Every sector behaves differently and undergoes series of outperformance and underperformance during varying economic phases and cycles. By focusing on certain sectors that are expected do well in the medium term, a fund can empower investor's desire of achieving their goals.

One such fund that aims to create long-term capital growth with focus on few selected sectors is Kotak Standard Multi-cap Fund.

Kotak Standard Multi-cap Fund (erstwhile Kotak Select Focus Fund) has a track record of almost a decade. Originally a focused fund, it has now been recategorised as a multi-cap fund, though it continues to maintain a focused approach to select the most promising sectors and maintains a large cap bias.

With a corpus of around Rs 25,000 crore, Kotak Standard Multi-cap Fund is the largest scheme in its category. The scheme is managed by Mr Harsha Upadhyaya since August 2012, who has over 23 years of experience spread over fund management and equity research.

Investment objective: Kotak Standard Multi-cap Fund aims to generate long-term capital appreciation from a portfolio of equity and equity related securities, generally focused on a few selected sectors.

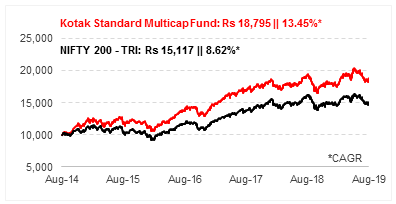

Graph 1: Growth of Rs 10,000, If Invested In Kotak Standard Multi-cap Fund 5 Years Ago

Had you invested Rs 10,000 in Kotak Standard Multicap Fund five years back on August 27, 2014, it would have grown to Rs 18,795 as on August 27, 2019. This translates into compounded annualised growth rate of 13.45%. In comparison a simultaneous investment of Rs 10,000 in its benchmark Nifty 200 - TRI would now be worth Rs 15,117 (a CAGR of 8.62%). As can be seen in the chart above, the fund generated significant lead over the benchmark in the last five years.

Data as on August 28, 2019

Data as on August 28, 2019

(Source: ACE MF)

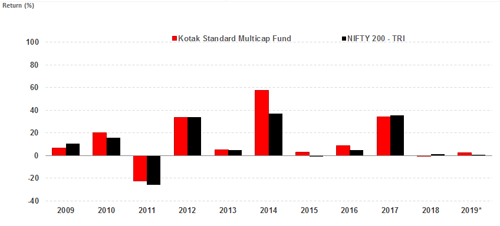

Graph 2: Kotak Standard Multi-cap Fund Year-on-Year Performance

*YTD as on August 28, 2019

*YTD as on August 28, 2019

(Source: ACE MF)

The year-on-year performance comparison of Kotak Standard Multicap Fund vis-a-vis its benchmark Nifty 200 - TRI shows that the fund outperformed the index in 5 out of last 10 calendar years. It outpaced the benchmark in CY 2010, 2014, 2015 and 2016, and managed to limit the downside risk in CY 2011. Its performance was in line with the index in CY 2012, 2013 and 2017. The fund slightly lagged the benchmark in CY 2009 and in the previous CY 2018. In the current year, the fund has maintained a decent lead over the index.

Table 1: Kotak Standard Multi-cap Fund Performance vis-a-vis category peers

| Scheme Name |

Corpus (Cr.) |

1-year (%) |

2-year (%) |

3-year (%) |

5-year (%) |

Std Dev |

Sharpe |

| Kotak Standard Multicap Fund |

24,960 |

4.09 |

11.22 |

15.37 |

19.09 |

12.96 |

0.08 |

| JM Multicap Fund |

129 |

-1.08 |

8.68 |

15.26 |

17.37 |

13.71 |

0.08 |

| Principal Multi Cap Growth Fund |

832 |

-2.92 |

10.14 |

15.13 |

16.88 |

15.45 |

0.04 |

| Aditya Birla SL Equity Fund |

10,694 |

-0.16 |

8.47 |

14.82 |

18.38 |

13.58 |

0.03 |

| HDFC Equity Fund |

22,215 |

4.75 |

10.89 |

14.79 |

15.48 |

15.45 |

0.07 |

| Edelweiss Multi-Cap Fund |

395 |

1.52 |

12.84 |

14.65 |

NA |

14.09 |

0.08 |

| Motilal Oswal Multicap 35 Fund |

12,413 |

-4.34 |

8.38 |

14.17 |

18.75 |

14.91 |

0.04 |

| Canara Rob Equity Diver Fund |

1,292 |

5.11 |

12.68 |

13.65 |

13.79 |

12.88 |

0.08 |

| Parag Parikh Long Term Equity Fund |

2,004 |

4.92 |

12.80 |

13.61 |

16.28 |

8.89 |

0.13 |

| SBI Magnum Multicap Fund |

7,465 |

0.67 |

10.06 |

13.55 |

18.91 |

12.98 |

0.05 |

| ICICI Pru Multicap Fund |

3,940 |

5.02 |

9.76 |

13.55 |

16.88 |

12.99 |

0.01 |

| DSP Equity Fund |

2,498 |

-0.37 |

8.83 |

12.87 |

15.55 |

14.99 |

0.04 |

| Quant Active Fund |

6 |

1.91 |

11.44 |

12.25 |

18.44 |

13.40 |

0.03 |

| UTI Equity Fund |

9,026 |

4.54 |

11.41 |

11.86 |

14.64 |

13.12 |

0.00 |

| BNP Paribas Multi Cap Fund |

688 |

-3.59 |

7.95 |

11.63 |

16.15 |

13.90 |

0.03 |

| Invesco India Multicap Fund |

811 |

-5.94 |

7.50 |

11.59 |

19.25 |

15.77 |

0.00 |

| Reliance Multi Cap Fund |

9,706 |

3.38 |

10.99 |

11.27 |

15.25 |

16.08 |

0.01 |

| L&T Equity Fund |

2,586 |

-1.78 |

7.91 |

11.11 |

14.37 |

12.90 |

0.00 |

| PGIM India Diversified Equity Fund |

111 |

-1.05 |

7.96 |

10.93 |

NA |

13.95 |

0.00 |

| HSBC Multi Cap Equity Fund |

438 |

-4.56 |

6.41 |

10.91 |

14.63 |

16.07 |

-0.04 |

| NIFTY 200 - TRI |

|

3.48 |

11.26 |

13.40 |

13.40 |

12.87 |

0.04 |

Returns are on a rolling basis and in %, calculated using Direct Plan - Growth option. Those depicted over 1-Yr are compounded annualised.

(Data as on August 28, 2019)

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

Kotak Standard Multicap Fund outperformed the average category returns by a significant margin across rolling periods. Its performance in the 1-year rolling period is noteworthy as many funds struggled to generate positive returns during the period. The fund outpaced the benchmark by a significant margin across rolling periods, except 2-year rolling period where its performance was nearly in line with the index.

On a 3-year rolling return basis, the fund stood as the category topper. JM Multicap Fund and Principal Multi Cap Growth Fund were the other top performers in the category.

In terms of risk-return parameters, Kotak Standard Multicap Fund undertook lower risk as compared to peers and benchmark, whereas its risk-adjusted returns were among the best.

Investment Strategy of Kotak Standard Multi-cap Fund

Kotak Standard Multicap Fund is an open-ended multicap fund with sectoral focus which aims to generate long-term capital appreciation from a portfolio of equity and equity related securities.

The scheme endeavours to identify sectors that are likely to do well over the medium term and takes focused exposures to the same. However, there is no restriction on the type of sector the scheme can take exposure to. The portfolio is diversified at the stock level across market capitalisation.

The fund adopts top-down approach to select few sectors which in the opinion of the fund manager have potential to grow, whereas, it follows the bottom-up approach to pick stocks within the selected sectors.

To select particular stocks and to determine the potential value of each stock, the fund may take one or more of the following into consideration.

1. The financial strength of the companies

2. Reputation of the management and track record

3. Companies that are relatively less prone to recessions or cycles

4. Companies which pursue a strategy to build strong brands for their products or services

5. Market liquidity of the stock.

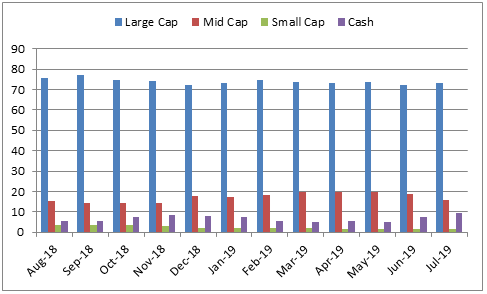

Graph 3: Kotak Standard Multi-cap Fund Portfolio Allocation And Market Capitalisation Trend

Holdings (in %) as on July 31, 2019

Holdings (in %) as on July 31, 2019

(Source: ACE MF)

Kotak Standard Multicap Fund is mandated to invest minimum 65% of its asset in equity and equity related instruments, with diversification across market caps. Though the fund has the flexibility to invest across market capitalisation, it maintains a large-cap bias.

Around 3/4th of its corpus is allocated towards large-cap. The allocation towards mid-caps is in the range of 14-20%, while there is a marginal allocation of 1-3% towards small-caps. Remaining corpus is held in the form of cash and equivalents. The fund has avoided investing in debt instruments.

Graph 4: Kotak Standard Multi-cap Fund Top Portfolio Holdings

Holdings (in %) as on July 31, 2019

(Source: ACE MF)

As on July 31, 2019, Kotak Standard Multicap Fund held 53 stocks in its portfolio. The top 10 stocks constitute 45.9% of the total holdings and are mainly concentrated towards the banking sector. ICICI Bank has the highest allocation of 6.7% in the portfolio, followed by HDFC Bank (6.6%) and Reliance Industries (6.1%). The other stocks in the top 10 holdings have allocation in the range of 2.5 to 5%.

In terms of sector wise holdings, the fund has the maximum exposure to the Banking sector at 27.2%, with another 9.4% in Finance. Infotech and Engineering have the next highest allocation with exposure of around 8% each, closely followed by Petroleum Products (7.1%). The other prominent sectors in the portfolio are Cement, Consumption and Oil & Gas.

Top Contributors

Among the stocks in the portfolio, ICICI Bank contributed the most to the portfolio gains in the last one year, with a weighted return of 1.1%. The other top contributors to the portfolio gains were ICICI Lombard General Insurance, HDFC Bank, Interglobe Aviation and Infosys.

The stocks that eroded portfolio gains the most were RBL Bank, Maruti Suzuki India, Mahindra & Mahindra and Arvind Ltd.

Suitability of Kotak Standard Multi-cap Fund

Kotak Standard Multicap Fund is a diversified equity fund with sectoral focus. It carefully identifies growth oriented sectors across market capitalisation and invests in the most promising ones.

Over 90% of the fund's holding is invested in equities with majority of it allocated towards large-caps. It also looks to tap high growth prospective of mid and small-caps. Having potential to generate capital appreciation with an element of stability, Kotak Standard Multicap Fund is suitable for moderately high risk takers with an investment horizon of 5 years or more.

The fund has performed exceptionally well under its current fund manager. It has rewarded investors reasonably well across time periods by delivering significant alpha over the benchmark and many of its category peers.

Before investing, do weigh all the options and make a prudent choice. The scheme should match your risk profile and should be suitable to meet your investment goals as per the set time period.

Note: This write up is for information purpose and does not constitute any kind of investment advice or a recommendation to Buy / Hold / Sell a fund. Returns mentioned herein are in no way a guarantee or promise of future returns. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Editor's note: The last few years have not been among the best for equity mutual funds. While most funds have underperformed or are struggling to match the returns of the benchmark, there are few funds that have the potential to constantly generate alpha for its investors. And we have recently identified five such high alpha generating funds, in our latest report 'The Alpha Funds Report 2019'. Do not miss our latest research finding. Get your access to this exclusive report, right here!

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr Ajit Dayal with an objective of providing value-based information/views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc. and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of the second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, its subsidiaries and its Directors.

Terms and condition on which its offer research report

For the terms and condition for research report click here.

Details of associates

-

Money Simplified Services Private Limited;

-

PersonalFN Insurance Services India Private Limited;

-

Equitymaster Agora Research Private Limited;

-

Common Sense Living Private Limited;

-

Quantum Advisors Private Limited;

-

Quantum Asset Management Company Private Limited;

-

HelpYourNGO.com India Private Limited;

-

HelpYourNGO Foundation;

-

Natural Streets for Performing Arts Foundation;

-

Primary Real Estate Advisors Private Limited;

-

Rahul Goel;

-

I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

-

Neither QIS, it's Associates, Research Analyst or his/her relative have any financial interest in the subject Company;

-

Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report;

-

Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However, any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront / annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices.

Disclosure with regard to receipt of Compensation

-

Neither QIS nor it's Associates have received any compensation from the subject Company in the past twelve months;

-

Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company;

-

Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company;

-

Neither QIS nor it's Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

-

Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

-

The Research Analyst has not served as an officer, director or employee of the subject Company.

-

QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021.

Email:info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222 SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments

| Comments |

drjinwala@yahoo.com

Aug 29, 2019

As per record on 28 Aug 2019 Kotak multicap direct growth shows return of + 4.09 % CAGR but according to moneycontrol data it shows -3.80 % . NAV on 28 Aug 2018 was 37.75 & NAV on 28 Aug 2019 is 36.31 Rs. It can not be positive return. Just check it

https://www.moneycontrol.com/mutual-funds/nav/kotak-standard-multicap-fund-direct-plan-growth/MKM520 |

1