With the boom in mid and small cap segment, L&T Emerging Businesses Fund has caught the fancy of mutual fund investors. This can be clearly noticed from the multifold rise in its Assets Under Management (AUM).

In the past 1 year, the fund’s corpus has grown almost 10x from just about Rs 380 crore in December 2016 to around Rs 3,587 crore as in December 2017.

L&T Emerging Businesses Fund is a small and mid-cap focused scheme from the stable of L&T Mutual Fund. The fund believes that today’s emerging businesses can become tomorrow’s giants and thus aims to invests in emerging businesses, typically in early stages of development, which have the potential to become future giants and deliver higher alpha.

Launched in May 2014, L&T Emerging Businesses Fund has delivered returns of around 34% CAGR, as against 29% CAGR by its benchmark S&P BSE Small-cap index (as calculated on January 23, 2018). In a short span of time, the fund is giving a tough time to its popular peers. However, it is noteworthy that in its history of three and half years, the fund remained calm and was struggling to match its benchmark index for almost 2 years. L&T Emerging Businesses Fund has moved to limelight with its extra ordinary performance over the past one year. Whether the fund can sustain this performance when the tide turns, is yet to be seen.

In this brief analysis, PersonalFN takes a close look at the features and performance of L&T Emerging Businesses Fund.

Investment Objective of L&T Emerging Businesses Fund

The investment objective of L&T Emerging Businesses Fund is to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks). L&T Emerging Businesses Fund may also additionally invest in Foreign Securities.

Emerging companies are businesses that are typically in the early stage of development and have the potential to grow their revenues and profits at a higher rate as compared to broader market. There is no assurance that the objective of the scheme will be realised and the scheme does not assure or guarantee any returns.

L&T Emerging Businesses Fund Details

Fund Facts

| Category |

Diversified |

Style |

Growth |

| Type |

Open ended |

Market Cap Bias |

Small & Mid cap |

| Launch Date |

12-May-14 |

SI Return (CAGR) |

33.75% |

| Corpus (Cr) |

Rs 3,587 |

Min./Add. Inv. |

Rs 5,000 / Rs 1,000 |

| Expense Ratio (Dir/Reg) |

1.61% / 2.12% |

Exit Load |

1% if less than 1 Yr |

Data as on December 31, 2017

(Source: ACE MF)

Under normal circumstances, the L&T Emerging Businesses Fund will allocate…

- 50% - 100% of its assets in equity and equity-related securities of small cap companies.

- 0% - 35% in equity and equity-related securities (including Indian and foreign equity securities as permitted by SEBI/RBI).

- 0% - 35% in debt and money market instruments.

Growth Of Rs 10,000, If Invested In L&T Emerging Businesses Fund At Its Inception

Data as on January 23, 2018 (Source: ACE MF) Data as on January 23, 2018 (Source: ACE MF)

|

Had you invested Rs 10,000 in L&T Emerging Businesses Fund in its NFO in May 2014, it would have grown to Rs 29,002. This translates in to a compounded annualised growth rate of 33.76%. In comparison, a similar investment in the benchmark S&P BSE Small-Cap would have resulted in a compounded return of 29.09%. Thus, the investment of Rs 10,000 in the benchmark would now be worth Rs 25,492. |

The fund has hugged the benchmark for most of the period. Bulk of the outperformance came in the current rally that began February 2016.

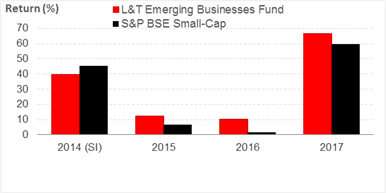

L&T Emerging Businesses Fund: Year-on-Year Performance

| Had you invested Rs 10,000 in L&T Emerging Businesses Fund in its NFO in May 2014, it would have grown to Rs 29,002. This translates in to a compounded annualised growth rate of 33.76%. In comparison, a similar investment in the benchmark S&P BSE Small-Cap would have resulted in a compounded return of 29.09%. Thus, the investment of Rs 10,000 in the benchmark would now be worth Rs 25,492. |

Data as on January 23, 2018 (Source: ACE MF) Data as on January 23, 2018 (Source: ACE MF)

|

In its three and half year history that began in May 2014, the fund underperformed its benchmark S&P BSE Small cap index in CY 2014, where it existed for only 7 months. However, the fund managed to stabilise its performance during market corrections seen in CY 2015 and 2016, which helped it catch the benchmark. CY 2017 was a terrific year for the fund where it generated an amazing 66.5% absolute return for its investors, as against 59.6% in the benchmark.

L&T Emerging Businesses Fund: Performance Vis-à-vis Category Peers

Rolling Period Returns

| Scheme Name |

Corpus

(Rs Cr) |

1

Year |

2

Year |

3

Year |

5

Year |

Std Dev |

Sharpe |

| SBI Small & Midcap Fund |

943.5 |

39.27 |

23.60 |

33.45 |

33.08 |

16.79 |

0.36 |

| DSP BlackRock Micro-Cap Fund |

6,890.4 |

31.55 |

22.59 |

31.95 |

31.05 |

16.38 |

0.29 |

| Mirae Asset Emerging Bluechip |

5,364.1 |

37.59 |

24.00 |

29.39 |

30.93 |

14.49 |

0.31 |

| Reliance Small Cap Fund |

6,371.5 |

41.74 |

24.29 |

29.32 |

31.97 |

18.44 |

0.27 |

| L&T Midcap Fund |

2,036.2 |

40.64 |

22.57 |

27.82 |

27.98 |

14.91 |

0.29 |

| Canara Rob Emerging Equities Fund |

3,142.7 |

35.82 |

19.72 |

27.66 |

28.91 |

17.03 |

0.22 |

| Aditya Birla SL Small & Midcap Fund |

1,865.8 |

38.15 |

24.81 |

27.55 |

26.24 |

16.46 |

0.29 |

| L&T Emerging Businesses Fund |

3,586.7 |

48.64 |

28.22 |

26.91 |

-- |

16.68 |

0.33 |

| Kotak Emerging Equity Scheme |

3,021.4 |

30.58 |

19.40 |

26.83 |

25.66 |

14.40 |

0.23 |

| Sundaram S.M.I.L.E Fund |

1,480.6 |

34.29 |

17.21 |

26.29 |

26.02 |

19.88 |

0.17 |

| Franklin India Smaller Cos Fund |

7,497.4 |

28.93 |

19.65 |

25.87 |

30.75 |

13.80 |

0.25 |

| Principal Emerging Bluechip Fund |

1,625.4 |

35.48 |

20.49 |

25.68 |

27.89 |

15.86 |

0.24 |

| Sundaram Select Midcap |

6,593.1 |

30.55 |

19.08 |

25.35 |

25.85 |

15.39 |

0.23 |

| DSP BlackRock Small & Mid Cap Fund |

5,475.7 |

31.62 |

20.02 |

24.39 |

24.34 |

16.31 |

0.20 |

| Kotak Midcap Scheme |

862.7 |

29.30 |

18.76 |

24.21 |

23.31 |

14.80 |

0.21 |

| HSBC Midcap Equity Fund |

657.7 |

33.12 |

18.21 |

23.65 |

23.83 |

18.91 |

0.21 |

| Aditya Birla SL Midcap Fund |

2,568.1 |

30.16 |

17.63 |

23.65 |

23.13 |

15.11 |

0.21 |

| HDFC Mid-Cap Opportunities Fund |

20,958.5 |

30.95 |

19.12 |

23.54 |

25.84 |

13.84 |

0.23 |

| Edelweiss Mid and Small Cap Fund |

598.3 |

29.22 |

15.17 |

23.52 |

26.43 |

15.28 |

0.23 |

| Franklin India Prima Fund |

6,806.3 |

26.73 |

17.00 |

23.27 |

26.44 |

13.35 |

0.20 |

| S&P BSE Small-Cap |

|

36.69 |

19.30 |

20.07 |

18.57 |

17.60 |

0.21 |

| S&P BSE Mid-Cap |

|

29.94 |

19.18 |

20.87 |

19.07 |

15.15 |

0.23 |

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on January 23, 2018

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

L&T Emerging Businesses Fund has delivered superior returns over the 1-year and 2-year rolling periods, where it outscored its benchmark and most of its category peers by a distinct margin. Over the 3 year periods too, the fund has done well to beat its benchmark, but is still short of some of the top performing funds in the mid cap segment. L&T Emerging Businesses Fund’s heavyweight exposure to small caps has helped it ride the current mid cap rally and make it to the list of top performers in the mid and small cap funds category.

Investment Strategy of L&T Emerging Businesses Fund

The L&T Emerging Businesses Fund aims to offer investors upside potential over the long term by investing in companies that are in their early years of development. The fund defines emerging businesses as small sized companies with the potential to grow at a much faster rate than established businesses. The smallcap fund believes, that small companies represent the entrepreneurial economy and can be part of an evolving industry, or in a large industry, they can be small players catering to a niche segment, or looking to acquire a share of the unorganized sector. The management teams of such companies are generally more hands-on and play an instrumental role in the success of the business.

While creating its investment portfolio, the fund follows bottom-up stock picking approach. The fund houses proprietary GEM investment approach (i.e. Generate Idea, Evaluate Business and Manage Business) helps it determine the investment portfolio.

L&T Emerging Businesses Fund aims to hold a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks).

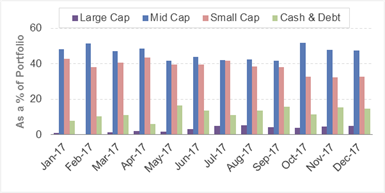

L&T Emerging Businesses Fund - Portfolio Allocation and Market Capitalisation Trends

Data as on January 23, 2018 (Source: ACE MF) Data as on January 23, 2018 (Source: ACE MF)

|

L&T Emerging Businesses Fund is mandated to hold at least 50% of its assets in small cap companies. The fund usually remains heavy weight on small and mid caps, where it allocates about 80% to 90% of its portfolio.

Over the past 12 months, the fund’s exposure to mid and small caps has been in the range of 75%-95%, while large-caps have stayed below 5%. Of late, the fund’s exposure to cash and has increased to 15% of its assets, which is more on account of fresh inflows in the fund. |

L&T Emerging Businesses Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| The Ramco Cements Ltd. |

2.41 |

| Carborundum Universal Ltd. |

2.19 |

| HEG Ltd. |

2.17 |

| Aarti Industries Ltd. |

2.16 |

| Rane Holdings Ltd. |

2.11 |

| Ipca Laboratories Ltd. |

2.01 |

| Coromandel International Ltd. |

2.00 |

| AIA Engineering Ltd. |

1.96 |

| Lakshmi Machine Works Ltd. |

1.96 |

| Syndicate Bank |

1.75 |

|

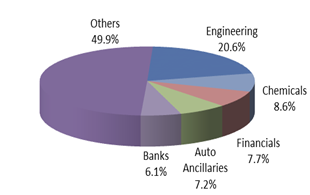

Top 5 Sectors

|

Holdings (in %) as on December 31, 2017

(Source: ACEMF) |

L&T Emerging Businesses Fund’s portfolio is heavy weight on stocks in the Engineering and Construction sector. Banking and financials too form a significant portion of its portfolio. The fund focuses on growth and high beta sectors to generate alpha returns. However, while aiming for returns it does not ignore risk and uses diversification to mitigate its risk. L&T Emerging Businesses Fund usually holds about 70 to 80 stocks in its portfolio. Currently stocks like Ramco Cements, Carborundum Universal, HEG Ltd., Aarti Industries and Rane Holdings are among the top 5 holdings in its portfolio.

Top Gainers in L&T Emerging Businesses Fund’s portfolio

L&T Emerging Businesses Fund’s performance is backed by robust investment processes with a focus on in-depth research and risk management coupled with experienced fund managers who provide a significant edge in identifying long-term winners in the small cap space.

In the last 12 months, some stocks in the fund’s portfolio like Avanti Feeds and Future Retail gained over 400% and 300% respectively. Other stocks like Future Lifestyle Fashions, IIFL Holdings, Aegis Logistics, Maharashtra Seamless, Orient Paper & Industries, Savita Oil Technologies and Sterlite Technologies, present in the fund’s portfolio have more than doubled.

Coromandel International, Supreme Petrochem, Rico Auto Industries, DCB Bank, Indian Bank, Aarti Industries and Skipper Ltd. too helped the fund deliver significant alpha for its fund.

L&T Emerging Businesses Fund’s performance is not driven by concentration to any specific sector, but has come through diversification across cyclical sectors and its preeminent stock picking in the small and mid cap segment.

Suitability of L&T Emerging Businesses Fund

Small caps are under-researched and hence under-owned. However, from a long-term perspective, small and mid cap stocks have been known to outperform large cap companies albeit with a relatively higher volatility. L&T Emerging Businesses Fund aims to offer investors upside potential over the long term by investing in companies that are in their early years of development. Its portfolio focusing on small cap stocks could be ideal only for investors having very high risk appetite and looking for a fund with potential to deliver higher returns, although at a higher risk. However, one cannot ignore the fact that the rally over the last 2 years has been driven by mid and small cap segment that are now in an extreme overvaluation zone. Thus, investors need to be careful while opting for mid and small cap biased funds.

As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor.

Note: PersonalFN adopts a stringent process to shortlist potentially the best mutual funds that have stood the test of time and have the potential to grow investor’s wealth in the long run.

If you are confused about which mutual funds to invest in, don’t worry. We are here to help you. Our premium research service ‘FundSelect’ offers honest and unbiased recommendations on which equity mutual funds to buy, hold or sell. Only for a limited period, we are offering this exclusive service with loads of benefits that you cannot afford to miss. Click here to know more.

Add Comments