Aditya Birla Sun Life Equity Fund has a long history that spans nearly two decades. The fund was launched by Alliance Capital Mutual Fund in August 1998 as Alliance Equity Fund. It was the flagship diversified equity fund of the AMC at the time.

The fund gained popularity as it was managed by ace fund manager Mr Samir Arora, then CIO of Alliance Capital MF. He generated supernormal returns for the fund and other schemes of the fund house during the tech rally in 1999-2000. However, the overaggressive nature, also led to huge losses for investors when the tech bubble popped. Mr Arora had to quit the fund house in 2003, as the regulator had charged him of professional misconduct, fraudulent and unfair trade practices and insider trading.

A year later, Birla Sun Life Mutual Fund took over the assets of Alliance Capital Mutual Fund. Alliance Equity Fund was renamed to Birla Sun Life Equity Fund. And more recently, to Aditya Birla Sun Life Equity Fund, after ‘Aditya’ was prefixed to all legal entities of the Aditya Birla Group.

Through the long history of the fund, the fund management changed hands several times. Mr Mahesh Patil, presently co-CIO at ABSL Mutual Fund, was at the helm the longest – between November 2005 and September 2012. The fund is currently managed by Mr Anil Shah, who took over the reins in October 2012.

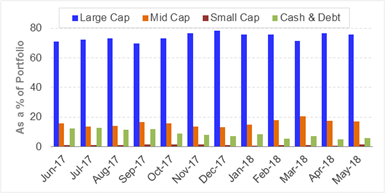

Though being free to invest in stocks across market-caps, ABSL Equity Fund maintains a large-cap bias. About 70%-75% of the assets are invested in large-cap stocks. Mid-and small-caps account for up to 20% of the portfolio. Thus the fund invests more like a large-cap fund, but maintains the flexibility to invest in mid caps if needed.

This flexibility enables the fund to provide stability in volatile market periods and turn aggressive when the market valuations come to be attractive.

In terms of performance, Aditya Birla SL Equity Fund has delivered a respectable performance over the long term, making it among the top performing funds for the period. However, its returns over the past year or so have trailed the benchmark. This can be attributed to the cautiousness developed due to the high market valuations. Hence, it needs to be seen how the fund is able to recover from here.

In this brief analysis, we take a close look at the features and performance of Aditya Birla Sun Life Equity Fund.

Has your Mutual Fund scheme name changed? For the entire list of scheme names changes, do read: Your Mutual Fund Scheme Renamed. What Should You Do?

Investment Objective of Aditya Birla Sun Life Equity Fund

ABSL Equity Fund has an investment objective to generate “long term growth of capital, through a portfolio with a target allocation of 90% equity and 10% debt and money market securities."

Aditya Birla Sun Life Equity Fund Details

Fund Facts

| Category |

Equity Diversified |

Style |

Blend |

| Type |

Open ended |

Market Cap Bias |

Multi Cap Fund |

| Launch Date |

14-Sep-98 |

SI Return (CAGR) |

23.82% |

| Corpus (Cr) |

Rs 9,376 |

Min./Add. Inv. |

Rs 500 / Rs 500 |

| Expense Ratio (Dir/Reg) |

1.03% / 2.26% |

Exit Load |

1% |

Portfolio Data as on May 31, 2018.

SI Return as on July 4, 2018.

(Source: ACE MF)

Growth Of Rs 10,000, If Invested In Aditya Birla Sun Life Equity Fund 5 Years Ago

Data as on July 4, 2018

Data as on July 4, 2018

(Source: ACE MF)

Had you invested Rs 10,000 in Aditya Birla SL Equity Fund five years back on July 4, 2013, it would have grown to Rs 27,348 as on July 4, 2018. This translates in to a compounded annualised growth rate of 22.28%. In comparison, a simultaneous investment of Rs 10,000 in its current benchmark – S&P BSE 200 - TRI index would now be worth Rs 21,254 (a CAGR of 16.27%). As can be seen in the chart alongside, the multi cap fund has generated a sustainable alpha over the benchmark. It has done well in the market rally that began in 2014, and has been able to maintain its lead. The fund is a promising contender in the amongst its peers.

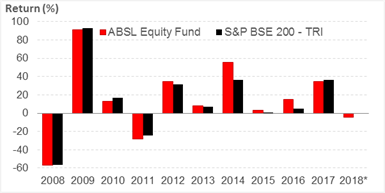

Aditya Birla Sun Life Equity Fund: Year-on-Year Performance

Data as on July 4, 2018

(Source: ACE MF)

ABSL Equity Fund, is among the few schemes that have a track record of over two decades. The year-on-year performance comparison of the fund vis-à-vis its current benchmark – S&P BSE 200 -TRI Index shows that the fund has outperformed the benchmark in 6 out of last 10 calendar years. The fund went through a turbulent phase between CY2009 and CY2011, trailing the benchmark by 2-3 percentage points. However, the fund regained its foothold in the following years. Bulk of the alpha was generated in CY2014 to CY2016. The fund generated an excess return of 19 percentage points and 20 percentage points respectively over these periods. In CY2017 and year-to-date, the fund has seemingly run into a rough patch, trailing the benchmark.

Aditya Birla Sun Life Equity Fund: Performance Vis-à-vis Category Peers

Rolling Period Returns

| Scheme Name |

Corpus (Rs Cr) |

1 Year (%) |

2 Year (%) |

3 Year (%) |

5 Year (%) |

Std Dev |

Sharpe |

| Motilal Oswal Multicap 35 Fund |

13,181 |

25.46 |

23.34 |

20.56 |

0.00 |

14.54 |

0.15 |

| SBI Magnum Multicap Fund |

5,338 |

20.80 |

19.31 |

15.83 |

21.24 |

13.28 |

0.14 |

| Principal Multi Cap Growth Fund |

674 |

27.61 |

24.22 |

15.78 |

21.63 |

16.70 |

0.14 |

| Aditya Birla SL Equity Fund |

9,376 |

19.72 |

22.07 |

15.53 |

22.27 |

13.86 |

0.15 |

| Kotak Standard Multicap Fund |

19,614 |

19.88 |

19.90 |

14.99 |

21.22 |

12.94 |

0.14 |

| Mirae Asset India Equity Fund |

7,733 |

22.78 |

20.70 |

14.73 |

21.18 |

13.56 |

0.14 |

| Invesco India Multicap Fund |

548 |

22.59 |

19.01 |

14.54 |

24.55 |

15.28 |

0.09 |

| JM Multicap Fund |

144 |

21.98 |

22.04 |

13.72 |

19.35 |

15.26 |

0.10 |

| BNP Paribas Multi Cap Fund |

882 |

22.78 |

18.20 |

13.49 |

19.46 |

14.59 |

0.05 |

| Parag Parikh Long Term Equity Fund |

1,077 |

20.62 |

16.58 |

13.31 |

19.20 |

10.08 |

0.17 |

| Edelweiss Multi-Cap Fund |

81 |

25.94 |

19.86 |

12.77 |

0.00 |

15.22 |

0.11 |

| ICICI Pru Multicap Fund |

2,794 |

14.34 |

16.53 |

12.37 |

18.68 |

12.36 |

0.10 |

| Franklin India Equity Fund |

11,569 |

16.13 |

14.77 |

12.19 |

19.21 |

11.90 |

0.07 |

| DSPBR Equity Fund |

2,595 |

20.07 |

18.77 |

12.05 |

17.62 |

15.44 |

0.09 |

| HSBC Multi Cap Equity Fund |

630 |

19.73 |

18.66 |

11.88 |

19.28 |

14.86 |

0.07 |

| IDFC Multi Cap Fund |

5,581 |

18.59 |

14.50 |

11.74 |

20.22 |

13.91 |

0.05 |

| L&T Equity Fund |

2,767 |

18.95 |

16.73 |

11.03 |

17.41 |

13.54 |

0.08 |

| IDBI Diversified Equity Fund |

375 |

16.12 |

12.52 |

10.85 |

0.00 |

12.37 |

0.05 |

| HDFC Equity Fund |

21,150 |

19.65 |

18.89 |

10.24 |

17.36 |

16.63 |

0.06 |

| Baroda Pioneer Multi Cap Fund |

681 |

17.42 |

15.51 |

9.90 |

15.63 |

13.60 |

0.03 |

| S&P BSE 200 - TRI |

|

20.75 |

18.04 |

11.33 |

15.97 |

13.07 |

0.11 |

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on July 4, 2018

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

ABSL Equity Fund has done exceedingly well in the 2-year, 3-year and 5-year rolling periods. The multi cap fund has outperformed the benchmark by 4-7 percentage points in these periods. However, its performance in the 1-year rolling periods is threatening to lower its long-term returns. The fund has marginally trailed the benchmark in this phase.

As Aditya Birla SL Equity Fund maintains a large cap bias, the fund has a lower volatility than most other schemes that maintain a higher exposure to mid caps. Despite ignoring a high return potential mid caps, the fund has not disappointed in generating returns. Hence, it scores well in terms of risk-adjusted returns when compared to other multi cap schemes.

The top five mutual funds with a similar investment objective and market-cap bias in the 3-year rolling period performance include—Motilal Oswal Multicap 35 Fund, SBI Magnum Multicap Fund, Principal Multi Cap Growth Fund, Kotak Standard Multicap Fund, and Mirae Asset India Equity Fund.

Investment Strategy of ABSL Equity Fund

Aditya Birla SL Equity Fund would adopt top-down and bottom-up approach of investing and will aim at being diversified across various industries and / or sectors and/ or market capitalization. This gives the fund the flexibility to switch between aggressive and defensive styles of investing, based on the fund managers outlook of the market.

The investment emphasis of the scheme would be on identifying companies with sound corporate managements and prospects of good future growth. Essentially, the focus would be on stocks driven by long-term fundamentals. However, short term opportunities would also be seized, provided underlying values supports these opportunities. A portion of the assets will also be invested in IPOs, emerging sectors, concept stocks and other primary market offerings that meet the fund management team’s investment criteria.

Aditya Birla Sun Life Equity Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on May 31, 2018

Holdings (in %) as on May 31, 2018

(Source: ACEMF)

As can be seen in the chart alongside, ABSL Equity Fund has predominantly invested over 70% of its portfolio to large-caps. While the fund has the flexibility to have a higher exposure to midcaps, it has chosen to maintain it has leaned towards stable bluechip stocks. Over the past year, the large cap exposure has moved in a narrow range of 70%-75%. The exposure to mid-and small caps hovers around 15%-20%. The allocation to cash has varied widely between 5%-15%. As on May 31, 2018, the exposure to large caps stands at 76%, Mid-and small-caps at 18% and cash & debt at 6%.

Aditya Birla Sun Life Equity Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| HDFC Bank Ltd. |

6.75 |

| ICICI Bank Ltd. |

4.76 |

| ITC Ltd. |

3.49 |

| Maruti Suzuki India Ltd. |

3.48 |

| Tata Steel Ltd. |

3.18 |

| Tech Mahindra Ltd. |

3.14 |

| Tata Chemicals Ltd. |

2.89 |

| Hindalco Industries Ltd. |

2.87 |

| Infosys Ltd. |

2.62 |

| Dabur India Ltd. |

2.52 |

|

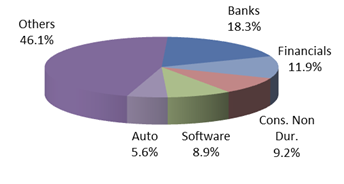

Top 5 Sectors

|

Holdings (in %) as on May 31, 2018

(Source: ACEMF) |

ABSL Equity Fund has as many as 77 stocks in its portfolio. The top 10 stocks account for 36% of the total holdings. HDFC Bank leads the list of stocks with an exposure of 6.75%. ICICI Bank follows behind with an exposure of 4.76%. These are the only two finance sectors stocks among the top 10 holdings. Other stocks present among the top 10 are from varied sectors.

In terms of sectorial exposure, Banks and Financials lead the list with an allocation of 18% and 12% respectively. FMCG and Software stocks follow closely behind with an exposure of around 9% each. Auto stocks too, find a place among the top sectors with an exposure of 5.6%.

Top Gainers in ABSL Equity Fund’s portfolio

Out of the 77 stocks in the portfolio, as many as 52 stocks have been held for 12 months or more. About 32 of these stocks generated a return in excess of 10% over the past 1 year. Among the top stocks in the portfolio, with the maximum return over the past 1 year were Tech Mahindra Ltd, Bajaj Finance, Hindustan Unilever, Cholamandalam Investment & Finance, and United Spirits. These stocks rallied 83%, 59%, 51%, 49%, and 48% over the past year.

About 18 stocks in the portfolio declined by 10% or more over the past year. Among the stocks that declined the most were Tata Communications, Max Financial Services, ACC, Castrol India, and Dr. Reddys Laboratories. These stocks declined -15%, -16%, -17%, -19%, and -23% respectively.

Suitability of Aditya Birla Sun Life Equity Fund

Under the different mutual fund categories, there are large-cap funds that offer stability at one end and midcap and smallcap funds, at the other end, that offer the excitement of supernormal returns, though being equally risky at the same time.

In between both the categories are multicap funds. Multicaps invest in a mix of both largecap and midcap stocks, without any allocation restrictions, as in the case of large- and midcap funds. Hence, multicap funds offer investors stability as well as a high-return potential.

Multi-caps funds are expected to maintain a flexible allocation to largecap and midcap stocks and thus, they can very their exposure to largecap and midcap stocks depending on the market conditions. The fund can work as a large cap fund, if the fund manager expects a better performance from largecaps. It may also serve as a mid & small cap fund if he (the fund manager) turns bullish on mid-sized companies.

Thus, under the multi cap category itself, you may find funds with varied investment styles adopting different asset allocations. Thus, at times it becomes difficult to ascertain the risk-return potential of such funds due to their dynamic nature. A lot depends on the fund manager’s experience and skill to derive the returns from multi cap funds.

You need to pick a multi cap fund based on its risk-return parameters vis-a-vis other peers and the quality of fund management. Not all mutual funds have the capability to perform consistently. You need to analyse the returns of multicap funds across multiple periods and market cycles. Shortlist the funds that have consistently outdone the market and their peers. The scheme you select should match your risk profile and should be suitable to meet your investment goals.

ABSL Equity Fund, as a multi cap fund, has been prudent in its fund management. It has not taken undue risk and keeps a reasonably diversified portfolio across stocks and sectors. The fund has done well over different market periods and across market cycles. However, it has shown some signs of stress in the recent few months.

Thus, before investing, do weigh all options and make a prudent choice.

If you are not sure about how to align these schemes with your financial goals, do consult your financial planner or investment advisor.

Note: This write up is for information purpose and not a recommendation to buy or sell the mutual fund scheme. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor.

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

and condition on which its offer research report. For the terms and condition for research report click here.

Details of associates

- Money Simplified Services Private Limited;

- PersonalFN Insurance Services India Private Limited;

- Equitymaster Agora Research Private Limited;

- Common Sense Living Private Limited;

- Quantum Advisors Private Limited;

- Quantum Asset Management Company Private Limited;

- HelpYourNGO Private Limited;

- HelpYourNGO Foundation;

- Natural Streets for Performing Arts Foundation;

- Primary Real Estate Advisors Private Limited;

- Rahul Goel;

- I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

- Neither QIS, it’s Associates, Research Analyst or his/her relative have any financial interest in the subject Company , except QIS receives fees for providing research to Quantum Equity Fund of Fund (QEFoF) which is Fund of Fund scheme managed by QMF.

- Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report.

- Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront /annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices

Disclosure with regard to receipt of Compensation

- Neither QIS nor it's Associates have any compensation from the subject Company in the past twelve months.

- Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company in the past twelve months.

- Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company in the past twelve months.

- Neither QIS nor it’s Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months except from Axis Bank Limited under a service agreement.

- Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

- The Research Analyst has not served as an officer, director or employee of the subject Company.

- QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments