Have you seen a ‘Falling Star’?

If you have, then you would probably wish for fortune, prosperity or good health for yourself and your loved ones.

Many believe falling stars have the power to fulfill ones wish. And it’s a human nature to secretly wish on a falling star, with a belief that it might come true. Anyways, it doesn’t cost anything to try your luck.

But personally, I am not equipped to say for sure if wishing on falling stars really works or not. Neither have I personally believed in creating fortune with stars that shine in the sky at night, nor the ones that many investors refer to in the world of mutual funds.

Because in mutual funds even a 5 Star rated fund can probably lose its rating from 5 Star to 1 Star and so your money.

SBI Magnum Midcap Fund is one such example of a falling star that has lost its stars on the list of many research houses, in a years’ time and so the faith of its investors. It came into the limelight backed by its stellar performance in CY 2014 & 2015, to become a preferred choice for investors looking for the most profitable mid cap fund.

You might have probably invested in SBI Magnum Midcap Fund couple of years back, looking at its 5 Star or 4 Star rating then. If you would have been fortunate enough to exit the fund on time, you won’t regret your decision today. But for investors who are still with the fund, this is food for thought.

From the high it saw in January 2018, the fund had lost almost 20% in value by the mid of last month, before recovering a bit. But the fund is still down by about 14% against 9% loss in the benchmark Nifty Free Float Midcap 100 – TRI index, simultaneously.

As the name suggests, SBI Magnum Midcap Fund has been categorized under midcap funds. It is mandated to invest a minimum 65% of its assets in midcap stocks, defined as stocks of companies from 101st to 250th on full market capitalisation basis. The fund originally defines midcap companies as those companies whose market capitalization at the time of investment is lower than the last stock in the S&P CNX Nifty Index less 20% (upper range) and above Rs 200 crores. This definition gives the fund a much broader universe to choose from. Historically, the fund has held a midcap biased portfolio that has been in the range of 60% to 80% of its assets, with slight diversification of 15% to 30% into large caps.

Managed by Ms. Sohini Andani, SBI Magnum Midcap Fund has a stable fund manager who has been managing the fund for over eight years now and has steered the fund through various peaks and troughs.

Fund Facts – SBI Magnum Midcap Fund

| Category |

Mid Cap Fund |

Style |

Blend |

| Type |

Open ended scheme |

Market Cap Bias |

Mid Cap Fund |

| Launch Date |

15-Apr-05 |

SI Return (CAGR) |

16.35% |

| Corpus (Cr) |

Rs 3,636 |

Min./Add. Inv. |

Rs 5,000 / Rs 1,000 |

| Expense Ratio (Dir/Reg) |

1.18% / 2.39% |

Exit Load |

1% |

Portfolio Data as on July 31, 2018.

SI Return as on August 21, 2018.

(Source: ACE MF)

Growth Of Rs 10,000, If Invested In SBI Magnum Midcap Fund 5 Years Ago

Data as on August 21, 2018

(Source: ACE MF)

Having a history of over 13 years, SBI Magnum Midcap Fund has gone through many market cycles. Its performance over the last 5 years has been reasonable to call it a decent mid cap fund. Over the past five years, the fund has rewarded its investors with a compounded annualised return of around 28.5%, as against 26.2% CAGR by the benchmark Nifty FF Midcap 100 – TRI index. An investment of Rs 10,000 in the fund five years back would now be worth Rs 35,047, while a similar investment in the index would have been valued at Rs 32,063. Notably the margin of outperformance by the fund has narrowed down in the last one year.

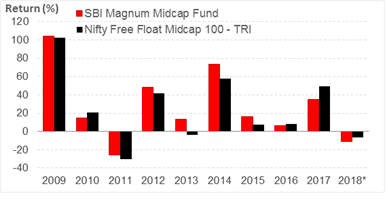

SBI Magnum Midcap Fund: Year-on-Year Performance

*YTD as on August 21, 2018

(Source: ACE MF)

If we ignore the recent underperformance of SBI Magnum Midcap Fund, the funds long term performance has been commendable. Barring CY 2010, the fund constantly outperformed the Nifty FF Midcap 100 – TRI index between 2009-2015. However, the fund has seen a change in tide since 2016; probably the year when it enjoyed the 5 star tag the most and saw its AUM double within a years' time. Its performance since 2016 might have surely disappointed investors who entered the fund looking at its star ratings backed by stellar historical performance. Notably, the fund is in the third consecutive year of underperformance vis-à-vis the benchmark.

SBI Magnum Midcap Fund: Performance Vis-à-vis Category Peers

| Scheme Name |

Corpus

(Rs Cr) |

1 Year (%) |

2 Year (%) |

3 Year (%) |

5 Year (%) |

Std Dev |

Sharpe |

| L&T Midcap Fund |

3,066 |

27.67 |

28.63 |

21.08 |

30.58 |

15.62 |

0.17 |

| Kotak Emerging Equity Scheme |

3,327 |

20.49 |

24.06 |

18.95 |

28.12 |

15.14 |

0.13 |

| DSP Midcap Fund |

5,676 |

19.00 |

23.89 |

17.89 |

26.73 |

16.35 |

0.12 |

| HDFC Mid-Cap Opportunities Fund |

21,149 |

20.51 |

24.19 |

17.81 |

27.74 |

14.84 |

0.14 |

| Sundaram Mid Cap Fund |

6,138 |

18.58 |

22.44 |

17.44 |

27.03 |

15.89 |

0.08 |

| Edelweiss Mid Cap Fund |

786 |

26.77 |

23.00 |

17.13 |

28.68 |

16.23 |

0.09 |

| Aditya Birla SL Midcap Fund |

2,323 |

19.15 |

21.60 |

16.76 |

24.34 |

15.77 |

0.08 |

| Franklin India Prima Fund |

6,617 |

18.92 |

21.24 |

16.60 |

26.78 |

13.76 |

0.13 |

| BNP Paribas Mid Cap Fund |

775 |

20.26 |

19.62 |

15.97 |

25.30 |

16.61 |

0.04 |

| Taurus Discovery (Midcap) Fund |

52 |

23.83 |

23.34 |

15.86 |

24.06 |

16.53 |

0.10 |

| Invesco India Midcap Fund |

193 |

22.41 |

21.26 |

15.33 |

26.44 |

15.39 |

0.11 |

| ICICI Pru Midcap Fund |

1,535 |

22.32 |

22.16 |

14.72 |

27.77 |

15.58 |

0.06 |

| SBI Magnum Midcap Fund |

3,636 |

11.90 |

15.75 |

14.64 |

26.55 |

14.87 |

0.01 |

| Motilal Oswal Midcap 30 Fund |

1,338 |

11.21 |

15.27 |

14.07 |

-- |

14.91 |

0.04 |

| UTI Mid Cap Fund |

4,036 |

18.97 |

18.63 |

14.04 |

28.33 |

16.00 |

0.04 |

| Reliance Growth Fund |

6,830 |

20.43 |

20.89 |

13.83 |

20.83 |

15.93 |

0.06 |

| Tata Mid Cap Growth Fund |

639 |

20.00 |

18.67 |

13.67 |

25.77 |

16.93 |

0.04 |

| Axis Midcap Fund |

1,564 |

25.32 |

18.45 |

12.30 |

23.84 |

14.68 |

0.08 |

| DHFL Pramerica Midcap Opp Fund |

111 |

15.05 |

15.92 |

10.77 |

-- |

15.57 |

0.00 |

| Baroda Pioneer Mid-cap Fund |

47 |

20.73 |

18.54 |

4.90 |

8.94 |

18.58 |

-0.01 |

| Nifty Free Float Midcap 100 - TRI |

|

19.80 |

22.86 |

16.58 |

21.82 |

17.11 |

0.10 |

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

Data as on August 21, 2018

(Source: ACE MF)

*Please note, this table only represents the best performing funds based solely on past returns and is NOT a recommendation. Mutual Fund investments are subject to market risks. Read all scheme related documents carefully. Past performance is not an indicator for future returns. The percentage returns shown are only for indicative purposes.

SBI Magnum Midcap Fund has seen a constant drop in its performance rankings, and clearly lags the benchmark and many of its category peers. Over 1 year and 2 year rolling return basis, the fund has underperformed the benchmark by 7 to 8 percentage points. Some of its core holdings like Manpasand Beverages, along with stocks like VA Tech Wabag and Clariant Chemicals have significantly dragged down the performance of the fund in the last one year and impacted its longer track record as well. SBI Magnum Midcap Fund is now counted among below average performers. The fund has even failed in terms of generating decent risk-adjusted returns for its investors, keeping them disappointed.

While its long term performance numbers of over 5 years may still give some confidence to investors, it is to be seen how long the fund takes to show a turnaround performance and improve on the risk-adjusted returns front.

Investment Strategy of SBI Magnum Midcap Fund

SBI Magnum Midcap Fund follows a blend of growth and value style of investing. It prefers bottom-up approach to stock-picking and chooses companies across sectors which it thinks has the potential to benefit from the economic growth. The fund predominantly holds a well-diversified portfolio of mid cap stocks, which it defines as stocks of companies whose market capitalization at the time of investment is lower than the last stock in the S&P CNX Nifty Index less 20% (upper range) and above Rs. 200 crores. Post categorization, SBI Magnum Midcap Fund has been mandated to invest a minimum of 65% of its assets in midcaps, which are defined as the 101st to 250th company in terms of full market capitalization.

SBI Magnum Midcap Fund - Portfolio Allocation and Market Capitalisation Trends

Holdings (in %) as on July 31, 2018

(Source: ACEMF)

With a mandate to hold a minimum 65% of its assets in midcaps, SBI Magnum Midcap Fund has slightly trimmed its exposure to mid and small-cap stocks over the year. From an exposure of about 80% to the mid and small sized companies, the fund has brought it down to about 65%. Simultaneously the allocation to large caps has increased from about 15% a year ago to 33% currently. The switch in allocation is also driven by the correction in the mid and small cap segment, vis-à-vis the sharp rally in large caps. Over the past six months the allocation to midcaps has varied within a range of 55%-60%, while small caps have been in the range of 5% to 15%. The weightage to large-caps has risen gradually, and settled at around 30%.

SBI Magnum Midcap Fund – Top Portfolio Holdings

Top 10 Stocks

| Stocks |

% of Assets |

| PNB Housing Finance Ltd. |

5.27 |

| Cholamandalam Invest. & Fin. Co. Ltd. |

5.24 |

| Carborundum Universal Ltd. |

4.13 |

| Godrej Properties Ltd. |

4.12 |

| The Ramco Cements Ltd. |

4.01 |

| Voltas Ltd. |

3.89 |

| Torrent Pharmaceuticals Ltd. |

3.69 |

| Mahindra & Mahindra Fin. Serv. Ltd. |

3.66 |

| Sheela Foam Ltd. |

3.66 |

| Coromandel International Ltd. |

3.48 |

|

Top 5 Sectors

|

| Holdings (in %) as on July 31, 2018 (Source: ACEMF) |

SBI Magnum Midcap Fund usually holds a well-diversified portfolio of around 50 to 60 stocks. As on July 31, 2018, PNB Housing Finance, Cholamandalam Investments, Carborundum Universal, Godrej Properties and Ramco Cements were among the top 5 holdings in the fund’s portfolio, having a combined weightage of around 23%. In the last one year the fund has added significant exposure to RBL Bank, HUDCO, Divis Labs, AU Small Finance Bank, Schaeffler India, Mahindra & Mahindra Financial Services, Thermax, Voltas and Sanofi India; while it has trimmed its holdings in Indraprastha Gas, Manpasand Beverages, Federal Bank and Carborundum Universal. The fund seems to be restructuring its portfolio. The number of stocks in the fund’s portfolio has been gradually trimmed from around 60 a year ago to 45 at present. Against 23 exits in the last one year, the fund has added just 10 new stocks. Coromandel International, Dixon Technologies, Godrej Properties, GSPL, PNB Housing Finance and Torrent Pharma are some of the new additions in the fund’s portfolio, where the fund has added significant exposure.

In terms of sectors, Financial services (21%), Pharma (17.1%), Engineering (14.1%), Construction (10.3%) and Consumer Durables (7.5%) carried a higher weightage in the fund’s portfolio. In the last one year, the fund has added significant exposure to Financials and Pharma, while paring some exposure to Consumption, Software and Chemicals.

Major Gainers: In the last one year, Page Industries and Divis Labs turned out to be major gainers in the fund’s portfolio appreciating over 70% in value. Other stocks in the portfolio like NRB Bearings, Sanofi India, Shriram Transport Finance and Thermax gained 35-40% in value.

Major Losers: However, the list of losers in the portfolio is longer. While Manpasand Beverages and Strides Pharma Science lost around 65-70% in a years’ time, Sequent Scientific, VA Tech Wabag and Clariant Chemicals (India) lost in the range of 40-60%. Mangalam Cement and HUDCO were among other major losers in the portfolio that saw a drop of 30-35% in their price.

Suitability of SBI Magnum Midcap Fund

There is a saying ‘Never catch a falling knife’, this sometimes holds true for stock traders as well. They avoid investing in, rather start selling stocks where the prices are falling, lest the price moves lower over the short term, leading to losses. The situation over the last few months, in the mid and small-cap segment has been something similar. When investing in midcaps, you should be aware of the underlying risk and keep a long-term focus.

Mid cap funds can be considered as a great investment avenue for high risk takers who aim to grow their wealth substantially but with high element of risk. Not every midcap fund can turn out to be a multi-bagger every year. The recent underperformance in SBI Magnum Midcap Fund is a serious concern and cannot be ignored. The sharp fall in its value over the last six months, does not give investors much confidence in terms of safety. Though the fund manager Ms. Andani has been at the helm of the scheme for over eight years, much needs to be done in terms of generating stable risk-adjusted returns. It needs to be seen if the fund manager will be able to put SBI Magnum Midcap Fund back on track and drive a turnaround performance in the scheme.

Note: This write up is for information purpose and not a recommendation to buy or sell the mutual fund scheme. As an investor, you need to pick the right fund to meet your financial goals. If you are not sure about your risk appetite, do consult your financial planner or investment advisor.

|

Editor's note:

Wondering where to invest, while the Sensex is at its peak?

We have an ideal equity funds portfolio one may consider in current market conditions.

This exclusive portfolio is based on a time-tested, proven investment strategy employed by most of successful investors.

Moreover, it lets you reap benefits from two worlds, viz. short rewarding opportunities and long term stable growth potential. Get your access now…

|

DISCLOSURE AS PER SECURITIES AND EXCHANGE BOARD OF INDIA (RESEARCH ANALYSTS) REGULATIONS, 2014

About the Company including business activity

Quantum Information Services Private Limited (QIS) was incorporated on December 19, 1989.

QIS was promoted by Mr. Ajit Dayal with an objective of providing value-based information / views on news related to equity markets, the economy in general, sector analysis, budget review and various personal products and investments options available to the Public. It was the first company to start equity research on an institutional level.

'PersonalFN' is a service brand of QIS and was started in the year 1999. In 1999, the Company registered the Domain name www.personalfn.com for providing information on mutual funds and personal financial planning, financial markets in general, etc and services related to financial planning and research in various financial instruments including mutual funds, insurance and fixed income products to customers. It offers asset allocation and researched investment recommendations through its financial planning services.

Quantum Information Services Private Limited (QIS) is registered as Investment Adviser under SEBI (Investment Adviser) Regulations, 2013 and having Registration No.: INA000000680. In terms of second proviso to Regulation 3 (1) of SEBI (Research Analysts) Regulations, 2014 the Company is not required to obtain Certificate of registration from SEBI.

Disciplinary history

There are no outstanding litigations against the Company, it subsidiaries and its Directors.

and condition on which its offer research report. For the terms and condition for research report click here.

Details of associates

- Money Simplified Services Private Limited;

- PersonalFN Insurance Services India Private Limited;

- Equitymaster Agora Research Private Limited;

- Common Sense Living Private Limited;

- Quantum Advisors Private Limited;

- Quantum Asset Management Company Private Limited;

- HelpYourNGO Private Limited;

- HelpYourNGO Foundation;

- Natural Streets for Performing Arts Foundation;

- Primary Real Estate Advisors Private Limited;

- Rahul Goel;

- I V Subramaniam.

Disclosure with regard to ownership and material conflicts of interest

- Neither QIS, it’s Associates, Research Analyst or his/her relative have any financial interest in the subject Company , except QIS receives fees for providing research to Quantum Equity Fund of Fund (QEFoF) which is Fund of Fund scheme managed by QMF.

- Neither QIS, it's Associates, Research Analyst or his/her relative have actual/beneficial ownership of one per cent or more securities of the subject Company, at the end of the month immediately preceding the date of publication of the research report.

- Neither QIS, it's Associates, Research Analyst or his/her relative has any other material conflict of interest at the time of publication of the research report except that QIS (PersonalFN) is, as per SEBI (Mutual Funds) Regulations 1996, an associate / group Company of Quantum Asset Management Company Private Limited and Trustees and Sponsor of Quantum Mutual Fund (QMF) and to that extent there may be conflict of interest while recommending any schemes of QMF. However any such recommendation or reference made is based on the standard evaluation and selection process, which applies uniformly for all Mutual Fund Schemes. The payment of commission (upfront /annualized & trail), if any, for any Schemes by QMF to QIS (PersonalFN) is also at arm's length and as per prevailing market practices

Disclosure with regard to receipt of Compensation

- Neither QIS nor it's Associates have any compensation from the subject Company in the past twelve months.

- Neither QIS nor it's Associates have managed or co-managed public offering of securities for the subject Company in the past twelve months.

- Neither QIS nor it's Associates have received any compensation for investment banking or merchant banking or brokerage services from the subject Company in the past twelve months.

- Neither QIS nor it’s Associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months except from Axis Bank Limited under a service agreement.

- Neither QIS nor it's Associates have received any compensation or other benefits from the subject Company or third party in connection with the research report

General disclosure

- The Research Analyst has not served as an officer, director or employee of the subject Company.

- QIS or the Research Analyst has not been engaged in market making activity for the subject Company.

Subject Company means Mutual Fund Schemes

Quantum Information Services Private Limited CIN: U65990MH1989PTC054667 Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com Website: www.personalfn.com Tel.: 022 61361200 Fax.: 022 61361222

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments