When filing income tax returns, you need to pay attention to detail. But as careful as one may be, at times certain errors may fail to get noticed.

Whether you have filed your income tax returns well in advance or even if filed at the last minute, there is a possibility of making a mistake. You may have forgotten to include certain exemptions, erroneously entered a wrong challan number for the tax credit, or even failed to include certain income.

The list can go on and on, as there could be endless possibilities. Hence, the tax department allows individuals to correct genuine mistakes in their income tax returns.

You may correct the error through two routes:

- Submitting a rectification request under Section 154 of the Income Tax Act or

- Filing a revised return under Section 139(5)

Difference between an Income Tax Rectification request and Revised Return

Once you submit and verify your income tax returns, an income tax Assessing Officer will authenticate the data you have entered and will send you an Intimation under Section 143(1) of the Income Tax Act. Here, you will need to match the data you’ve submitted and computed under Section 143(1) by the assessing officer. If there is a mistake, it will need to be corrected by submitting a rectification request.

You can submit a rectification request after the income tax return is processed or on receiving an Intimation u/s 143(1). You can rectify mistakes apparent from the record. Under this section, one can rectify clerical, arithmetical mistakes, a mismatch in tax payments, inclusion of income chargeable under an incorrect heading, and even changes in your resident status. Further, there must be confirmation that the mistake is apparent from the records and it is not a mistake that requires debate, elaboration, investigation, etc.

You can file a rectification request within four years from the date of the order that needs to be rectified, not necessary the original order. Thus, even after you file a rectification request and there continues to be an error in the revised order, you can file another rectification within four years from the date of the revised order.

If you unintentionally failed to include certain income or forgot to claim additional income exemptions, then file a revised return. There is a possibility where one could have forgotten to include interest income or even misplaced a donation receipt to claim exemption under Section 80G. A revised return can be filed even before receiving an Intimation u/s 143(1).

You can file a revised return under Section 139(5) of the Income Tax Act. Earlier, it was not permitted to file a revised return for returns filed after the due date. However, from April 1, 2017, you can file a revised return even for belated returns. This is applicable for Assessment Year 2017-18 and onwards.

You can file a revised return before the end of the next assessment year, which is March 31, 2019 for the annual year of 2017-18(AY). Please note, the deadline for filing revised returns has been reduced. From next year, i.e. AY2018-19, the deadline for filing revised returns is March 31, 2019.

4 easy steps to file a rectification request

Step 1

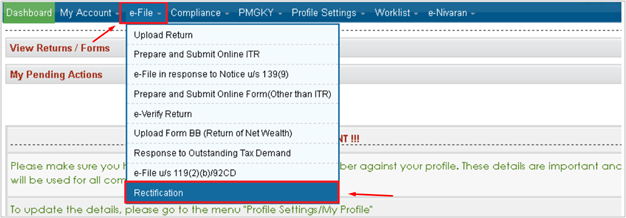

Login to e-Filing portal and under the ‘e-File’ tab,go to ‘Rectification’.

(Source: incometaxindiaefiling.gov.in, PersonalFN Research)

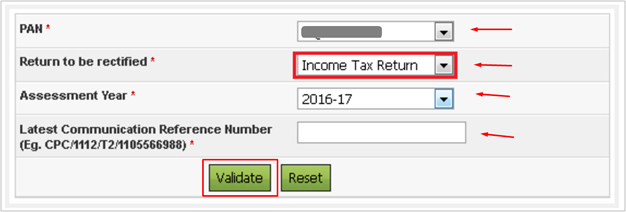

Step 2

Fill in a short form. The PAN is prefilled. Select ‘Return to be rectified’ as ‘Income Tax Return’ from the drop-down box available, choose the relevant Assessment year for which the rectification needs to be filed and mention the communication reference number as mentioned in the intimation received. Click on ‘Validate’.

