I'm sure many of you recognise the benefit of investing in mutual funds as a worthy investment avenue that creates wealth to accomplish your financial goals.

But has your portfolio rewarded you well recently?

Perhaps, it has not.

Here's how you can change that.

First, I recommend that you review your investment portfolio ––particularly now that the Indian equity market is going through turbulence––before you add more mutual fund schemes to your portfolio.

[Read: Unsure When To Review Your Mutual Fund Portfolio? Read This…]

And if you are planning to discontinue investing in SIPs because you are too frenzied about the falling market, let me apprise you that it would be a grave mistake.

I completely understand the dilemma you are facing. From the beginning of 2018, the Indian stock market has been mercurial, making new day-highs and day-lows. Especially since September onwards, the Indian equity market has hit a rough patch; almost every investor in the Indian equity markets has suffered either a realized loss or a notional loss.

The small and mid-cap segment of the market, in particular, has been hammered over a period of one year.

The current liquidity crunch and weak rupee-a concern. Moreover, the recent tussle between the RBI and government invoking section 7(1) of the Reserve Bank of India Act has brewed murkier conditions.

These factors among a host of others have pulled down the BSE Mid-cap index by a little over 22% from its January high, while BSE Small-cap index declined 31% from its 2018 peak. Many individual stocks have plunged in the range of about 40%-70%.

Table 1: How have various categories of equity mutual funds performed?

| Type of Funds |

Absolute average returns (%) |

CAGR (%) |

| 01/Jan/18 To 09/Nov/18 |

1 Year |

3 Years |

5 Years |

| Market Cap Fund |

|

|

|

|

| Large-cap |

-3.8 |

-1.0 |

10.9 |

14.9 |

| Mid-cap |

-13.1 |

-7.1 |

11.1 |

21.8 |

| Small-cap |

-17.9 |

-10.5 |

11.7 |

23.1 |

| Large and Mid-cap |

-8.4 |

-4.0 |

12.2 |

18.6 |

| Thematic |

-5.5 |

-0.9 |

13.3 |

18.4 |

| Value |

-9.7 |

-5.8 |

12.2 |

19.6 |

| Focused Fund |

-6.9 |

-3.0 |

11.9 |

17.8 |

| Aggressive Hybrid Fund |

-3.9 |

-1.5 |

10.3 |

15.3 |

(Data as on 9th November 2018)

(Source: ACE MF)

As a result, the small-cap funds and mid-cap funds have seen the short end of the stick on a year-to-date basis (See table above).

I believe naïve investors, who invested or bought small and mid-cap funds on misinformation and invested lump sum, have seen one of the biggest losses in their investment history. The ones who had opted for the Systematic Investment Plans (SIPs), which is a mode of investing in mutual funds, are perhaps better off.

On the other hand, the market setback has facilitated a seasoned investor to look at these times as the ripe opportunities to invest.

However, are you holding the right mutual fund schemes in your portfolio?

If you recall in our recent article: “Why You Should Not Stop Investing in Turbulent Times”, we highlighted that not investing during tough market conditions or bringing it to a halt would be a blunder because this can get in the way of compounding that works for your envisioned financial goals.

In my view, at these levels the valuations are fairly placed and provide you with the margin of safety.

There is no denying that the shockwave hasn’t passed through completely yet and still there is more to come; the outcome of the Reserve Bank of India’s autonomy is to be decided soon.

Additionally, with the probable chances of US Federal Reserve’s rate hike, the monetary policy is likely to become tight and drive the market into another round of correction.

However, if you have a time horizon of three years or more, are willing to take risk, and want to create wealth that counters inflation effectively, there are certain categories of equity mutual funds appropriate for your equity mutual fund portfolio.

So, if you invest now, when the market is in a correction mode, you can invest with low corpus at an affordable price. And if you remain invested for a longer time horizon, you can clock a substantial real rate of return to grow your wealth across different market cycles.

(Source: pixabay.com)

Do not worry about short-term volatility/turbulence – that’s the very nature of the equity market.

Hence, I would suggest you to not give up on investing in equity mutual funds now.

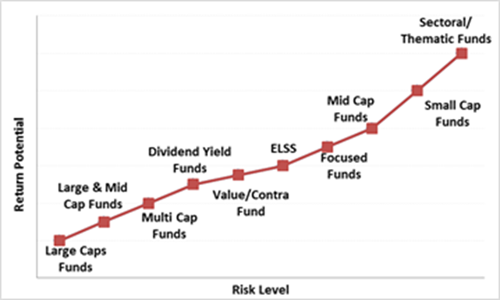

Graph1: Equity Risk-Return Potential

(Source: PersonalFN Research)

Among all the equity-oriented funds, large-cap funds are the safest, while mid-cap funds and small-cap funds carry very high risk.

Table 2: Allocate in equity mutual funds optimally recognising your risk profile

| Category |

Very Aggressive |

Aggressive |

Moderate |

Conservative |

Very Conservative |

| |

|

|

|

|

|

| Equity |

90% to 100% |

75% to 80% |

60% to 70% |

40% to 50% |

20% to 30% |

| Large Cap Funds |

10% to 15% |

10% to 15% |

10% to 15% |

15% to 20% |

10% to 15% |

| Midcap Funds |

20% to 25% |

15% to 20% |

-- |

-- |

-- |

| Large & Midcap Funds |

20% to 25% |

15% to 20% |

10% to 15% |

-- |

-- |

| Multi Cap Funds |

15% to 20% |

15% to 20% |

10% to 15% |

-- |

-- |

| Value Style Funds |

15% to 20% |

10% to 15% |

10% to 15% |

10% to 15% |

0% to 10% |

| Aggressive Hybrid Fund |

-- |

-- |

10% to 15% |

15% to 20% |

10% to 15% |

|

|

|

|

|

|

| Debt |

0% to 5% |

10% to 15% |

20% to 30% |

40% to 50% |

70% to 80% |

| Dynamic Bond Funds |

0% to 5% |

10% to 15% |

10% to 15% |

20% to 25% |

15% to 20% |

Short Duration /

Corporate Bond Funds |

-- |

-- |

10% to 15% |

20% to 25% |

25% to 30% |

Liquid /

Ultra Short Duration Funds |

-- |

-- |

-- |

0% to 10% |

20% to 30% |

|

|

|

|

|

|

| Gold |

0% to 5% |

5% to 10% |

5% to 10% |

5% to 10% |

0% to 5% |

| Gold Funds |

0% to 5% |

5% to 10% |

5% to 10% |

5% to 10% |

0% to 5% |

|

|

|

|

|

|

| |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

| |

|

|

|

|

|

Source: PersonalFN Research

This table is for illustration purpose only.

Remember that as per your level of risks, you should invest in schemes that have a proven track record of performance across market cycles and timeframes. While rebuilding your mutual fund portfolio, choose a combination of funds––equity, debt, hybrid, and gold–––in accordance with your risk profile.

Picking the right mutual fund is challenging because there are over 2,000 plus mutual fund schemes in the market (and growing). Past returns are a good starting point; though this is not the only criteria investors should look at.

If you have noticed in Table 1 above that the Large and Mid-cap funds have been performing consistently to provide decent long-term returns, in rising as well as falling markets.

Hence, be prudent and do not chase momentum or follow the herd because “one man’s meat is another man’s poison”. Evaluate your selection based on qualitative and quantitative parameters to choose a mutual fund scheme for your portfolio.

Quantitative parameters:

- Return analysis across time frames

- Studying the risk ratios to evaluate the level of risk the fund would expose you to

- The effective risk-adjusted returns

- Performance across market cycles, i.e. bull and bear phases

Qualitative parameters:

- The fund manager's work experience from process-driven fund houses backed by the experienced research team

- Low portfolio churning to ensure low costs

- Number of schemes managed by the fund manager

- Adequate Diversification, i.e. exposure to the top 10 holdings should not be more than 50% of the total equity portfolio.

Selecting the most appropriate mutual fund scheme is the key to generating superior returns consistently. And invest directly (vide

Direct Plan) and regularly via SIP to mitigate the risk involved (facilitated by rupee-cost averaging) as well as to benefit from the power of compounding. You can evaluate and create a portfolio of 7-10 funds to construct a winning portfolio.

Editor’s note:

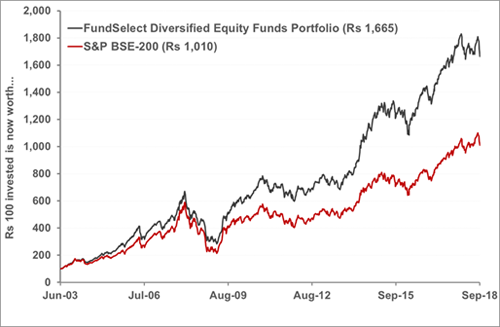

If you want to add SOLID mutual funds to your portfolio that could help you create wealth in the long run?

But don’t have time and skills to select worthy mutual fund schemes; don’t lose heart. PersonalFN's unbiased premium research service—FundSelect is meant to assist investors in selecting worthy mutual fund schemes.

Performance as on September 28, 2018; Past performance is no guarantee of future results

(Source: ACE MF; PersonalFN Research)

PersonalFN's FundSelect has 15+ years of an impeccable track record. FundSelect has been based on one simple motto: “Be steady. Be alert. Be winning.”

With FundSelect, you get access to high quality and reliable funds picked by our research team using their comprehensive S.M.A.R.T. score fund selection matrix.

S – Systems and Processes

M – Market Cycle Performance

A - Asset Management Style

R - Risk-Reward Ratios

T - Performance Track Record

So if you are serious about investing in a rewarding fund, try PersonalFN’s flagship mutual fund research service FundSelect.

Every month, PersonalFN’s FundSelect service will provide you with an insightful and practical guidance on equity funds and debt schemes – the ones to buy, hold, or sell, therefore assisting you in creating the ultimate portfolio that has the potential to top the market. Subscribe to FundSelect today!

Happy Investing!

Happy Investing!

Add Comments