(Image source: freepik.com)

(Image source: freepik.com)

I was glad to share some insights with her on SIP. Here's what I told her...

It is a mode of investing in mutual funds regularly so you can accumulate wealth for the long-term. This inculcates a disciplined way of making investments in mutual funds.

This method of investing is like investing in a recurring deposit (RD) with a bank, where you deposit a fixed sum of money regularly (into your RD account) and reap the benefits from the market investments.

A SIP includes a series of consecutive payments of pre-determined amounts made after a defined period. It can be weekly, monthly, quarterly, or even yearly. This is a hassle-free way to invest in mutual funds and inculcate a regular savings habit.

[Read: Are SIPs Better Than Lumpsum Investments? Know Here...]

With the SIP mode of investment, your money is deployed in a mutual fund scheme (equity schemes and/ or debt schemes). But your investments are subject to market risk.

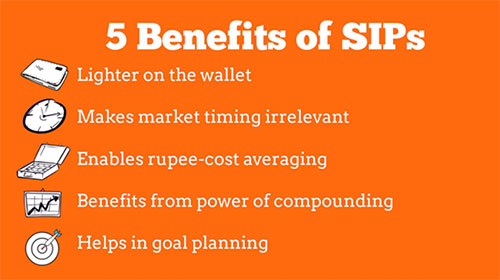

Chaya interrupted me, 'So, then what are the benefits of SIP investment?'

I explained that SIPs work on the simple principle of investing regularly in a disciplined manner that enables you to build wealth over a long period of time.

Due to the averaging of costs and the power of compounding, SIPs makes for a smart investment option without you having to time the market.

By opting for SIPs to invest in mutual funds you even mitigate the shocks of volatile equity when you invest regularly and systematically to build a corpus to accomplish your financial goals, such as retirement.

She quizzed me, 'What are the common mistakes I must avoid?'

I've observed that prolonged bull or bear phases deter investors from continuing their SIPs. During prolonged bull phases, there's no rupee-cost averaging. And during prolonged bear phases, you can accumulate more units as the market value of one's investment tends to be lower than the amount invested.

But most people tend to make this mistake and more when investing in SIPs...

-

Choose a high/low denomination amount for SIP

Many of the investors I have come across they have a misconception that it's better to start investing with high amount regularly without considering their financial position, age, and financial goals.

But this is a huge mistake, as when you are younger your financial responsibilities are low, so it's possible to contribute a huge sum of money regularly. But when you get married, or avail of home/car loan, or encounter some financial instability, contributing a high SIP amount regularly can become difficult.

At the same time do not choose an extremely low instalment amount. A low amount will not grow your wealth to the desired corpus.

'So, then what should I do?', questioned Chaya.

Before you decide a fixed amount to contribute towards SIP via the direct route, ensure that you evaluate your financial situation. Do a proper analysis of the funds to include future expenses, inflation costs, life goals... Set a realistic amount as SIP instalments.

-

Choosing a short tenure

Another most common mistake many individuals make is choosing a small tenure of SIP investments. They expect they will get rewarded in a short duration and choose an investment term of less than three years.

But they fail to see that when they opt for a lesser tenure, they expose themselves to a higher risk of market volatility to encounter losses. And, to accrue gain is highly improbable

If you want to accumulate wealth, invest for a longer time frame. Do not forget the SIP rupee cost averaging across various market cycles has a much lower chance of loss and helps in creating wealth /provide inflation-adjusted returns in the long run. Therefore, invest in SIP for at least a minimum tenure of three years for your medium-term life goals and 7 to 8 years for long term goals.

-

Stopping SIP due to any volatility in the short term

Fear, panic sets within investors due to the poor performance of a fund during market turbulence. This drives them into abruptly discontinuing their SIPs. Any short-term volatility can affect the fund's return, but if you have selected the right mutual fund, do not get swayed and have patience. As mutual fund investment can only be successful if it is done for a long time on account of the power of compounding.

When the market is down, you should continue your SIPs, you can buy more mutual fund units for the same price. In the long run, this helps in lowering the total cost of investment. In short take advantage of this situation.

-

Forgetting about investment

Once you start a SIP, you completely forget it and do not bother reviewing it. They assume that since it is a long-term wealth accumulation process, monitoring isn't required.

Every fund performs differently and even the soundest mutual fund which is managed the best fund manager requires monitoring. Because if you do not monitor and review them, you might end up losing opportunities that can help you accumulate your desired corpus faster.

Hence you need to review, evaluate to make renewals, or rethink your investments based on the performance of the investment portfolio frequently, and replace the non-performing mutual funds by those with a high probability of good returns after every 6 months or at least a year.

-

Not choosing the step-up option

Not considering, a step-up option can be a deterrent for growing your corpus to the desired level. SIP investments over the long run help in accomplishing your financial goals due to the power of compounding as it provides inflation-adjusted returns.

So, in case if you receive a salary hike or a bonus, increasing /stepping up your SIP instalment annually at a fixed rate will help in the accumulation of a bigger amount.

She interrupted me, 'what's better, a dividend option or growth option?'

Choosing a dividend over a growth option solely relies on your cashflow requirement and your end objective.

With the focus on long term growth, many individuals choosing the dividend option to earn income as well through partial withdrawals on a regular basis would be wrong. This is a bummer because it goes against the major benefit of SIP investments and mind you, mutual fund houses and their schemes do not guarantee regular dividends. Hence, the growth of your initial investment (wealth accumulation process) through compounding doesn't reach its potential.

Whereas under the growth option, reinvestment of your initial amount takes place multiple times and compounds it manifold to boost up in growing wealth for you. Hence choose the growth option to receive compounded wealth, and eventually, to help you achieve your goals.

Epilogue:

Chaya thanked me and summarised all that she understood about SIP investments.

Investing in Mutual Funds through SIPs can help one accomplish financial milestones in the right way. It is a wonderful option that besides growing wealth also helps in developing patience, focus, and discipline, i.e. good habits.

[Read: Best SIPs To Invest in 2019]

But the most important aspect is to keep your eye on the long-term objective; the longer is your investment horizon, the higher will be your scope to build wealth from the market. Hence don't let your emotions influence your decisions in the short run.

Before our phone call ended, I pointed out two more important points:

-

Before investing in any mutual fund don't forget your financial goal, risk ability, investment time horizon, and your financial position.

-

Do consider qualitative and quantitative parameters when selecting the right mutual fund suitable for you.

If you too have made these mistakes, it isn't too late to correct them.

Editor's note: Do you want to own an Ultimate Strategic Ready-made Portfolio based on the core and satellite approach of investing?

Yes?

PersonalFN offers you this great opportunity: The 2019 Edition of PersonalFN's Premium Report, "The Strategic Funds Portfolio For 2025"

If you're looking for "high investment gains at relatively moderate risk", this report is extremely worthy.

In this report, PersonalFN will provide you with a ready-made portfolio of its top equity mutual funds schemes for 2025 that have the ability to generate lucrative returns over the long term.

PersonalFN's "The Strategic Funds Portfolio for 2025" is geared to potentially multiply your wealth in the years to come. Subscribe now!

Add Comments