The S&P BSE Sensex crashed over 800 points in a day, post budget, and another 900 points in the first two trading session this week, losing atleast 5% of investor’s wealth. Such a fall is usual for a mid and small cap index, but seeing the larger market index collapsing like a house of cards is actually a nail biting event for any equity investor.

Large cap funds are considered to add the stabilizing factor in one’s equity mutual funds portfolio. But can you rely on them indeed, after such a crash? Well, you can, only if you have studied them well.

Let us have a look at one of the blue-eyed boys in the large cap funds category – The SBI Bluechip Fund. SBI Bluechip is one such large cap fund in the stable of SBI Mutual Fund. It aims to invest in stocks of bluechip companies, suitable for long term capital growth. Bluechip companies are typically large businesses, with substantial market share & leadership in their respective industries. They historically have shown successful growth, high visibility and reach, good credit ratings and greater brand equity amongst the public. Investing in such companies brings relative consistency to a portfolio.

Launched in January 2006, SBI Bluechip Fund holds a track of well over a decade now. The fund remained subdued during its initial years, but over time, it has matured enough to deliver superior returns at a much lower volatility as compared to the benchmark S&P BSE 100. SBI Bluechip’s turnaround performance has come under its fund manager Ms. Sohini Andani, who took over the reins of this fund in September 2010. The fund has not looked back since then. Her adherence to picking stable and high growth companies has helped SBI Bluechip Fund sail through market volatility without compromising on growth.

Its success in terms of creating substantial wealth for its investors, has clearly made it popular among investors over the last few years. The fund has grown substantially in the last 5 years, where its AUM has increased from just around Rs. 750 crores (in December 2013) to Rs. 17,869 crores (as of December 2018).

A point to note is that, despite being a large cap fund, the scheme holds flexibility to invest up to 20% of its assets in mid-cap stocks. This opportunistic allocation strategy allows investors to benefit from a mix of stability and growth. The fund dynamically varies the allocation to mid-caps depending on the market outlook and prevailing valuations.

In this brief analysis, PersonalFN takes a close look at the features and performance of SBI Bluechip Fund.

Investment Objective of SBI Bluechip Fund

The investment objective of SBI Bluechip Fund is to provide investors with opportunities for long-term growth in capital through an active management of investments in a diversified basket of equity stocks of companies whose market capitalization is atleast equal to or more than the least market capitalised stock of BSE 100 Index.

Currently, the fund is predominantly large cap with opportunistic allocations to high conviction midcaps (up to 20%).

SBI Bluechip Fund Details

Fund Facts

| Category |

Diversified |

Style |

Blend |

| Type |

Open ended |

Market Cap Bias |

Large cap |

| Launch Date |

20-Jan-2006 |

SI Return (CAGR) |

11.61% |

| Corpus (Cr) |

Rs 17,869 |

Min./Add. Inv. |

Rs 5,000 / Rs 1,000 |

| Expense Ratio (Dir/Reg) |

1.12% / 1.97% |

Exit Load |

1% if less than 1 Yr |

Data as on December 31, 2017. SI Return as on February 07, 2018.

(Source: ACE MF)

Under normal circumstances, SBI Bluechip Fund will aim to have…

- An exposure of atleast 70% of its investments in the equity stocks, preferably from the large cap universe.

- 0% - 10% in Foreign Securities /ADRs/ GDRs.

- 0% - 30% in debt and money market instruments.

Growth Of Rs 10,000, If Invested In SBI Bluechip Fund 5 Years Back

YTD as on February 07, 2018 (Source: ACE MF) YTD as on February 07, 2018 (Source: ACE MF)

|

SBI Bluechip Fund has been able to maintain a significant outperformance over the benchmark at that too much lower volatility. Had you invested Rs 10,000 in the fund 5 year back, it would have grown to Rs 22,556 (CAGR: 17.66%) at present, as compared to Rs 18,085 (CAGR 12.57% p.a.) in its benchmark S&P BSE 100 index. (Calculated as on February 07, 2018)

|

As can be seen in the graph, SBI Bluechip Fund's performance has been exceptionally well as compared to the benchmark returns in the upside market rally, that began in 2014. It has not only generated significant alpha for its investors during upside market rallies, but has also managed to limit downsides during market corrections.

SBI Bluechip Fund: Year-on-Year Performance

|

Over the last decade, SBI Bluechip Fund has largely outperformed the benchmark S&P BSE 100. It has done so, in 7 out of the 9 full calendar years considered. The margin of outperformance in CY 2014 and 2015 was quite substantial, where the fund outperformed the benchmark by an absolute margin of 15% and 11% respectively. However, in the YTD performance of CY 2018, the fund has trailed the benchmark. Notably, it trailed the benchmark in CY 2017 too. While some investors may be disappointed with the short-term performance of the fund, it has definitely created wealth for its long-term investors.

|

YTD as on February 07, 2018 (Source: ACE MF) ) YTD as on February 07, 2018 (Source: ACE MF) )

|

SBI Bluechip Fund: Performance Vis-à-vis Category Peers

Rolling Period Returns

| Scheme Name |

Corpus

(Rs Cr) |

1 Year |

2 Year |

3 Year |

5 Year |

Std. Dev |

Sharpe |

| Kotak Select Focus Fund |

17,040.6 |

27.89 |

16.88 |

19.30 |

21.50 |

12.97 |

0.14 |

| Axis Focused 25 Fund |

2,623.0 |

29.53 |

16.21 |

17.20 |

18.16 |

14.22 |

0.16 |

| Franklin India Prima Plus Fund |

12,265.8 |

20.23 |

12.27 |

16.85 |

19.45 |

11.65 |

0.11 |

| SBI BlueChip Fund |

17,869.5 |

19.88 |

13.05 |

16.53 |

19.57 |

11.74 |

0.13 |

| MOSt Focused 25 Fund |

945.0 |

25.44 |

12.35 |

16.20 |

-- |

13.20 |

0.09 |

| DSPBR Focus 25 Fund |

3,206.4 |

20.64 |

11.70 |

15.79 |

17.05 |

13.87 |

0.08 |

| Reliance Top 200 Fund |

7,169.7 |

27.04 |

12.85 |

15.28 |

18.27 |

13.78 |

0.11 |

| Aditya Birla SL Frontline Equity Fund |

20,702.2 |

22.55 |

13.46 |

14.70 |

18.64 |

12.43 |

0.10 |

| Aditya Birla SL Top 100 Fund |

3,930.0 |

23.29 |

13.44 |

14.56 |

18.74 |

12.40 |

0.09 |

| ICICI Pru Focused Bluechip Equity Fund |

16,538.7 |

24.19 |

13.68 |

13.78 |

17.18 |

12.21 |

0.11 |

| Kotak 50 |

1,411.9 |

19.51 |

10.86 |

13.71 |

15.81 |

12.56 |

0.07 |

| BNP Paribas Equity Fund |

1,011.3 |

20.42 |

9.54 |

13.63 |

17.53 |

13.77 |

0.06 |

| IDBI India Top 100 Equity Fund |

441.5 |

19.96 |

10.11 |

13.54 |

16.56 |

13.07 |

0.04 |

| Invesco India Business Leaders Fund |

136.9 |

18.94 |

10.60 |

13.51 |

16.10 |

12.06 |

0.09 |

| UTI Top 100 Fund |

999.5 |

22.92 |

11.36 |

13.50 |

15.71 |

13.12 |

0.08 |

| ICICI Pru Top 100 Fund |

3,166.7 |

24.93 |

15.21 |

13.30 |

16.98 |

12.25 |

0.10 |

| Indiabulls Blue Chip Fund |

975.6 |

23.61 |

13.43 |

13.28 |

13.93 |

14.47 |

0.10 |

| Franklin India Bluechip Fund |

8,651.8 |

18.74 |

11.37 |

13.22 |

14.87 |

11.59 |

0.08 |

| DHFL Pramerica Large Cap Fund |

393.1 |

19.98 |

10.63 |

12.95 |

16.22 |

12.18 |

0.06 |

| IDFC Focused Equity Fund |

1,143.8 |

35.32 |

15.53 |

12.94 |

13.89 |

14.01 |

0.13 |

| SBI Magnum Equity Fund |

2,153.6 |

16.86 |

10.64 |

12.94 |

15.46 |

12.19 |

0.05 |

| Edelweiss Large Cap Advantage Fund |

134.4 |

20.45 |

10.00 |

12.59 |

15.88 |

12.91 |

0.06 |

| Principal Large Cap Fund |

321.9 |

22.18 |

12.09 |

12.57 |

15.72 |

13.18 |

0.07 |

| Reliance Focused Large Cap Fund |

1,359.7 |

23.23 |

10.47 |

12.49 |

16.38 |

13.81 |

0.07 |

| HDFC Top 200 Fund |

15,821.4 |

26.76 |

13.99 |

12.40 |

15.90 |

15.10 |

0.07 |

| S&P BSE 100 |

|

22.02 |

11.00 |

10.10 |

13.27 |

12.98 |

0.05 |

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on February ,07 2018

(Source: ACE MF)

SBI Bluechip Fund has delivered superior returns over longer rolling periods of 3 years and 5 years, where it has outpaced the benchmark by a margin of over 6 percent points. Moreover, it has been among the top performers in the large cap funds category. The fund's Standard Deviation of 11.74 depicts that its performance has come at a lower volatility, while its Risk Adjusted Return (Sharpe Ratio) is one of the highest in the category.

Investment Strategy of SBI Bluechip Fund

SBI Bluechip Fund is mandated to invest a minimum 70% of its portfolio in equity. While the fund is predominantly large-cap biased, it does make opportunistic allocations to mid-caps. Large-caps form over 80% of the portfolio, while mid-caps command a weightage of up to 20%. The fund defines large-caps as those stocks that have a market capitalisation that is equal to or more than the market capitalisation of the last stock of BSE 100 Index. This also means that the fund's investment universe is not limited to stocks from the BSE 100 index, but it is free to invest in a stock that is not a part of the BSE 100.

While identifying stocks for the fund's portfolio, the fund manager aims to invest in large companies with an established business presence, good reputation, solid brand equity and are possibly market leaders in their industries with less uncertainty in top-line and bottom-line growth. The investment team also aims to keep an eye on consistency in management performance, change in leadership and key management decisions that can affect the outlook of the business.

SBI Bluechip Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| HDFC Bank Ltd. |

7.92 |

| Larsen & Toubro Ltd. |

4.33 |

| Mahindra & Mahindra Ltd. |

3.10 |

| Nestle India Ltd. |

3.02 |

| ITC Ltd. |

2.64 |

| HPCL |

2.64 |

| Bharat Electronics Ltd. |

2.57 |

| State Bank Of India |

2.55 |

| Hindalco Industries Ltd. |

2.39 |

| IndusInd Bank Ltd. |

2.39 |

|

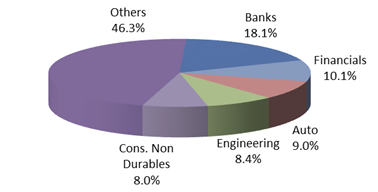

Top 5 Sectors

|

Holdings (in %) as on December 31, 2017

(Source: ACEMF) |

SBI Bluechip Fund usually holds about 50-60 stocks in its portfolio. As on December 31, 2017, the fund had invested in 61 stocks. The top 10 stocks account for around 33.5% of the portfolio, while the top 5 sectors had a total weight of 53.7%. The weightage to stocks is reasonably spread out with just one stock—HDFC Bank, having an allocation of over 5%. SBI Bluechip Fund's portfolio is heavy weight on stocks in the Banking and Financial sector, followed by Auto, Engineering and Consumption. It held significant exposure in Pharma, Petroleum, Cement, Chemicals and I.T. among core sectors that usually exist in the fund's portfolio.

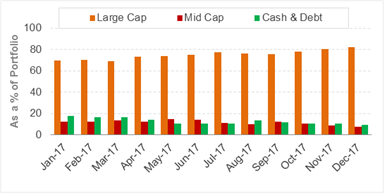

SBI Bluechip Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on December 31, 2017 Holdings (in %) as on December 31, 2017

(Source: ACEMF)

|

SBI Bluechip Fund has maintained an allocation of 70%-85% in large-cap stocks. The funds allocation to large caps increased gradually over the last one year. As against 70% in January 2017, the funds large cap exposure stood at around 83% in December 2017. On the other hand, its mid cap holdings have been within the 15% mark. The cash and debt component had peaked to around 18% in January 2017, and had eased below 10% in the last disclosed portfolio as of December 2017.

|

Suitability of SBI Bluechip Fund

SBI Bluechip is a diligently managed large-cap fund that stands out on multiple fronts. Led by an experienced stock-picker, the funds consistent performance is backed by a stable process and steady fund management team. With opportunistic exposure to midcaps, SBI Bluechip Fund may have been more aggressive than most large-cap funds, but this has not translated in to a higher volatility in returns. Hence, the fund has effectively managed risk. Large-cap funds have the potential to hold their ground and offer stability in a sliding market and thus are suitable for investors looking for stability along with long-term growth.

Note: This write up is for information purpose and not a recommendation to buy or sell the mutual fund scheme. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your investment consultant/advisor.

PersonalFN adopts a stringent process to shortlist potentially the best mutual funds that have stood the test of time and have the potential to grow investor’s wealth in the long run.

If you are worried about the unpredictability of the equity markets and confused about which mutual funds to invest in this year, don’t worry. We have something special for you. Click here to know more.

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

and condition on which its offer research report. For the terms and condition for research report click here.

Details of associates

- Money Simplified Services Private Limited;

- PersonalFN Insurance Services India Private Limited;

- Equitymaster Agora Research Private Limited;

- Common Sense Living Private Limited;

- Quantum Advisors Private Limited;

- Quantum Asset Management Company Private Limited;

- HelpYourNGO Private Limited;

- HelpYourNGO Foundation;

- Natural Streets for Performing Arts Foundation;

- Primary Real Estate Advisors Private Limited;

- Rahul Goel;

- I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

- Neither QIS, it’s Associates, Research Analyst or his/her relative have any financial interest in the subject Company , except QIS receives fees for providing research to Quantum Equity Fund of Fund (QEFoF) which is Fund of Fund scheme managed by QMF.

- Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report.

- Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront /annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices

Disclosure with regard to receipt of Compensation

- Neither QIS nor it's Associates have any compensation from the subject Company in the past twelve months.

- Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company in the past twelve months.

- Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company in the past twelve months.

- Neither QIS nor it’s Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months except from Axis Bank Limited under a service agreement.

- Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

- The Research Analyst has not served as an officer, director or employee of the subject Company.

- QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments