BHARAT Bond ETF And Fund of Fund - April 2033: Here’s all You Need to Know

Mitali Dhoke

Dec 05, 2022 / Reading Time: Approx. 14 min

Listen to BHARAT Bond ETF And Fund of Fund - April 2033: Here’s all You Need to Know

00:00

00:00

Edelweiss Mutual Fund has launched the fourth tranche of the BHARAT Bond Exchange-traded Fund (ETF). The latest Bharat Bond ETF is maturing in April 2033, and subscriptions in this new ETF will be allowed till December 8, 2022. Previously, the fund house had launched Bharat Bond ETFs maturing in 2023, 2025, 2030, 2031, and 2032.

Bharat Bond ETF would be a wise choice for investors seeking to invest in a fixed income product that offers inflation-beating returns while also providing tax benefits. Although there are subtle differences, the BHARAT Bond ETF is similar to fixed maturity and target maturity funds in many ways. The debt mutual funds in the target maturity segment are gaining traction, while the most significant retracement has occurred around 3-5 years yields, this tranche with a long duration of 11-years also offers attractive yields.

Considering the current market scenario, the returns in the interim may appear volatile, however, do note that as the fund gets closer to maturity, the sensitivity to interest rates declines and the scheme will provide investors with significant risk-adjusted returns in the long run.

What is BHARAT Bond ETF?

On December 4, 2019, the Indian government launched the BHARAT Bond initiative. It is an Exchange-traded Fund (ETF) and would track the Nifty BHARAT Bond Index. A BHARAT Bond ETF will only invest in debt instruments of AAA-rated public sector companies and hence, has a low-risk profile.

Edelweiss Mutual Fund has launched BHARAT Bond ETF - April 2033 and BHARAT Bond ETF FOF - April 2033. If you do not have a Demat Account and you are willing to invest in this NFO, you may consider the fund-of-funds (FOF) option.

Commenting on the launch of two NFOs, Ms Radhika Gupta, MD & CEO at Edelweiss Mutual Fund, said, "BHARAT Bond ETF now has six maturities - from 2023 to 2033, which will allow investors to select the right maturity as per their investment goals."

Table 1: Details for BHARAT Bond ETF - April 2033

| Type |

An open-ended Target Maturity Exchange Traded Bond Fund investing in constituents of the Nifty BHARAT Bond Index - April 2033. A relatively high-interest rate risk and relatively low credit risk. |

Category |

Exchange-traded Fund |

| Investment Objective |

The investment objective of the scheme is to track the Nifty BHARAT Bond Index - April 2033 by investing in bonds of AAA-rated CPSEs/CPSUs/CPFIs and other Government organisations, subject to tracking errors. However, there is no assurance that the investment objective of the scheme will be realised and the scheme does not assure or guarantee any returns. |

| Min. Investment |

Rs 1,001 and in multiples of Re 1/- thereafter. |

Face Value |

Rs 10/- per unit |

| Entry Load |

Not Applicable |

Exit Load |

Nil |

| Fund Manager |

- Mr Dhawal Dalal

- Mr Rahul Dedhia

|

Benchmark Index |

Nifty BHARAT Bond Index - April 2033 |

| Issue Opens |

December 02, 2022 |

Issue Closes |

December 08, 2022 |

(Source: Scheme Information Document)

Table 2: Details for BHARAT Bond ETF FOF- April 2033

| Type |

An open-ended Target Maturity fund of funds scheme investing in units of BHARAT Bond ETF - April 2033. |

Category |

Fund of Fund |

| Investment Objective |

BHARAT Bond ETF FOF - April 2033 is a fund-of-funds scheme with the primary objective to generate returns by investing in units of BHARAT Bond ETF - April 2033. However, there is no assurance that the investment objective of the scheme will be realised. |

| Min. Investment |

Rs 1,000 and in multiples of Re 1/- thereafter. Additional Purchase Rs 500 and in multiples of Re 1/- thereafter. |

Face Value |

Rs 10/- per unit |

| Plans |

|

Options |

- Growth

- Income Distribution Cum Capital Withdrawal (IDCW)

|

| Entry Load |

Not Applicable |

Exit Load |

- If redeemed or switched out on or before completion of 30 days from the date of allotment of units - 0.10%.

- If redeemed or switched out after completion of 30 days from the date of allotment of units - NIL

|

| Fund Manager |

- Mr Dhawal Dalal

- Mr Rahul Dedhia

|

Benchmark Index |

Nifty BHARAT Bond Index - April 2033 |

| Issue Opens |

December 02, 2022 |

Issue Closes |

December 08, 2022 |

(Source: Scheme Information Document)

What will be the investment strategy for BHARAT Bond ETF - April 2033 and BHARAT Bond ETF FoF - April 2033?

