Academic results are announced this time of the year and students are in a frenzy making big life decisions. Perhaps looking at the younger generation, you, too, might have become nostalgic, reminiscing of the D-day when your results were declared decades ago, and you probably dreaded it to the core.

But little did you know in life, you wouldn’t be judged merely on academic scores, and there was much more coming. You might have thought: there won’t be an exam, test, or critical evaluation in life any longer.

But you would agree now that, life has always been full of critical evaluation, tests, and scores. You are constantly being judged on many levels by some scorecard or the other. One such scorecard is your ‘credit report’ or your ‘credit score’.

A Credit Score is assigned to you by a credit information company (for example companies such as CIBIL, Equifax, HighMark) and is accessed by a prospective lending financial institution, indicating to the lender your history as a borrower — whether good or poor.

When you were younger, if you secured low marks, it called for working hard to overcome your weakness to do better next time (score better). But in real life, a poor score means you’ll be ineligible for many services. Primarily, if you wish to opt for a loan, banks / financial institutions will refuse or lower the maximum they would have been willing to lend you. Plus, they are likely to charge you a higher rate of interest along with the other costs thereto, if your credit score is poor. Over time, as your credit behaviour improves, your credit score will improve too; but until such a time, you might stand to lose out on the benefits that come with a health credit score.

If your credit report is read correctly, it can help you take prudent corrective actions to improve your credit worthiness.

So, here’s how to read your credit report in detail…

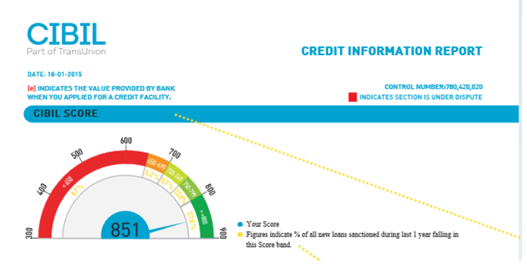

CIBIL Score

This section exclusively talks about your credit score. The score ranges between 300 to 900 and the higher it is, the better your credibility. So, the credit score assigned gives lenders a broad view of your credit behaviour and credit worthiness.

If your score is below 300, you are in very bad light, in eyes of the lender. You definitely need to work on your credit behaviour and adopt financial discipline to improve it.

You might also get something termed as NA or NH; this means, either you have no credit history available or you are new to the credit system. This does puts you in a neutral place.

And mind you, there’s no one-shot solution or ‘one size fits all’ approach. Life is dynamic, it does not move in a linear direction, and hence all aspects need to be interwoven well in your financial plan.

(Source: www.cibil.com )

(Please note this is a sample CIBIL credit report)

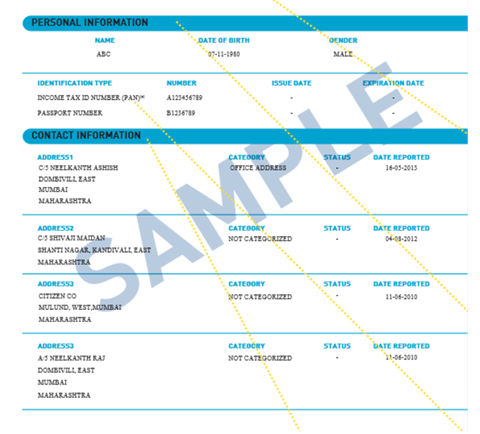

Personal and Contact Information

Next part of your report is your personal and contact information. This will include details such as your name, date of birth, passport, address, etc. You can have up to four addresses which could include permanent, temporary, and office addresses.

(Source: www.cibil.com )

(Please note this is a sample CIBIL credit report)

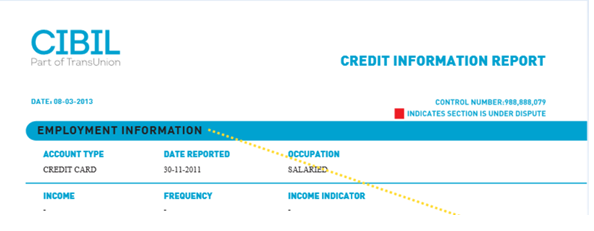

Employment Information

This section contains all the information of your occupation and income at the time of loan application. This matters to the lender and you; as usually lenders assess your earning potential based on the company you work for. For employees from listed and reputed companies, availing a loan is less of a hassle.

