Motilal Oswal Mutual Fund has launched another passively managed fund, but this time it is in the form of Fund of Funds.

Motilal Oswal Nasdaq 100 Fund of Fund (MOFN100FOF) is the latest offering from the fund house, where the scheme will invest in units of its open-ended ETF – Motilal Oswal Nasdaq 100 ETF, that passively tracks and invests in stocks constituting the Nasdaq 100 index.

As you may be aware, a passively managed fund mirrors the performance of its benchmark index and does not require active management. The manager of such a fund buy only the stocks of the underlying index and exits a certain stock only when the respective stock exits from the index and is replaced by another one.

About Motilal Oswal Nasdaq 100 Fund of Fund

The MOFN100FOF is a type of fund of fund, wherein the scheme is mandated to invest a minimum 95% of its total assets in the units of underlying scheme (Motilal Oswal Nasdaq 100 ETF).

It is noteworthy that Motilal Oswal Nasdaq 100 ETF (MOFN100), is a fund that aligned to the world's second largest benchmark index NASDAQ 100 Index. This equity index contains stocks of top 100 U.S. companies (excluding non-financial securities) listed on the NASDAQ stock exchange in the United States.

Being an offshore dominated fund, it contains the risk of investing in foreign securities i.e. exposure of dynamic exchange rate fluctuations and country risks.

[Read: Why Comparing Returns to Risk Is More Meaningful!]

Table 1: NFO Details

| Type |

An open-ended fund of fund scheme investing in Motilal Oswal Nasdaq 100 ETF. |

Category |

Domestic FOF |

| Investment Objective |

The investment objective of the Scheme is to seek returns by investing in units of Motilal Oswal Nasdaq 100 ETF.

However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved |

| Min.Investment |

Rs 500 and in multiples of Re 1 thereafter |

Face Value |

Rs 10 per unit |

| Plans |

• Direct

• Regular |

Options |

• Growth |

| Entry Load |

Nil |

Exit Load |

Nil |

| Fund Manager |

Mr Ashish Agrawal (Equity) and Mr Abhiroop Mukherjee (Debt) |

Benchmark Index |

NASDAQ-100 Index |

| Issue Opens |

November 9, 2018 |

Issue Closes: |

November 22, 2018 |

(Source: Scheme Information Document)

How will the scheme allocate its assets?

Under normal circumstances, it is anticipated that the asset allocation of MOFN100FOF will be as follows:

Table 2: MOFN100FOF's Asset Allocation

|

Instruments

|

Indicative allocations

(% of Total Assets) |

Risk Profile |

| Minimum |

Maximum |

| Units of Motilal Oswal Nasdaq 100 ETF |

95 |

100 |

High |

| Units of liquid/ debt schemes, Debt, Money Market Instruments, G-Secs, Cash and Cash at call, etc. |

5 |

0 |

Low to Medium |

(Source: Scheme Information Document)

What will be the Investment Strategy?

(Image source: freepik.com)

MOFN100FOF will follow a passive investment strategy to achieve the given objective of the scheme that is to seek returns by investing in units of Motilal Oswal Nasdaq 100 ETF.

While making investments the AMC will not perform any economic, financial or market analysis as the underlying scheme reflects NASDAQ-100 Index and so the AMC may not make any judgments about the investment merit of it. Except to meet its liquidity requirements, the scheme would also invest in units of Liquid/ debt schemes, debt and money market instruments as specified in the asset allocation table.

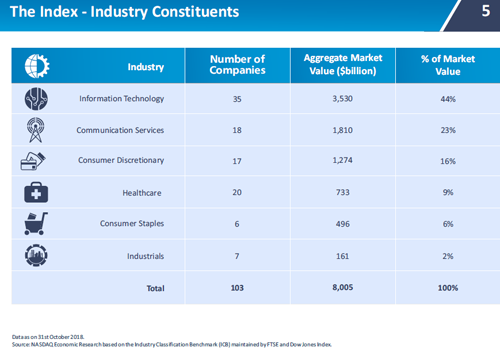

A quick glance on NASDAQ 100 index:

(Source: Motilal Oswal Nasdaq 100 Fund Of Fund Presentation)

The Nasdaq 100 Index is a basket of 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange. The index includes companies from various industries except for the financial services industry, like commercial and investment banks.

As disclosed by the fund house in its presentation, NASDAQ 100 index is skewed more towards the IT- sector and comprises of global business leaders like Apple, Microsoft, Google, Facebook. Over the years technology stocks have evolved to create new and niche consumer products to a host of companies upon which every industry and sector depends.

Who will manage MOFN100FOF?

The Motilal Oswal Nasdaq 100 Fund of Fund will be managed by Mr Ashish Agrawal (Exchange Traded Funds) and Mr Abhiroop Mukherjee (Debt Component).

