Is Your Liquid Fund Really Safe and Liquid?

Listen to Is Your Liquid Fund Really Safe and Liquid?

00:00

00:00

The pandemic crisis has caused high volatility and uncertainty in financial markets. This has induced a flight to safety and higher liquidity.

Liquid funds are perceived to be the safest in the debt funds category. This category of funds invest in debt and money market instruments such as Certificate of Deposits (CDs), Commercial Papers (CPs), Term Deposits, Call Money, Treasury Bills and so on, with a maturity of upto 91 days.

A Liquid Fund is suitable if you have a very low-risk appetite (prefer safety and liquidity over returns), wish to park money for the short-term, for contingency planning, to address short-term goals, and/or to tactically shift money from an equity fund (via the Systematic Transfer Plan) to offset volatility.

Therefore, investors can expect these funds to provide liquidity whenever the need arises while undertaking low risk. Fund managers of liquid funds are expected to prioritize preservation of capital rather than maximizing returns.

Since the holding period of such funds is low, a significant write-off of a particular asset in the portfolio would mean that investors would have to hold on to their fund longer than expected to recover from losses. Thus, evaluating the quality of portfolio is of utmost importance to mitigate credit risk.

[Read: Lessons Learnt from the Debt Fund Crisis]

This brings us to a very important question - Is your liquid fund really safe and liquid?

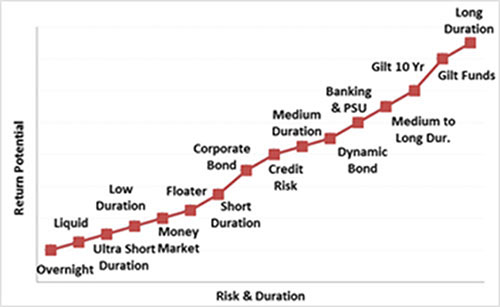

Graph: How is a Liquid Fund placed on the Risk-Return spectrum?

For illustration purpose only

For illustration purpose only

A Liquid Fund entails low risk; it is placed at the lower end of the risk-return spectrum vis-a-vis other debt mutual funds as depicted by the graph above.

However, scheme selection plays a crucial role.

In late 2018, when the IL&FS crisis broke out, several liquid funds took a hit in the range of 0.5% to 8% as the funds had to mark down the company along with its group companies owing to sudden rating downgrades.

Notably, debt securities issued by IL&FS and its group companies were rated top notch by rating agencies before these were downgraded to below investment grade within a matter of few days. Rating agencies have rarely been able to accurately predict a company about to default.

Let's look at how some of the popular funds in the category have been managing your hard-earned money.

Table: Asset allocation of top 5 liquid funds by AUM

Data as on April 30, 2020

(Source: ACE MF)

Commercial Paper, Certificate of Deposit, and Corporate Debt together account for about 78% of the total assets of liquid funds. Many of these papers belong to private issuers. Whereas, Government Securities (G-secs) account for just around 22% of liquid fund assets.

To be sure, most of the assets in the portfolio have top credit rating, but as past evidence suggests, reliability of ratings is questionable.

What's more?

Many of the funds have substantial exposure to papers in banking and finance sector. Aditya Birla SL Liquid Fund has an exposure of 41.7% to banking and finance papers, HDFC Liquid Fund 43.3%, ICICI Pru Liquid Fund 39%, Kotak Liquid Fund 50.4%, and SBI Liquid Fund 31.9%.

This is a cause of worry because a slowdown in economic activity and RBI's loan moratorium is likely to bring in liquidity and asset quality challenges for many firms in the sector. If the non-performing assets of these firms pile-up, it will have an impact on the mutual funds holding exposure to such firms; ultimately, investors will bear the brunt.

[Read: How the COVID-19 Extended Lockdown Has Made Investments in 'Banking Funds' Very Risky]

As the lockdown further slows economic activity and the past few years of miserable economic growth take its toll, even the AAA rated funds can become higher risk. So, it is possible that a major chunk of the mutual fund industry's fixed income holding is no longer considered AAA equivalent... That is the nightmare the industry may have to face.

Liquid fund managers are clearly risking investor's money by betting on instruments issued by corporates for higher yield.

A Liquid Fund should ideally follow the spirit of the product. The portfolio of Liquid Fund should be constructed in a way that ensures the investors' hard-earned money is prudently parked in safe and liquid instruments, whereby it can earn a slightly higher return than the interest on a savings bank account (but not extra-ordinary returns).

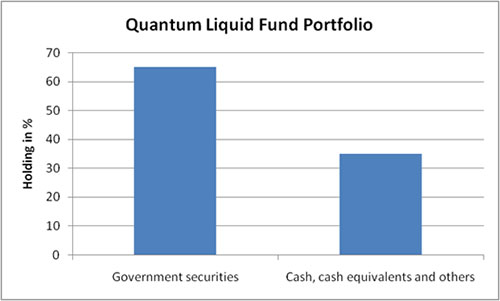

Quantum Liquid Fund (QLF) prioritises safety and liquidity over returns. QLF invests only in Government Securities, Treasury Bills, and AAA/A1+ rated Public Sector Undertakings. QLF has no exposure to private corporate credit risk papers. The portfolio is disclosed weekly and the entire portfolio is marked-to-market daily to ensure that the declared NAV is 'real'.

Graph: Quantum liquid fund invests primarily in Government securities

Data as on April 30, 2020

Data as on April 30, 2020

(Source: ACE MF)

As an investor, these are crucial questions to look into:

-

✓ Is the quality of the securities held in the portfolio reliable?

-

✓ How reliable are the ratings assigned?

-

✓ What if the rating assigned to particular debt paper slips; does the fund house have adequate risk management measures in place in such a case?

-

✓ Is the fund manager compromising on the 'liquidity' aspects?

[Read: Should Retail Investors Stay Away From Debt Mutual Funds Altogether?]

Do note that a pure Liquid Fund serves to be in the best interest of investor by maintaining the risk exposure moderate-to-low; prioritises safety, liquidity, and does not chase yields or credit risk for high returns.

A Liquid fund is supposed to be alternative to parking money in a savings bank account. That's the reason its primary objective is to keep the investors' hard-earned money safe and offer high liquidity. Remember, returns are secondary when you approach a Liquid Fund.

You would be better off sticking to a pure Liquid Fund where the fund manager doesn't chase returns by taking higher credit risk.

Our friends at Quantum Mutual Fund have highlighted the secret behind their debt management strategy, which has helped them provide safety and liquidity to investors when it comes to investing in quantum funds. Don't Worry, Quantum Liquid Fund always aims for Safety and Liquidity.

Warm Regards,

Divya Grover

Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds