The Indian equity market is hitting turbulence almost every day. Perhaps this is causing sleepless nights to many investors ––particularly those financial goals such as children's education, wedding expenses, and retirement are nearing.

If the equity markets fall further, it would significantly affect their financial goals, which is disheartening for anyone.

As far as savvy and mature investors are concerned, they are seasoned witnesses to market gyrations. Still, the current fall in the mid-cap and small-cap stocks and equity mutual funds is unusual and shocking. In fact, mid-cap and small-cap funds have incurred 12%-15% losses in September alone.

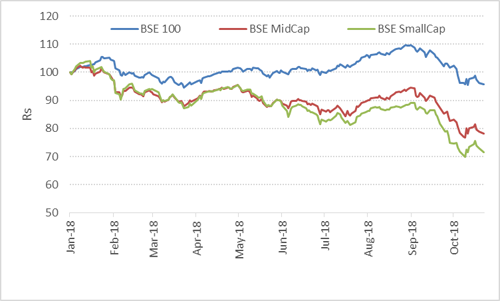

Graph1:Mid & Small Caps are hammered! Worth buying?

Note: the graph above shows the worth of Rs 100 invested on January 01, 2018

Data as on October 22, 2018

(Source:BSE)

Several heavyweights of the benchmark index have been pulled down on evaporating liquidity, poor results, and governance issues.

Considering the distress in Non-banking Financial Companies (NBFCs), many experts are predicting more downside to this market.

The mid-caps and small-cap space, in particular, has been hammered. Now that mid cap and small cap funds have fallen significantly in 2018, some seasoned investors are tempted to invest in them.

Besides, a large number of investors are clueless as to which type of equity mutual fund schemes to buy in the current market condition ––and how to invest, whether lump sum (now that the markets have corrected) or through Systematic Investment Plans (SIPs).

Are you one such investor?

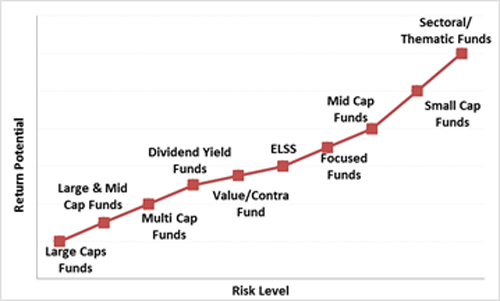

Among all the equity-oriented funds, large-cap funds are the safest, while mid-cap funds and small-cap funds carry very high risk.

Chart 2: Risk-Return Matrix

Note: This chart is indicative and for illustration purpose only

(Source: PersonalFN Research)

[Read: Why Comparing Returns to Risk Is More Meaningful!]

What looks attractive at this juncture, you may ask.

Under the current market conditions, you should not be picking funds that have fallen the most in terms of their NAV. That would be an imprudent assessment to pick best mutual fund schemes for your investment portfolio.

On the contrary, evaluate funds holistically considering a combination of quantitative and qualitative parameters.

The quantitative parameters include:

-

Return analysis across time frames

-

Studying the risk ratios to evaluate the level of risk the fund would expose you to

-

The effective risk-adjusted returns

-

Performance across market cycles i.e. bull and bear

While amongst the qualitative factors, pay attention to the following:

-

Portfolio characteristics (Top-10 holdings, top-5 sectors, the quality of the portfolio, portfolio turnover, etc.)

-

The experience of the fund manager and his research team

-

Number of schemes managed by the fund manager

-

The efficiency with which the fund house is managing your hard-earned money (The proportion of AUM actually performing)

Watch this video:

When you analyse all these aspects in detail, you would be able to make the best use of volatility to invest in sound investment propositions.

Coming to the question of “type of funds”; in the current conditions, multi-cap funds and large-cap funds would be better suited. ‘Multi-cap funds’ hold the flexibility to invest across capitalisations ––i.e. large cap, mid cap and small cap.

A ‘large-cap fund’ on other hand, would offer some stability. A ‘large-cap fund’ may not be as vulnerable as the mid-cap and small-cap funds, who although have the potential to attractive returns during the upswing, during the downswings are more vulnerable.

Having said that, if you wish to assume slightly high risk, you may consider investing in a ‘large-and-mid-cap funds’ that provide you with the best of both worlds i.e., the stability of large-caps and agility of mid-caps.

Hence in the current market conditions a combination of ‘large-cap fund’, ‘multi-cap fund’, and a large-and-mid-cap fund’ would be appropriate to buy. And to mitigate the risk involved, investing via Systematic Investment Plans (SIPs) would be better, especially if you are planning for your long-term financial goals.

Also, note that lesser-known or funds that unpopular today have the potential.

When markets fall, investors become even more cautious about the star-ratings that mutual funds carry. They try to exit mutual fund schemes that enjoy the low ratings.

PersonalFN is of the view that you should not necessarily discard a fund just because it doesn’t enjoy the five-star rating.

In fact, you should take advantage of the current downfall to invest in equity mutual funds that have been ignored by the majority of investors. They need not have fallen the most, but they aren’t in the limelight just yet. It’s just like betting on the superstars of tomorrow.

Rahul Dravid is one of the best test players India ever produced. Choosing Virat Kohli over him would have been extremely difficult for any selector 10-12 years ago. But if you are selecting a player for the future of Indian cricket, there must be enough ‘cricket’ left in that sportsperson. In 2012, Dravid played his last test match. Virat Kohli has kept blossoming with every passing year over this decade.

The same principle holds true for mutual fund schemes.

If you have a time horizon of say 5-7 years, you should bank on mutual fund schemes that have the potential to outperform even today’s top-rated funds.

[Read: 10 Mistakes To Avoid While Investing In Mutual Funds]

But, any small sized fund will not do. After all, you do not want to pick lesser-known funds that have delivered a one-off performance. Also, over the long-term, poor quality funds can lead to disappointing returns. So, you need to find and invest in the ‘right’ ones.

So, how to select undiscovered funds that may potentially help you for retirement planning?

-

Choose mutual fund schemes floated by process-driven fund houses

-

A fund manager should have a decent track record and not managing too many other schemes

-

The fund manager should hold a highly liquid portfolio

-

The portfolio of the fund should be well-diversified across themes and are well-poised to weather any storm coming your way

-

The scheme should have a proven track record across timeframes and market phases

-

A scheme should have favourable risk-reward ratios

These are just a few factors amongst an exhaustive mutual fund research process.

Do you think it's too taxing for you to do it yourself, or you do not have the time and skills to pick the hidden gems of tomorrow?

Don't lose heart. PersonalFN's brand new research report: 5 Undiscovered Equity Funds – With High Growth Potential is meant just for you.

These unusual and lesser-known funds are capable of generating big gains for you, the investor. So, recognize the hidden gems before the crowd discovers them.

Want to know which are these ‘Undiscovered’ funds? Subscribe now!

Happy Investing!

Add Comments

| Comments |

garlapatikr@gmail.com

Oct 28, 2018

Undiscovered funds pl forward information |

spkakde@gmail.com

Oct 28, 2018

What about Balance & Etf funds? |

satnirm@gmail.com

Oct 30, 2018

Call |

satnirm@gmail.com

Oct 30, 2018

Call |

1