photo created by freepik - www.freepik.com

photo created by freepik - www.freepik.com

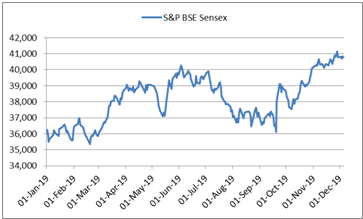

The S&P BSE Sensex is trading above the 40,000 mark since the last 26 sessions. During this period, the index scaled a fresh lifetime high of 41,130 on the back of sustained inflows from FIIs and steady buying from domestic investors. The index has risen 12.48% (since the beginning of 2019) amid a year filled with sharp volatility.

Some of the major factors that influenced the market movement during the year were the general election, union budget, macro-economic indicators, monetary policy decisions, and reform measures by the government as well as global cues.

But the present economic condition is in sharp contrast to the optimism evident in the bellwether index. The economy is grappling with weakening rural and urban consumption, low income, rising unemployment, muted industrial and agricultural growth along with tepid private investment. This has contributed to India's GDP growth rate dropping to 4.5% in Q2 FY20 from 8% in Q1 FY19.

[Read: Is India's Consumption Story Fizzling Out?]

Graph 1: Large caps have witnessed sharp rally despite poor economic growth

Data as on December 05, 2019

Data as on December 05, 2019

(Source: bseindia.com)

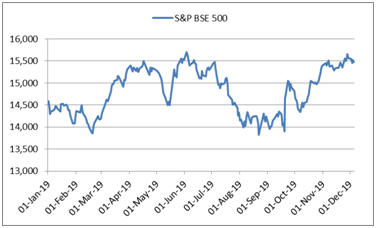

Economic downturn does not augur well for corporate revenue, especially smaller sized businesses. Consequentially, this has resulted in the muted corporate earnings growth. The effect of this can be witnessed in the broader market indicator S&P BSE 500, which rose just 6.1% since the beginning of the year.

Graph 2: The broader index highlights the stress in the economy

Data as on December 05, 2019

Data as on December 05, 2019

(Source: bseindia.com)

The equity markets have been highly volatile over the last two years making investors cautious. Numerous mid and small cap stocks corrected sharply during this period. On the other hand, large caps proved to be a safe haven for investors, which lead to a rally in the segment.

A similar trend could be witnessed in mutual fund investment where the schemes with higher exposure to mid and small caps underperformed as compared to those with higher exposure to large caps.

[Read: Are Your SIPs Giving Negative Returns? Here's What To Do...]

Large caps are better poised to handle slowing economy because of their stable business operation, quality of management, competitive advantage, and sustainable business models. Mid and small caps have high growth potential, but their limited access to various resources, lower ability to adapt to changing market conditions, and fewer opportunities puts them at risk in case of poor economic growth.

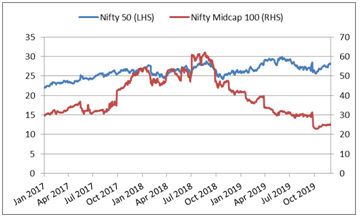

Going forward mid and small caps may stage a comeback. Due to the sharp correction in price of various stocks in the segment, valuations in the segment look attractive. By picking quality stocks available at lower valuations and holding them for long term, fund managers investing in these can reward investors with high growth.

In case of large caps, some of them are trading at very high valuations; which means that growth in mutual funds owning such stocks could be limited in the years to come.

Graph 3: Valuations in mid caps look attractive

Data as on December 05, 2019

Data as on December 05, 2019

(Source: nseindia.com)

It is important to set the realistic return expectations in the coming years as very high growth may not be possible in the current market scenario.

[Read: Want To Multiply Your Portfolio Returns In A Volatile Market? Read This!]

The government has announced several measures in the recent months to boost economic growth, prominent ones being, 1) slashing of corporate tax rate, 2) merger of PSUs, 3) capital infusion in PSUs and NBFCs, 4) incentives for the auto sector, 5) fund support for completion of stuck housing projects, 6) measures to boost exports and credit growth.

Besides, the RBI has cut policy rate by 135 bps cumulatively in the current year. These measures could start showing results in the coming quarters.

Markets are at all-time high, but, as an investor, one must always exercise caution. Volatility and market go hand in hand, so one cannot predict its movement. Thus, during a bull run avoid going overboard and lapping up more funds without proper research and evaluation of your needs because there is a possibility of ending up with an unworthy scheme. Similarly, during volatile phase do not stop, sell, or pause your investment as you will risk deviating from your set objective.

[Read: Mutual Fund Portfolio Under Performing During A Market High? Here's What To Do...]

It is difficult to ascertain when the tides will turn in favour of mid and small caps and whether large caps will be able to sustain rally given the difficulties the economy is facing. Thus, it makes sense to diversify your portfolio across market caps to reap the maximum benefit of changing market condition.

Table 1: Top performers across categories based on 5-year returns

1-year returns are absolute; those depicted above 1-year are compounded annualised

Data as on December 05, 2019

(Source: ACE MF)

By diversifying your investment, you benefit from the stability of the large caps and high growth potential of mid and small caps. One of the most successful and time-tested strategies to build a portfolio of diversified equity mutual funds is to follow the `Core & Satellite' approach to investing. This strategy lets you focus on the stable schemes with a long-term view and at the same time capitalise on short-term opportunities.

The `Core' part (majority of portfolio) can consist of large-cap fund, multi-cap fund, and a value style fund that can provide stability over a long term. Whereas, the `Satellite' part can consist of mid-cap fund, large & mid-cap fund, and an aggressive hybrid fund that can enhance the portfolio's overall gains.

Here are 6 benefits of 'Core & Satellite Approach':

-

Facilitates optimal diversification;

-

Reduces the need for constant churning of your entire portfolio;

-

Reduces the risk to your portfolio;

-

Enables you to benefit from a variety of investment strategies;

-

Aims to create wealth cushioning the downside; and

-

Offers the potential to outperform the market

To build a strategic portfolio based on this approach, carefully assign weightage to each category and the schemes for the portfolio based on your financial objective, risk appetite, and investment horizon. Thereafter, select worthy schemes in the respective categories by evaluating its performance based on quantitative and qualitative parameters.

It would not be wise to depend on your friends, relatives, star ratings of mutual funds, or Google search to select the best mutual fund schemes. Moreover, do not rely heavily on past performance of the fund as it is not an indicative of future growth.

Choose the schemes that are managed by experienced and competent fund managers and belong to fund houses that have well-defined investment systems and processes in place. Each fund should have performed consistently well across market phases and cycles in comparison to their respective benchmark and category peers and rewarded investors with superior risk-adjusted returns.

[Read: Selecting Mutual Funds Carelessly Can Cost You Dear]

As an investor, it may be difficult for you to evaluate the schemes on all the above mentioned parameters. What you need is superlative research-backed advice to be able to select the right fund for your financial goals and needs.

At PersonalFN, we have developed S.M.A.R.T. score fund selection matrix to select mutual funds based on these five variables test, viz.

-

Systems and Process

-

Market cycle performance

-

Asset management style

-

Risk-reward ratios and

-

Performance Track Record

If your portfolio is strategically placed, there will be no need to worry about timing the market and your portfolio will be well placed to tide over the market highs and lows.

The long-term outlook for India looks positive and one can expect growth in the years to come. Thus, there is scope to create wealth for all types of investors. If you invest prudently with a proper strategy in place, it could prove to be rewarding.

Editor's Note: Do wish to invest in top-quality, well managed mutual funds that come with solid long-term potential and build wealth with tested mutual fund portfolio strategies? Get two of our most promising services FundSelect and FundSelect Plus in this mega combo offer.

Our special research reports can help you with some great picks of our research team and provide a boost to your investment strategy.

Subscribe now!

Add Comments