| S&P BSE Sensex* |

Re/US $ |

Gold Rs/10g |

Crude ($/barrel) |

FD Rates (1-Yr) |

35,689.00 |66.86

0.19% |

67.83 |0.31

0.45% |

30,437.00 | -612.00

-1.97% |

73.05 |-2.89

-3.81% |

5.00% - 7.00% |

Weekly changes as on June 21, 2018

BSE Sensex value as on June 22, 2018

Impact

The capital market regular wants them to trim their product baskets. But mutual fund houses are bending the rules to expand them.

As you might be aware, SEBI has defined 36 categories for mutual funds. Out of that, 10 categories are for equity-oriented schemes and 16 categories for debt-oriented schemes. The remaining 10 scheme categories cover hybrid and solution-oriented schemes.

The regulator also laid down specific terms and conditions for launching New Fund Offers (NFOs), while even nudged fund houses to merge similar schemes.

Following this, mutual fund houses in India performed a massive exercise of re-categorising and repositioning their scheme offerings. These actions had a common objective to achieve—to do away with scheme duplication which can help investors in scheme selection.

But as they say, old habits die hard.

Mutual fund houses have launched NFOs again. And many of them are launching the closed-ended ones, since the latest SEBI rules aren’t applicable to them.

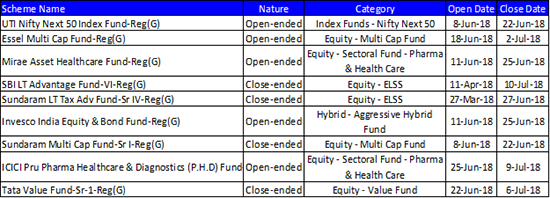

NFO Rush…

(Source: ACE MF)

Aren’t these fund houses concerned about the consequences of scheme duplication?

Similarly, fund houses are also launching sectoral NFOs that predominantly invest in a respective sector or a theme, closely linking the fortune of the fund to undercurrents of that sector/ theme.

[Read: Should You Invest In Mirae Asset Healthcare Fund?]

And launching NFOs particular when valuations appear stretched,exposes investors to very-high risk.

The time of many of the NFO launches is crucial.

Why is it that most mutual fund houses launch NFO when markets are near the high?

The answer is simple: They want to make when the sun shines, garner more Assets Under Management when sentiments are upbeat.

Also, many of these NFO come at a time when investors are unsure whether they should continue with their investments in merged schemes or exit. Instead, to fill in the gap mutual funds are launching NFOs and confusing investors even more.

[Read: Why You Should Be Careful About Investing In NFOs]

Mutual fund houses while they are harping on “Mutual Funds Sahi Hain”, should also educate investors rightly in a far more holistic and engaging way. Mere advertising campaigns may not help.

[Read: Are All Mutual Funds ‘Sahi Hai’? Find Out Here…]

What should investors do?

PersonalFN is of the view that, investors need to outsmart opportunistic fund houses that want to grow their business without bothering about your interest.

Of course, not all fund houses are alike. Some of them manage their assets meticulously, avoid duplicating products, and reward investors well.

Therefore, when choose a fund for your portfolio do not forget to pay close attention the traits of a fund house ––its ideologies, rationale behind launching the fund, whether the fund is unique, and the investment processes & system at the fund house, besides the quantitative factors.

PersonalFN’s more than 15 years’ experience in mutual fund research can help you select the best mutual fund schemes for your investment portfolio.

If you’re looking for “high investment gains at relatively moderate risk”, PersonalFN offers you a great opportunity:

The 2018 Edition of PersonalFN’s Premium Report, "The Strategic Funds Portfolio For 2025"

Based on the ‘core and satellite’ approach to investing, here’s PersonalFN’s premium report:

The Strategic Funds Portfolio For 2025 (2018 Edition).

In this report, PersonalFN will provide you with a readymade portfolio of its top equity mutual funds schemes for 2025 that can generate lucrative returns over the long term.

The Strategic Funds Portfolio For 2025 is built on the “Core and Satellite strategy”for mutual funds investing.

“Core” applies to the more stable, long-term holdings of the portfolio; while the term “satellite” applies to the strategic portion that would help push up the overall returns of the portfolio, across market conditions.

PersonalFN’s research states that 60% of the portfolio should be reserved for Core mutual funds and the balance 40%, for the Satellite mutual funds.

At PersonalFN we believe, if you apply this approach to invest in equity oriented mutual funds, you can get the best of both worlds, that is, short-term high-rewarding opportunities and long-term steady-return investing, and the good thing is, it works!

The ‘Core and satellite’ investing is a time-tested strategic way to structure and/or restructure your investment portfolio.

But what matters the most is the art of cleverly structuring the portfolio by assigning weights to each category of mutual funds and the schemes picked for the portfolio.

[Read: Why You Should Strategically Structure Your Mutual Fund Portfolio]

Also, when there is a change in market outlook, PersonalFN will revisit the strategically structured portfolio by reviewing assigned weights to funds and the portfolio.

How this will help?

✔ Your portfolio will be optimally diversified;

✔ The risk to your portfolio would reduce;

✔ You can benefit from a variety of investment strategies;

✔ Create wealth cushioning the downside;

✔ Potentially outperform the market; and

✔ Would reduce the need for constant churning

PersonalFN’s “The Strategic Funds Portfolio for 2025” is geared to potentially multiply your wealth in the years to come. Subscribe now!

Markets Will Remain Volatile, But Here's How A Strategic Portfolio Comes To the Rescue

Impact

Financial markets are under pressure these days because of on-going tariff war between the U.S. and China.

What initially looked as political rhetoric is now proving to be the real threat that has grown out of proportion.

While addressing the National Federation of Independent Businesses in Washington on the occasion of 75th-anniversary celebrations, President Trump said, “China has been taking out $500 billion a year out of our country and rebuilding China. I always say, “We have rebuilt China.” They’ve taken so much. It’s time, folks. It’s time.” (Source Whitehouse)

To read more, please click here.

Willing To Take Some Investment Risk? Mutual Funds Are Your Best Bet

Impact

When we invest, the essential objective is to earn a decent rate of return that can beat the inflation. Meaning, the returns should counter inflation and protect the ‘time-value’ of our hard-earned money.

But better inflation-adjusted returns (also known as real rate of return), comes with high risk.

If you are willing to take some investment risk, mutual funds–––particularly the equity-oriented ones–––are potentially a worthy option.

To read more, please click here.

Why You Need An All-Weather Mutual Fund Portfolio

Impact

Uncertainty is a part of living.

And the state of capital markets, globally, reeling under the threat of tariff wars and dynamic geo-political equations is proof enough.

In 2017, equity markets across the globe were firing on all cylinders.

Ubiquitously, markets took a U-turn when nobody anticipated them to.

And most times, during the phases of high optimism, mid caps and small caps tend to do exceedingly well. But when the tide turns, they get hammered.

To read more, please click here.

Have You Built A Rainy Day Fund Wisely?

Impact

Last week a very close friend of mine lost her job. It was a shock for her and for all of us. She was working with that organization for 8 years. And you know how it feels when you give almost everything to an organization and it does not take a while to lose all of that.

Well, that is how it is. It is a sad reality. Life is and has always been uncertain.

The only thing we can do is, while we hope for the best, even plan for the worst; because life is full of ups and downs.

To read more, please click here.

Invesco India Equity Bond Fund – New Fund Offer Should You Invest?

Impact

Invesco India Equity Bond Fund is an aggressive hybrid fund which invests 65% - 80% of its net assets into equity and equity related instruments. And being an aggressive hybrid fund it will have debt exposure of around 20% - 35% of its net assets.

To read more, please click here.

FUND OF THE WEEK

SBI Magnum Global Fund: From A MidCap Fund To An MNC Fund

SBI Mutual Fund has re-categorized SBI Magnum Global Fund as an MNC Fund. As the new scheme name suggests, the erstwhile mid-cap oriented fund will now invest in MNC stocks.

Effective from May 16, 2018, as per its new mandate, the two-decade old fund will now maintain a bias towards multi-national companies listed in India.

Earlier, the fund used to invest across equity assets, with a bias towards mid-cap stocks. As the fund moves towards the MNC theme, the exposure to mid-caps will gradually reduce, giving way to globally present large-caps stocks.

To read the complete note, click here.

Tutorials…

Top 10 Mutual Funds For SIP: Don't Ask Alexa Or Google

Financial Terms. Simplified.

Tariff War: A tariff war is an economic battle between two countries in which Country A raises tax rates on Country B's exports, and Country B then raises taxes on Country A's exports in retaliation. The increased tax rate is designed to hurt the other country economically, since tariffs discourage people from buying products from outside sources by raising the total cost of those products.

(Source: Investopedia)

Quote: "The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices.”‒Benjamin Graham