(Source: www.cibil.com )

(Please note this is a sample CIBIL credit report)

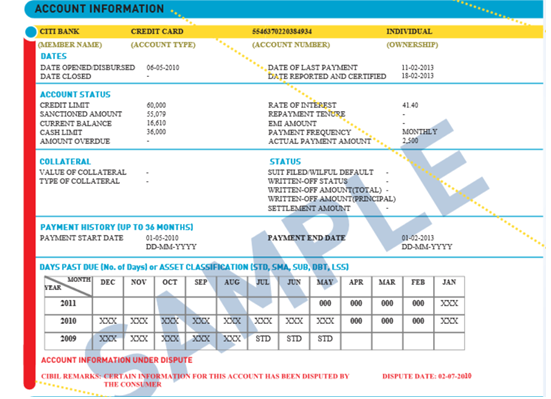

Account Information

This is the most important part of your credit report. It reflects all your loans and credit history. It includes the name of all your lenders, type of loan (such as home loan, personal loan etc.) availed, your loan account number, the mode of holding loan (joint or single), loan open date, last payment date, loan amount, current account balance, loan amount overdue (if any) and month-on-month record of your past payments upto 36 months. Your default history, if any, will also be reflected here in this section. A dispute that needs to be addressed might be highlighted as a red band on the left-side of this section. You can resolve the issue by discussing it with your lender, and once this is sorted, you need to get a letter of clarification. This red band may or may not change even after the dispute is resolved; the decision thereto depends on the lender, and the credit bureau / agency cannot make amendments in this report on its own.

(Source: www.cibil.com )

(Please note this is a sample CIBIL credit report)

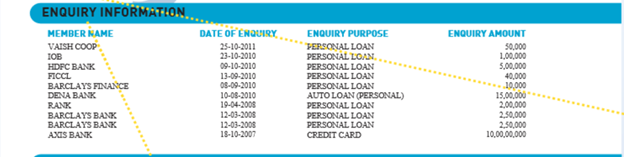

Enquiry Section

This is the last section of your report and has all the information about the enquiries for various loans you’ve made so far. It provides details such as name of the lender, date of the application, the type of loan and the amount of loan required. The higher number of enquiries in a short period of time is indicative of your urgency to avail of loan(s), and this can negatively impact your credit score.

(Source: www.cibil.com )

(Please note this is a sample CIBIL credit report)

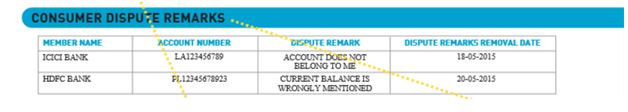

Consumer Dispute Remarks

This section allows you to add comments to your credit report. These remarks will be accessible to you and your lender for a year.

(Source: www.cibil.com )

(Please note this is a sample CIBIL credit report)

To sum-up…

Your credit report gives you and your lender a clear picture about your credit history, credit behaviour, and worthiness. If you have a low score, work on your weaknesses and overcome them with an aim to improve your credit score before applying for any loans in future.

PersonalFN is of the view that the credit score, in a way, sheds light on your financial health, besides reflecting your credit behavior and worthiness. Hence, in the interest of you and your family’s financial wellbeing, bite off only as much as you can chew. To put it simply, stretch within your means. A loan or a credit card must be taken only if you really require one and have the means, the ability to make timely repayments. If you simply opt for a loan or a credit card, and are unable to repay all the dues on time, not only will this ruin your long-term financial wellbeing, but it will also have an impact on your credit score.

Get your credit score card for free!

Also, know how prudent borrowing may help improve your credit score.

Be moneywise!

Add Comments