Fresh out from your carefree days of college, you start earning brimming with hope and have a zest for life. All you think of is having it all and living life king size…... with the income.

Hence you start saving and investing to fund yourself to buy that dream car, to go for that holiday, for own wedding, own a house, children’s future, and of course, a peaceful retirement.

And if you are a millennial, it is likely that you are extremely cautious about not losing your hard-earned money-probably because you have witnessed your parents lose money through risky investments and/or experienced the impact of the stock market crash.

So, you become risk-averse and invest in ‘safe investment instruments – especially bank FDs or insurance plans’.

[Read: Why Endowment Plans are Useless: A Case Study ]

Will this conservative approach help in the long run?

Will you be able to save enough to get inflation-adjusted returns?

Can you lead a financially independent life during your retirement?

Worry not, there is time now to change your negative answers into positives.

All you have do is be open-minded and understand there is a difference between ad-hoc investing and strategically planned investing. So, you do not have to follow your parents’ footsteps or harbour any behavioural biases.

As investing is an individualistic exercise and ‘one man’s food is another man’s poison’, a well-planned investment strategy is based on your risk profile, financial goals, and investment horizon.

A risk profile is a combination of your risk appetite and risk tolerance. Risk Appetite means the willingness to take risk (depends upon one's age, experience, and knowledge). Whereas, risk tolerance implies to the actual ability of taking risk which is measured by your income, expenses, financial goal and its time horizon, any loans or financial responsibility, insurance cover, and contingency fund.

Assess your risk profile and be offensive, moneywise, if you want to retire rich!

[Read: Thinking Of A Blissful Retirement? Here’s Why You Can’t Ignore Investing in Mutual Funds]

Let me share my personal experience, until I started working in the finance sector, even I was playing ‘defence with finances’ in my earlier days. My parents had conditioned me to safeguard my hard-earned money by putting in a bank FD and earn interest on it.

Over the years, when I saw that the actual worth of return was far less as compared to investing in equity stocks for a longer time period, I changed my investment mind-set. I assessed my risk profile and built a strategically planned portfolio as per personalised asset allocation to invest in riskier assets too. Because my risk profile result indicated that I can bear high risks over the long term with direct equity investments.

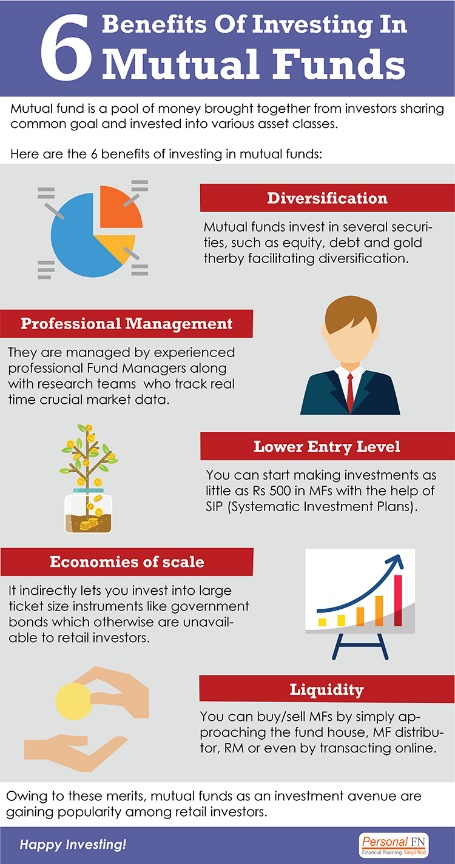

But for a risk-averse investor like you, the wise thing to do is investing in mutual funds after understanding your risk profile, investment goals, and time horizon of the goal.

When you have your long-term financial goals set, then you should think of a well-diversified portfolio of equity mutual funds.

If you are going to worry about losing all your money due to short-term volatility/turbulence – that’s the very nature of the equity market. But being a young investor, you can bear several cycles of downturn to earn-risk-adjusted returns for your long-term retirement, as you have many number years before it.

