Franklin Templeton Moves Supreme Court. What’s Next for Unitholders?

Listen to Franklin Templeton Moves Supreme Court. What’s Next for Unitholders?

00:00

00:00

Franklin Templeton has moved the Supreme Court which it said will ensure an appropriate implementation of the law in the best interest of unitholders.

Earlier the Karnataka High Court had ruled that Franklin Templeton (FT) cannot go ahead with the winding up of the schemes without obtaining the consent of a simple majority of the unitholders. It had stayed its own order for six weeks ending December 05 to allow FT time to appeal in the Supreme Court. The schemes will remain frozen for transactions during this period.

Notably, FT wants the six schemes to remain under winding up till the unitholders' consent is received via voting. Franklin in its petition to the SC has mentioned that if the redemptions remain unrestricted till the time unitholders' vote is obtained, it may force the fund managers to sell holdings at deep discounts. This could result in irrecoverable loss to unitholders and the fund will not be able to ensure equitable treatment to all.

As per news reports, FT has pointed out in the petition that the K'taka High Court's reliance on regulation 18(15)(c), which reads that trustees shall obtain unitholders' consent when the majority of the trustees decide to wind up, was misplaced and proceeded on an erroneous understanding of the scheme of regulations. It also stated that only a handful of people holding less than 0.03% of the units in the schemes have challenged its decision to wind up the schemes.

photo created by Racool_studio - www.freepik.com

photo created by Racool_studio - www.freepik.com

Till now 4 out of 6 schemes have turned cash positive after repaying the borrowings. These are Franklin India Ultra Short Bond Fund (FIUBF), Franklin India Dynamic Accrual Fund (FIDA), Franklin India Low Duration Fund (FILDF), and Franklin India Credit Risk Fund (FICRF),. Franklin India Short Term Income Plan (FISTIP), and Franklin India Income Opportunities Fund (FIIOF) still have outstanding borrowings.

FT has received Rs 9,682 crore as of September 30 from the six schemes in the form of maturities, prepayments and coupons. Of this, Rs 5,952 crore is available for distribution to unitholders in the four cash positive schemes.

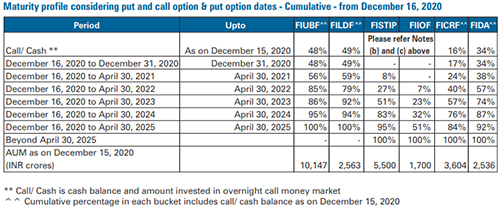

Table: Expected timeline of payout from wound-up schemes of FTMF

(Source: Franklin Templeton Mutual Fund)

(Source: Franklin Templeton Mutual Fund)

After the abrupt decision to wind up its schemes, looks like FT has yet again taken investors for granted. Despite K'taka high court's ruling and the fact that it received six weeks of stay order during which redemptions will continue to be frozen, FT has not yet conducted the voting process to seek unitholders' consent.

The consequence is that the matter might reach the apex court, if it accepts the petition, which could spell further delay in resolution for the unitholders. However, there is a possibility that the apex court rejects the petition and directs FT to start the voting process without further delay, though it remains to be seen if the scheme will remain wound up in the meanwhile. Notably, it has been more than six months since the fund house wound up six of its schemes leaving its unitholders in a lurch.

[Read: Who Is to Blame for the Franklin Templeton Fiasco?]

Since four out of six schemes have turned cash positive, unitholders would start receiving money as per the expected recovery timeline mentioned by the fund house once the consent for winding up is received.

However, if the decision of winding up is held invalid (due to non-consent of unitholders), the schemes will have to be reopened for redemption. It is likely that the schemes will receive severe redemption pressure once that happens. Consequently, to meet these requests the schemes will have to undertake sale of assets at deep discount, which would negatively impact the NAV of the schemes. The fund house may thus set withdrawal limits to deal with redemption requests.

Everything will now depend on the Supreme Court's review of the fund house's petition.

PS: If you wish to select worthy mutual fund schemes, subscribe to PersonalFN's unbiased premium research service, FundSelect. Each fund recommended under FundSelect goes through our stringent process, where funds are tested on both quantitative as well as qualitative parameters.

Every month, PersonalFN's FundSelect service will provide you with insightful and practical guidance on equity mutual funds and debt schemes - the ones to Buy, Hold, or Sell.

And on the occasion of 20 years of our unbiased research service, we bring to you this Special Anniversary Offer. Subscribe now!

Warm Regards,

Divya Grover

Research Analyst

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds