Reliance Growth Fund is among the few schemes with a track record of over two decades. Launched in 1995, by Reliance Mutual Fund, it is one of the flagship schemes of the fund house. Last year, ace fund manager Mr Sunil Singhania and then CIO moved out of the AMC and gave way to Mr Manish Gunwani, another well-known fund manager, and erstwhile Deputy CIO of ICICI Prudential Mutual Fund.

As Mr Gunwani took over as CIO-Equity, Reliance Mutual Fund and the fund manager of Reliance Growth Fund in September 2017, there has been a drastic shift in the portfolio holdings and market-cap allocation. There has been a significant reallocation of assets from large-caps into mid-cap stocks. This comes especially at a time when most fund managers have been doing the opposite.

In March 2018, Reliance Mutual Fund reclassified the scheme from an Equity Growth scheme to a Mid-cap Fund. Though in the past the fund has not hesitated to introduce mid-caps in the portfolio, it maintained a multi-cap style of investing. Now, the fund has adopted a more aggressive mid-cap approach.

In view of the new strategy, the Reliance Growth Fund has rightly adopted the S&P BSE Midcap as the new benchmark, from S&P BSE 100 earlier.

In terms of performance, Reliance Growth Fund has delivered decent returns. Being a multi-cap styled fund in the past, it is not fair to compare the performance with the aggressive S&P BSE Mid-cap Index. On comparing the performance of the scheme with the S&P BSE 100, we find it has generated an acceptable alpha.

Even on comparing the performance to the more aggressive Mid-cap Index, it is seen that the returns of the growth scheme has closely tracked the S&P BSE Mid-cap. Thus with the new aggressive strategy of the fund and with a highly experienced fund manager, it needs to be seen whether the Reliance Growth Fund is able to generate an alpha as it has done in the past.

The AUM of the fund is not extremely high at around Rs 7,000 crore. This gives the fund manager a reasonable amount of flexibility and liquidity to manage a portfolio of mid-cap stocks.

In this brief analysis, we take a close look at the features and performance of Reliance Growth Fund.

Investment Objective of Reliance Growth Fund

Reliance Growth Fund has an investment objective to "achieve long-term growth of capital by investment in equity and equity related securities through a research based investment approach."

Fund Facts

| Category |

Diversified |

Style |

Growth |

| Type |

Open ended |

Market Cap Bias |

Mid-cap |

| Launch Date |

8-Dec-95 |

SI Return (CAGR) |

23.06% |

| Corpus (Cr) |

Rs 7,033 |

Min./Add. Inv. |

Rs 5,000 / Rs 1,000 |

| Expense Ratio (Dir/Reg) |

1.28% / 1.98% |

Exit Load |

1% |

Data as on February 28, 2018.

SI Return as on April 4, 2018.

(Source: ACE MF)

Under normal circumstances, Reliance Growth Fund will allocate…

Growth Of Rs 10,000, If Invested In Reliance Growth Fund 5 Years Ago

Data as on April 4, 2018

Data as on April 4, 2018

(Source: ACE MF)

Had you invested Rs 10,000 in Reliance Growth Fund, five years back on April 4, 2013, it would have grown to Rs 25,381. This translates in to a compounded annualised growth rate of 20.46%. In comparison, a simultaneous investment of Rs 10,000 in its current benchmark – S&P BSE Mid-cap would now be worth Rs 26,346 (a CAGR of 21.37%). However, as the scheme was earlier a multi-cap style fund, it will be right to compare the performance to the S&P BSE 100 index. Over the 5-year period, the S&P BSE 100 generated a compounded return of 13.52%, resulting in a portfolio value of Rs 18,849. Reliance Growth has performed reasonable well to outdo its earlier benchmark.

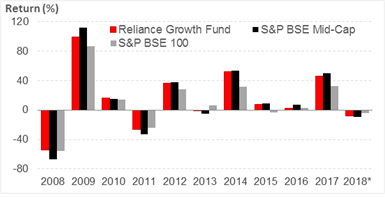

Reliance Growth Fund: Year-on-Year Performance

YTD as on April 4, 2018

(Source: ACE MF)

Reliance Growth Fund has a track record of over two decades. The year-on-year performance of the fund vis-à-vis its current benchmark – S&P BSE Mid-cap has not been very impressive when the market has been rallying. However, in periods where the market has declined, the scheme has been able to restrain losses. But when compared to its erstwhile benchmark for its past performance, Reliance Growth has outperformed in most periods. Therefore, prior to the change in its investment strategy, Reliance Growth has been a competitive scheme.

Reliance Growth Fund: Performance Vis-à-vis Category Peers

Rolling Period Returns

| Scheme Name |

Corpus (Rs Cr) |

1 Year |

2 Year |

3 Year |

5 Year |

Std Dev |

Sharpe |

| Mirae Asset Emerging Bluechip |

5,131 |

34.19 |

26.62 |

25.94 |

31.16 |

15.50 |

0.19 |

| Aditya Birla SL Small & Midcap Fund |

2,070 |

35.68 |

28.14 |

25.01 |

27.02 |

17.35 |

0.20 |

| L&T Midcap Fund |

2,313 |

38.84 |

26.20 |

24.61 |

28.76 |

15.69 |

0.19 |

| Canara Rob Emerg Equities Fund |

3,209 |

34.25 |

23.12 |

23.70 |

29.36 |

17.46 |

0.15 |

| Kotak Emerging Equity Scheme |

3,027 |

27.12 |

22.19 |

22.79 |

25.83 |

14.98 |

0.14 |

| Principal Emerging Bluechip Fund |

1,666 |

32.81 |

24.20 |

22.52 |

27.93 |

16.53 |

0.14 |

| Franklin India Smaller Cos Fund |

7,128 |

26.96 |

22.50 |

22.19 |

30.71 |

14.41 |

0.16 |

| Sundaram Select Midcap |

6,256 |

27.09 |

21.67 |

21.68 |

26.17 |

15.96 |

0.14 |

| DSPBR Midcap Fund |

5,390 |

27.69 |

22.82 |

21.10 |

24.70 |

16.75 |

0.14 |

| Kotak Midcap Scheme |

834 |

26.67 |

21.50 |

20.96 |

23.51 |

15.42 |

0.14 |

| Aditya Birla SL Midcap Fund |

2,393 |

27.92 |

20.37 |

20.54 |

23.50 |

15.82 |

0.11 |

| HDFC Mid-Cap Opportunities Fund |

19,891 |

27.88 |

21.96 |

20.50 |

26.19 |

14.48 |

0.15 |

| Edelweiss Mid Cap Fund |

653 |

30.50 |

19.21 |

20.38 |

26.98 |

15.85 |

0.13 |

| Franklin India Prima Fund |

6,500 |

24.41 |

19.73 |

19.77 |

26.40 |

13.78 |

0.12 |

| BNP Paribas Mid Cap Fund |

814 |

27.32 |

18.30 |

19.54 |

25.54 |

16.78 |

0.09 |

| SBI Magnum MidCap Fund |

3,933 |

17.76 |

16.21 |

19.54 |

27.22 |

14.09 |

0.10 |

| IDFC Sterling Equity Fund |

2,548 |

39.78 |

23.22 |

18.90 |

21.48 |

16.39 |

0.12 |

| Tata Mid Cap Growth Fund |

652 |

27.45 |

16.35 |

18.41 |

24.83 |

16.72 |

0.05 |

| Reliance Mid & Small Cap Fund |

3,320 |

26.26 |

19.10 |

18.19 |

24.35 |

17.30 |

0.08 |

| UTI Mid Cap Fund |

4,167 |

22.66 |

16.33 |

17.94 |

26.73 |

15.65 |

0.09 |

| ICICI Pru Midcap Fund |

1,498 |

28.77 |

18.38 |

17.48 |

24.99 |

15.69 |

0.10 |

| Invesco India Mid N Small Cap Fund |

527 |

26.15 |

17.12 |

17.10 |

24.75 |

15.16 |

0.06 |

| Invesco India Mid Cap Fund |

174 |

25.27 |

16.80 |

17.09 |

24.11 |

15.07 |

0.06 |

| Reliance Growth Fund |

7,033 |

27.14 |

18.05 |

16.10 |

19.32 |

15.96 |

0.08 |

| SBI Magnum Global Fund |

3,456 |

18.42 |

11.62 |

14.39 |

21.57 |

13.63 |

0.03 |

| Axis Midcap Fund |

1,304 |

22.87 |

12.27 |

13.35 |

21.71 |

14.73 |

0.05 |

| S&P BSE Mid-Cap |

|

27.91 |

22.00 |

18.68 |

19.78 |

16.06 |

0.14 |

| S&P BSE 100 |

|

13.95 |

13.56 |

9.07 |

13.48 |

13.18 |

0.01 |

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on April 4, 2018

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

Given that the scheme will now compete with other mid-cap oriented schemes, let us take a closer look at the performance comparison. Reliance Growth appears at the bottom of the list in the longer-term periods, mainly because of its erstwhile strategy. The fund performance lags the benchmark and most other schemes in the category. However, over the past 1-year rolling periods, the performance of the fund has started to get better and in line with the category performance.

