The disappointment of investors betting on small cap stocks and small-cap mutual funds in 2018 was understandable.

Most of them are staring at double-digit losses.

At the dawn of the New Year, some market experts have started predicting 2019 to be a year of excitement and high returns. Their logic is, 2018 knocked off small caps, so 2019 will see their revival.

Can it really happen in this way?

If we subscribed to this logic, infrastructure companies should have skyrocketed by now (a decade ago, most experts were bullish on the infra theme). On the contrary, they have drifted down for almost a decade now.

The year 2019 is not going to be easy; it could test the patience of several investors. We are in an election mode in the run-up to Lok Sabha elections in April-May 2019, and surrounded by factors viz. loss in economic momentum, pace of job creation is very slow, farm loan waiver and increased Minimum Support Prices (MSP) may weigh on fiscal deficit, domestic liquidity has been surreal, and people, in general, seem disgruntled after high hopes of Acche Din.

[Read: Have You Planned A Strategy To Invest In Mutual Funds In 2019?]

Domestic Institutional investors are, of course, exuding confidence in the current dispensation; but for how long that continues remains to be seen. Foreign Institutional Investors (FIIs), for the first time since the Modi-led-NDA government came to power, have net sold Indian equities (to the tune of Rs 32,628 crore) in 2018. This is a worrisome sign because it doesn’t mean that equity markets will go up only abetted by domestic flow even if FIIs continue to pull out money. So, there’s high risk involved.

Yet many retail investors are betting on small caps in pursuit of high returns.

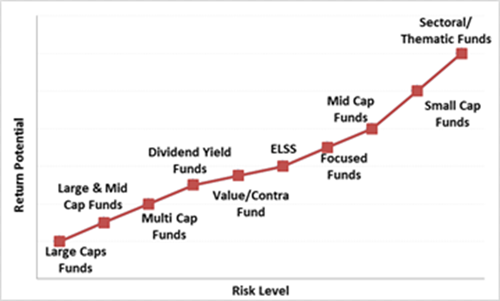

Chart1: Small-cap funds are risky…

(Note: For illustrative purpose only)

Invest in small-cap funds only if:

Here’s why small caps are extremely risky…

Any adverse economic impact of greater magnitude can topple small caps. Often, smaller companies fail to cope with business challenges, which then weighs on their bottom-line and end up piling massive debt that they can rarely manage.

From the stock markets’ perspective, if small-cap funds witness incessant inflow money, the fund managers may jump on the bandwagon to invest in small caps, even when the valuations may be expensive (like they were a few months ago).

Usually, small-cap stocks have low trading volumes due to their size. And because of the risks associated with such stocks, buyers often exit when markets fall relentlessly. In such a situation, the fund manager may end up holding an illiquid stock or may sell it at a deep discount. And at the end of it, your investment in the fund would bear the brunt.

Similarly, if a small-cap fund holds a concentrated portfolio, it may experience higher volatility. Moreover, small-cap funds that churn their portfolio quite aggressively––follow momentum––may not necessarily be the best performer. Once the momentum in a small cap stock is lost, and/or at worst, if the valuations are high, small-cap funds may take years to reclaim their peaks. Under such a scenario, small-cap funds may suffer a capital loss.

If you have any small-cap fund in your portfolio that’s underperformed constantly, it’s perhaps time to review your mutual fund portfolio. There could be few more underperformers in your portfolio.

But the positive side is small-caps can reward you handsomely…

Small-cap companies can grow faster during the upswings of business cycles or when the overall economy is witnessing accelerated growth. Their revenue and profit growth tend to outpace that of large-cap companies by a significant margin. As a result, investors buy them aggressively when the growth momentum is strong.

If you hold a well-managed small-cap fund/s that pick fundamentally robust companies at reasonable valuations (and have the potential of being tomorrow’s large caps), small-cap funds can generate stupendous returns for you, the investor.

Is the small-cap universe in good shape?

The S&P BSE SmallCap Index is trading at a negative P/E of 96.26 as on December 31, 2018. A negative PE indicates that many constituents of the BSE SmallCap index are making losses thereby contributing negatively. Do note, only a handful of small companies can handle financial stress.

This isn’t very encouraging for those who think 2019 would be a year of revival for small-caps. However, if the market falls further and there’s value proposition evident, they could be a worthwhile buy.

After the Securities and Exchange Board of India (SEBI) introduced mutual fund re-categorisation norms, it’s mandatory for small-cap mutual fund schemes to invest at least 60% of their assets in small-cap stocks. For the purpose of classifying stocks into various baskets, SEBI has decided to use the criterion of market capitalisation. Any stock beyond first 250 companies is a small-cap stock.

While this might give you a feeling that the basket of small-cap stocks is fairly big, the reality is that many companies do not meet typical selection criteria of institutional investors like mutual funds.

How small-cap funds fared?

On a 3-year and 5-year time frame, small-cap funds have well outperformed S&P BSE Small Cap-TRI.

Table 1: Satisfactory report card?

| |

Absolute (%) |

CAGR (%) |

| 6 Months |

1 Year |

2 Years |

3 Years |

5 Years |

| Average returns generated by small cap schemes |

-3.4 |

-16.7 |

12.3 |

10.0 |

21.3 |

| S&P BSE Small-Cap – TRI |

-6.6 |

-23.0 |

12.0 |

8.3 |

18.5 |

Data as on December 28, 2018

(Source: ACE MF)

The evaluation of performance across market cycles (see table 2) reveals that historically, small-cap mutual funds have been able to arrest the downside when compared with the S&P BSE Small-Cap Total Return Index (TRI). This is positive since it denotes that active management strategies have been effectively containing risks.

Table 2: How have small-cap funds fared across market cycles?

|

Bear |

Bull |

Bear |

Bull |

Corrective / Bear |

| 05/Nov/10 To 20/Dec/11 |

20/Dec/11 To 03/Mar/15 |

03/Mar/15 To 25/Feb/16 |

25/Feb/16 To 23/Jan/18 |

23/Jan/18 To 28/Dec/18 |

| CAGR (%) |

CAGR (%) |

Absolute (%) |

CAGR (%) |

Absolute (%) |

| Average returns generated by small cap schemes |

-27.6 |

36.3 |

-11.8 |

41.9 |

-17.9 |

| S&P BSE Small-Cap – TRI |

-45.7 |

28.0 |

-15.9 |

46.6 |

-25.1 |

Data as on December 28, 2018

(Source: ACE MF)

If you want to invest in small-cap funds in 2019 hoping to generate attractive returns over the long term, stick to well-managed funds coming from process-driven fund houses. Finally, when you invest, prefer direct plans and opt for the Systematic Investment Plan (SIP) to mitigate the volatility any enjoy the benefit of rupee-cost averaging and compounding.

Editor’s note:

Do you know unusual and lesser-known funds are capable of generating big gains for you?

Yes, some hidden gems that are managed well and have the potential to deliver superior risk-adjusted returns in line with the popular peers in the category.

But any small sized fund will not do. You do not want to pick lesser-known funds that have delivered a one-off performance, isn’t it? You need the ‘right’ ones that can generate wealth for you.

PersonalFN brings to you a special report: 5 Undiscovered Equity Funds with High Growth Potential. This report will help you invest in the hidden gems. PersonalFN has tested the viability of the Undiscovered Equity Funds featuring in this report by applying its stringent mutual fund selection process.

What are you waiting for? Subscribe to the special report, 5 Undiscovered Funds today!

Add Comments