Union Budget 2025-26: Will You Be Entitled to Section 87A Rebate If You Have Earned Capital Gains? Find Out Here

Rounaq Neroy

Feb 08, 2025 / Reading Time: Approx. 6 mins

Listen to Union Budget 2025-26: Will You Be Entitled to Section 87A Rebate If You Have Earned Capital Gains? Find Out Here

00:00

00:00

Recognising the role of the middle class in India's growth, the Union Budget 2025-26 has stayed true to its promise.

Finance Minister Ms Nirmala Sitharaman announced significant changes to the income tax slab for the FY2025-26 under the New Tax Regime, aimed at leaving more disposable income in the hands of individuals.

One of the most talked-about aspects of this budget is that annual income up to Rs 12 lakh will be exempt from tax. Here's what Finance Minister, Ms Nirmala Sitharaman said in her Union Budget 2025 speech:

"I am now happy to announce that there will be no income tax payable up to income of Rs 12 lakh (i.e. average income of Rs 1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs 12.75 lakh for salaried taxpayers, due to a standard deduction of Rs 75,000,"

However, the government's stance on additional income from capital gains has left many wondering whether this is truly the case.

Here are the income tax slabs under the New Tax Regime:

Table 1: Tax Slabs under New Tax Regime for FY 2025-26 and FY 2024-25

| Income Slab (Rs) |

New Tax Regime Rate for FY 2025-26 |

Income Slab (Rs) |

New Tax Regime Rate for FY 2024-25 |

| Up to 4 lakh |

Nil |

Up to 3 lakh |

Nil |

| 4 lakh - 8 lakh |

5% |

3 lakh - 7 lakh |

5% |

| 8 lakh - 12 lakh |

10% |

7 lakh - 10 lakh |

10% |

| 12 lakh - 16 lakh |

15% |

10 lakh - 12 lakh |

15% |

| 16 lakh - 20 lakh |

20% |

12 lakh - 15 lakh |

20% |

| 20 lakh - 24 lakh |

25% |

Above 15 lakh |

30% |

| Above 24 lakh |

30% |

|

|

(Source: http://www.indiabudget.gov.in/)

The government has also proposed revisions to Section 87A of the Income Tax Act, 1961, which provides a tax rebate to resident individuals whose total income does not exceed the specific threshold.

Here's what Ms Sitharaman said in the Union Budget 2025-26 speech:

"To taxpayers up to Rs 12 lakh of normal income (other than special rate income such as capital gains) tax rebate is being provided in addition to the benefit due to slab rate reduction in such a manner that there is no tax payable by them."

Keep in mind, the word 'normal income' is used, i.e. other than special rate income.

So far in FY 2024-25 (relevant to the Assessment Year 2025-26), under the New Tax Regime, individuals earning up to Rs 7 lakh annually are eligible for a rebate of up to Rs 25,000 under Section 87A.

Now, as per the Union Budget 2025-26 announcements, the income threshold for the Section 87A rebate has been raised significantly from Rs 7 lakh to Rs 12 lakh in a financial year. Consequently, the maximum rebate amount has been increased from Rs 25,000 to Rs 60,000.

Combined with the increased standard deduction of Rs 75,000 for salaried individuals those with an income of up to Rs 12.75 lakh can benefit from zero tax liability for the FY 2025-26.

[Read: Union Budget 2025: Is the New Tax Regime Really Beneficial for You]

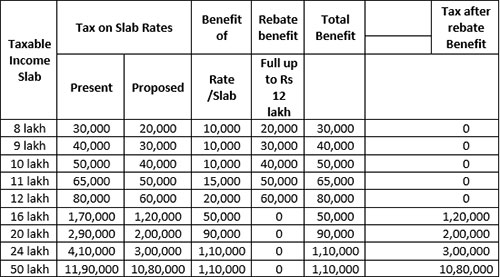

Below is the illustration of tax benefits to taxpayers across taxable income slabs:

Table 2: Boost to Your Disposable Income

(Source: Annexure to Part B of the Budget 2025-26 Speech)

(Source: Annexure to Part B of the Budget 2025-26 Speech)

Marginal relief is also available for resident individuals whose income marginally exceeds Rs 12 lakh, in the new regime under Section 115BAC(1A).

For example, if you have a total income of Rs 12.10 lakh your calculated tax liability without relief would be Rs 61,500 (0% on the first 4 lakh + 5% on the next 4 lakh + 10% on the next 4 lakh + 15% on the remaining 10,000).

However, with marginal relief of Rs 51,500 [61,500 - (12.10 lakh - 12.00 lakh)], the actual tax payable is limited to just Rs 10,000, providing significant relief.

Note that the marginal relief is not available for an income of Rs 12.75 lakh and above.

Table 3: Marginal Relief Under the New Tax Regime for FY 2025-2026

| Income (Rs) |

Tax Without Marginal Relief

(Rs) |

Tax Actually Payable With Marginal Relief |

| 12,10,000 |

61,500 |

10,000 |

| 12,50,000 |

67,500 |

50,000 |

| 12,70,000 |

70,500 |

70,000 |

| 12,75,000 |

71,250 |

71,250 [No marginal relief] |

(Source: incometaxindia.gov.in)

Now, with the government's clarification on excluding "special rate income such as capital gains" for rebate purposes, the question that arises is - What happens when your income includes capital gains such as STCG and/or LTCG?

Let's explore some possible scenarios under the New Tax Regime.

Scenario 1: Rs 10 Lakh Annual Salary Income

-

0% on the first 4 lakh = 0

-

5% on the next 4 lakh = 20,000

-

10% on the next 2 lakh = 20,000

Total tax before rebate will be Rs 40,000

The maximum rebate available under Section 87A for FY 2025-26 will be Rs 60,000

Therefore, the final tax payable will be Nil (as the rebate fully covers the tax liability)

Scenario 2: Rs 10 Lakh Annual Salary Income + Rs 1 Lakh Short-Term Capital Gains (STCG)

-

Tax on Rs 10 lakh annual salary will be Rs 40,000 (covered by rebate, making it 0)

-

Tax on Rs 1 lakh STCG will be at the rate of 20% = Rs 20,000

Even though the total taxable income is still under Rs 12 lakh, the STCG is not eligible for the rebate, making the final tax payable Rs 20,000.

Scenario 3: Entire Income from Capital Gains (Up to Rs 12 Lakh)

If an individual's total income is solely from capital gains and does not exceed Rs 12 lakh, they will still not be eligible for a Section 87A rebate. This income will be taxed at a special rate of 20% for STCG and 12.5% for LTCG.

Scenario 4: Total Income of Rs 15 Lakh (Rs 12.75 Lakh Annual Salary Income + Rs 2.25 Lakh Long-Term Capital Gains)

For a taxpayer earning an annual salary of Rs 12.75 and Rs 2.25 lakh from LTCG, opinions are divided:

-

Some argue that since the total income from all sources exceeds Rs 12 lakh, no rebate will be applicable.

-

Others believe that the rebate will still apply to the Rs 12.75 lakh salary, while the LTCG will be taxed separately at 12.50%.

In this respect, a formal clarification from the Income Tax Department is necessary.

To Conclude...

The Union Budget 2025-26 proposals will take effect from 1 April 2025, bringing significant changes to the income tax structure.

The revised tax slabs and the higher rebate limit under the New Tax Regime are expected to ease the financial burden on the common man, increasing disposable income and encouraging higher consumption, savings, and investment -- all of which bodes well for India's economic growth.

[Read: Top 5 Mutual Funds with Strong Holdings in India's Consumption Sector]

At a time when rising inflation is eroding the purchasing power of hard-earned money and consumption is slowing, these measures are a welcome relief.

However, the government needs to provide clarification on varying interpretations regarding Section 87A rebate eligibility to ensure assessees understand their tax liabilities better.

We are on Telegram! Join thousands of like-minded investors and our editors right now.

-New.png)

ROUNAQ NEROY heads the content activity at PersonalFN and is the Chief Editor of PersonalFN’s newsletter, The Daily Wealth Letter.

As the co-editor of premium services, viz. Investment Ideas Note, the Multi-Asset Corner Report, and the Retire Rich Report; Rounaq brings forth potentially the best investment ideas and opportunities to help investors plan for a happy and blissful financial future.

He has also authored and been the voice of PersonalFN’s e-learning course -- which aims at helping investors become their own financial planners. Besides, he actively contributes to a variety of issues of Money Simplified, PersonalFN’s e-guides in the endeavour and passion to educate investors.

He is a post-graduate in commerce (M. Com), with an MBA in Finance, and a gold medallist in Certificate Programme in Capital Market (from BSE Training Institute in association with JBIMS). Rounaq holds over 18+ years of experience in the financial services industry.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.