PGIM India Midcap Opportunities Fund: Focusing on Quality Midcap Stocks

Divya Grover

Jun 15, 2023 / Reading Time: Approx. 10 mins

Welcome to PersonalFN's weekly analysis on diversified equity mutual funds. In this issue, we have analysed PGIM India Midcap Opportunities Fund, highlighting its performance, peer comparison, investment strategy, fundamentals, portfolio, and suitability.

PGIM India Midcap Opportunities Fund is a well-managed Midcap Fund that has turned out to be one of the top performers in the category. It focuses on identifying quality midcap stocks which can benefit from a favourable economic environment.

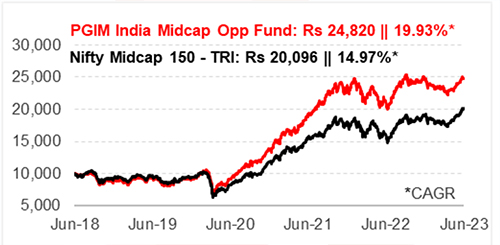

Growth of Rs 10,000 if invested in PGIM India Midcap Opportunities Fund 5 years ago

PGIM India Midcap Opportunities Fund is a growth-oriented mid-cap biased fund that aim to offer greater growth potential as compared to large caps but at a lower volatility and risk as compared to small caps. The fund follows a mix of the top-down and bottom-up approach to select high-quality stocks across sectors. Belonging to a process-driven fund house, PGIM India Midcap Opportunities Fund considers valuation parameters as well as growth, margins, asset returns, and cash flows, amongst others while selecting stocks. The fund remained among the underperformers in its first few years of inception. However, with a focus on high-quality stocks, it recorded a major breakthrough outperformance during the market crash in 2020 and stood strong among the category outperformers. Moreover, the fund participated in the ensuing bounce-back rally and turned out to be one of the top performers, not only in the Mid-cap Fund category but across diversified equity funds. Overall, with its extraordinary performance recorded in the last few years, PGIM India Midcap Opportunities Fund has shown a clear turnaround and improvement in its performance across time periods. In the past 5 years, PGIM India Midcap Opportunities Fund has rewarded investors with a CAGR of around 19.9%, as against about 15% CAGR delivered by its benchmark Nifty Midcap 150 – TRI index. An investment of Rs 10,000 in PGIM India Midcap Opportunities Fund would have now appreciated to Rs 24,820.

Past performance is not an indicator of future returns

Past performance is not an indicator of future returns

Data as on June 12, 2023

(Source: ACE MF)

PGIM India Midcap Opportunities Fund's performance vis-á-vis category peers

| Scheme Name |

Corpus (Cr.) |

1 Year |

2 Year |

3 Year |

5 Year |

7 Year |

Std Dev |

Sharpe |

| Motilal Oswal Midcap Fund |

4,508 |

38.85 |

27.36 |

41.09 |

18.49 |

17.12 |

17.43 |

0.53 |

| Quant Mid Cap Fund |

1,973 |

20.38 |

18.19 |

40.42 |

21.34 |

18.49 |

18.74 |

0.48 |

| PGIM India Midcap Opp Fund |

8,549 |

16.93 |

13.58 |

39.62 |

19.93 |

19.08 |

17.96 |

0.51 |

| SBI Magnum Midcap Fund |

10,145 |

27.92 |

19.10 |

39.60 |

17.77 |

15.42 |

17.42 |

0.51 |

| HDFC Mid-Cap Opportunities Fund |

39,296 |

34.63 |

18.20 |

36.98 |

15.67 |

17.59 |

17.08 |

0.48 |

| Edelweiss Mid Cap Fund |

3,011 |

25.78 |

14.77 |

36.24 |

16.76 |

18.19 |

17.59 |

0.46 |

| Nippon India Growth Fund |

15,165 |

25.00 |

16.48 |

35.67 |

17.05 |

17.56 |

17.60 |

0.47 |

| Kotak Emerging Equity Fund |

27,871 |

23.52 |

14.40 |

34.89 |

16.89 |

17.91 |

16.27 |

0.48 |

| Mahindra Manulife Mid Cap Fund |

1,208 |

25.33 |

14.26 |

32.86 |

16.72 |

-- |

17.28 |

0.42 |

| ICICI Pru Midcap Fund |

3,803 |

18.45 |

10.20 |

32.74 |

13.00 |

15.52 |

17.93 |

0.43 |

| Nifty Midcap 150 - TRI |

|

25.09 |

13.00 |

34.56 |

14.97 |

17.34 |

16.10 |

0.38 |

The securities quoted are for illustration only and are not recommendatory

Returns are point to point and in %, calculated using the Direct Plan-Growth option. Those depicted over 1-Yr are compounded annualised.

Data as on June 12, 2023

(Source: ACE MF)

Please note, this table only represents the best-performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully before investing. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

PGIM India Midcap Opportunities Fund has registered superior performance in the last few years and has managed to generate a healthy alpha over its benchmark Nifty Midcap 150 - TRI Index. The recent outperformance has helped the fund improve its long-term performance as well and has helped it to generate a significant lead over the category average and the benchmark across most time periods. On a longer time periods of 5-years and 7-years, the fund stands among the category toppers. Even though PGIM India Midcap Opportunities Fund has trailed the benchmark and many of its peers in the last one-year period, it has the potential to bounce back with significant gains.

On risk-return parameters, PGIM India Midcap Opportunities Fund has encountered higher volatility (17.96%) when compared to some of its category peers but is still lower than the benchmark. The fund's superior outperformance over the last few years has helped it generate higher risk-adjusted returns for investors. Its Sharpe (0.51) is currently among the highest in the Mid-cap Fund category, thus rewarding investors with superior risk-adjusted returns.

Image source: www.freepik.com - photo created by rawpixel.com

Image source: www.freepik.com - photo created by rawpixel.com

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

Investment strategy of PGIM India Midcap Opportunities Fund

PGIM India Midcap Opportunities Fund is a midcap fund that is mandated to invest a minimum 65% of its assets in mid-cap stocks (defined as stocks between 101 to 250 ranked as per market capitalization). The fund follows a combination of the top-down and bottom-up approach to select quality mid-cap stocks across sectors, and gives higher weightage to valuation parameters as well as growth, margins, asset returns, and cash flows, amongst others. While selecting stocks the fund managers look at the current and historical financial condition of the company, potential value creation/unlocking of value and its impact on earnings growth, capital structure, business prospects, policy environment, strength of management, responsiveness to business conditions, product profile, brand equity, market share, competitive edge, research, technological know-how, and corporate governance.

The fund holds top 40%-45% of its portfolio in 'Stable Growth' i.e. companies with stable earnings and strong earnings visibility (of 14-16%); mid 40%-45% of the portfolio is in 'High Growth' stocks i.e. companies with strong earnings growth (of above 20%); and bottom 10%-20% of the portfolio in 'Turnaround' stocks i.e. Turn around stories and good companies going through bad times with significant potential for alpha generation.

PGIM India Midcap Opportunities Fund invests in a well-diversified portfolio of stocks, limiting exposure to single stocks within the 5% mark. Although PGIM India Midcap Opportunities Fund follows a buy and hold investment strategy, it is nimble in its approach and does not hesitate to churn a small portion of its portfolio to capture attractive opportunities in the mid cap segment. In the last 12 months, PGIM India Midcap Opportunities Fund has registered a turnover ratio between 85% to 120%.

Top portfolio holdings in PGIM India Midcap Opportunities Fund

Holding in (%) as of May 31, 2023

(Source: ACE MF)

As of May 31, 2023, PGIM India Midcap Opportunities Fund held a diversified portfolio of 67 stocks. The top-10 stocks accounted for around 30% of its assets, with names like Jubilant FoodWorks, Cholamandalam Investment & Finance Company, Tube Investments of India, Timken India, and Persistent Systems forming part of its prominent holdings. Max Healthcare Institute, The Phoenix Mills, Cummins India, Navin Flourine International, and Indraprastha, were among other prominent holdings in the fund's portfolio.

PGIM India Midcap Opportunities Fund has gained immensely from its holding in Cholamandalam Investment & Finance Co., Cummins India, SKF India, The Federal Bank, and Coforge that have grown significantly in value since the time the fund added them in the portfolio. Meanwhile, it booked substantial profits in The Indian Hotels Company, Ashok Leyland, Bharat Forge, and ICICI Bank among many others.

PGIM India Midcap Opportunities Fund is benchmark agnostic, and prefers to hold a low overlap of 30%-35% with the benchmark and is overweight on sectors which are currently underbought. In terms of sector holdings, the fund's portfolio is majorly exposed to Finance, Engineering, Auto & Auto Ancillaries, Consumption, Chemicals, and Infotech that collectively account for 58.4% of its assets. The fund's other core sectors include Consumer Durables, Construction, Oil & Gas, Healthcare Services, and Pharma among others.

Suitability

PGIM India Midcap Opportunities Fund is an aggressive growth oriented midcap fund, that focuses on investing in high quality growth stocks of mid-sized companies. The fund is capable of riding the tough market conditions well. The nimble approach followed by the fund managers helps it take advantage of stock and sectorial rotations during positive as well as negative market conditions. The fund takes overweight position on underbought sectors to benefit from the growth potential in temporarily ignored sectors.

As PGIM India Midcap Opportunities Fund is benchmark agnostic and has a low overlap with that of the benchmark, the investments in stocks shortlisted using various parameters are made typically at the conviction of the fund manager, irrespective of their weightage in the index. Certainly, the performance of the fund may deviate significantly from the benchmark. Though the fund may at times struggle to keep pace with the benchmark it can reward investors with reasonable gains over complete market cycles.

PGIM India Midcap Opportunities Fund is suitable for investors with a high risk appetite and an investment horizon of at least 5-7 years.

Note: This write up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

.png)

DIVYA GROVER is the co-editor for FundSelect, the flagship research service of PersonalFN. She is also the co-editor of DebtSelect. Divya is an avid reader which helps her in analysing industry trends and producing insightful articles for PersonalFN’s popular newsletter – Daily Wealth letter, read by over 1.5 lakh subscribers.

Divya joined PersonalFN in 2019 and has since then used stringent quantitative and qualitative parameters to analyse funds to provide honest and unbiased research to investors. She endeavours to enable investors to make an informed investment decision and thereby safeguard their wealth.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

Disclaimer: This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision.

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr Ajit Dayal with an objective of providing value-based information/views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc. and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of the second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, its subsidiaries and its Directors.

Terms and condition on which its offer research report

For the terms and condition for research report click here.

Details of associates

-

Money Simplified Services Private Limited;

-

PersonalFN Insurance Services India Private Limited;

-

Equitymaster Agora Research Private Limited;

-

Common Sense Living Private Limited;

-

Quantum Advisors Private Limited;

-

Quantum Asset Management Company Private Limited;

-

HelpYourNGO.com India Private Limited;

-

HelpYourNGO Foundation;

-

Natural Streets for Performing Arts Foundation;

-

Primary Real Estate Advisors Private Limited;

-

HYNGO India Private Limited;

-

Suresh Lulla;

-

I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

-

‘subject company’ is a scheme on which a buy/sell/hold view or target price is given/changed in this Research Report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have any financial interest in the subject Company;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However, any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront / annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices.

Disclosure with regard to receipt of Compensation

-

Neither QIS nor it's Associates have received any compensation from the subject Company in the past twelve months;

-

Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company;

-

Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company;

-

Neither QIS nor it's Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

-

Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

-

The Research Analyst has not served as an officer, director or employee of the subject Company.

-

QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Click here to read PersonalFN's Mutual Fund Rating Methodology

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. & Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021

Email:info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222 SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013