(Image Source: thebluediamondgallery.com)

(Image Source: thebluediamondgallery.com)

“Nowadays people know the price of everything and the value of nothing.”— Oscar Wilde

In daily conversations, market participants usually talk about price levels and index levels. Have you heard investors saying, Markets went up 500 points; Markets fell 200 points?

But how often do you hear about movement in the Price-To-Earnings (P/E) ratio of an index or a stock? P/E ratio is the most commonly used indicator of market valuation. A higher P/E ratio indicates that the valuations are expensive, and vice-a-versa. Nonetheless, that’s not the only parameter to measure the attractiveness of valuations.

After reading this, most of you would agree with Oscar Wilde.

On the one hand, we have legendary investors such as Warren Buffett and John Templeton who always focused on the value of an enterprise, and on the other, we have modern fund managers who almost always talk about “quarterly earnings”. Does that mean value investing is dying?

Perhaps, investors cling to value investing only when the market valuations are skewed and appear extremely expensive.

Are they at present?

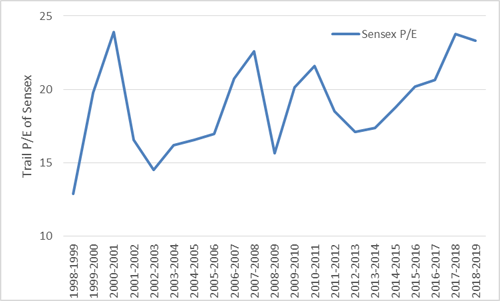

Chart: Time to buy Indian equities?

(Source: BSE)

The table above displays that valuations aren’t cheap.

So, does that mean value investing would be the flavour of 2019?

Possibly yes.

In anticipation of a significant earnings recovery, huge money flowed into the markets over the last few years, which drove valuations higher. But Foreign Institutional Investors (FIIs) have net-sold Indian equities in 2018.

Domestic Institutional Inflows (DIIs), on the other hand, saved Indian markets—courtesy the Mutual Funds Sahi Hai campaign and the retail money that flocked the equity markets through Systematic Investment Plans (SIPs).

[Read: What's In Store For The Indian Mutual Fund Industry In 2019 And Beyond?]

In the absence of earnings recovery, if the flow of DII money slows up in 2019, markets may fall steeply and valuations might also drop.

Many individual stocks, despite falling 25%-30% from their 2017 and early 2018 highs, are expensive. If earnings fail to grow, they might see an even deeper fall in prices.

Remember, 2018 was a bad year for a majority of investors despite investing in mutual fund through SIPs. During such times, novice investors get tempted to stop their SIPs and sell off investments in a panic.

Factors that will make value funds more attractive in 2019:

Markets are expected to stay volatile in 2019, on account of both, international and domestic factors.

At the global level, tensions between the U.S. and China over trade policies might not get resolved even in 2019. In fact, if the global economy heads for a slowdown, as anticipated by many experts, the global trade might come under the weather. Additionally, as business houses prepare for Brexit, trade conditions in Europe are expected to deteriorate further.

Speaking about domestic factors, the markets are oscillating amidst the hustle and bustle of the political arena of late ahead of 2019 Lok Sabha elections. Many were anticipating them to react negatively after BJP lost their foothold in three crucial states. However, the markets’ resilience took everybody by surprise.

This makes it somewhat clear that markets aren’t factoring in the possibility that BJP-led NDA could lose the Lok Sabha 2019 elections.

[Read: Waiting To Invest Until the Outcome of 2019 Lok Sabha Elections? You’re Making a Mistake!]

Will 10% quota for the economically backward upper caste pacify the traditional voter of the ruling party?

Will that have a backlash since it might upset some sections of society?

Will the slogan of sabka saath sabka vikas hold up ground or the traditional caste-based voting pattern make a comeback?

As reported by the Business Standard dated January 08, 2019, inflation-adjusted farm incomes stand at a 10-year low despite generous Minimum Support Price (MSPs) announced by the government. Will this affect the voter’s sentiment in the rural areas?

All these factors will have a bearing on your investments, directly as well as indirectly. Rural distress will spell a muted growth for a number of industries depending on rural spending.

If NDA fails to get another term, markets may retreat.

In falling markets, ‘growth funds’ might underperform value funds this time; since valuations are too high as per the historical standards. Further, value funds will have an edge over ‘growth funds’ in 2019 since they might get attractive buying opportunities this year.

Thus, staying with value funds in 2019 might pay off.

Before you invest in value funds do remember this:

-

Don’t invest in them unless your time horizon is five years and above.

-

Invest in value funds only if you have a high-risk appetite because they can be highly volatile sometimes.

-

Consider your financial goals before investing

If you decide to invest in value funds, prefer

direct plans and invest through the SIP route. This can help you mitigate the volatility (with rupee-cost averaging) and power your investments with the benefit of compounding.

How to select the right value fund for your portfolio?

Look at their performance track record over various time frames and market phases. In addition, pay attention to the risk-return ratios.

Besides, consider the various qualitative factors such as fund manager’s experience, portfolio characteristics, and the fund house’s investment philosophy, among a host of other parameters.

[Read: Why Qualitative Aspects Are So Important To Pick Mutual Funds]

Watch this video to get guidance on selecting the right mutual fund scheme

It’s quite possible that a fund might classify itself as a value fund, but might invest a considerable chunk of its portfolio in growth companies. You need to be wary of such schemes.

The Securities and Exchange Board of India (SEBI) hasn’t specifically defined what classifies as a value stock, unlike for other equity mutual funds that follow a particular market capitalisation bias. So, pick your funds carefully while you endeavour to create wealth.

PS: Believe us, unusual and lesser-known funds are capable of generating big gains for you. Some hidden gems are managed well and have the potential to deliver superior risk-adjusted returns in line with the popular peers in the category.

But any small sized fund will not do. You do not want to pick lesser-known funds that have delivered a one-off performance. You need the ‘right’ ones that can appealingly generate wealth for you.

PersonalFN's special report 5 Undiscovered Funds

PersonalFN's special report 5 Undiscovered Funds will help you invest in the hidden gems. PersonalFN has tested the viability of

Undiscovered Funds featuring in this report by applying a stringent selection process.

What are you waiting for? Subscribe to the special report, 5 Undiscovered Funds today!

Add Comments