Riya and Sandeep have many dreams and life goals. Some of them are as follows:

- Buy a duplex house;

- 2 SUV cars;

- Funds for your daughter’s higher education abroad;

- Annual international holiday;

- Luxurious post retirement life; etc.

Discussing their finances with each other they felt achieving these goals to be impossible.

Do you too feel that it’s impossible to achieve such goals?

If yes, please do not worry. We have a solution for you. And all your goals are achievable if you follow the plan well.

We believe that investing in mutual funds can make your dreams come true.

Yes, you read it correct. We are not trying to draw a fancy canvas for you but it’s a fact. Let us see how:

First and foremost, get a reality check.

Set realistic financial goals

You might want to purchase that duplex house, like Riya and Sandeep. Maybe you dream of travelling the world, living in the most luxurious hotels, owning the most expensive clothes and accessories, and driving a new sports car, and so on. However, these things become a reality only for a handful few people. Hence, it is imperative to let your list of financial goals be realistic. If you set up financial goals that are basically a list of all your heart's desires, you might be disappointed if things don't seem achievable. Although, you must forge ahead to get that extra edge and realise your true potential, it is also important to know your capabilities and not discourage yourself.

Prepare a Financial Plan

Once your goals are set what you need is a strong plan to enable you to achieve these goals.

The term financial planning, unfortunately, has been thrown around very loosely in the wealth management industry. Very few recognise it is a much personalised service, where enormous personal financial data needs to be obtained to draw up an unbiased plan to achieve your financial goals.

To put it simply , financial planning is a tool through which you can chalk out a definite plan in order to achieve your financial goals. Thus, ensuring your peace of mind at various stages of your life cycle.

All of us have financial goals. And unless, we do not assess where we stand in terms of our income, expenses, assets, liabilities, age, and risk appetite, all the financial goals would just remain "dreams" and never become a reality.

Today, there are several investment avenues; but for you to optimally undertake financial planning (to achieve financial freedom), a combination of various financial products is needed in the respective asset classes —equity, debt, or gold. However, your asset allocation also needs to be optimally structured to work for you (in the financial plan); or else it will not accelerate attaining financial freedom.

Once your asset allocation is optimally structured, the next important action point should be having the right investment avenues / products under each asset class, in order to achieve the financial goals (within the time frame) with comfort.

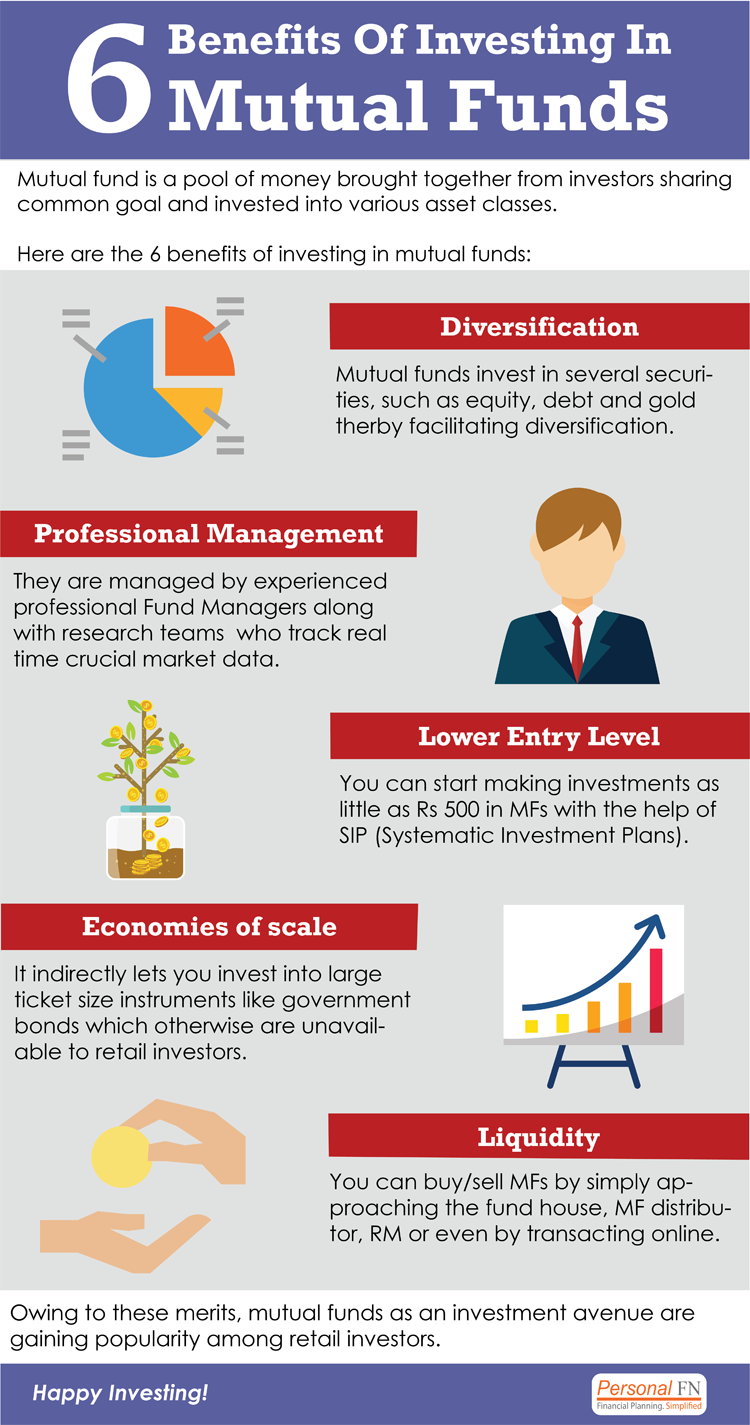

Among the various investment avenues available today, mutual funds (amongst other investment avenues) are a wealth creating avenue to achieve your financial goals. Moreover, empower your portfolio with diversification benefit. And mind you, diversification immensely helps during the turbulence of the capital markets as the upsets (of turbulence) are absorbed better. The other benefits when investing in mutual funds are:

- Professional management – Your money is managed by a professional fund manager, hence ascertaining the prospect of the companies is not your prerogative, and portfolio churning (if required) is taken care by him/her.

- Economies of scale – Even if a mutual fund does engage in high portfolio churning in the race to deliver luring returns, the voluminous trade carried out by it helps to enjoy the economies of large scale and have lower impact on their profitability. But on the other hand, if you were to do this by yourself, it could negatively impact the profitability due to the small volume of trades carried out.

- Lower entry level – With the minimum investment amount in mutual funds being as low as ` 5,000, this encourages you to start small. At the same time, take exposure to the fund's portfolio of 20-30 stocks (due to diversification). Now, this is unlike stocks because with 5,000 you can barely buy few quality stocks – and this especially true when valuations are expensive.

- Innovative plans/services for investors – Today for regular investing in mutual funds (which is much needed to achieve financial goals), AMC (Asset Management Companies) offer innovative plans such as SIP (Systematic Investment Plan) / STP (Systematic Transfer Plan). Also for facilitating withdrawals too (taking care of your cash flow requirements), SWPs (Systematic Withdrawal Plans) are in place, thus enabling you to manage your portfolio from a financial planning perspective too.

- Liquidity – Unlike direct stock investing where you may encounter a situation where a stock turns illiquid (due to various reasons); in mutual funds you would not face such a situation if the scheme you have selected follows strong investments systems and process. This because the stock selection process helps in eliminating such illiquid stocks. Moreover, as an investment avenue, mutual funds per se, especially the open-ended mutual funds offer you the much required liquidity as you can simply buy/sell units at the day's NAV (Net Asset Value) by approaching the fund house directly, approaching your mutual fund distributor, or transacting online.

Hence having assessed the inherent advantages of mutual funds, you can strategise your portfolio with the help of equity funds, debt funds, hybrid funds, and gold funds. This way these financial objectives can be catered to:

- Growth

- Income

- Inflation protection

- Peace of mind

- Preservation of capital and

- Tax saving

But your financial planner should ideally balance the importance of each of the above points while structuring a portfolio. Remember, there is not one-rule-for-all in Financial Planning.

While drawing up a financial plan, you need to cooperate with your financial planner and try to ask yourself the following questions and attempt answering them in an honest manner.

- Towards what objective/goal am I investing my money?

– Knowing the objective of investing enables you to select the right options. For example, if you have a long term objective of wealth creation, going with an equity oriented fund (following a growth style of investing) would be prudent. However, if your objective is to maintain short-term fund requirements, you may invest in liquid funds or ultra-short term funds.

- What is the time horizon?

– Time horizon is defined as the year/duration you want to enjoy the fruits of your investments. Ascertaining this is critical because both, the risk and the reward of investments, can vary according to the time horizon. Generally, a longer horizon allows for more aggression in investment. Lesser the time, the more one needs to avoid risk.

- What is my risk appetite?

– There is a risk-reward continuum running from cash to bonds to stocks. Returns are commensurate with the risk someone is willing to tolerate. High risks may also eat into your capital. And if there is no income to make up for that lost capital, replacing it would be difficult; which means, a more conservative approach needs to be followed. Other considerations could be the present financial situation, estate planning , and level of taxation.

Another important factor is age. As a general rule, the younger you are, the more aggressively you can afford to be with your investment portfolio. This is because you have more time to recover from any possible setbacks in the value of the portfolio.

And, mind you, this professional and holistic approach of assessing the micro-issues of your personal finances helps you see a clear picture of where you stand today, where you want to be (your financial goal/s), and how can you achieve it (your financial plan).

Please don't live under the illusion that financial planning is only meant for the wealthy ones. No! Financial planning is for everyone.

And, for you to build wealth to achieve your financial goals, you need a systematic financial planning – managing your money properly.

"Becoming wealthy is not a matter of how much you earn, who your parents are, or what you do... it is a matter of managing your money properly." – Noel Whittaker

Yes, we do understand that you may not have the expertise in drawing a financial plan by yourself. So, to achieve financial freedom / financial goals, you require the personalised services of an experienced financial planner, who is knowledgeable, selfless, and reviews and balances your portfolio whenever the need arises.

But the best route to allocate your funds is to invest in mutual funds through Systematic Investment Plan.

Benefits of SIPs are:

- SIPs are light on the wallet

- SIPs make market timing irrelevant

- SIPs enable upee-cost averaging

- SIPs benefit from the power of compounding ; and

- SIPs are effective medium for goal planning

PersonalFN has launched the Exclusive Report on SIP-worthy mutual funds— The Super Investment Portfolio – For SIP Investors.

After our rigorous shortlisting process, we go a step ahead when picking funds that are SIP-worthy. Under this, PersonalFN conducts a detailed analysis on how SIPs in the top shortlisted funds have performed, across multiple market conditions and timeframes. Only those funds that successfully pass this evaluation are chosen.

Don’t miss out on early bird discounts. Subscribe to the report here.

All your dreams can come true if you persistently follow a plan.

Add Comments