However, you should not base your opinion of the fund based on this performance. When compared to the S&P BSE 100, the more appropriate benchmark for the past performance, the returns of Reliance Growth Fund begins to look up. The fund outperformed the benchmark in all periods. Surprisingly, the volatility of the fund compares to other mid-cap schemes.

The top five mid-cap funds based on the 3-year rolling period performance include—Mirae Asset Emerging Bluechip, Aditya Birla SL Small & Midcap Fund, L&T Midcap Fund, Canara Robeco Emerging Equities Fund, and Kotak Emerging Equity Scheme.

Investment Strategy of Reliance Growth Fund

Reliance Growth Fund is a midcap oriented fund aiming at long-term long wealth creation through investments in high growth companies, which are potential large caps. The fund attempts to achieve superior alpha by investing in a combination of market leaders and emerging leaders. It endeavours to identify growth stocks that are available at reasonable valuation, thus adopting a Growth at Reasonable Price (GARP) style for investing.

Reliance Growth Fund invests in companies that have the potential to substantially increase their profitability and companies with a consistent track record. The fund manager will try to identify deep value stocks and benefit from the potential growth from such stocks. The fund invests in companies that are having ability to provide high alpha as compared to risk taken.

Currently, the portfolio is well positioned to benefit from domestic revival through allocation in themes like – Urban Discretionary: Auto, Retail, Short Cycle Capex: Industrial Capital Goods, Industrial Products and Unique Themes: Insurance, Commodity Exchange, Logistics/Distribution

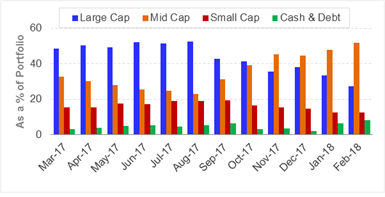

Reliance Growth Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on February 28, 2018

Holdings (in %) as on February 28, 2018

(Source: ACEMF)

Reliance Growth Fund's change in investment strategy is clearly noticeable in the chart alongside. Between March 2017 and August 2017, the fund had been steadily reducing its mid-cap exposure, from about 33% to 23%. However, post-September 2017, the strategy of the fund changed. It began increasing its mid-cap exposure, and the allocation to large-caps reduced. By February 2018, the Mid-cap allocation stood at 52%, the exposure to large-caps was 28% and small-cap exposure was 13%. The fund currently has a high cash balance of 8.21%.

Reliance Growth Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| Varun Beverages |

3.27 |

| Muthoot Finance |

3.04 |

| Spicejet |

2.63 |

| Birla Corporation |

2.51 |

| HSIL |

2.46 |

| Cyient |

2.44 |

| Bharat Financial Inclusion |

2.40 |

| Vardhman Textiles |

2.30 |

| Cholamandalam Invest. & Fin. |

2.08 |

| NMDC |

2.08 |

|

Top 5 Sectors

|

Holdings (in %) as on February 28, 2018

(Source: ACEMF) |

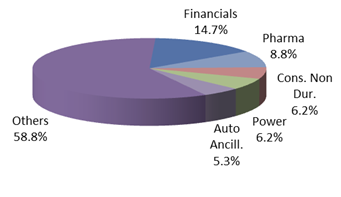

Reliance Growth Fund currently maintains a portfolio of 81 stocks. The number of stocks in the portfolio has increased from around 55 stocks a year ago. The fund maintains a fairly well diversified portfolio over stocks and sectors. The exposure is not skewed to a specific set of stocks or sectors. Among the top 10 holdings, the weightage to individual stocks ranges between 2%-3%. The top 10 stocks account for just 25% of the total portfolio.

Among the sectors, Financial stocks accounted for 15% of the portfolio. Pharma stocks followed behind with an allocation of 9%. Stocks related to the Consumer Non-Durables and Power sectors made up 6.2% of the portfolio each. Auto Ancillary stocks trailed behind with an allocation of 5.3%.

Top Gainers in Reliance Growth Fund's portfolio

It is difficult to pick out the top gainers of the past year in Reliance Growth Fund's portfolio as just 20 stocks of the 81 stocks in the portfolio have been held for over a year. From these 20 holdings, Spice Jet (83%) and NCC (57%) are the only two stocks that returned over 50% over the past year. Among the other performers were Birla Corporation and HSIL.

The laggards in the portfolio included Max Financial Services (-12%), State Bank of India (0%) and Muthoot Finance (10%).

Suitability of Reliance Growth Fund

PersonalFN is of the view that, mid and smallcap space, although has corrected, the valuations are not encouraging, unless you hold a very high-risk appetite. If Indian equities tumble due to any global and/or domestic factors, the mid and smallcap space are bound to take beating, in fact by a greater magnitude than large caps, especially in an environment where corporate earnings miss market expectations.

