Top 10 Factors to Consider When Buying a Cancer Insurance Policy

Ketki Jadhav

Jun 24, 2022

Listen to Top 10 Factors to Consider When Buying a Cancer Insurance Policy

00:00

00:00

Cancer is an unpredictable disease that affects not only the patient physically but also the patient and their loved ones emotionally. Unfortunately, cancer cases in India are upsurging at an alarming rate. It can strike anyone, regardless of family health history or lifestyle. Cancer was once thought of as an old age disease, but it has now become a cause of concern for young as well as children. Cancer insurance has become necessary due to the increasing number of cancer cases and the exorbitant cost of cancer treatment.

What is Cancer Insurance?

Cancer insurance is a type of Health Insurance that covers the cost of cancer treatment and care. It is one way to prepare yourself financially for the expensive cost of cancer treatment.

Several health insurance companies offer cancer insurance policies to offer comprehensive coverage against cancer. With sufficient insurance cover, the patient and their family members can concentrate on their health and recovery without worrying about their finances.

What are the benefits of Cancer Insurance?

-

The insurance company pays out a lump-sum amount (100% sum assured) on a diagnosis of major cancer conditions

-

In case of detection at an early stage, most insurers offer a waiver of premiums, or 25% of the sum assured or both

-

For no claim during a policy year, most insurance companies provide an increased sum assured in the next year

-

Several insurance companies offer an added benefit of monthly income for a certain number of years on a diagnosis of major cancer conditions

-

Most leading insurers have affordable premiums for cancer insurance policies

Image source: www.freepik.com

Image source: www.freepik.com

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

What are the factors to consider when buying a Cancer Insurance Policy?

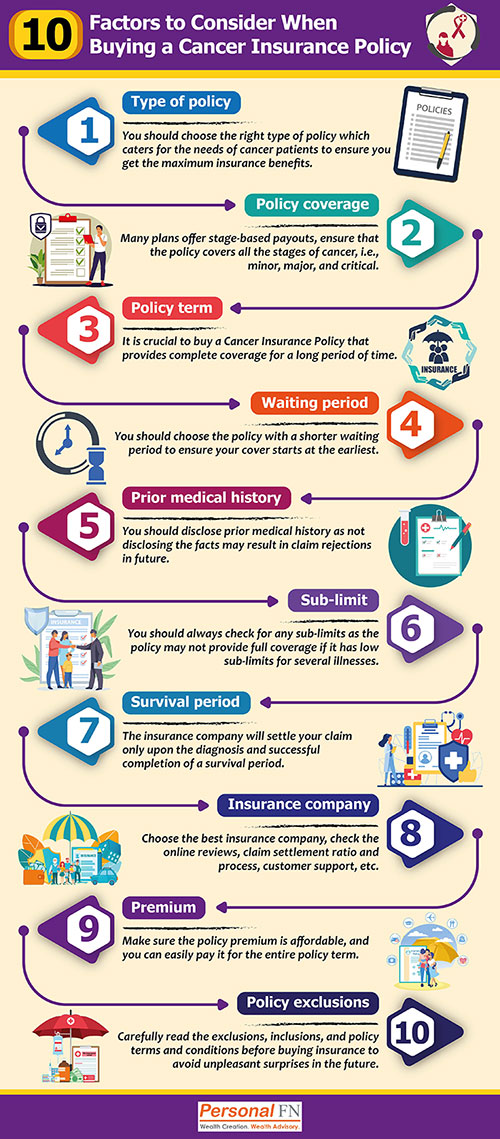

Buying a critical illness policy like cancer insurance is a necessity nowadays, but it is equally important to buy the right policy that matches your requirement to get benefited in case of a need. Here are the 10 important factors you should consider when buying a Caner Insurance Policy:

1. Type of Policy:

When buying a cover for cancer, you will come across different types of insurance policies. You can buy an exclusive Cancer Insurance Policy that is specifically designed to cater for the needs of cancer patients, buy a cancer cover add-on with a basic health insurance policy, or buy a critical illness insurance policy that provides cancer cover.

Furthermore, the insurers provide cancer policies in two forms, Benefit Policies and Indemnity Policies. Benefit Policies offer the sum insured upon the discovery of cancer and passing the survival period. Whereas, Indemnity Policies allow you to claim/reimburse the cancer treatment charges.

You should choose the right type of policy based on your needs to ensure you get the maximum insurance benefits.

2. Policy Coverage:

We all are aware of how expensive cancer treatments are. Since it is a long-term ordeal, the treatment expenses, pre and post-hospitalisation expenses, cost of drugs, etc., can put your savings on a toss. Besides losing their life savings, many individuals have to opt for a loan to cover these expenses. Therefore, it is advisable to opt for a maximum sum assured and policy coverage. Apart from the regular cover, such as pre and post-hospitalisation, specialist fees, nursing, etc., make sure your policy provides coverage for extensive chemotherapy, medicines, etc. as well. The policies that cover such high-end treatments and procedures may have a higher premium, but they serve the purpose of buying cancer insurance.

When choosing the cancer policy, you should also check whether it covers all the stages of cancer, i.e., minor, major, and critical. Many plans offer stage-based payouts. In a critical stage of cancer, you might not be able to work, and your income may stop. Hence, you should ensure your plan offers a sufficient sum assured to cover your lost income along with the medical expenses.

3. Policy Term:

The growth of a cancer tumour can be very slow. In most cases, it takes years for a cancer tissue to develop before it is detected. Therefore, it is crucial to buy a Cancer Insurance Policy that provides complete coverage for a long period of time. Many insurers offer coverage till 70 years of age, and it makes sense to opt for the longest period available.

4. Waiting Period:

Every health insurance plan comes with a waiting period. The waiting period for a specific disease can differ from insurer to insurer. Your policy will not come into force, and you will not be able to claim for the medical expenses pertaining to certain illnesses until you have completed its waiting period. Hence, you should choose the policy with a shorter waiting period to ensure your cover starts at the earliest.

5. Prior Medical History:

Most insurers do not provide cancer cover to individuals with prior cancer history. So, if you are a cancer survivor who has been diagnosed and treated for cancer, your application is likely to be rejected by the insurer because of the high risk involved.

Apart from cancer, you are required to disclose any critical illness you had or still have at the time of buying cancer insurance. Such cases may attract higher premiums or application rejection. However, not disclosing the facts will result in claim rejection. Therefore, when purchasing any health insurance, you should disclose all the truthful health-related information.

6. Sub-limit:

Some regular Health Insurance Plans and Critical Illness Plans may have a sub-limit on the claim amount. For example, your critical illness insurance cover may be Rs 10 Lakhs, but the policy may offer cancer cover up to Rs 3 Lakhs only. While buying a Cancer Insurance Plan or any other Health Insurance Plan, you should always check for such sub-limits as the policy might not prove to be of any use if it has low sub-limits for several illnesses.

7. Survival Period:

If you are buying a Benefit Policy, you should know that it comes with a survival period clause. The insurance company will settle your claim only upon the diagnosis and successful completion of a survival period as per policy terms and conditions. In an unfortunate case, if the policyholder does not survive this period even after the diagnosis and treatment, the insurer is not liable to pay the sum assured.

8. Insurance Company:

Apart from the policy offerings and benefits, it is essential to choose the right insurer to ensure you get a smooth purchase and claim settlement experience. It is advisable to check the insurance company's online reviews, claim settlement ratio, claim settlement process, customer support, etc., and then choose the right insurer that offers the best of these parameters.

9. Premium:

The Cancer Insurance Policy you chose might offer the maximum benefits and have great customer support, but if the insurance premium is out of your budget, you should think before making a purchase decision. You may buy the policy now, thinking it is a one-time expense, but renewing the policy next year could be unaffordable. Many people buy critical and cancer insurance policies but never renew them next year. Therefore, make sure the premium is affordable, and you can easily pay it for the entire policy term.

10. Policy Exclusions:

All the insurance policies, including cancer insurance policies, come with a list of exclusions. The list of exclusions is the situations and circumstances under which the policyholder cannot claim the insurance benefit. Hence, it is crucial to carefully read the exclusions, inclusions, and policy terms and conditions before buying insurance. This will help you avoid unpleasant surprises in the future.

To Conclude:

Considering these important factors while buying a Cancer Insurance Policy will ensure you choose the right plan from the right insurer and have a hassle-free purchase and claim settlement experience. Doing thorough research by comparing different policies will help you choose the best-suited insurance plan.

Warm Regards,

Ketki Jadhav

Content Writer