In India, people usually retire at 58-60 years. But you will find many elderly people working out of compulsion.

Well, there's nothing wrong in having the ambition to work until your mind and body allow you to work, but you can't take any of them for granted.

And depending on your children is the least ideal retirement option.

The financial services industry has very well understood gaps in people's retirement planning.

Fancy marketing campaigns of retirement planning products and emotive advertisements have created some awareness of late. At least, the urban office-going community understands the importance of retirement planning now.

However, not enough is done to help individuals aptly plan their retirement, and as a result, they end up choosing the wrong investment avenues for their retirement.

Unfortunately, some financial manufacturers push unsuitable products that only take care of the retirement plans of the people selling them. The retirement plans offered by insurance companies, for example.

You shouldn’t invest in pension plans offered by insurance companies because…

- They are unviable

- Most of the times, they generate lacklustre returns

- Make you buy annuities which are taxable

And how about a combination of Public Provident Fund (PPF), Employee’s Provident Fund (EPF), and Fixed Deposits (FDs)?

Well, PPF and EPF are great retirement saving options, since they offer you around 8% compounded annualised tax-free returns. Nevertheless, they might fall short of meeting your expectations, if you depend entirely on them.

On the other hand, returns offered by FDs are taxable and when adjusted for tax and inflation both, they do not look very promising – particularly when inflation is eroding the purchasing power of hard-earned money.

‘Then, where should I invest money for retirement?’, you might inquire.

Well, before you can decide on any product, you need to understand how much you must save for a peaceful retirement.

Have you done this exercise before?

Great, if you have!

And no worries, if you haven’t.

Let’s do it together.

Why is retirement planning needed?

- To meet daily expenses post-retirement

- To address medical emergencies

- To deal with contingencies (Situations such as natural calamities, theft, fire, loss of loved ones, etc., wreak havoc emotionally and financially)

- To counter the negative effects of inflation on your household budgets

- To be financial independent

[Read: The Step-by-Step Approach To Retirement Planning]

[Read: The Step-by-Step Approach To Retirement Planning]

To estimate the amount you need for a blissful retirement, use PersonalFN’s retirement calculator, an online tool that helps you to calculate your retirement corpus. Further, you can use this Retirement Calculator to find out the future value of your current expenses.

PersonalFN’s retirement calculator requires some basic inputs from your side, such as your retirement age, life expectancy, inflation, expected return on investments, your current portfolio size and expected retirement expenses. The calculator will help you recognise how much you need to grow your wealth before you hang your boots and plan accordingly. Upon this, you would realise that inflation is the biggest hurdle in your retirement planning.

And as we have seen earlier, fixed income instruments such as FDs don’t help in wealth creation because they can’t keep up with inflation.

What’s the suitable option then?

Diversified equity mutual funds.

If you invest in diversified equity mutual funds vide Systematic Investment Plans (SIPs), you would be able to build a sufficient corpus for your retirement.

A monthly SIP of Rs 15,000 in a worthy diversified equity fund can help you accumulate Rs 1.5 crore over 20 years and Rs 2.8 crore over 25 years, assuming you clock a 12% rate of return. If your investments fetch you 15% returns, the SIP will accumulate Rs 2.2 crore over 20 years and Rs 4.9 crore over 25 years.

That’s the power of compounding which makes equity mutual funds a perfect investment avenue for retirement planning.

Moreover, investing in direct plans offered by mutual funds can fetch you even higher returns.

[Read: Even 1% Difference Can Make A Huge Difference To Your Investments]

Are you sceptical about their ability to generate remarkable returns?

For the last two-three decades, major equity indices such as BSE Sensex and CNX Nifty have generated 15%-17% compounded annualised returns. And given the shape of the Indian economy today, it won’t be unwise to assume that the equity asset class still remains an attractive proposition.

This is about markets in general. Well-managed active mutual funds often outperform their respective benchmark indices.

While it’s true that, investing in mutual funds for long-term is crucial for generating a sizable corpus for retirement, it’s equally important to choose mutual fund schemes carefully.

Given there are a plethora of options available, it’s quite possible for you to invest in a wrong mutual fund scheme.

This brings us to the most interesting discussion.

How to select a winning mutual fund scheme for retirement

- Primarily, the mutual fund scheme/s should be from a fund house/s that follows robust and well-established investment processes and systems. The idea behind this is to have funds that are process-driven and not the ones that work on the fund manager's whim and fancies. The experience of the mutual fund house's fund management team also plays a crucial role in the overall performance of a fund house.

- Ideally, the fund house should not focus on launching too many schemes but must have unique ones in its product basket. If the funds-to-fund manager ratio is high, or to put it simply there are many schemes which a single fund manager handles; it could weigh on the performance of the schemes.

For example, if a fund house employs five fund managers and has floated 30 schemes; there will be a pressure on the fund management team. Against this, a fund house that offers only 12 schemes and still employs five fund managers will have a less pressing environment for its fund managers.

- When you look at the past performance of a scheme, judge it across time frames and market cycles (i.e. bulls and bears). This will help you appraise the consistency of the scheme/s and include only the worthy ones in your portfolio. Moreover, do not merely look at returns; also recognise the risk the mutual fund scheme/s has exposed you to.

- Besides, evaluate mutual fund schemes based on their portfolio characteristics; because ultimately it's the portfolio and how the fund manager handles it, is what will drive returns and draw risk. For example, a concentrated portfolio may eventually expose you to a greater risk as opposed to a well-diversified one.

Watch this video to learn how to select mutual funds…

But before you invest in any mutual fund….

- Identify your retirement savings needs clearly.

- Know your risk appetite. If your risk appetite is low and have a few years (less than 3 years), before you retire, avoid allocating to equities. But if you have the stomach for high risk and have a fairly long time before you hang your boots, say at least 5 years, consider skewing your retirement portfolio to equity assets.

- Based on your risk appetite and investment time horizon before the goal realises, draw up a personalised asset allocation plan and invest accordingly.

[Read: 8 Things You Should Do To Retire Early and Rich]

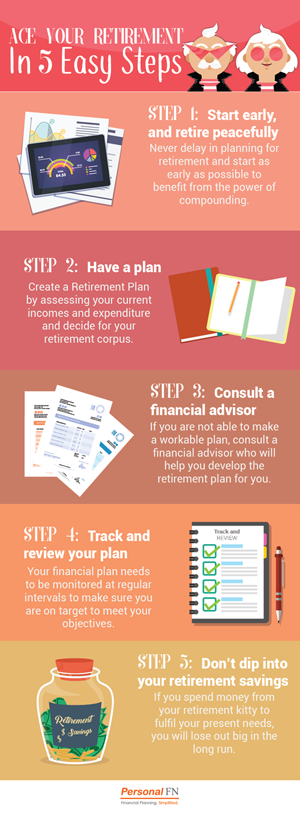

The key to retiring rich, i.e. have enough money for your golden years of life, is to start early and plan your retirement today! Remember, the early bird gets a bigger worm.

And after you have holistically engaged in financial planning and invested, timely review your portfolio to ensure that you are on track to a blissful retirement. Any changes in your income, expenses, retirement age etc. need to be incorporated.

Editor’s note:

If you want to add SOLID mutual fund schemes for your retirement, but don’t have time and skills to select worthy mutual fund schemes; don’t lose heart.

PersonalFN's unbiased premium research service—FundSelect is meant to assist investors in selecting worthy mutual fund schemes.

PersonalFN's FundSelect has 15+ years of an impeccable track record. FundSelect has been based on one simple motto: “Be steady. Be alert. Be winning.”

With FundSelect, you get access to high quality and reliable funds picked by our research team using their comprehensive S.M.A.R.T. score fund selection matrix.

S – Systems and Processes

M – Market Cycle Performance

A - Asset Management Style

R - Risk-Reward Ratios

T - Performance Track Record

So if you are serious about investing in a rewarding fund, try PersonalFN’s flagship mutual fund research service FundSelect.

Every month, PersonalFN’s FundSelect service will provide you with an insightful and practical guidance on equity funds and debt schemes – the ones to buy, hold, or sell, therefore assisting you in creating the ultimate portfolio that has the potential to top the market. Subscribe to FundSelect today!

Happy Investing!

Add Comments

| Comments |

Leela.mounica@gmail.com

Nov 24, 2018

30%slab |

sarabjeetanand@yahoo.co.in

Nov 27, 2018

Want to talk to someone regarding fund select |

1