(Source: incometaxindiaefiling.gov.in, PersonalFN Research)

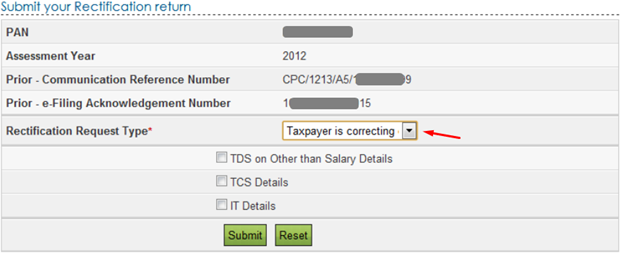

Step 3

On successful validation, an additional drop-down is displayed to select the ‘Rectification Request Type’ option. You can select one of the following options:

‘Taxpayer is correcting data for Tax Credit Mismatch only’

‘Tax Payer is correcting the data in rectification’

‘No further Data Correction required. Reprocess the case’

On selecting the option ‘Taxpayer is correcting data for Tax Credit mismatch only’, three check boxes TCS, TDS, IT are displayed. You may select the checkbox for which data needs to be corrected. Details regarding these fields will be prefilled from the ITR filed. User can add a maximum of 10 entries for each of the selections. It isn’t required to upload any ITR.

(Source: incometaxindiaefiling.gov.in, PersonalFN Research)

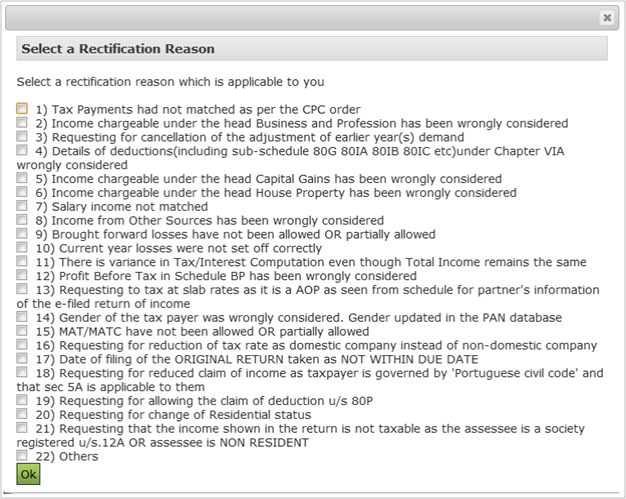

On selecting the option, ‘Taxpayer is correcting Data in Rectification’, select the reason for rectification. Schedules being changed, Donation and Capital gain details (if applicable), upload XML and Digital Signature Certificate (DSC), if available and applicable. You can select a maximum of 4 reasons.

(Source: incometaxindiaefiling.gov.in, PersonalFN Research)

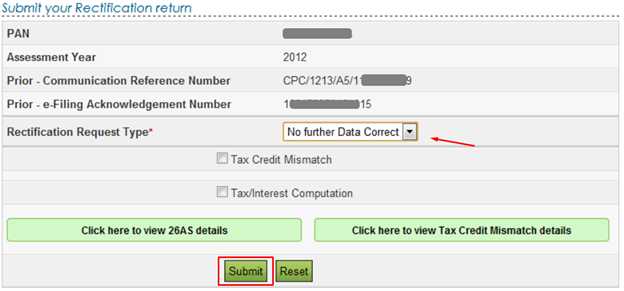

On selecting the option, ‘No further Data Correction Required. Reprocess the case’, you will need to select the appropriate check box –

Tax Credit Mismatch

Gender Mismatch (Only for Individuals),

Tax / Interest Mismatch

Select the checkbox for which re-processing is required. No upload of any ITR is required. You can view their 26AS details by clicking on “Click here to view 26AS details” button, and view the tax credit mismatch details by clicking on “Click here to view Tax Credit Mismatch details” button.

(Source: incometaxindiaefiling.gov.in, PersonalFN Research)

Step 4

After entering details under the rectification details type, click on ‘Submit’.

A confirmation popup will appear. Click on the ‘Ok’ tab to submit the rectification.

