Are you born during the 1980s and 1990s?

If yes, you are a “Millennial”— considered to be smart, confident, an opinionated, experimental, tech-savvy and adventurous.

In my view, what makes millennials stand out is that they are the generation which transitioned from the old school system to new-age technology.

So, usually, they tend to adapt quicker and intertwine the old with new.

Millennials have seen the old ways and are welcoming new ideas with an open mind. They are always ready to experiment, be it with the different epicurean fare, fashion trends, and even investments. What’s a good thing about millennials, in general, is that they value money and aspire to create wealth.

So, they are saving and investing their hard-earned money for their financial future, their envisioned financial goals –– buying that dream car, house, and the future of their children’s education needs, wedding expenses, and their own retirement.

But are they doing it right?

I guess not!

A common trait I have observed is that millennials are quite careful about not losing their hard-earned money – which is good, of course! Perhaps, they’ve been a victim of stock market crashes and/or seen their parents lose money through risky investments.

Hence, the majority of this demographic still invests in traditional investment avenues such as bank fixed deposits, recurring deposits, Public Provident Fund (PPF), physical gold, etc.

According to a report by BankBazaar, ‘Aspiration Index 2018 - Decoding Indian Millennials’, while 91% of millennials believe in making their own financial decisions, 57% invest in fixed deposits, and 36% in Provident Fund (PF) and PPF. Only about 56% invest in instruments like mutual funds.

[Read: Where Should You Invest – Fixed Deposits Or Debt Mutual Funds?]

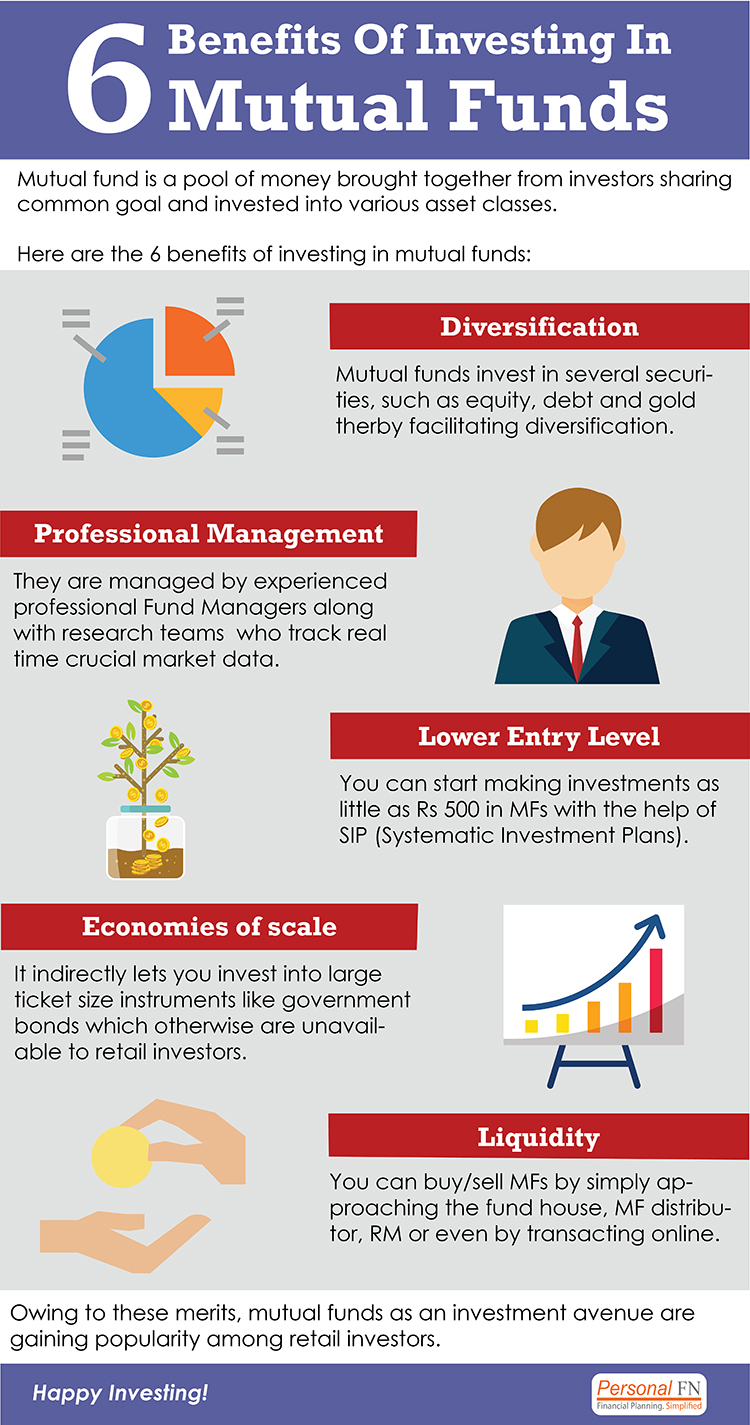

However, this trend is slowly changing. Millennials are now recognising the benefits of mutual funds in their journey of wealth creation.

In the pursuit to accomplish their envisioned financial goals, millennials are willing to take the moderate-high risk. Thanks to the “Mutual Funds Sahi Hai” campaign by the Association of Mutual Funds in India (AMFI).

[Read: Are All Mutual Funds ‘Sahi Hai’? Find Out Here…]

Having said that, millennials (and everyone) need to be smarter and have a financial plan or a roadmap to accomplish their financial goals.

(Image source:freepik)

Your investments need to be well-aligned for each financial goal. There’s no point investing in an ad-hoc manner or mimicking your friends and relatives and their approach to investments.

Remember, investing is a personal, individualistic exercise. As the adage goes, ‘One man’s meat is another man’s poison.’

Hence, before you invest, do the following:

-

Set S.M.A.R.T. financial goals- Specific, Measurable, Adjustable, Realistic, and Time-bound

-

Determine the time and cost involved to achieve the financial goals

-

Decide the amount required to invest the financial goals

-

Judge your risk profile whether aggressive, moderate, and conservative

-

Chart out an asset allocation (to divided the investible surplus in equity, debt, and gold) based on your risk profile

-

And then choose the right investment avenues to deploy your hard-earned money

[Read: How to Set S.M.A.R.T Financial Goals]

Mutual fund investments with a personalised asset allocation strategy that is based on your risk profile can help you to grow wealth when matched with your goals and time horizon.

When addressing long-term goals, investing through Systematic Investment Plans (SIPs) is potentially worthy to mitigate the risk involved in the path to wealth creation, given the current market scenario.

But, what matters is sensibly selecting mutual fund schemes so as to have the consistently performing ones in your portfolio. In fact, the topsy-turvy markets separate the smart investors from the others.

If you are a novice at creating a financial plan, I encourage you to seek professional guidance from PersonalFN, a SEBI registered investment adviser. Reach out to PersonalFN’s Financial Guardians, on 022-61361200 or write to info@personalfn.com. You may also fill in this form, and soon our experienced financial planners will reach out to you.

Alternatively, you may use PersonalFN’s robo-advisory platform, 'PersonalFN Direct'.

Here’s how PersonalFN Direct will help you:

-

Sensibly add mutual funds to your investment portfolio

-

Enable you to plan for your child’s education and wedding expenses

-

Facilitate you to plan for your retirement

-

Save for an international vacation you always longed for

-

And much more!

For millennials opting for an efficient robo-advisory platform makes tremendous sense for the following reasons:

-

Can be accessed 24x7 unlike a human investment adviser

-

Eliminates personal bias element, contrary to human advisers;

-

Saves time to give quick solutions by performing complex algorithmic calculations

-

Offers personalised asset allocation solutions

-

Can also assess your risk appetite through a questionnaire to recommend a suitable asset allocation strategy

-

Is highly cost-effective

-

Recommends a portfolio/s of suitable mutual funds; and

-

Offers a reasonable level of customisation in portfolio construction;

[Read: Work Timings Prevent You From Investing? An Efficient Robo-Advisor Can Help]

But choosing the right robo-advisory platform is imperative! Because the quality of the advice offered should be of value-addition to your investment decisions.

Currently, there are a number of robo-advisory platforms available. Most of them look and feel good, but the pertinent question is:

Are they serving your investment needs in an unbiased way?

Independent and unbiased research plays a crucial role throughout the investment process. If recommendations aren’t backed by sound research processes, they are unlikely to live up to your expectations.

[Read: Looking For A Robo-advisor? Here's How To Go About…]

Take it easy because ‘PersonalFN Direct’ is here to solve your problem permanently.

It is India’s only robo-advisor backed by extensive research and experience.

How is it different from other robo-advisory platforms?

#1: It offers only DIRECT PLANS (devoid of commissions);

#2: Offers customisable investment solutions based on one’s risk profiling;

#3: It is backed by outstanding research experience of over 15+ years;

#4: Minimal paperwork and ease of transacting; and

#5: It comes at a pocket-friendly price.

At PersonalFN, we are committed to presenting informed views and unbiased opinions on various personal finance issues that can impact your investments and finances.

PersonalFN has offered investment recommendations to more than 8,000 clients and created customised financial plans for more than 2,000 clients till date.

Since 1999, we have been researching mutual funds and providing premium mutual fund research services to investors.

To conclude:

Your success in the journey of wealth creation will be hinged on the investment avenues you pick; whether they are worthy and can counter inflation and help you achieve your financial goals; if the investments are in line with your risk profile and asset allocation; and above all, if these are conducted with the much need discipline and dedication.

Editor’s note:

Have you claimed your copy of our latest report ‘5 Undiscovered Equity Funds with High Growth Potential’?

This report will tell you about 5 well-managed equity funds capable of generating big gains, undiscovered by investors. Surprisingly, almost nobody is talking about them.

These are 5 hidden gems that carry commendable management qualities, portfolio features, and have the superior potential to become category outperformers in the long run.

This report is very exclusive, so do not miss it for anything. Get access to these 5 undiscovered funds right now!

Happy Investing!

Add Comments