Launched a mere 8 years ago, Axis Long Term Equity Fund raced to the forefront of tax-saving schemes in just a few years of its inception. Despite being a new fund house at the time, Axis Mutual Fund was able to get Axis Long Term Equity Fund to deliver supernormal returns since inception — 19.49% CAGR v/s 10.29% CAGR of the benchmark S&P BSE 200.

In certain periods, the superior performance of the ELSS fund across market cycles even gave many equity-diversified schemes a run for their money. Such spectacular performance rarely goes unnoticed. Soon, retail investors started flocking the scheme in large numbers and the fund’s corpus raced passed others in the category. In a matter of just four years, the fund’s AUM grew by 26 times to Rs 13,200 crore in May 2017 from about Rs 500 crore in March 2013. Over the past two years or so, the AUM more than doubled from Rs 5,400 crore in June 2015 to Rs 16,100 crore in December 2017.

From September 2015 onwards, Axis Long Term Equity Fund struggled to keep up with the benchmark. Much of its underperformance was due to its stock selection and its resistance from investing in high beta stocks. Its stock selection created a drag on the portfolio returns over the past 1-2 years. Axis Long Term Equity Fund has now rejigged its portfolio with an aim to come out strong from this setback.

In this brief analysis, PersonalFN takes a close look at the features and performance of Axis Long Term Equity Fund.

Investment Objective of Axis Long Term Equity Fund

The investment objective of Axis Long Term Equity Fund is to generate income and long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related securities. Axis Long Term Equity Fund will aim to invest in quality businesses across market-caps.

In accordance with the ELSS guidelines, investments by Axis Long Term Equity Fund in equity and equity related Securities will not fall below 80% of the net assets of the Scheme. As per the ELSS, pending deployment of funds, Axis Long Term Equity Fund may invest in short-term money market instruments or other liquid instruments or both. After three years of the date of allotment of the units, the Mutual Fund may hold upto twenty per cent of net assets of the scheme in short-term money market instruments and other liquid instruments to enable redemption of investment of those unit holders who would seek to tender the units for repurchase.

Axis Long Term Equity Fund retains the flexibility to invest across all the securities in the equity, debt, Money Markets Instruments and mutual fund units to such extent as maybe permitted by the Regulations and ELSS Guidelines.

Axis Long Term Equity Fund Details

Fund Facts

| Category |

ELSS |

Style |

Growth |

| Type |

Open ended |

Market Cap Bias |

Multi-cap |

| Launch Date |

31-Dec-09 |

SI Return (CAGR) |

19.49% |

| Corpus (Cr) |

Rs 16,108 |

Min./Add. Inv. |

Rs 500 / Rs 500 |

| Expense Ratio (Dir/Reg) |

1.27% / 1.97% |

Exit Load |

1% if less than 1 Yr |

NAV Data as on February 1, 2018 | Fund details as on December 31, 2017

(Source: ACE MF)

Under normal circumstances, the Axis Long Term Equity Fund will allocate…

- 80% - 100% of its assets in equity and equity-related securities.

- 0% - 20% in debt and money market instruments.

Growth Of Rs 10,000, If Invested In Axis Long Term Equity Fund 5 years ago…

Data as on February 1, 2018 (Source: ACE MF) Data as on February 1, 2018 (Source: ACE MF)

|

Had you invested Rs 10,000 in Axis Long Term Equity Fund five years ago, it would have grown to Rs 28,838. This translates in to a compounded annualised growth rate of 23.59%. In comparison, a similar investment in the benchmark S&P BSE 200 would have resulted in a compounded return of 14.41%. Thus, the investment of Rs 10,000 in the benchmark would now be worth Rs 19,605.

|

The fund has raced past the benchmark as the market began its rally in August 2013. Bulk of the outperformance came in the rally between 2013 and 2015.

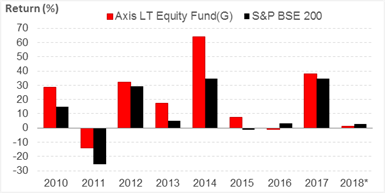

Axis Long Term Equity Fund: Year-on-Year Performance

|

In its eight-year history that began in December 2009, Axis Long Term Equity Fund underperformed its benchmark just once in CY 2016. Though the fund has trailed the benchmark in the year to date, it is too short a period to judge its performance. The fund's stellar performance in clearly visible in CY 2013, 2014 and 2015, which helped it outpace the benchmark by a wide margin. Even though the market was found struggling in 2015, Axis Long Term Equity Fund was able to generate positive returns.

|

Data as on February 1, 2018 (Source: ACE MF) Data as on February 1, 2018 (Source: ACE MF)

|

Over the past two years or so, the fund's alpha over the benchmark has diminished. In CY2016, it struggled to outpace the benchmark and ended up delivering negative returns.

Axis Long Term Equity Fund: Performance Vis-à-vis Category Peers

Rolling Period Returns

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on February 1, 2018

(Source: ACE MF)

The returns of Axis Long Term Equity Fund have been subdued over the 1-year and 2-year rolling periods. In the 3-year rolling returns, where it used to earlier top the list, it still manages to hold its ground. Given its exemplary returns in the past, the Axis Long Term Equity Fund continues to top the list based on the 5-year rolling returns. Though the ground has shifted below its feet, will Axis Long Term Equity Fund be able to regain its past glory?

In terms of volatility, the once top ELSS fund does not disappoint. It is among the top ELSS funds with the lowest standard deviation, a measure for risk. The volatility is even lower than the benchmark. In terms of risk-adjusted returns, the ELSS disappoints due to its lacklustre returns in the past few years.

Investment Strategy of Axis Long Term Equity Fund

Axis Long Term Equity Fund can vary its equity assets between 80%-100% of the total portfolio. Under normal circumstances, the equity allocation is kept at over 95%. The fund’s maintains a focus on high quality strong growth companies with sustainable business models and those that carry competitive advantages as compared to their competitors.

Following multi-cap strategy, Axis Long Term Equity Fund does not maintain a market-cap bias. The allocation to mid-caps can go up to 50% of the portfolio. The fund maintains a stable core portfolio with relatively low churn. Within that objective, it is comfortable looking past shorter term volatility in performance. The fund management is currently focused on financials and auto to support the core portfolio while maintaining a strategic allocation to the infrastructure and capital goods sector. Axis Long Term Equity Fund also looks to pick export oriented businesses to act as a hedge to the portfolio.

Axis Long Term Equity Fund avoids highly cyclical & regulated sectors, sectors where there are serious growth challenges, corporate governance issues and political interventions.

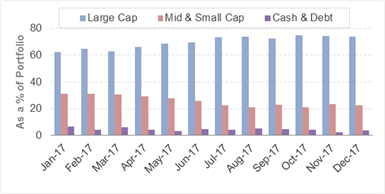

Axis Long Term Equity Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on December 31, 2017 Holdings (in %) as on December 31, 2017

(Source: ACEMF)

|

Axis Long Term Equity Fund has stuck to an allocation of about 65%-75% to large-caps and 20%-30% to mid-caps. In most months of the past year, the allocation to large-caps was kept around 70%. The allocation briefly dipped to 60% in January 2017, before rising back up. Over the past year, Axis Long Term Equity Fund has reduced its exposure to midcaps from about 30% to just 25%. In the past 6 months, the mid-cap allocation has stayed around 20%.

|

Axis Long Term Equity Fund holds its conviction and focusses on holding stocks for the long term. The cash component of the scheme has varied around 1%-7% of the portfolio. As on December 2017, Axis Long Term Equity Fund had an allocation of 74% to large-caps, 22% to mid-caps and 4% to cash.

Axis Long Term Equity Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| HDFC Bank Ltd. |

7.98 |

| Kotak Mahindra Bank Ltd. |

7.53 |

| HDFC |

6.08 |

| Pidilite Industries Ltd. |

5.77 |

| Maruti Suzuki India Ltd. |

5.72 |

| Motherson Sumi Systems Ltd. |

4.80 |

| Bajaj Finance Ltd. |

4.36 |

| TTK Prestige Ltd. |

3.69 |

| Avenue Supermarts Ltd. |

3.61 |

| Gruh Finance Ltd. |

3.25 |

|

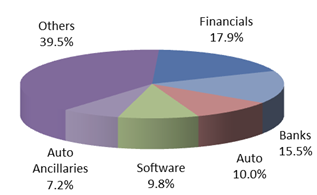

Top 5 Sectors

|

Holdings (in %) as on December 31, 2017

(Source: ACEMF) |

Banks and NBFCs dominate the portfolio of Axis Long Term Equity Fund. Both the sectors account for 15%-18% each. The allocation to both these sectors has remained steady over the past one year. Similarly, Axis Long Term Equity Fund has increased its exposure to Auto and Auto Ancillaries stocks. Software stocks accounted for nearly 10% of the portfolio in December 2017.

Among the top holdins, HDFC Bank and Kotak Mahindra Bank dominate the list of 53 stocks with a weightage of near 8% each. HDFC, Pidilite, and Maruti Suzuki are among the few other with an exposure over 5% each. The top 10 holdings account for over half the portfolio at 53%.

Top Gainers in Axis Long Term Equity Fund's portfolio

As the top holdings of Axis Long Term Equity Fund have a dominant large-cap exposure, the returns have been decent over the past year. HDFC Bank, which leads the list with a near 8% weightage, generated a return of 56%. Bajaj Finance was the top performer in the top 10 holdings. The share price of the finance company more than doubled from Rs 840 at the beginning of January 2017 to over Rs 1750 at the end of December 2017.

Stocks such as Kotak Mahindra Bank, Pidilite, Maruti Suzuki, Motherson Sumi, Avenue Supermarts and Gruh Finance too helped Axis Long Term Equity Fund generate a significant alpha.

Among the laggards in Axis Long Term Equity Fund's portfolio were Tata Consultancy Services, Sun Pharma, PI Industries, Cummins India and Cadila Healthcare. These stocks weighed down on the returns of Axis Long Term Equity Fund.

Suitability of Axis Long Term Equity Fund

Tax Saving Funds or ELSS (Equity Linked Savings Scheme) are a variation of diversified equity mutual funds that provides tax deduction benefit of up to Rs 1.5 lakh to its investors under Section 80C of the Income Tax Act, 1961 and at the same time participate in equity markets.

Besides the tax break, many ELSS funds have delivered healthy double-digit returns over the long term. It is noteworthy that these special funds come with a lock in period of 3 years, which means your investment in these funds cannot be withdrawn before completion of 3 years from the date of your investment.

Equity schemes, whether tax-saving or not, are high risk. Therefore, you should maintain a long-term focus of five years or more when investing. Those who have invested in Axis Long Term Equity Fund over the past year or so, may be a bit disappointed with the returns. But that is the risk one has to accept. Even good schemes with a spectacular track-record may suffer bouts of underperformance. However, this may just be a bad phase that needs to be dealt with by the fund management.

As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor.

|

Editor's note:

As an investor, you need to pick the right and suitable ELSS funds to meet your financial goals.

Hence, a process that combines both quantitative and qualitative factors has a good chance of picking funds that can deliver decent market-beating returns. The quantitative factors will cover the fund’s performance across multiple periods and market cycles, as well as the fund’s ability to manage risk among other factors.

The qualitative factors will take into account the fund manager’s experience, the performance of the fund house across multiple schemes, as well as the quality of assets in the portfolio, to name a few. Thus, when analysing a fund across both quantitative and qualitative parameters, you will be able to pick a fund that has a promising future.

PersonalFN adopts such a process to shortlist the potentially best mutual funds for its subscribers.

If you are looking for the top ELSS funds, subscribe to PersonalFN’s Exclusive Report - 3 Tax-Saving Mutual Funds For 2018.

In this report, you will find the Top 3 ELSS that are geared to grow your investment multi-fold over long term while saving your taxes. These Top 3 ELSS are handpicked through our special 7-point Selection Matrix methodology, and are considered to be potentially the best tax-saving mutual funds in the Indian market.

|

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

and condition on which its offer research report. For the terms and condition for research report click here.

Details of associates

- Money Simplified Services Private Limited;

- PersonalFN Insurance Services India Private Limited;

- Equitymaster Agora Research Private Limited;

- Common Sense Living Private Limited;

- Quantum Advisors Private Limited;

- Quantum Asset Management Company Private Limited;

- HelpYourNGO Private Limited;

- HelpYourNGO Foundation;

- Natural Streets for Performing Arts Foundation;

- Primary Real Estate Advisors Private Limited;

- Rahul Goel;

- I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

- Neither QIS, it’s Associates, Research Analyst or his/her relative have any financial interest in the subject Company , except QIS receives fees for providing research to Quantum Equity Fund of Fund (QEFoF) which is Fund of Fund scheme managed by QMF.

- Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report.

- Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront /annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices

Disclosure with regard to receipt of Compensation

- Neither QIS nor it's Associates have any compensation from the subject Company in the past twelve months.

- Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company in the past twelve months.

- Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company in the past twelve months.

- Neither QIS nor it’s Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months except from Axis Bank Limited under a service agreement.

- Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

- The Research Analyst has not served as an officer, director or employee of the subject Company.

- QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments

| Comments |

susantaghosh973@gmail.com

Feb 03, 2018

Fine |

1