Remember, investing early on in life helps build a bigger corpus because the power of compounding works for you. And, the way you invest today, you will gain accordingly in the future. So, if you choose to invest in a bank FD, the fixed rate of interest will not be helpful in providing you with inflated-adjusted returns like an equity mutual fund.

[Read: Can Fixed Deposits Help You Retire Comfortably?]

Still wondering how will you get inflation-adjusted returns with equity?

First, let’s understand what inflation is. Inflation is when the value of the rupee falls, so it requires more rupees to buy the exact, same product. When the value of your money goes down, you’ll need more in the future to equal what it’s worth today.

Let’s do the math, if you are 25 years old, you plan to retire by say age 60.

Number of years before retirement= 60-25= 35 years.

The returns you get after 35 years if you invest Rs 5 lakhs individually in various instruments:

| Investment Instrument |

Rate of interest |

Amount invested at age 25 (in Rs) |

Amount received at age 60 (in Rs) |

| Bank FD |

6.85% |

500000 |

5082512 |

| Equity Mutual fund |

12% |

500000 |

26399810 |

| Debt mutual fund |

7.42% |

500000 |

6122802 |

From the table, it is clearly seen that if you invest in equity or equity-oriented schemes you get Rs 2,63,99,810 on retirement.

But to invest in a lump sum at once is not possible, hence choose direct plans and invest through a Systematic Investment Plan (SIP). So, even if you invest Rs 4,064 systematically in direct plans, for 35 years, you will build a corpus of approximately Rs 2,63,99,810 by retirement. To estimate the amount you need for a blissful retirement, use PersonalFN’s retirement calculator, an online tool that helps you calculate your retirement corpus.

But most importantly, you need to know your risk and allocate a portion to various asset classes for diversification so that your risk is also balanced.

|

Equity |

Debt |

Gold |

| Return |

High

[Capital Appreciation & Dividend Income]

|

Low

[Interest Income]

|

Medium

[Capital Appreciation]

|

| Risk |

High |

Moderate to Low |

Moderate |

| Liquidity |

High |

Medium |

Medium |

| Suitability |

For long term Investors having high risk appetite |

For short term Investors having low risk appetite |

For long term Investors having moderate risk appetite |

While investing remember these key points:

-

Your investment goals

-

Determine the time required to accomplish each goal

-

Compute the amount you will require for that goal

-

Assess your risk profile whether aggressive, moderate, and conservative

-

Choose the right investment strategy with proper asset allocation of funds and start investing

Ideally, as a thumb rule, the proportion of debt investment should be equal to your age. So, if you are a 25-year-old, 25% of the investible surplus can be parked in debt and the remaining 75% in equity as an asset class. "This rule of thumb helps investors keep in mind that their portfolios need to change as they age, becoming more focused on avoiding risk in their investing than on higher growth," says John C. Bogle, Founder, Vanguard Group.

Endnote:

As per your risk appetite, you need to make productive investment strategically in mutual funds that will help counter inflation well. Investing in fixed deposits, buying endowment plans cannot help you accomplish your financial goals effectively.

Invest in funds with a ‘core and satellite’ Strategy.

This strategy aims to get the best of both worlds, that is, short-term high-rewarding opportunities and long-term steady-return investing, and the good thing is, it works!

‘Core and Satellite’ strategy will help you tackle the present market downturns. However, investing in mutual fund schemes that have a proven track record and from the process-driven fund houses is imperative.

Based on the ‘core and satellite’ approach to investing, here’s PersonalFN’s premium report: The Strategic Funds Portfolio For 2025 (2018 Edition).

In this report, PersonalFN will provide you with a readymade portfolio of its top equity mutual funds schemes for 2025 that have the ability to generate lucrative returns over the long term.

PersonalFN’s “The Strategic Funds Portfolio for 2025” is geared to potentially multiply your wealth in the years to come. Subscribe now!

Add Comments