All You Need to Know About SEBI’s New Gold Exchange Framework and Electronic Gold Receipts

Listen to All You Need to Know About SEBI’s New Gold Exchange Framework and Electronic Gold Receipts

00:00

00:00

SEBI in its Board Meeting on September 28, 2021 approved the framework for Gold Exchange and SEBI (Vault Managers) Regulations, 2021 to enable spot trading in gold. Notably, Finance Minister Ms Nirmala Sitharaman had announced the government's intent to establish a system of regulated gold exchange in India during the Union Budget 2018-19.

Consequently, during the Union Budget 2021-22, the Finance Minister notified SEBI as the regulator for gold exchange. SEBI will also regulate the vaulting, assaying, gold quality, and delivery standards.

At present, investors in India can trade in Gold Futures, Gold ETFs, and Sovereign Gold Bond. But unlike other countries, the option to trade in spot gold was not available, until now.

How will the Gold Exchange work?

The gold exchange will facilitate trading of gold in the form of Electronic Gold Receipt (EGR). In other words, EGR is an instrument that represents the physical gold kept in registered vaults. The trading, clearing, and settlement features of EGRs will be similar to other securities like stocks.

Investors can convert their physical gold in to Electronic Gold Receipts. The person can hold the EGRs for as long as he/she intends, since it will have perpetual validity. They can also convert it back to physical gold by surrendering their EGR. The Clearing Corporation will settle the trades executed on stock exchanges by way of transferring EGRs and funds to the respective buyer and seller.

Apart from retail investors, Banks, Foreign Portfolio Investors, Jewellers, Bullion traders can also trade on Gold exchange.

Any recognised stock exchange, existing as well as new, can launch trading in EGRs in a separate segment. The stock exchanges can decide the denomination for trading of EGRs (for example 5 gram, 10 gram, 50 gram, 1 Kg, etc.) and conversion of EGR into gold, with approval of SEBI.

(Image source: by xb100 - www.freepik.com)

SEBI has stated that Vault Managers will be responsible for the storage and safekeeping of gold deposits, creation of EGRs, withdrawal of gold, grievance redressal, and periodic reconciliation of physical gold with the records of depository.

The Vault Managers should have the following features:

1) It should be a corporate body incorporated in India.

2) It should have a net worth of at least Rs 50 crore.

3) The Vault Manager will be registered and regulated as SEBI intermediary, for providing vaulting services meant for gold deposited to create EGRs.

SEBI has mentioned that the EGRs will be fungible. Meaning, the holders can convert the EGR issued by one vault manager with any other vault manager.

What are the benefits of Gold Exchange?

The Gold exchange has been in the making for many years now. India is one of the leading consumers and importers of gold in the world. Despite this, India does not play a key role in setting global gold price. Experts believe that setting up of gold exchange will give India the capacity to set price in the global commodity space rather than being a price-taker.

Furthermore, since gold prices in India vary across the states and channels, Gold exchange can help in bringing uniformity in pricing.

According to SEBI, the gold exchange would lead to efficient and transparent domestic spot price discovery, assurance in the quality of gold, promotion of India good delivery standard with active retail participation, greater integration with financial markets, and augment gold recycling in the country.

Therefore, as an investor, trading in Gold exchange will give you the assurance of purity of the metal, liquidity, and transparency of pricing, etc.

Does it make sense to invest in Gold now?

Gold has corrected around 7.5% so far in the calendar year 2021 and nearly 16% from the peak of August 2020. Therefore, it would not be wise to expect stupendous returns from gold in the year 2021 as compared to the past couple of years.

Strong growth in the equity market supported by adequate liquidity, an uptick in economic activities, pick up in COVID-19 inoculations, drop in the number of new cases of COVID-19, etc. are some of the factors that have turned the spotlight away from gold.

[Read: Will Gold Be a Worthwhile Buy This Dussehra?]

Going forward, the key factors that would decide the future course for gold are mainly inflation and interest rates.

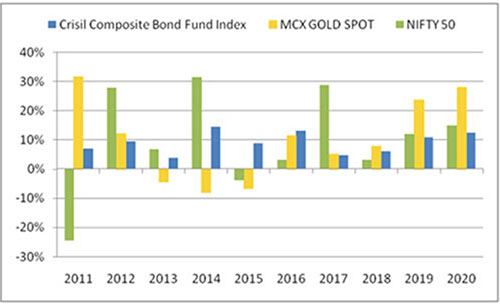

Historically, gold has often rallied in periods of high inflation, economic uncertainty, and geopolitical risks. As these risks persist, gold will remain one of the most sought-after avenues among smart investors. In the graph below, we can observe the investment trends for gold from 2011 to 2020.

Graph: Gold has proved its worth as an effective portfolio diversifier

(Source: ACE MF, PersonalFN Research)

The long-term secular uptrend that gold exhibited is something that you cannot ignore. It highlights the importance of owning gold in your portfolio as a diversifier. Therefore, it makes good sense to buy gold strategically and be a smart investor.

Consider allocating around at least 10-15% of your entire investment portfolio to gold and hold it with a long-term investment horizon. Instead of buying physical gold, you may consider investing in gold 'the smart way' through Gold Exchange Traded Funds (ETFs), Gold savings funds, or Sovereign Gold Schemes. You can also consider investing through Gold exchange as and when it is available for trading.

PS: Are you looking to add some quality mutual fund schemes to your investment portfolio, I suggest that you subscribe to PersonalFN's premium research service, FundSelect.

PersonalFN's FundSelect service provides insightful and practical guidance on which mutual fund schemes to Buy, Hold, and Sell.

The robust mutual fund process followed at PersonalFN has helped our valued mutual fund research subscribers to own some of the best mutual fund schemes in the investment portfolio with a commendable long-term performance track record.

Currently, with the subscription to FundSelect, you can also get access to PersonalFN's Debt Fund recommendation service DebtSelect.

If you are serious about investing in a rewarding mutual fund scheme, subscribe now!

Warm Regards,

Divya Grover

Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds