Bank fixed deposits, a staple investment product since the 80s and 90s, are considered secure wealth creation products. I remember my uncle telling my cousin, Neha about it after he had invested in bank FDs. He expected her to do the same as well, once she started earning.

But with the changing times due to the new monetary reforms, new investment avenues came into existence. Neha avoided following in her father’s footsteps as soon as she started working as a PRO for a top media house. She instead invested her hard-earned money in shares, gold bonds, and ULIPS to earn better returns with a high-risk trade-off.

Soon Neha realised, every investment avenue she chose had risk attached to it. As she had lost too much already, she decided to follow her father’s conservative investment approach. After all, there are five good reasons to invest in a bank FD:

-

Fixed and secured returns, unlike market-linked instruments;

-

Addresses liquidity needs (if the plan and tenure is thoughtfully selected);

-

Addresses short-term goals and contingency requirements;

-

Can take a loan against bank FD when in dire need of money; and

-

A 5-year tax-saver bank fixed deposit can help in tax planning as well

[Read: Factors To Look At While Investing In Bank FDs]

Recently, Neha went to her bank and was about to invest her savings into an FD.

However, a familiar friendly bank executive explained to her that investments have to be goal-based (short-term, medium-term, and long-term such as retirement), recognising one's financial health, risk appetite (high, moderate, and conservative), investment objectives and investment time horizon before goals befall, and the tax implications.

Further the executive, thankfully and rightly, stated that the interest on FDs are taxable, and as an investment avenue may prove inefficient if you are in the highest tax bracket.

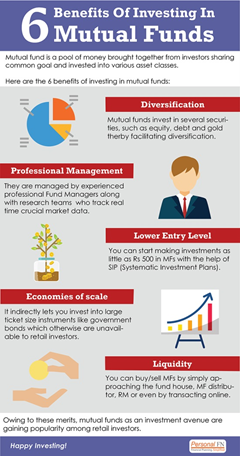

She explained to Neha how mutual funds work and the types available– equity-oriented mutual funds, debt-oriented, hybrid, solution-oriented, and other schemes (index funds and fund of fund schemes). Every type of fund has a set-out investment objective, which could address to a certain need. The broad objective could be capital appreciation and/or income generation, depending on the type and the investment mandate of the scheme. Thus, selecting a suitable type of mutual fund is crucial in the endeavour to generate wealth depending on the investor’s risk tolerance.

Since Neha was not willing to take very high risk, like in equities, the executive informed her about debt mutual funds.

If you are a conservative investor, you would, of course, prefer FDs and similar fixed income instruments (KVP, POTD, PPF, NSC, POMIS) for investments. But, if you are willing to take the medium-to-high risk, debt funds could earn slightly better and tax-efficient returns, the executive explained.

[Read: 5 Facets To Look Into While Investing In Debt Mutual Funds]

Further, the executive explained that debt mutual funds invest in a variety of fixed income securities such as Treasury Bills, Government Securities, Corporate Bonds, Money Market instruments, and other debt securities and with different maturity papers. There are 16 types of debt funds with a strict investment mandate.

So, for instance, if you have an investment time horizon of up to two years, consider short-term debt funds. If you have an investment horizon of less than one-year, low duration and money market funds would be the preferred choice. And if you have an extremely short-term time horizon (of less than six months), you would benefit from investing in liquid funds and ultra-short duration funds.

You ought to select debt mutual funds recognising your investment time horizon and risk profile.

Here are three reasons why investing in debt mutual funds could be better than fixed deposits:

-

Risk-Return

(www.Pixabay.com)

(www.Pixabay.com)

The returns on debt funds are market-linked and how efficiently the fund is managed. Investing in debt funds exposes you to various risks: interest rate risk and credit risk being the primary ones. Hence the disclaimer, “Mutual fund investments are subject to market risks, read all scheme related documents carefully.”

Currently, looking at the market volatility, two of the executive’s risk-averse clients, Anurag (a professor) and Ashok (a banker), invested Rs 2,00,000 for a short-term goal of three years. And by choosing debt mutual fund, the calculation shows how Ashok will earn better returns than Anurag.

|

Anurag invested in FD |

Ashok invested in Debt MF |

| Amount invested (in Rs) |

2,00,000 |

2,00,000 |

| Amount received after 3 years (in Rs) |

2,43,978 |

2,51,942 |

| Return on investment |

6.85% (interest) |

8% CAGR |

Disclaimer: The table is based on assumptions and is for illustrative purpose.

Therefore, sensibly investing in a debt mutual fund—backed by thorough research—can earn you a better real rate of return (also known as inflation-adjusted returns) compared to a bank FD.

-

Taxation

(www.freepik.com)

(www.freepik.com)

The capital gains from a debt mutual fund are taxed depending on the number of months the units held. If you redeem the units within less than 36 months (or 3 years), the gains, referred to as Short-Term Capital Gains (STCG), will be added under your gross total income and taxed as per your tax slab.

But if you redeem the units at a profit after 36 months (or after 3 years)—referred to as Long-Term Capital Gain— you enjoy an indexation benefit and the gains are taxed at20% flat. This proves to be beneficial if you are in the highest tax bracket of 30 % as the indexation benefit reduces the tax burden.

Whereas the interest earned on FD is taxed as per the income tax slab, which proves disadvantageous for those in the highest tax bracket.

-

Liquidity

Depending on the type of fund you select, a debt mutual fund can offer far more liquidity compared to a bank FD. To park money for the very short-term, say from day to a week; consider an overnight fund as a substitute for holding money in short-term FD or a savings bank account. Likewise, if you require money a few months from now or to address contingency needs, a liquid fund is better suited.

Do note that premature withdrawals from FDs are subject to penalty and you lose out on a portion of your expected return. Debt funds have high liquidity.

A quick comparison between Debt Mutual funds and Bank Fixed deposits

| Parameter |

Bank Fixed Deposits |

Debt Mutual Funds |

| Rate of Returns |

Fixed |

Market-linked (Variable) |

| Inflation-Adjusted Returns |

Usually low |

Potentially High |

| Risk |

Low |

Medium to High |

| Liquidity |

Low to medium |

High |

| Premature Withdrawal |

Permitted, but subject to a penalty |

Allowed subject to applicable exit load |

| Cost of Investment |

No cost |

Expense ratio |

| Tax Status# |

As Per Tax Slab |

Depending on STCG or LTCG |

Before parting, Neha thanked the bank executive for making her aware about debt mutual funds.

But before investing, she wanted to double-check and thus reached out to me and enquired about credible mutual fund advice. I helped her on-board for PersonalFN’s unbiased and independent mutual fund research service.

Today, Neha uses ‘PersonalFN Direct’-- PersonalFN’s robo-advisory platform that helps her to keep better track of her investments.

PersonalFN Direct is an ultra-reliable robo-advisor backed by PersonalFN's vast experience of well over 15 years.

-

PersonalFN Direct offers only DIRECT PLANS (devoid of commissions)

-

Offers customisable investment solutions based on your risk profiling

-

Brings outstanding research experience of over 15 years

-

Minimal paperwork and ease of transacting

-

Comes at a pocket-friendly price

Investing in mutual funds through

PersonalFN Direct is simple, rewarding, and economical.

To know more, click here.

What are you waiting for?

Become a paid subscriber of PersonalFN Direct today and start your journey towards wealth creation.

Happy Investing!

Add Comments