BHARAT Bond ETF - April 2033 will have a fixed maturity period with a diversified portfolio of Public Sector Company Bonds. It will seek to track investment results of the Nifty BHARAT Bond Index - April 2033.

Image source: www.freepik.com

Image source: www.freepik.com

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

It will invest in AAA-rated Public Sector bonds maturing on or before the maturity date of the respective fund. The fund will invest in bonds issued by Central Public Sector Enterprises (CPSEs), Private Finance Initiatives (PFIs) and statutory bodies owned by the Government of India maturing not beyond April 2033. The scheme will follow a Buy & Hold strategy where existing bonds are held till maturity unless sold for meeting redemptions and will aim to provide stable and predictable returns. The fund is a target maturity fund that will terminate on April 18, 2033, on which date it will distribute its maturity proceeds (net assets) to the unit holders.

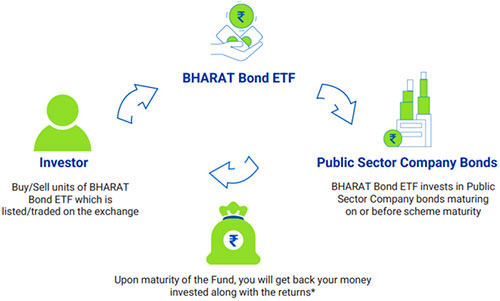

Illustration: How does BHARAT Bond ETF work

On the other hand, BHARAT Bond ETF FoF - April 2033 would endeavour to provide investment returns linked to BHARAT Bond ETF - April 2033 and intends to achieve its investment objective by replicating the BHARAT Bond ETF - April 2033.

How will these schemes allocate their assets?

BHARAT Bond ETF - April 2033 will seek to meet its investment objective by investing 95% to 100% in individual debt securities which satisfy the criteria of the underlying index. Whereas BHARAT Bond ETF FoF - April 2033 will aim to invest 95% to 100% of its assets in units of the underlying ETF scheme.

Both the schemes may also invest a portion of its portfolio in Government securities maturing on or before the maturity date of the Scheme, Repo in government securities and TREPS to manage liquidity requirements.

Table 3: Asset Allocation for BHARAT Bond ETF - April 2033

| Instruments |

Indicative Allocations (% of Net Assets) |

Risk Profile |

| Minimum |

Maximum |

High/Medium/Low |

| Debt Securities issued by CPSEs/CPSUs/CPFIs and other Government organisations which are part of Nifty BHARAT Bond Index -April 2033 |

95 |

100 |

Low to Medium |

| Government Securities maturing on or before the maturity date of the Scheme, TREPS and REPO in government bonds |

0 |

5 |

Low |

(Source: Scheme Information Document)

Table 4: Asset Allocation for BHARAT Bond ETF FoF - April 2033

| Instruments |

Indicative Allocations (% of Net Assets) |

Risk Profile |

| Minimum |

Maximum |

High/Medium/Low |

| Units of BHARAT Bond ETF - April 2033 |

95 |

100 |

Low to Medium |

| Government Securities maturing on or before the maturity date of the Scheme, TREPS and REPO in government bonds |

0 |

5 |

Low |

(Source: Scheme Information Document)

About the benchmark

Nifty BHARAT Bond Index - April 2033, part of the Nifty BHARAT Bond Index Series, seeks to measure the performance of the portfolio of AAA-rated bonds issued by government-owned entities maturing during the twelve months ending April 18, 2033. The index represents the performance of the maturity-targeted segment of the corporate bond market.

Here's the list of top issuers/constituents by their weightage under the index as of November 2022:

(Source: BHARAT Bond ETF and FoF - April 2033 PPT)

(Source: BHARAT Bond ETF and FoF - April 2033 PPT)

# Note that the index will rebalance on a quarterly basis.

Who will manage BHARAT Bond ETF and FoF - April 2033?

Mr Dhawal Dalal and Mr Rahul Dedhia will be the designated fund managers of both schemes.

Mr Dhawal Dalal has completed his MBA and B.E degree and has an overall work experience of 25+ years, mostly in the fixed-income investment & research function. Prior to joining Edelweiss AMC, he was associated with DSP BlackRock Investment Managers Pvt.Ltd. as Executive Vice President and Head of Fixed Income and with Merrill Lynch Investment Managers as Assistant Portfolio Manager.

At Edelweiss Mutual Fund, Mr Dalal currently manages Edelweiss Money Market Fund, Edelweiss Banking and PSU Debt Fund, Edelweiss Government Securities Fund, Edelweiss Equity Savings Fund (Debt Portion), Edelweiss Arbitrage Fund (Debt Portion), Edelweiss Aggressive Hybrid Fund (Debt Portion), BHARAT Bond ETF - April 2023, BHARAT Bond ETF - April 2030, BHARAT Bond FOF - April 2023, BHARAT Bond FOF - April 2030, BHARAT Bond ETF - April 2025, BHARAT Bond ETF - April 2031, BHARAT Bond FOF - April 2025, BHARAT Bond FOF - April 2031, Edelweiss Nifty PSU Bond Plus SDL Apr 2026 50:50 Index Fund, Edelweiss Nifty PSU Bond Plus SDL Apr 2027 50:50 Index Fund, Edelweiss CRISIL PSU Plus SDL 50:50 Oct 2025 Index Fund, Bharat Bond FOF - APRIL 2032, Bharat Bond ETF - APRIL 2032, Edelweiss CRISIL IBX 50:50 Gilt Plus SDL June 2027 Index Fund and Edelweiss CRISIL IBX 50:50 Gilt Plus SDL April 2037 Index Fund.

Mr Rahul Dedhia holds a B.E (Electronics) degree from Mumbai University and MBA (Finance) from MET College Mumbai. He has over 13 years of experience in the fixed-income market, including 11 years in the mutual fund industry. Prior to joining Edelweiss AMC, he was associated as Assistant Fund Manager with DHFL Pramerica Mutual Fund and with Deutsche Asset Management (India) Pvt. Ltd.

At Edelweiss Mutual Fund, Mr Dedhia currently manages manages Edelweiss Liquid Fund, Edelweiss Overnight Fund, Edelweiss Banking and PSU Debt Fund, Edelweiss Government Securities Fund, Edelweiss Balanced Advantage Fund (Debt Portion), BHARAT Bond ETF - April 2023, BHARAT Bond ETF - April 2030, BHARAT Bond FOF - April 2023, BHARAT Bond FOF - April 2030, BHARAT Bond ETF - April 2025, BHARAT Bond ETF - April 2031, BHARAT Bond FOF - April 2025, BHARAT Bond FOF - April 2031, Bharat Bond FOF - APRIL 2032, Bharat Bond ETF - APRIL 2032, Edelweiss Nifty PSU Bond Plus SDL Apr 2026 50:50 Index Fund, Edelweiss Nifty PSU Bond Plus SDL Apr 2027 50:50 Index Fund, Edelweiss CRISIL PSU Plus SDL 50:50 Oct 2025 Index Fund, Edelweiss CRISIL IBX 50:50 Gilt Plus SDL June 2027 Index Fund and Edelweiss CRISIL IBX 50:50 Gilt Plus SDL April 2037 Index Fund.

Should You Invest in BHARAT Bond ETF - April 2033 or BHARAT Bond ETF FoF - April 2033?

BHARAT Bond ETF - April 2033 comes with a tenure of a little below 11 years. It is a passively managed Target Maturity Debt Index Fund that will invest your money in AAA-rated Government of India-backed companies. The scheme will mirror the performance of the Nifty BHARAT Bond Index - April 2033, subject to tracking errors.

BHARAT Bond ETF FoF - April 2033 aims to simply invest in units of BHARAT Bond ETF - April 2033 and replicate the underlying ETF's performance.

The underlying Nifty Bharat Bond Index - April 2033 consists of AAA-rated debt securities of government-owned companies. A bond like structure with fixed maturity provides predictable and stable returns at maturity. Both schemes endeavour to hold securities till maturity. Therefore, the impact of mark-to-market loss on the fund will be low. The funds will invest in securities issued by public sector companies that enjoy high credit ratings due to government backing.

Thus, from the credit quality perspective, these funds are relatively safe. Bharat Bond ETF and FoF - April 2033 is more tax-efficient compared to traditional investments such as Bank FDs. Gains on these funds are taxable similar to other debt mutual funds. Investors in the highest tax bracket can avail of the indexation benefit if they invest for 3 years or more.

Although the schemes offer low credit risk by investing in high-quality government-backed debt securities, they are still prone to high market and interest rate risks. In addition, the recent increase in interest rates by the RBI maintains the rising interest rate environment, which is unfavourable for debt funds. If there are adverse developments, such as a worsening geo-political scenario, rising inflation, and a massive increase in government borrowings, bond yields can go up further. The interest rate risk amidst the dynamic market conditions is likely to have a bearing on the scheme's performance. Investors should be prepared for some volatility in the near term.

Thus, these schemes are suitable for investors with a low to moderate risk appetite looking forward to building their Debt portfolio and hold an investment horizon to match the fund's portfolio duration. Before investing, ensure your investment objectives align with the respective mutual fund scheme. You may choose between BHARAT Bond ETF - April 2033 and the Fund of Fund scheme as per your suitability.

PS: If you wish to select actively managed best mutual fund schemes, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect.

As a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

PersonalFN adheres to a stringent process that assesses both quantitative and qualitative parameters, providing you with Buy, Hold, and Sell recommendations on equity and debt mutual fund schemes. Read here for more details...

If you are serious about investing in rewarding mutual fund schemes, Subscribe now!

Warm Regards,

Mitali Dhoke

Research Analyst