Hence, it's better to be very selective in your approach. Prefer mutual fund schemes that follow strong investment processes and systems. Also, in the current scenario, staggering your investments would be a better strategy, as it can help manage downside risk. If you are addressing long-term financial goals, opt for Systematic Investment Plans (SIPs), as it would help you mitigate the risk in equities.

Midcap stocks tend to have a higher growth potential. They are often less researched and hence, more often, available at a discount to large-caps. Investment in midcaps can be rewarding over a longer term, as they need considerable time to grow. Though midcaps are often referred as the future large-caps, very few companies actually manage to zoom past the competitors. These companies are not as stable as the large sized companies and at times struggle to sustain when the going gets tough. For this reason, investment in midcaps is considered highly risky. But investment in mid-caps could be well-rewarding over the long-term, provided you hold a very high risk appetite.

Reliance Growth Fund, being mid-cap focused is certainly suitable for investors having a high-risk appetite with a long-term investment horizon. However, not much can be said on how the fund is likely to perform, given the new investment strategy.

Reliance Growth Fund has been generating decent returns ever since inception, and has performed steadily across market cycles. But given its new high-risk strategy, investors should clearly understand their risk appetite, before taking exposure in this fund.

If you plan to invest in mid-cap funds, do ensure that the investments is in line with your financial goals. If you are not sure about how to align these schemes with your tax planning or financial goals, do consult your financial planner or investment advisor.

Note: This write up is for information purpose and not a recommendation to buy or sell the mutual fund scheme. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor.

|

Editor's note:

If you’re unsure where to invest fresh investible surplus currently, to strike the correct risk-return trade-off we recommend adopt a ‘core and satellite approach’ to investing. Here are 6 benefits of ‘core and satellite approach’:

-

Facilitates optimal diversification;

-

Reduces the risk to your portfolio;

-

Enables you to benefit from a variety of investment strategies;

-

Aims to create wealth cushioning the downside;

-

Offers the potential to outperform the market; and

-

Reduces the need for constant churning of your entire portfolio

‘Core and satellite’ investing is a time-tested strategic way to structure and/or restructure your investment portfolio. Your ‘core portfolio’ should consist of large-cap, multi-cap, and value style funds, while the ‘satellite portfolio’ should include funds from the mid-and-small cap category and opportunities style funds.

But what matters the most is the art of astutely structuring the portfolio by assigning weightages to each category of mutual funds and the schemes you select for the portfolio.

Moreover, with change in market outlook the allocation/weightage to each of the schemes, especially in the satellite portfolio, need to change.

Keep in mind: Constructing a portfolio with a stable core of long-term investments and a periphery of more specialist or shorter-term holdings can help to deliver the benefits of asset allocation and offer the potential to outperform the market. The satellite portfolio provides the opportunity to support the core by taking active calls determined by extensive research.

So, PersonalFN offers you a great opportunity, if you’re looking for “high investment gains at relatively moderate risk”. Based on the ‘core and satellite’ approach to investing, here’s PersonalFN’s latest exclusive report: The Strategic Funds Portfolio For 2025 (2018 Edition).

In this report, PersonalFN will provide you with a readymade portfolio of its top equity mutual funds schemes for 2025 that have the ability to generate lucrative returns in the long run. PersonalFN’s “The Strategic Funds Portfolio for 2025” is geared to potentially multiply your wealth in the years to come. Subscribe now!

|

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

and condition on which its offer research report. For the terms and condition for research report click here.

Details of associates

- Money Simplified Services Private Limited;

- PersonalFN Insurance Services India Private Limited;

- Equitymaster Agora Research Private Limited;

- Common Sense Living Private Limited;

- Quantum Advisors Private Limited;

- Quantum Asset Management Company Private Limited;

- HelpYourNGO Private Limited;

- HelpYourNGO Foundation;

- Natural Streets for Performing Arts Foundation;

- Primary Real Estate Advisors Private Limited;

- Rahul Goel;

- I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

- Neither QIS, it’s Associates, Research Analyst or his/her relative have any financial interest in the subject Company , except QIS receives fees for providing research to Quantum Equity Fund of Fund (QEFoF) which is Fund of Fund scheme managed by QMF.

- Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report.

- Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront /annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices

Disclosure with regard to receipt of Compensation

- Neither QIS nor it's Associates have any compensation from the subject Company in the past twelve months.

- Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company in the past twelve months.

- Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company in the past twelve months.

- Neither QIS nor it’s Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months except from Axis Bank Limited under a service agreement.

- Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

- The Research Analyst has not served as an officer, director or employee of the subject Company.

- QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments