Have you ever asked yourself why do you work hard?

Some of you might find it a silly question. Most of you might have similar answers to this question.

You work hard so that you can send your children to the best schools.

You can’t improve your lifestyle without working hard, could you?

And yes, you want to retire peacefully without caring about your finances.

Retirement planning is one of the most important financial goals of our life.

Insurance companies thrive by banking on this need and have released umpteen products until now.

Mutual fund houses have lagged behind for years; however, even they have started taking strides to attract more investors to their retirement plans.

As you might be aware, the Securities and Exchange Board of India (SEBI) has allowed mutual fund houses to offer retirement plans as solution-oriented schemes.

According to SEBI’s scheme categorisation norms, retirement schemes must be offered as open-ended schemes with a lock-in period of 5 years or until retirement, whichever is earlier.

Should you invest in retirement funds that mutual funds offer?

Performance of the retirement plans offered by mutual funds has been a mixed bag so far. Some of them such as HDFC Retirement Savings Fund-Hybrid-Equity Plan and Tata Retirement Savings Fund-Progressive Plan have done well; while others haven’t.

PersonalFN is of the view that, instead of treating retirement funds as a special category, you should consider them on par with comparable schemes such as diversified equity funds or aggressive hybrid equity funds, depending on their asset allocation.

Please remember, they have a lock-in period of 5 years. In case a scheme you have invested in underperforms, you won’t have a way out.

Hence, if you are investing in retirement funds, please treat them at par with other comparable close-ended mutual fund schemes.

How would you plan your retirement then?

Merely investing in a particular mutual fund scheme, be it a retirement plan or any other diversified equity fund, in an ad hoc manner is not enough. You must determine money you need at the time of retirement to live peacefully. Use PersonalFN’s retirement calculator and know how much you need to live a blissful retired life.

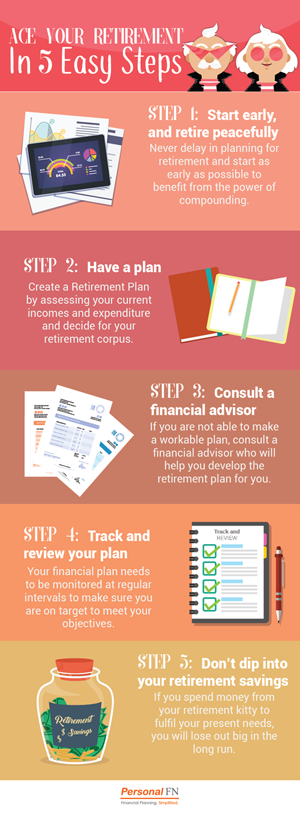

Follow these simple steps to ensure that you are planning the right way.

Once you are done with the planning part, select diversified equity mutual funds to create your retirement kitty.

If you invest in diversified equity mutual funds through Systematic Investment Plans (SIPs), you would be able to build a sufficient corpus for your retirement.

A monthly SIP of Rs 15,000 in a worthy diversified equity fund can help you accumulate Rs 1.5 crore over 20 years and Rs 2.8 crore over 25 years, assuming you clock a 12% rate of return. If your investments fetch you 15% returns, the SIP will accumulate Rs 2.2 crore over 20 years and Rs 4.9 crore over 25 years.

That’s the power of compounding which makes equity mutual funds a perfect investment avenue for retirement planning.

Moreover, investing in direct plans offered by mutual funds can fetch you even higher returns.

Aren’t you sure about their ability to generate remarkable returns?

For the last two-three decades, major equity indices such as the S&P BSE Sensex and CNX Nifty have generated 15%-17% compounded annualised returns. And shaped the Indian economy today, it wouldn’t be unwise to assume that the equity asset class still remains an attractive proposition.

This is about markets in general. Well-managed active mutual funds often outperform their respective benchmark indices.

While it’s true that, investing in mutual funds for the long-term is crucial for generating a sizable retirement corpus, it’s equally important to choose mutual fund schemes carefully.

PersonalFN presents a strategy that might help you in retirement planning.

Have you heard of the Core and Satellite strategy?

The ‘Core and satellite’ investing is a time-tested strategy to build your investment portfolio. For the mutual fund investors, the ‘core portfolio’ should consist of large-cap, multi-cap, and value funds, and the ‘satellite portfolio’ should include mid-and-small cap funds and opportunities style funds.

Read this carefully

While the ‘Core’ part of your portfolio focuses on the stable schemes with a long-term view and the ‘Satellite’ part revolves around capitalising on short-term opportunities, the combination helps you generate superior returns without taking excessive risks.

Editor’s note:

PersonalFN offers you a great opportunity if you’re looking for “high investment gains at relatively moderate risk”. Based on the ‘core and satellite’ approach to investing, here’s PersonalFN’s premium report: The Strategic Funds Portfolio For 2025 (2019 Edition).

In this report, PersonalFN will provide you with a ready-made portfolio of its top equity mutual funds schemes for 2025 that have the ability to generate lucrative returns over the long term. Subscribe now!

Add Comments