8 Points to Consider Before Buying Group Health Insurance for Your Employees

Ketki Jadhav

Apr 26, 2022

Listen to 8 Points to Consider Before Buying Group Health Insurance for Your Employees

00:00

00:00

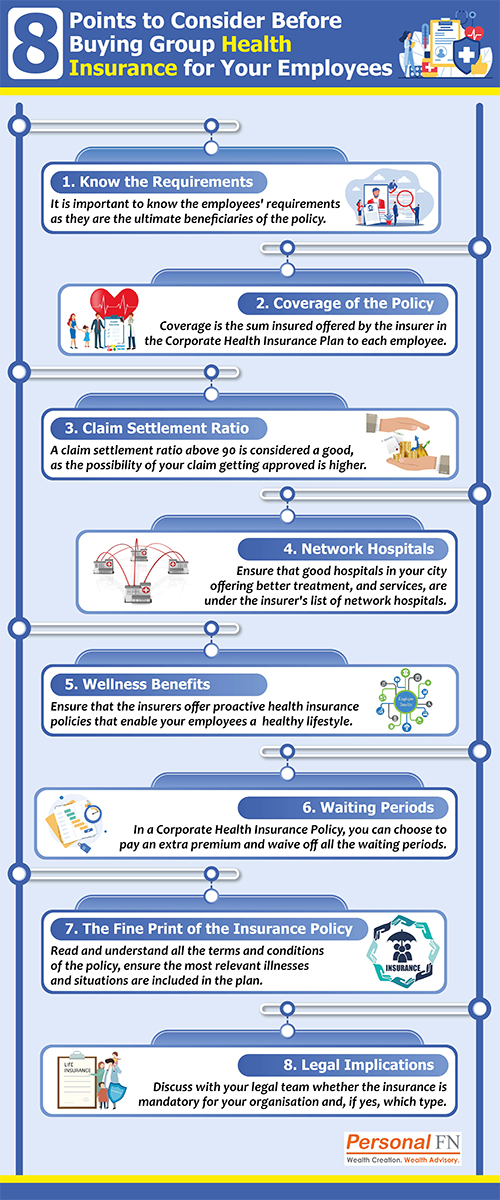

Employees are the most crucial asset for the growth of an organisation. Hence, it is the employer's responsibility to care for their employees' health and well-being. The basic thing that an employer can do to contribute to the employees' health and ensure they are financially protected against any uncertainty is to provide them with Group Health Insurance. A Comprehensive Group Health Insurance Cover not only provides financial protection to the employees but also acts as an important factor for employees' satisfaction and retention. However, to ensure the employees' insurance is productive, you should buy the right plan that offers maximum benefits to the employees and their families. This article elucidates 8 important points to consider before buying Group Health Insurance for your employees.

To ensure your Group Health Insurance is beneficial to the employees, it has to be employee-centric. Here are 8 points to consider when buying Group Health Insurance for your employees:

1. Know the Requirements:

The first thing to do when buying any product or service is to understand your requirement. While saving the premium amount could be your requirement, it is important to know the employees' requirements as they are the ultimate beneficiaries of the policy. However, you need to be realistic with the cost at the same time. The cost of premiums increases with the increased number of employees, and the insurance premium per employee will also increase over time, which needs to keep in mind. Hence, you need to strike a balance between what you pay and what benefits are offered to the employees. It is also necessary to take feedback from the employees on the various benefits that you offer to them. Make sure they are actually benefiting the employees.

2. Coverage of the Policy:

Coverage is the sum insured offered by the insurer in the Corporate Health Insurance Plan to each employee. Depending upon the size of the organisation and the age group of the employees, you may need or do not need certain insurance covers. For example, if all your employees are unmarried and need to travel a lot, a personal accident cover should be a part of your policy. Similarly, if most of your employees are married, you should consider having maternity benefits. Some of your employees could be senior citizens who might require critical illness cover. So, depending upon the age group, you can buy the insurance coverage.

(Image Source: www.freepik.com)

(Image Source: www.freepik.com)

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds

3. Claim Settlement Ratio:

The claim settlement ratio is the number of claims settled by the insurer out of the number of claims received in a year. A claim settlement ratio above 90 is generally considered a good ratio as it suggests the possibility of your claim getting approved is higher. Apart from the claim settlement ratio, you should also check whether the insurer's claim settlement process is quick and easy so that your employees have a hassle-free experience during the challenging times.

4. Network Hospitals:

When you buy a health insurance policy, the insurer gives you a list of network hospitals. These are the hospitals the insurer has tie-up with for cashless hospitalisation. The biggest benefit of getting treatment from a network hospital is that the policyholder, in this case, the employee, does not have to make arrangements to pay hospital bills and then wait for the reimbursement as the patient does not have to pay anything for a cashless treatment. Many employers do not give importance to this point, but when a person is sick, they would want the treatment from a hospital that offers the best medical facilities and expert doctors without worrying about arranging the finances. Therefore, it is crucial to ensure that the good hospitals in your city that offer good facilities, treatment, and services, are under the insurer's list of network hospitals.

5. Wellness Benefits:

Nowadays, more and more people are focusing on their mental health and well-being due to increased awareness about it during the Covid-19 pandemic. Hence, many insurers offer proactive health insurance policies that not only offer financial assistance when the employee is hospitalised but also help them enable a lifestyle that can avoid hospitalisation in the first place. These policies offer benefits like free health check-ups, discounts on labs, discounts on gym subscriptions, free consultation with a dietitian, discounts on medicines, tele-consultation for mental health, provide free wearable devices that can track employees' health, etc.

6. Waiting Periods:

The waiting period is the time when your employees have to wait to take certain treatments. The waiting periods are of generally three types:

-

Initial waiting period: once you purchase the policy, there is typically a waiting period of 30 days. So, during this waiting period, you can only make claims related to accidental hospitalisation.

-

Specific disease waiting period: The insurer will give you a list of diseases that are generally covered under the policy after a waiting period of 2 years.

-

Pre-existing diseases waiting period: Pre-existing diseases are the medical conditions that you have before purchasing the policy. These conditions are covered after a waiting period of 3-4 years.

However, in a Corporate Health Insurance Policy, you can choose to pay an extra premium and waive off all these waiting periods.

7. The Fine Print of the Insurance Policy:

Every insurance policy comes with its own sets of inclusions and exclusions. Inclusions are the situations and illnesses that are covered under the policy. Whereas exclusions are the situations and illnesses that are not covered under the policy. Besides, there are policy exemptions and situations that are not covered under the policy. Therefore, before buying the Corporate Health Insurance Policy, you should read and understand all these terms and ensure the most relevant illnesses and situations are included in the plan. Otherwise, the plan will not be of any use to your employees. Furthermore, once you get the insurance policy, it is important to read that fine print to understand all the terms and conditions.

8. Legal Implications:

Discuss with your legal team whether the insurance is mandatory for your organisation and, if yes, which type. For example, if your organisation is a manufacturing industry, you might require to insure your employees, including factory workers, as per the Employee State Insurance Act, 1948.

If your organisation has opened up after the lockdown, the government encourages these new firms to insure their employees with group health insurance.

To Conclude:

Buying a Comprehensive Group Health Insurance Plan helps employees live stress-free and increases their productivity. It also helps the employer save tax and increase employee retention. Considering the above-mentioned points when buying Corporate Health Insurance will ensure you provide maximum benefits to your employees while also saving the cost of the premium. It is advisable to compare different insurers in terms of premium, customer reviews, claim settlement ratio, customer service, etc. Also, encourage your employees to provide timely feedback about the services so that you know how much it is beneficial to them.

Warm Regards,

Ketki Jadhav

Content Writer