ICICI Prudential Nifty Low Vol 30 ETF FOF: Focusing on Capital Appreciation with Low Volatility

The Indian equity market crashed to multi-year lows in March 2020 due to the outbreak of COVID-19 pandemic. However, by the end of the year, as the lockdown restrictions were steadily lifted, the equity market performed well by not only recovering the losses but also setting new all-time highs.

Recently, with reports of a resurgence of coronavirus cases and the possibility of lockdown restrictions, the equity market has turned volatile. Amid such volatility in the equity market, many investors tend to panic and withdraw from equity mutual funds as it gives them an impression that they might suffer losses.

You see, such financial decisions made considering high volatility in the markets may be detrimental to your financial goals, as the funds performance may bounce back in the long run and result in better risk-adjusted returns.

As an investor, you should keep in mind that market volatility plays an undeniable role when investing in equity-oriented mutual funds. If you are a risk-averse investor seeking capital appreciation through equity-oriented mutual funds, low volatility investing could be an option.

Low volatility investing refers to investing in equity-oriented mutual funds that comprise of securities with low price fluctuations that mitigates the risk of loss to investor's wealth due to higher volatility.

ICICI Prudential Mutual fund has recently launched ICICI Prudential Nifty Low Vol 30 ETF FoF, an open-ended fund of funds scheme investing in ICICI Prudential Nifty Low Vol 30 ETF that focuses on 30 large-cap stocks from the Nifty 100 Index, which have lower volatility.

During the launch of this fund, Mr Nimesh Shah, Managing Director of ICICI Prudential AMC Ltd. said, "Through investment in ICICI Prudential Nifty Low Vol 30 ETF FOF, an investor gets access to a factor-based smart beta ETF that limits downside risk. Our goal is to help investors to limit the effect of market volatility and gain exposure to the least volatile bluechip companies across sectors in a simple and convenient manner"

Table 1: Details of ICICI Prudential Nifty Low Vol 30 ETF FOF

| Type |

An open ended fund of funds scheme investing in ICICI Prudential Nifty Low Vol 30 ETF |

Category |

Fund of Fund |

| Investment Objective |

ICICI Prudential Nifty Low Vol 30 ETF FOF (the Scheme) is a Fund of Funds scheme with the primary objective to generate returns by investing in units of ICICI Prudential Nifty Low Vol 30 ETF. However, there can be no assurance or guarantee that the investment objectives of the Scheme would be achieved |

| Min. Investment |

Rs 1000/- and in multiples of Re 1 thereafter. Additional purchase Rs 500/- and in multiples of Re 1 thereafter. |

Face Value |

Rs 10/- per unit |

| SIP/STP/SWP |

Available |

| Plans |

|

Options |

|

| Entry Load |

Not Applicable |

Exit Load |

- If units purchased or switched in from another scheme of the Fund are redeemed or switched out up to 10% of the units (the limit) purchased or switched within 1 year from the date of allotment - Nil

- If units purchased or switched in from another scheme of the Fund are redeemed or switched out in excess of the limit within 1 Year from the date of allotment - 1% of the applicable NAV

- If units purchased or switched in from another scheme of the Scheme Information Document ICICI Prudential Nifty Low Vol 30 ETF FOF 7 Fund are redeemed or switched out after 1 Year from the date of allotment - Nil

|

| Fund Manager |

- Mr Kayzad Eghlim

- Mr Nishit Patel |

Benchmark Index |

Nifty 100 Low Volatility 30 TRI |

| Issue Opens: |

March 23, 2021 |

Issue Closes: |

April 06, 2021 |

(Source: Scheme Information Document)

What will be the Investment strategy for ICICI Prudential Nifty Low Vol 30 ETF FOF?

The scheme intends to achieve its investment objective by primarily investing in ICICI Prudential Nifty Low Vol 30 ETF directly or through secondary market.

The AMC will endeavour to replicate the returns generated by the underlying scheme and is not expected to deviate more than 2% on an annualized basis, net of recurring expenses in the Scheme. The deviation of returns from the scheme benchmark return may be on account of the tracking error of underlying scheme and expense ratio.

This scheme aims to offer investors an access to Factor Based Smart Beta - ETF that replicates the Nifty 100 low volatility 30 Index and limits the downside risk. The scheme will be investing in a portfolio of 30 least volatile large-cap stocks from the Nifty 100 Index.

Being a fund of fund, ICICI Prudential Nifty Low Vol 30 ETF FoF will follow a passive investment strategy by tracking and replicating the performance of the underlying scheme that invests in the units of Nifty 100 low volatility 30 Index.

About the benchmark

NIFTY100 Low Volatility 30 Index aims to measure the performance of the low volatile securities in the large market capitalisation segment.

The securities are selected from NIFTY 100 index and should be available for trading in derivative segment (F&O) and have minimum listing history of 1 year. The selection of securities and its weights in NIFTY100 Low Volatility 30 are based on volatility, the top 30 large-cap stocks with least volatility are included and volatility is calculated as the standard deviation of daily price returns (log normal) for last one year.

In order to make the index replicable for passive products, weightage of the stocks with turnover less than the stock having the lowest turnover in NIFTY 50, has been capped at 3%. The index is reviewed on a quarterly basis.