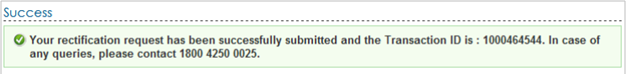

On successful submission, you will get a message as below:

(Source: incometaxindiaefiling.gov.in, PersonalFN Research)

5 Easy Steps to file a Revised Return

The steps to filing a revised return are similar to filing your original tax returns with one minor difference. In the Excel utility or in the online form, you need to select the ‘Revised’ return option, and provide the original e-Filing acknowledgement number and date of filing the original return.

We will take you through the procedure of revising your return through the online form.

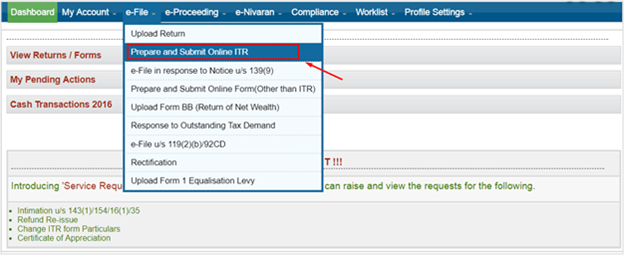

Step 1

Login to the Income Tax efiling portal and access the online form. Under the e-File tab, click on ‘Prepare and Submit Online ITR’.

(Source: incometaxindiaefiling.gov.in, PersonalFN Research)

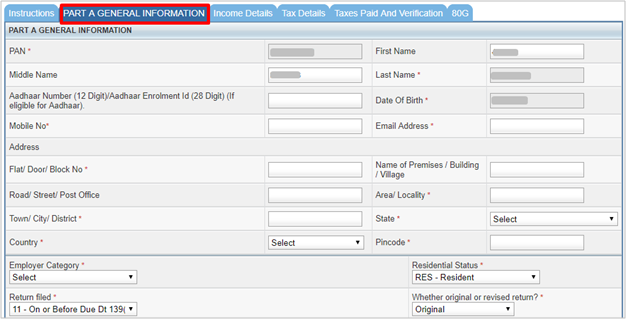

Step 2

Part A contains all the basic particulars. If you requested to prefill a new address in Step 2, you would get a blank form as below. Where asked, ‘Whether original or revised return?’, select the ‘Revised’ option.

(Source: incometaxindiaefiling.gov.in, PersonalFN Research)

You can then proceed to enter your income and deductions. Enter the details of what you had missed mentioning earlier.

You may view the complete process here – How to e-File your returns in a few easy steps.

Step 4

After mentioning all details, click on ‘Preview & Submit’. If there are any discrepancies or if you have missed any mandatory fields, you will get a pop-up message detailing the error. Once this is rectified, you will be able to preview the entire form on one page. Make sure all the details are accurate and correct. If needed, you can edit the section where there is an error. If there are no changes, submit the form.

Step 5

After submitting the revised return, you will once again need to e-verify this. You can verify the form through:

- An electronic verification code (EVC) by logging in through your internet banking account;

- Aadhaar OTP; or

- By sending the signed acknowledgement copy to CPC, Bengaluru. The second option is preferable.

You may choose a similar or alternative option from that used when filing the original return. For a detailed process on verifying income tax returns, read this tutorial - 7 Ways To Verify Your Income Tax Returns.

As you can see, you can correct your mistakes in a few easy steps. At the same time, it is important to adhere to deadlines. Always ensure that you have documentary proof available of your income and tax deductions availed of. In case your income tax submission is scrutinised, be prepared to give a valid explanation for the revision or rectification of tax return.

You can always avoid silly errors if you plan your taxes well before the due date. This effort will also help you to make the best use of the income tax provisions along with many other benefits.

Read – 5 benefits of tax planning early.

Additionally, read – 10 Reasons Why You Should File Your Income Tax Return On Time

PersonalFN is of the view that you need to plan your taxes at the start of the financial year, to assess where you stand and make adjustments accordingly. It is important for you to know the various routes to save tax on your income. You need to check if you are on the right track towards saving on taxes, and to take timely action in case you have missed any benefits.

You can seek the assistance of a financial planner to suggest the best tax-saving products that will not only help you save tax, but that can be aligned to achieve your financial goals as well. It would, therefore, be worthy to reach out to a Certified Financial Guardian – a mark of trust and respect, who can counsel and handhold you to streamline your personal finances prudently.

Add Comments

| Comments |

satishailwad@gmail.com

Apr 24, 2019

Sir,

Maine FY 2017-18 ka return file kiya hai usme galti se 26as se jyada credit liya gaya hai Income Tax ki demnad ayi hai to mai kya karu, jo TDS ka credit jyada liya hai uske agains income bhi dikhaya hai to income reduce karu kya,

|

rojapremi@yahoo.com

Aug 02, 2019

HI,

I have submitted this year form with out paying the pending tax, I tried to update the form again and Epaid the tax. After updating the challan details, not able to resubmit the tax form.

As per the above content on Rectification, I updated the AY, but it says: "Processed Income Tax detail are not available for the assessment year. Kindly try after some time". Let me know hen this will allow me to update?

Also for updating challan details, which option I need to select and proceed?

Thanks |

neerajg34@gmail.com

Aug 13, 2018

I Did file ITR on July 3, 2018 for FY 2017-18. I have claimed TDS refund as on 3rd july 2018 and same have been received also.

My Bank did deduct TDS from Fix deposit by error amount to Rs 30537/- on July 11, 2017. But the Bank uploaded TDS Return on NSDL in August 2018. I am not provided Form 16 A of the same amount.

This amount is reflecting in 26AS of FY 2017-18 now ( as on August 8,2018 ). Earlier the TDS amount ( as on July 2,2018) from the Bank was Rs.10003/- now it is 40540/-( as on august 8,2018 ). secondly, the same amount ( Rs. 30537/-) is shown as interest paid which do not increase my income and this amount is not included in Interest income certificate given by Bank.

Hence, i do request you to pl. let me know about the provision fori claiming the balance TDS amount of Rs. 30537/-

How can i file rectification request while the refund was correct as per the income and Tax credit at the the time of ITR filed. ?

If i submitt the revised return will it be entertained and process for balance refund ?

|

neerajg34@gmail.com

Aug 13, 2018

I Did file ITR on July 3, 2018 for FY 2017-18. I have claimed TDS refund as on 3rd july 2018 and same have been received also.

My Bank did deduct TDS from Fix deposit by error amount to Rs 30537/- on July 11, 2017. But the Bank uploaded TDS Return on NSDL in August 2018. I am not provided Form 16 A of the same amount.

This amount is reflecting in 26AS of FY 2017-18 now ( as on August 8,2018 ). Earlier the TDS amount ( as on July 2,2018) from the Bank was Rs.10003/- now it is 40540/-( as on august 8,2018 ). secondly, the same amount ( Rs. 30537/-) is shown as interest paid which do not increase my income and this amount is not included in Interest income certificate given by Bank.

Hence, i do request you to pl. let me know about the provision fori claiming the balance TDS amount of Rs. 30537/-

How can i file rectification request while the refund was correct as per the income and Tax credit at the the time of ITR filed. ?

If i submitt the revised return will it be entertained and process for balance refund ?

|

akdasteacher@gmail.com

Dec 11, 2018

I am a salarid person. By mistake I have shown my income under salary head more than the actual income as reflected in 26AS for the assessment year 2017-18 and also forgotten to add income from bank interest. As per these data I demanded some amount as refund. But income tax has issued a notification u/s 143(1)(a) and has asked to pay tax on the amount of bank interest or to file a revised return.In the revised return I have did the same mistake and again I have notified. I have filed a revised return as per income from salary shown on 26AS and included the bank interest as per the pre-filled proforma.The refund amount has been increased in respect to the original return.Will I get the refund as per the revised return ? or income tax will served any notice. |

1 ...