Caught in the Mid and Small-Caps Tumble? Time to Review Your Portfolio!

Feb 15, 2025 / Reading Time: Approx. 10 mins

Listen to Caught in the Mid and Small-Caps Tumble? Time to Review Your Portfolio!

00:00

00:00

In recent months, the stock markets have witnessed a wave of volatility, culminating in a significant market downturn. With the global economic situation, rising interest rates, inflation concerns, and geopolitical tensions influencing investor sentiment, the market has faced steep declines.

While large-cap stocks tend to offer a sense of stability in turbulent times, the mid and small-cap segments are often more vulnerable to market fluctuations.

As the market correction unfolds, many investors are finding their portfolios under pressure due to declines in the performance of the mid and small-cap segments. This has led to concerns among investors who were once confident in their high-risk, high-reward strategies.

------------------------------------------------------------------------------------

Want to Make Your Money Work While You Sleep?

Talk to Our Investment Advisors Today!

Schedule a First Consultation Call Right Now

------------------------------------------------------------------------------------

[Read: Decoding the Recent Market Correction: What's Behind the Fall in Mid and Small Caps]

Now is the crucial time for investors to review their portfolios and determine whether their current allocation is aligned with their financial goals and risk tolerance.

Why Mid and Small-Cap Stocks Have Been Hard-Hit

Mid and small-cap stocks are often seen as the backbone of a growing economy. These stocks typically represent companies that are in the growth phase, and they can offer high growth potential compared to their large-cap counterparts. However, the current market crash has raised alarms about the performance of these segments, especially in the face of ongoing economic uncertainty.

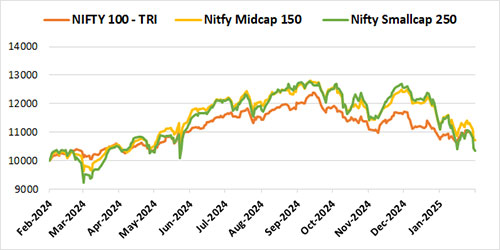

Graph 1: Downward Trend in Large, Mid, and Small Cap Stocks

Data as of February 12, 2025

Data as of February 12, 2025

Past performance is not an indicator of future returns.

(Source: ACE MF, data collated by PersonalFN Research)

The mid and small-cap segments are generally more vulnerable to a variety of macroeconomic factors, and the current market conditions have been particularly harsh on them. A few factors contributing to the downturn in these segments include:

1. Inflationary Pressures: As inflation remains high, many mid and small-cap companies are facing increased costs of production. The margin pressures associated with rising raw material costs, labour costs, and supply chain disruptions have hit smaller companies harder than large-cap ones, as the latter often have more resources to weather such challenges.

2. Global Uncertainty: Geopolitical tensions, trade wars, and economic slowdowns across major global economies have added further volatility to the market. As global investors have become more cautious, mid and small-cap stocks have been disproportionately affected due to their higher sensitivity to external factors.

3. Risk Aversion: During market crashes, investors tend to shift their capital away from high-risk assets, such as mid and small-cap stocks, toward safer, more liquid investments like government bonds or blue-chip stocks. This risk aversion exacerbates the sell-off in mid and small-cap stocks, leading to even deeper declines.

Portfolio Concerns Amid Market Volatility

The ongoing market downturn has brought several concerns to the forefront for investors, particularly those heavily invested in mid and small-cap stocks. The most pressing concerns include:

1. Unrealized Losses

Many investors who bought into mid and small-cap stocks during the bull run have seen significant unrealized losses as these stocks have plummeted in value. For those who were heavily invested in these segments, the psychological toll can be intense, with many questioning whether they should continue holding onto these stocks or make a change.

2. Overexposure to Risk

While mid and small-cap stocks offer high growth potential, they also carry higher risks. A portfolio that is overweight in these stocks may have become overly exposed to market volatility. In the event of further market declines, such portfolios may suffer more substantial losses compared to a more balanced or conservative portfolio.

3. Lack of Diversification

Some investors, particularly those who have been focused on growth at all costs, may have concentrated their investments in mid and small-cap stocks, ignoring the importance of diversification. A lack of diversification can expose investors to higher levels of risk, especially in volatile markets like the one we are currently experiencing.

[Read: Should You Invest in Mid-Cap and Small-Cap Funds Amidst Volatile Equity Markets?]

4. Changes in Investment Goals

As market conditions change, so too may an investor's financial goals or risk tolerance. Some investors may have initially been comfortable with the volatility of mid and small-cap stocks but may now find that their risk tolerance has changed as a result of the current market downturn.

Conducting a Portfolio Review: A Vital Step in Amidst Market Turbulence

Given the current market conditions and the challenges faced by mid and small-cap investors, all investors must conduct a thorough portfolio review. A portfolio review allows investors to evaluate whether their current asset allocation aligns with their financial goals and risk profile.

Benefits of a Portfolio Review

1. Risk Mitigation and Adjustments: It is essential to determine whether your risk tolerance has changed. If the market downturn has made you more risk-averse, you may want to consider reducing your exposure to volatile segments like mid and small-cap stocks.

2. Improved Diversification: Review the allocation of your portfolio to ensure that it is well-diversified across different asset classes, such as equities, bonds, and other investment vehicles. Consider adjusting the weightage of mid and small-cap stocks within your portfolio, especially if they have become a significant portion of your holdings.

3. Capitalizing on Market Opportunities: If you have invested in mutual funds, ETFs, or other pooled investment vehicles, it is essential to assess the performance of those funds during the market downturn. Evaluate whether the funds are managed by skilled professionals who can navigate through volatile markets. You may also want to check whether the funds are overly concentrated in mid and small-cap stocks.

4. Consider Rebalancing: Rebalancing your portfolio involves buying and selling assets to return to your desired allocation. If your mid and small-cap stocks have underperformed significantly, it may be a good idea to sell off some of these positions and shift towards more stable, income-generating assets like large-cap stocks or bonds.

5. Assess Liquidity Needs: If you have upcoming financial goals or need access to liquidity, now might be the time to assess the liquidity of your investments. In turbulent markets, it can be challenging to sell off assets without incurring significant losses. Therefore, ensuring that your portfolio has a sufficient amount of liquid assets may help in reducing stress during market crashes.

6. Focus on Long-Term Goals: It is important to remember that the stock market is cyclical, and downturns are often followed by periods of recovery. If your financial goals are long-term, it may be wise to ride out the volatility, rather than making drastic changes based on short-term market movements. That said, make sure your portfolio still reflects your evolving risk profile.

7. Consult a Financial Advisor: If you are unsure about how to approach your portfolio review, consider consulting a SEBI-registered financial advisor. An advisor can help you evaluate your financial situation and guide you in making informed decisions that are in line with your long-term financial goals.

Navigate Volatility with a Prudent Approach

The current market crash has undoubtedly created significant concerns, particularly for investors in the mid and small-cap segments. While the volatility and market downturn can be unsettling, it is important to remember that the market operates in cycles.

Taking the time to conduct a thorough portfolio review and make necessary adjustments will help investors navigate these turbulent waters with confidence.

By reassessing your risk tolerance, reallocating assets, and diversifying your investments, you can ensure that your portfolio remains well-positioned to weather the storm. Whether you are looking to reduce your exposure to mid and small-cap stocks or simply rebalance your holdings, the key is to remain focused on your long-term financial goals.

We are on Telegram! Join thousands of like-minded investors and our editors right now.

Hiral Bhuta is a Investment Consultant & Principal Officer. She is a seasoned professional in the financial services industry, currently serving as an Investment Advisor and Financial Planner at PersonalFN. With her expertise, she plays a pivotal role as the Principal Officer appointed under SEBI's amended IA Regulation. Hiral holds distinguished certifications such as Certified Financial Planner (CFP) and NISM XA & XB, complemented by a post-graduate degree in commerce (M. Com). Her primary areas of focus encompass financial planning, investment advisory, and wealth management, where she leverages her knowledge and skills to provide tailored solutions to clients. With a cumulative experience spanning five years, Hiral brings a wealth of expertise and insight to her role at PersonalFN, ensuring clients receive expert guidance and support in navigating their financial goals.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.