Mr Ashish Agrawal is the Vice President Dealing and Fund Manager in Motilal Oswal Asset Management Co. Ltd. He is a Commerce Graduate with a Post Graduate program in Management to his credit. Mr Agrawal has around 13 years of experience in institutional equities business. Prior to joining Motilal Oswal Asset Management Co. Ltd, he worked at RBS Securities India Limited - as Associate Director, Sales for a brief period and at Citigroup Global Markets - as Vice President, Sales Trading for 6 years. Mr Agrawal is one of the lead fund managers at the AMC. Other schemes that he manages include Motilal Oswal M50 ETF and Motilal Oswal Midcap 100 ETF

Mr Abhiroop Mukherjee is the Associate Vice President - Fixed Income at Motilal Oswal Asset Management Company Ltd. He has a BCom(Honours) and PGDM in Finance to his credit. He has over 10 years of experience in the Fixed Income Securities trading and fund management. Prior to joining the fund house, he worked as an Assistant Vice President of Fixed Income at PNB Gilts Ltd for 5 years

Currently, Mr Mukherjee manages the debt component at the fund house that includes: Motilal Oswal Ultra Short -Term Fund, Motilal Oswal Midcap 30 Fund, Motilal Oswal Multicap 35 Fund Motilal Oswal Long-Term Equity Fund and Motilal Oswal Dynamic Fund

The outlook for Motilal Oswal Nasdaq 100 Fund of Fund:

The aim of Motilal Oswal Nasdaq 100 fund of fund is to capture potential returns of the underlying NASDAQ 100 ETF for over a longer horizon.

The fund house believes that the US market has been in a long-drawn bull run since the first launch of NASDAQ 100 ETF and further appreciation of US dollar has fed into the fund's past returns.

Table 3: Performance history of Motilal Oswal Nasdaq 100 ETF

| |

Absolute Returns (%) |

CAGR (%) |

| Scheme Name |

6 Months |

1 Year |

2 Years |

3 Years |

5 Years |

Since Inception |

| Category: ETFs - Other |

|

|

|

|

|

|

| Motilal Oswal Nasdaq 100 ETF |

5.21 |

20.35 |

22.85 |

17.75 |

17.53 |

22.40 |

| Category: Benchmark |

|

|

|

|

|

|

| Nasdaq-100 |

-0.91 |

8.33 |

19.71 |

14.56 |

14.93 |

15.22 |

| NIFTY 50 - TRI |

0.43 |

6.02 |

16.27 |

12.48 |

13.40 |

9.87 |

(Performance as on 16-Nov-2018; Source: ACEMF)

As seen above the underlying Motilal Oswal Nasdaq 100 ETF has managed to provide returns better than the benchmark Nasdaq 100 index as well as the Nifty 50 TRI index.

It is noteworthy that these returns are in rupee terms and the huge depreciation in the value of INR against the USD has resulted in additional alpha over the benchmark Nasdaq 100 index. Undoubtedly, Nasdaq 100 has delivered returns better than Nifty 50 - TRI (benchmark for the performance of Indian equity markets).

It is important to understand that both the markets have their own pros and cons. Therefore, whether to sign up for this fund or avoid will depend on your preference, suitability and risk appetite as an investor.

PersonalFN believes that one should preferably invest in the market they understand well. Offshore funds are not everyone's cup of tea. It can be at the best be considered for diversification, only after you have fulfilled your domestic commitment. Still it is important to understand the underlying risk related to offshore investing i.e. the risk of investing in foreign securities that carry an exchange rate risks related to depreciation of foreign currency, geo-political risk and country specific risks.

From taxation point of view, offshore funds as well Fund-of-Funds qualify under non-equity tax status. Therefore, investors in this fund will not be getting the favourable tax status enjoyed by equities and equity mutual funds.

Another point to keep in mind is that the expense of the fund will be slightly higher compared to the underlying Motilal Oswal Nasdaq 100 ETF. Motilal Oswal Nasdaq 100 Fund of Fund however offers an opportunity to investors who would prefer enjoying the benefit of the fund through the SIP mode, instead of buying units of the Motilal Oswal Nasdaq 100 ETF directly from the exchange. But you need to keep in mind your preferences before signing up for the fund.

[Read: Skip NFOs, Instead Consider Building A Strategic Mutual Fund Portfolio]

PS: If you want to add SOLID mutual funds to your portfolio, try PersonalFN's unbiased premium research service—FundSelect is meant to assist investors in selecting worthy mutual fund schemes.

© Quanutm Information Services Pvt. Ltd. All rights reserved.

Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement.

Disclaimer: Quantum Information Services Pvt. Limited (PersonalFN) is not providing any investment advice through this service and, does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. All content and information is provided on an 'As Is' basis by PersonalFN. Information herein is believed to be reliable but PersonalFN does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. PersonalFN and its subsidiaries / affiliates / sponsors or employees, personnel, directors will not be responsible for any direct / indirect loss or liability incurred by the user as a consequence of him or any other person on his behalf taking any investment decisions based on the contents and information provided herein. This is not a specific advisory service to meet the requirements of a specific client. Use of this information is at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. All intellectual property rights emerging from this newsletter are and shall remain with PersonalFN. This is for your personal use and you shall not resell, copy, or redistribute this newsletter or any part of it, or use it for any commercial purpose. The performance data quoted represents past performance and does not guarantee future results. As a condition to accessing PersonalFN's content and website, you agree to our Terms and Conditions of Use, available here.

Quantum Information Services Pvt. Ltd. Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com CIN: U65990MH1989PTC054667

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments