be returned to the unit holders, though it can delay the start of pay out to unitholders.

The repayment of the borrowings that the fund has taken, along with the cash flows it receives in the respective schemes based on the maturity of the underlying securities in the portfolio as well as coupon receipts will determine the payout to the unitholders.

Moreover, the fund will seek pre-payment from issuers of the underlying securities and will look to sell portfolio holdings in secondary market at fair value.

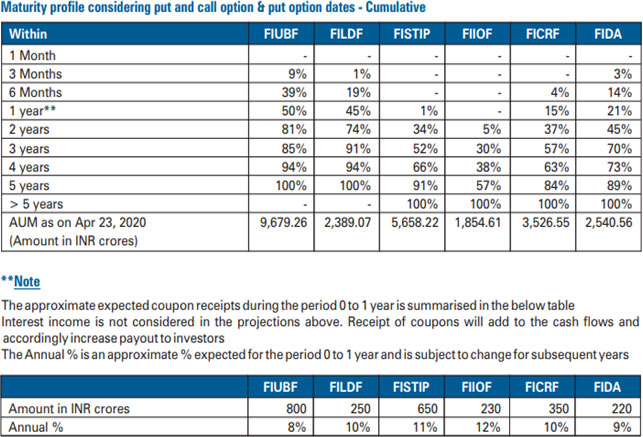

Table 1: Maturity profile of wound up FTMF schemes

Data as on April 23, 2020

(Source: Franklin Templeton Mutual Fund)

Franklin India Ultra Short Bond Fund (FIUBF) and Franklin India Low Duration Fund (FILDF) are the schemes with shorter maturity. If you are an investor in this scheme, you may expect a significant payout within 2-3 years. However, to recover the entire amount you may have to wait up to 5 years.

If you are wondering why a scheme with average maturity of just 0.44 years and 1.45 years will take around 5 years to repay the entire amount?

This is because the maturity of some underlying securities is much longer (around 4-5 years), even though the schemes belong to low duration category. Additionally, the schemes have borrowings in the range of 6.5% and 8.5% respectively, which have to be repaid first.

Whereas, if you are an investor in Franklin India Dynamic Accrual Fund (FIDA), Franklin India Short Term Income Fund (FISTIP), Franklin India Credit Risk Fund (FICRF), and Franklin India Income Opportunities Fund (FIIOF) your wait will be longer. These schemes primarily invest in medium to long duration securities.

These funds had to sell a number of their short term and liquid securities in the portfolio to meet redemptions. Hence, to get a significant payout from these schemes you will have to wait at least 4-5 years. The year wise expected cumulative cash flows is given in the table below.

Notably, FIIOF is the longest duration fund from among the six funds that have been wound up. It will only be able to repay a very small portion (5%) in the next two years.

Another key reason that could delay the payout from these schemes is the high borrowing rate. FISTIP has 28% of its assets as borrowings, FIIOF has 26%; while FICRF also has significant 16% as borrowings. Furthermore, factors such as credit issues or payment delays faced by any of the investee companies could negatively impact cash flows.

Table 2: Cash flows expected by FTMF across different time period

(Source: Franklin Templeton Mutual Fund)

(Source: Franklin Templeton Mutual Fund)

Many of the securities with longer maturities have regular interim cash flows and features such as interest rate resets or call/ put options, which significantly reduce the effective maturity and the same has been factored into the calculation of the Macaulay Duration.

FTMF said that it would actively explore opportunities with a goal to facilitate repayment prior to the maturity of the portfolio investments. To do this it will seek prepayment from the issuers of the underlying securities and look to sell the securities in the secondary market.

However, the current market scenario is rife with risk aversion and illiquidity. The fact that wound up schemes have high holding of lower rated securities, FTMF will have to wait for the market conditions to go back to normal to liquidate the portfolio at the earliest, without causing value erosion for investors.

[Read: RBI Steps in to Take Some Pain Off Mutual Funds. Will It Help?]

Way ahead for debt fund investors

Keep in mind that debt funds are not risk-free. Investment in debt funds carry various risks relating to liquidity, credit quality, and interest rate. Therefore, before investing in debt funds understand the various risks involved and invest in schemes where the portfolio risk aligns with your own risk appetite and financial objective.

In this market environment, it would be preferable to invest in instruments issued by government and public sector enterprises, and stay away from those having high exposure to private issuers.

At PersonalFN, we arrive at top rated funds using our SMART Score Model. If you wish to select worthy mutual fund schemes, I recommend you to subscribe to PersonalFN's unbiased premium research service, FundSelect.

Additionally, as a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

If you are serious about investing in a rewarding mutual fund scheme, Subscribe now!

Warm Regards,

Divya Grover

Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds