IDFC Classic Equity Fund was launched by IDFC Mutual Fund over a decade ago in August 2005. Except for Mr Ankur Arora, who had been managing the fund of four years between February 2012 and March 2016, none of the other fund managers were at the helm for more than three years.

About two years ago, ace fund manager Mr Anoop Bhaskar—who was earlier with UTI Mutual Fund—took over the reins of IDFC Classic Equity Fund. Since then, the performance of the scheme has shown signs of improvement.

In the past, the performance of the scheme has been decent and was in line with the benchmark. The alpha generated over the benchmark was acceptable, but ranked the scheme lower down the order. The performance of the scheme over the past one year has picked up and ranks among the top 15 schemes. With the decent alpha generated in the past year, the performance of the longer timeframes of 3-years and 5-year has picked up as well. The portfolio rejig in the past one year seems to have proved worthwhile.

Given the strong performance and the optimism of an highly experienced fund manager at the helm, the corpus of IDFC Classic Equity Fund has more than doubled over the past year. Before Mr Bhaskar took over in April 2016, the corpus of the fund was hovering around Rs 150 crore. By March 2017, the corpus touched Rs 850 crore. Over the next one year, the AUM ballooned to Rs 2,500 crore as on February 28, 2018. Clearly, distributors and investors have started to show confidence in the scheme.

In this brief analysis, we take a close look at the features and performance of IDFC Classic Equity Fund.

Investment Objective of IDFC Classic Equity Fund

IDFC Classic Equity Fund has an investment objective to “generate long-term capital growth from a diversified portfolio of predominantly equity and equity related instruments”

IDFC Classic Equity Fund Details

Fund Facts

| Category |

Diversified |

Style |

Blend |

| Type |

Open ended |

Market Cap Bias |

Large and Mid-cap |

| Launch Date |

9-Aug-05 |

SI Return (CAGR) |

12.41% |

| Corpus (Cr) |

Rs 2,530 |

Min./Add. Inv. |

Rs 5,000 / Rs 1,000 |

| Expense Ratio (Dir/Reg) |

0.50% / 2.07% |

Exit Load |

1% |

Data as on February 28, 2018.

SI Return as on March 28, 2018.

(Source: ACE MF)

Under normal circumstances, IDFC Classic Equity Fund will allocate…

-

65% - 100% to equity and equity related securities

-

0%-35% to debt and money market instruments

-

0%-35% to securitised debt instruments

Growth Of Rs 10,000, If Invested In IDFC Classic Equity Fund 5 Years Ago

Data as on March 21, 2018

Data as on March 21, 2018

(Source: ACE MF)

Had you invested Rs 10,000 in IDFC Classic Equity Fund, five years back on March 28, 2013, it would have grown to Rs 20,782. This translates in to a compounded annualised growth rate of 15.74%. In comparison, a simultaneous investment of Rs 10,000 in its benchmark – S&P BSE 200 would now be worth Rs 19,374 (a CAGR of 14.13%). The large-and mid-cap fund has outperformed its benchmark over the period of last five years by a good margin.

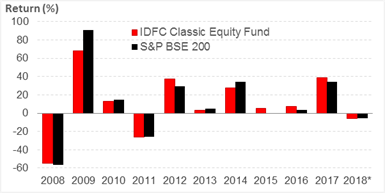

IDFC Classic Equity Fund: Year-on-Year Performance

YTD as on March 28, 2018

(Source: ACE MF)

IDFC Classic Equity Fund has a track record of just over 12 years. The year-on-year performance of the fund vis-à-vis its benchmark – S&P BSE 200 shows that the fund performance not been too impressive. Over the past 10 yearly periods, the fund has trailed the benchmark in as many as 5 yearly periods and recent YTD performance. The scheme is not a bull market fund, showing signs of struggle when the market has move up in the past. Over the recent three years though, the performance of IDFC Classic Equity Fund has been resilient. It needs to be seen if the fund is able to keep up its performance.

IDFC Classic Equity Fund: Performance Vis-à-vis Category Peers

Rolling Period Returns

| Scheme Name |

Corpus (Rs Cr) |

1 Year |

2 Year |

3 Year |

5 Year |

Std Dev |

Sharpe |

| L&T India Value Fund |

7406 |

30.33 |

21.90 |

22.01 |

26.47 |

15.43 |

0.16 |

| Aditya Birla SL Pure Value |

3263 |

34.74 |

25.43 |

21.11 |

28.88 |

18.18 |

0.17 |

| Tata Equity P/E Fund |

2799 |

33.35 |

24.68 |

19.83 |

23.09 |

15.09 |

0.14 |

| Aditya Birla SL Advantage |

5819 |

26.53 |

20.16 |

18.91 |

23.15 |

15.41 |

0.09 |

| Tata Mid Cap Growth Fund |

675 |

27.59 |

16.14 |

18.73 |

24.79 |

16.74 |

0.06 |

| SBI Magnum Multicap Fund |

4532 |

23.82 |

18.25 |

18.24 |

21.29 |

13.43 |

0.11 |

| DSPBR Equity Opportunities |

4936 |

26.39 |

20.62 |

17.98 |

20.94 |

14.77 |

0.12 |

| Aditya Birla SL Equity Fund |

8602 |

25.71 |

20.75 |

17.41 |

22.43 |

13.99 |

0.11 |

| Principal Growth Fund |

620 |

33.05 |

21.98 |

16.85 |

21.72 |

16.60 |

0.13 |

| Kotak Opportunities Fund |

2386 |

25.62 |

18.32 |

16.72 |

19.63 |

13.62 |

0.08 |

| Mirae Asset India Equity |

6785 |

27.06 |

19.02 |

16.54 |

21.30 |

13.86 |

0.10 |

| SBI Magnum Multiplier Fund |

2218 |

22.74 |

15.39 |

15.83 |

20.32 |

14.29 |

0.07 |

| Sundaram Equity Multiplier |

347 |

26.86 |

17.38 |

15.78 |

17.62 |

12.07 |

0.11 |

| HDFC Capital Builder Fund |

2654 |

27.16 |

18.34 |

15.44 |

20.16 |

14.30 |

0.11 |

| L&T India Spl. Situations |

1286 |

29.20 |

17.42 |

15.27 |

19.45 |

13.73 |

0.08 |

| IDFC Classic Equity Fund |

2530 |

27.13 |

19.09 |

15.24 |

16.48 |

13.92 |

0.08 |

| Templeton India Growth |

612 |

27.84 |

19.00 |

15.23 |

17.80 |

14.51 |

0.10 |

| Reliance RSF-Equity Option |

3295 |

27.13 |

15.82 |

15.20 |

18.38 |

16.62 |

0.07 |

| ICICI Pru Multicap Fund |

2873 |

19.48 |

15.64 |

14.46 |

19.06 |

12.50 |

0.08 |

| Franklin India Opportunities |

659 |

20.75 |

14.08 |

14.29 |

18.70 |

13.99 |

0.03 |

| Essel Equity Fund |

239 |

22.88 |

16.13 |

13.67 |

15.47 |

13.36 |

0.06 |

| DSPBR Equity Fund |

2330 |

24.94 |

16.71 |

13.64 |

17.35 |

15.87 |

0.05 |

| HSBC Multi Cap Equity Fund |

614 |

23.13 |

16.92 |

13.60 |

18.99 |

14.93 |

0.05 |

| Tata Equity Opportunities |

1288 |

19.00 |

13.58 |

13.57 |

18.08 |

13.84 |

0.03 |

| S&P BSE 200 |

|

21.84 |

14.21 |

10.61 |

14.38 |

13.23 |

0.02 |

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on March 28, 2018

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

IDFC Classic Equity Fund ranks much lower down the order based on its three-year rolling period performance. The uptick in performance is skewed to the recent years. In the 1-year and 2-year rolling periods the fund has outscored the benchmark by nearly 5-6 percentage points. Making its performance better than average. Due to its bland performance in the earlier periods, the alpha is not encouraging on the 5-year rolling returns.

The risk of IDFC Sterling Equity Fund is marginally higher than benchmark. But compared to some of the top peers, the volatility is much lower. Given the overall mediocre performance, the risk-adjusted return does not seem very encouraging.

The top five multi-cap funds based on the 3-year rolling period performance include—L&T India Value Fund, Aditya Birla SL Pure Value, Tata Equity P/E Fund, Aditya Birla SL Advantage and SBI Magnum Multicap Fund.

Investment Strategy of IDFC Classic Equity Fund

IDFC Classic Equity Fund will endeavour to invest in well-managed sustainable businesses whose shares are available at reasonable value through a process of disciplined research. The portfolio will aim to provide part ownership to investors in some of the best run companies in India. The portfolio of securities will be well-diversified across sectors, so identified, to mitigate overall risk. As IDFC Classic Equity Fund is expected to be part of the core long-term equity holdings of the investors, a well-balanced and prudent style of fund management will be adopted to endeavour to deliver good returns at controlled levels of risk. The guiding principles while managing the portfolio are summarised below:

1. Stock prices are directly correlated to company profits over the medium to long term

Fund management would focus primarily on business fundamentals of the underlying company. The Equity Research process will endeavour to acquire a robust understanding of the dynamics of the underlying business. This would form the basis for forecasts on future profitability and sustainability of cash profit growth. Stock prices of companies that can sustain periods of high cash profit growth will outperform the markets over the long term. Investors entering this scheme are therefore expected to have at least a 2-3 years’ time horizon.

2. Margin of Safety

The fund managers will look to build a “margin of safety” while making forecasts on business profitability. “Margin of safety” will also be the guiding principle while evaluating a company’s current market price. The portfolio would also be protected from company specific risks by constantly monitoring the economic and business environment and changes in management strategy.

3. Acquire stocks at reasonable value

Once good businesses are identified, stocks would be endeavored to be acquired when they are available at a reasonable value. Overall market corrections and stock price falls due to temporary factors that don’t affect long-term profitability are an excellent opportunity to buy stocks cheap.

4. Stay fully invested over most periods

IDFC Classic Equity Fund will not try to profit by predicting overall market direction based on technical indicators or momentum. It will generally stay fully invested in equities to give investors the full advantage of a rise in the markets that is inevitable given the current trajectory India’s GDP growth. IDFC Classic Equity Fund may however hold cash during periods where in the view of the fund manager the market valuations have run ahead of its fundamentals or when the fund manager is unable to identify stocks at a reasonable value. It may also hold cash to meet anticipated redemptions or to tide over temporary adverse market developments.

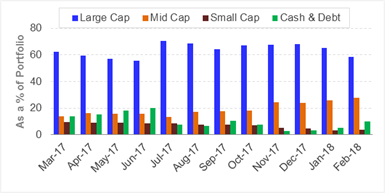

IDFC Classic Equity Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on February 28, 2018

Holdings (in %) as on February 28, 2018

(Source: ACEMF)

There has been substantial movement in the portfolio of IDFC Classic Equity Fund. Over the past 12 months, the large-cap allocation gradually dipped from 60% to 55%, while the cash levels increased from 14% to 20%. In July 2017, the excess cash was put to use. The large cap allocation jumped to 70% and the cash levels dropped to 7.5%. Over the next 8 months, the large-cap and small-cap exposure has been reduced, while the mid-cap levels have gradually increased. As on February 28, 2018, the large-cap exposure stood at 59%, mid-caps at 28% and small-caps at 4%. The exposure to cash & debt has risen marginally to 10%.

IDFC Classic Equity Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| HDFC Bank |

4.77 |

| Infosys |

2.92 |

| Larsen & Toubro |

2.85 |

| ICICI Bank |

2.44 |

| ITC |

2.29 |

| Reliance Industries |

2.27 |

| Kotak Mahindra Bank |

2.18 |

| HDFC |

1.87 |

| Future Retail |

1.85 |

| State Bank Of India |

1.63 |

|

Top 5 Sectors

|

Holdings (in %) as on February 28, 2018

(Source: ACEMF) |

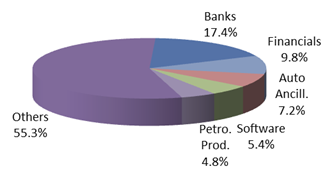

IDFC Classic Equity Fund has a portfolio of 88 stocks. The top 10 holdings of the scheme account for 25% of the total portfolio. As can be inferred from this data, the portfolio of the large-and mid-cap fund is extremely diversified. None of the stocks among the top holdings account for more than 5% of the assets. The top holdings of the scheme includes index heavy weights such as HDFC Bank, Infosys, Larsen & Toubro, ICICI Bank and ITC.

Banks and financials lead the list of sectors with an allocation of 17% and 10% each. Auto Ancillaries account for 7.2% of the portfolio, while software stocks and petroleum stocks account for about 5% of the portfolio each.

Top Gainers in IDFC Classic Equity Fund's portfolio

Among the top stocks in IDFC Classic Equity Fund’s portfolio were Reliance Industries, Future Retail Ltd., Apollo Tyres Ltd., Mahindra & Mahindra Financial Services Ltd. These stocks rallied 54%, 107%, 46%, and 48% respectively. Of these, the first two stocks were present among the top holdings in February 2018.

Minda Industries Ltd., Mastek Ltd. and DCM Shriram Ltd. were some of the other top stocks in the portfolio, with an exposure under 1%. These stocks returned 158%, 176%, and 105% respectively.

Among the laggards in the portfolio were ITC Ltd., State Bank Of India, RBL Bank Ltd and Axis Bank Ltd. These stocks added little value to the portfolio.

Suitability of IDFC Classic Equity Fund

Though the market has corrected, the margin of safety is not conducive, unless you hold a very high-risk appetite. Hence, it is better to be very selective in you approach while building your investment portfolio. The same strategy should be adopted when selecting equity-diversified schemes.

Large- and mid-cap schemes give the best of both worlds—stability and wealth generation. However, if the scheme does not manage its assets well, it can turn in to a wealth destroyer.

While on the returns front, IDFC Classic Equity Fund has generated decent returns, in terms of risk-adjusted returns, it is not very encouraging. Hence, you need to decide whether to invest in this scheme after due consideration of other schemes in the category.

Prefer mutual fund schemes that follow robust investment processes and systems, as against those indulging in momentum playing or even those that are extra-cautious. Both the latter investment strategies can lead to inefficient returns.

If you opt for large-and mid-cap funds, do ensure that the investments is in line with your financial goals. If you are not sure about how to align these schemes with your tax planning or financial goals, do consult your financial planner or investment advisor.

Note: This write up is for information purpose and not a recommendation to buy or sell the mutual fund scheme. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor.

|

Editor's note:

Are you confused with the present market conditions?

Will the market go up or down from here?

Should you invest at all? If yes, how?

Which mutual fund schemes to invest?

If such questions are lingering in your mind, subscribe to PersonalFN’s latest exclusive report: Top 5 Equity Funds To Invest In 2018.

This exclusive report has been created keeping the Investment Scenario IN 2018 in mind.

If you have a question, “Which equity funds to invest in now ––under the current market conditions?”This report is the answer to your question. Subscribe now!

|

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

and condition on which its offer research report. For the terms and condition for research report click here.

Details of associates

- Money Simplified Services Private Limited;

- PersonalFN Insurance Services India Private Limited;

- Equitymaster Agora Research Private Limited;

- Common Sense Living Private Limited;

- Quantum Advisors Private Limited;

- Quantum Asset Management Company Private Limited;

- HelpYourNGO Private Limited;

- HelpYourNGO Foundation;

- Natural Streets for Performing Arts Foundation;

- Primary Real Estate Advisors Private Limited;

- Rahul Goel;

- I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

- Neither QIS, it’s Associates, Research Analyst or his/her relative have any financial interest in the subject Company , except QIS receives fees for providing research to Quantum Equity Fund of Fund (QEFoF) which is Fund of Fund scheme managed by QMF.

- Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report.

- Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront /annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices

Disclosure with regard to receipt of Compensation

- Neither QIS nor it's Associates have any compensation from the subject Company in the past twelve months.

- Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company in the past twelve months.

- Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company in the past twelve months.

- Neither QIS nor it’s Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months except from Axis Bank Limited under a service agreement.

- Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

- The Research Analyst has not served as an officer, director or employee of the subject Company.

- QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments