“Wisdom is often found through unexpected events and people” sounds true in hindsight. Just last week, my brother and I were en route to work when we were passing the St. Xavier’s school near Churchgate station and noticed toddlers obediently waiting in a line to enter the school premises.

This got us reminiscing about our school days and we realized how drastically times had changed. I remarked that a journey from my home in Colaba to my school, which was 20 minutes away, would cost me Re 1. My travel budget for the entire month used to be Rs 60!

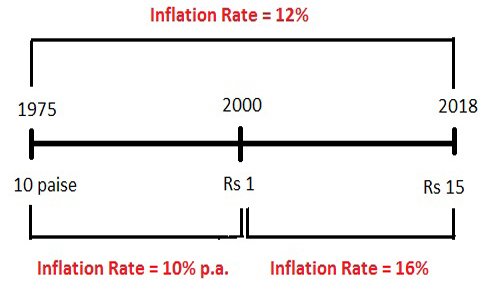

Just to put things in the current perspective, the same journey costs Rs 15. My mother highlighted that it used to cost her 10 paisa. To sum up, 10 paisa in 1975 to Rs 15 in 2018, an average y-o-y inflation of 12%!

Being a Financial Planner, I’m used to gigantic numbers and even though we work on similar assumptions, I had never considered a travel inflation of 12% p.a. But, this article isn’t about inflation. Everyone from the Mumbai dabbawallas to the CEOs in the corner offices understands inflation because they are directly affected by it.

Coming back to the story, we realized that the value of money had changed thrice and while the 12% p.a. inflation didn’t scare us to death, it did make us wonder how adept we would be to handle our future expenses.

Case in point, my brother, Rahul (31), a bank manager in a public sector bank always wanted to travel. His life’s ambition was to become a pilot, but he was bad at math and didn’t have the best eyesight either. Eventually, he became a banking professional.

He still harbours that aspiration to travel and explore places and wants to do it while he is still young. The millennials, no longer wish to work till 60, but instead wish to retire as early as possible, travel the world and live life, but on what terms?

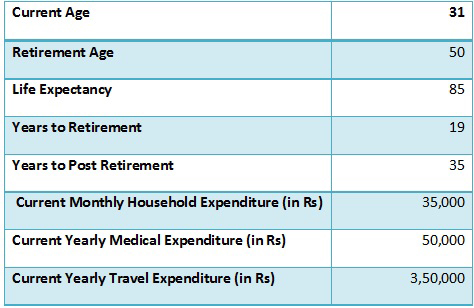

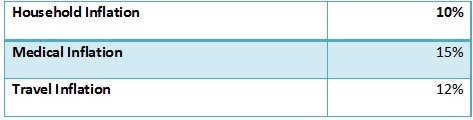

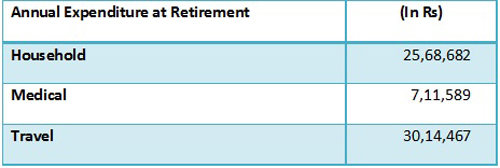

Using PersonalFN’s retirement calculator, I quickly added up the corpus my brother will need to retire comfortably and travel the world. As expected, the answer knocked his socks off!

Table: Hard facts

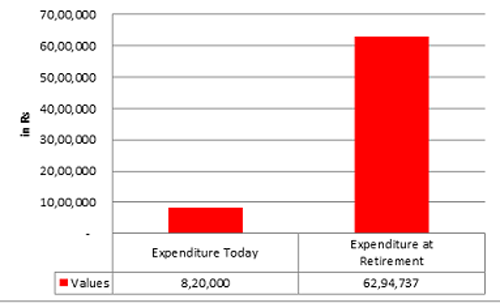

Chart: Today v/s Tomorrow

Just to reiterate, an annual outflow of Rs 8.20 Lakh today will inflate to Rs 62.94 Lakh in the next 19 years. To sustain his post retirement lifestyle, my brother Rahul will have to build a

retirement corpus of Rs 18.89 Crore!

Yes, you read that right. To lead a comfortable, average middle-class lifestyle, a man no longer needs just roti, kapda, aur makaan, he needs 18.89 Crore!

There was a stunned silence in the car. This wasn’t the silence of fear, but rather of dejection and hopelessness.

An event which would occur 19 years down the line had the ability to rob Rahul off his sleep that night. So, my brother pulled out his investment data the following evening and enlisted my help to pave the path for a blissful retirement.

Rahul’s portfolio was fairly simple–and not at all surprising considering his job as a bank manager. Majority of his money was locked in bank Fixed Deposits (FDs) and Systematic Investment plans were replaced by recurring deposits. He also had a couple of Unit Linked Insurance Plans (ULIPs), which were unethically sold to him (by his own colleagues). His only retirement savings were his NPS account, which had returned a CAGR of 6.75% in the last five years.

I informed him that if he kept shunning equities, he would never reach his retirement goal. His existing investments would collectively achieve 35% of his corpus requirement and to fund the balance, he would have to start a Systematic Investment Plan (SIP) of Rs 94,000 per month. This would not be impossible, considering his household income.

While Rahul promised to get started immediately, I couldn’t comprehend why an educated finance person like my brother was apprehensive about equities. And if an educated man, like Rahul who is well versed with the financial world and its nitty-gritty’s is scared, I can only imagine the plight of the non-finance people, who too make a respectable sum of money, but don’t have a clue about how to grow their wealth.

These are the very individuals who end up getting cheated by agents and relationship managers, but refrain from paying fees to an honest, unbiased, ethical financial planner. This is because they refuse to recognise the value of good advice.

You see, there aren’t visible short-term effects of good financial advice. The effects are all long-term and the ones who believe in the essence of planning and are strong enough to manoeuvre through market ups and down see this. They know that good things come to those who wait, patiently and persistently

Oscar Wilde famously said, “Life is too short to make all the mistakes yourself, so learn from the mistakes of others”. So here are some fairly simple pointers from Rahul’s case:

- Don’t stay in the dark: Ignorance is no longer bliss. You will retire someday, so might as well as know your retirement corpus and your chances of achieving it. If you don’t know the problem, how will you find a solution?

- Don’t wait for the right time: Start planning for your financial goals early in life. The right time is now.

- Appreciate the value of good advice: Newspapers, trade pundits or your know-it-all-relatives have no clue of your goals and aspirations. Seek professional financial advice because not everything can be a DIY (Do-It-Yourself) thing.

- Save every penny: Basically, curtail unnecessary expenses and invest the money saved to accomplish your financial goals. Take responsibility for your future today.

Joe Vitale (a spiritual teacher) has aptly said,

“A goal should scare you a little and excite you a lot”.

Want to draw up a holistic financial plan to accomplish your financial goals, but you don't know how to begin?

You can reach out to PersonalFN's Financial Guardian on 022-61361200 or write to info@personalfn.com. You may also fill in this form and our experienced financial planners will reach out to you.

PersonalFN is a SEBI registered investment advisor. We will be happy to help you.

Happy Planning!

Add Comments

| Comments |

debajit.shyamal1986@gmail.com

Mar 15, 2019

The article is......???????????? |

1