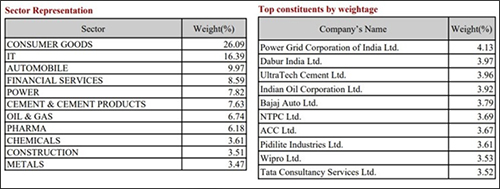

The following is the list of Top constituents and sectors under the Index by their weightage as of now:

(Source: Nifty100 Low Volatility 30 Index)

(Source: Nifty100 Low Volatility 30 Index)

This scheme apart from investing 95% of its assets in the units of ICICI Prudential Nifty Low Vol 30 ETF, it will also invest up to 5% of its assets in Reverse Repo, Tri-Party Repo, Units of Debt Mutual Funds and ETFs to meet its liquidity requirements.

Under normal circumstances, asset allocation will be as under:

Table 2: Asset Allocation of ICICI Prudential Nifty Low Vol 30 ETF FOF

| Instruments |

Indicative Allocation (% of assets) |

Risk Profile |

| Minimum |

Maximum |

High/Medium/Low |

| Units of ICICI Prudential Nifty Low Vol 30 ETF |

95 |

100 |

Medium to High |

| Reverse Repo, Tri-Party Repo*, Units of Debt Mutual Funds and ETFs |

0 |

5 |

Low to Medium |

*or similar instruments as may be permitted by RBI/ SEBI, subject to requisite approvals from SEBI / RBI, if needed.

(Source: Scheme Information Document)

Who will manage ICICI Prudential Nifty Low Vol 30 ETF FOF?

Mr Kayzad Eghlim and Mr Nishit Patel will be dedicated fund managers for ICICI Prudential Nifty Low Vol 30 ETF FOF

Mr Kayzad Eghlim is a Fund Manager at ICICI Prudential Asset Management Company Ltd. and he has around 30 years of total experience. Prior to this he was associated with IDFC Investment Advisors Ltd as Dealer Equities, Prime Securities as Manager, Canbank Mutual Fund (IS Himalayan Fund) - Fund Manager, Canbank Mutual Fund - Equity Dealer, Canbank Mutual Fund - Assisting the Fund Manager, Canbank Mutual Fund in the Primary Market Department (IPO).

Mr Kayzad is MBA, M.com and B.com and currently schemes under his management are; ICICI Prudential Equity - Arbitrage Fund,ICICI Prudential Nifty 100 ETF, ICICI Prudential Nifty ETF, ICICI Prudential Nifty Index Fund, ICICI Prudential NV20 ETF, ICICI Prudential Sensex ETF,ICICI Prudential Midcap Select ETF, ICICI Prudential Equity Savings Fund, ICICI Prudential Nifty Low Vol 30 ETF, ICICI Prudential Sensex Index Fund, BHARAT 22 ETF, ICICI Prudential S&P BSE 500 ETF, ICICI Prudential Nifty Next 50 ETF, ICICI Prudential Bharat 22 FOF, ICICI Prudential Bank ETF, ICICI Prudential Private Banks ETF, ICICI Prudential Midcap 150 ETF, ICICI Prudential Alpha Low Vol 30 ETF, ICICI Prudential IT ETF, ICICI Prudential Nifty Next 50 Index Fund.

Mr Nishit Patel is Fund Manager - ETFs/Index funds at ICICI Prudential Asset Management Company Ltd. and he joined ETF Business - ICICI Prudential AMC Ltd in 2018. Mr Patel is Chartered Accountant and B.com.

Currently he manages schemes such as; ICICI Prudential Midcap Select ETF, ICICI Prudential Nifty 100 ETF, ICICI Prudential Nifty Index Fund, ICICI Prudential Nifty ETF, ICICI Prudential Nifty Low Vol 30 ETF, ICICI Prudential Sensex Index Fund, ICICI Prudential NV20 ETF, ICICI Prudential Regular Gold Savings Fund (FOF), ICICI Prudential Nifty Next 50 Index Fund, ICICI Prudential Sensex ETF,ICICI Prudential S&P BSE 500 ETF, ICICI Prudential BHARAT 22 FOF, ICICI Prudential Nifty Next 50 ETF, ICICI Prudential Bank ETF, ICICI Prudential Private Banks ETF, , ICICI Prudential Midcap 150 ETF, ICICI Prudential Alpha Low Vol 30 ETF, ICICI Prudential IT ETF, BHARAT 22 ETF,ICICI Prudential Gold ETF.

Fund Outlook - ICICI Prudential Nifty Low Vol 30 ETF FOF

ICICI Prudential Nifty Low Vol 30 ETF FoF holds the primary objective to generate returns by investing in units of ICICI Prudential Nifty Low Vol 30 ETF. This scheme will track and replicate the performance of the underlying scheme by minimizing the tracking errors.

This scheme offers investors access to factor based smart-beta ETF that limits the downside risk and it offers non-Demat account holders to invest in an ETF through the facility of lump sum or SIP. Investors get an opportunity to invest in large cap segment and low volatility bluechip companies of various sectors.

The scheme offers wealth creation opportunity to investors by tracking the least volatile stocks in the Nifty 100 Index. However, do note that, this scheme is a fund of fund and it will be passively managed, reducing the risk of active stock selection by fund managers also restricting their role to only replicating the underlying scheme and not actively managing the portfolio.

This scheme is suitable for investors seeking long-term wealth creation opportunity with a long-term investment horizon and moderate risk tolerance. Before investing, ensure that your investment objective aligns to the fund's objective.

PS: If you wish to select worthy mutual fund schemes, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect.

Additionally, as a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

PersonalFN recommendations go through our stringent process that assesses both quantitative and qualitative parameters, providing you with Buy, Hold, and Sell recommendations on equity and debt mutual fund schemes. Read here for details...

If you are serious about investing in a rewarding mutual fund scheme, Subscribe now!

Warm Regards,

Mitali Dhoke

Jr. Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds