Tread Cautiously. "Be fearful when others are greedy and greedy when others are fearful," is one of the most cited quotes of Warren Buffett. In October 2008, he used this expression to highlight the fear prevalent amid the global financial crisis. Fast forward eight years later, and fear is prevalent once again, albeit not at a crisis-like level yet.

Try googling each of these terms—Trump, US Fed rate decision, demonetisation, GST, RBI policy rate—and you will come across scores of articles with varied opinions on the economic impact of such events. The one thing that echoes across loud and clear is – uncertainty.

Predictively, fear of the unknown creates hysteria. This is exactly what we have witnessed over the past month. Markets were turbulent the world over. Back home, the markets corrected by 9-10% in November. The S&P BSE Sensex declined by 9% and the S&P BSE Midcap index plunged by 12% over the one-month period ended November 24, 2016.

Over this period, mid-cap stocks such as Deewan Housing Finance, Reliance Communications, Page Industries, Tata Global Beverages, and Wockhardt lost over one-fourth of their value.

In times of turmoil, high-risk mid-cap stocks dominate the sellers' stock list in the market. Hence, the price of midcap stocks plunges the most.

Only a handful of midcap mutual fund schemes were able to arrest the recent fall. The returns for most other schemes were in line with the midcap index. The 46 schemes delivered an average return of -10.8% over the month. If you had invested over the year, you would still be sitting on decent gains despite the sharp correction.

Assessing the prevailing negative sentiments, should you sell fearing the worst is yet to come, or should you see this as an opportune time to invest? Let’s take a look.

Have valuations turned attractive?

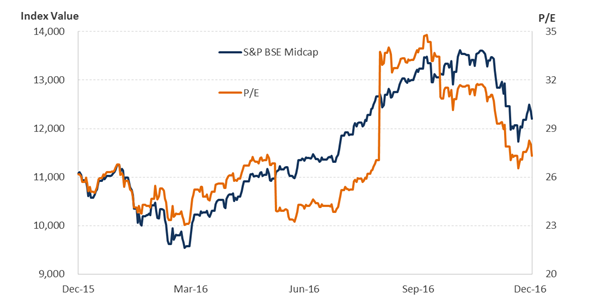

Valuations dropped significantly – thanks to the fall in prices and marginally improved earnings. The mid-cap index, which commanded a price-to-earnings (P/E) nearly 35 times a few months ago, suffered a massive sell-off. The midcap index P/E eased by nearly 21%, from a peak of 34.8 times as on 6 September 2016 to 27.5 times on 6 December 2016. Though the index registered a substantial fall in valuations, this is still two standard deviations above the 10-year average P/E of the index. Despite the correction, valuations still seem high, based on the deviation from the mean.

A Sharp Fall In Price And Valuations

(Source: BSE, PersonalFN Research)

Yet, some analysts would defer, especially those who strongly believe in evaluating the market using the Equity Risk Premium model or the Fed model. Both these models rely heavily on bond yields (or the risk-free rate) to generate a fair value for stocks. Don’t worry, we will not bore you with the calculations involved in these models. To give you a gist, they believe that low bond yields justify higher stock prices.

For the mathematically inclined, here’s why the analysts strongly stand by these models: The low interest rate leads to low discount rates. Therefore, when you discount future cash flows or dividends at a lower rate, the intrinsic value or the fair value of a stock goes up. This, according to them, justifies the higher valuations in a low interest rate environment. Seems logical, doesn’t it? This is probably why everyone is looking at the US Federal Reserve’s rate decision so closely.

You need to be mindful that markets are complex and cannot be easily predicted using stock models that rely on past data. Remember the phrase, “past performance is not an indicator of future success”? Sure you do. There are far too many variables to estimate the market's direction. For example, how do you factor in the effect of demonetisation or the unknown decisions of Donald Trump, president-elect of the United States? You can’t. For those who say they know, they are simply making a guesstimate.

Foreign investors are selling stocks by the dozen. In November 2016, foreign investors sold Rs 17,736 crore worth of Indian equities. Falling bond yields and higher valuation in equities may make India more vulnerable to further outflows. Lower growth forecast, due to demonetisation, will make Indian stocks unattractive. A culmination of other global factors may add to the worries.

Should you be investing in midcap funds?

Mid-cap equity funds offer investors the potential to generate significant wealth. However, the risk is substantially magnified.

In the bull periods, mid-cap stocks tend to outperform their large-cap peers by a significant margin. Unfortunately, in the bear periods, mid-cap funds can lead to deep losses as well. This is evident in the table below…

Performance Of Equity Schemes Across Market Cycles

| Category Average |

Bear Phase |

Bull Phase |

Bear Phase |

Bull Phase |

Bear Phase |

Bull Phase |

08/Jan/08

To

09/Mar/09 |

09/Mar/09

To

05/Nov/10 |

05/Nov/10

To

20/Dec/11 |

20/Dec/11

To

03/Mar/15 |

03/Mar/15

To

25/Feb/16 |

25/Feb/16

To

06/Dec/16 |

| Small-cap Funds |

-62.2% |

107.0% |

-30.1% |

42.3% |

-11.1% |

29.7% |

| Mid-cap Funds |

-64.0% |

104.6% |

-27.9% |

38.1% |

-16.3% |

27.0% |

| Multi-cap Funds |

-55.7% |

82.6% |

-26.3% |

29.3% |

-18.3% |

24.9% |

| Large-cap Funds |

-53.1% |

76.5% |

-24.6% |

26.3% |

-20.6% |

20.7% |

| Benchmark |

| S&P BSE Small-Cap |

-73.5% |

125.3% |

-46.5% |

26.2% |

-16.7% |

26.7% |

| S&P BSE MidCap |

-68.5% |

108.9% |

-38.0% |

27.6% |

-13.9% |

29.3% |

| S&P BSE 200 |

-59.0% |

84.4% |

-28.5% |

25.0% |

-21.1% |

19.8% |

| S&P BSE SENSEX |

-55.3% |

76.7% |

-25.1% |

23.2% |

-22.4% |

14.9% |

Data as on December 6, 2016

Returns over 1-Yr are compounded annualised

(Source: ACE MF, PersonalFN Research)

Over the long-term period of 5-10 years, mid-and small-cap funds come out as winners, but in the short term, small-and mid-cap schemes can be highly volatile. So, if you have longer investment horizon and very high risk appetite, may be you can consider investing in the mid-and-small cap funds.

The exuberant times that we’ve witnessed in the Indian equity market has been mainly led by the small-and-mid cap space, and result small- and mid-cap schemes have outshined in all the periods.

Rolling Period Returns Of Equity Schemes

| Category Average |

1 year |

2 year |

3 year |

5 year |

7 year |

10 year |

| Small-cap Funds |

10.0% |

29.1% |

36.4% |

21.7% |

24.0% |

12.9% |

| Mid-cap Funds |

4.7% |

22.3% |

28.5% |

18.6% |

22.0% |

14.1% |

| Multi-cap Funds |

2.3% |

15.3% |

20.3% |

13.2% |

15.7% |

12.5% |

| Large-cap Funds |

-0.4% |

10.9% |

15.5% |

10.8% |

13.5% |

11.2% |

| Benchmark |

| S&P BSE Small-Cap |

3.6% |

16.8% |

24.1% |

8.0% |

12.9% |

6.6% |

| S&P BSE MidCap |

8.4% |

11.8% |

21.3% |

10.5% |

11.7% |

10.2% |

| S&P BSE 200 |

-0.9% |

8.7% |

13.2% |

9.1% |

12.2% |

9.7% |

| S&P BSE SENSEX |

-3.9% |

4.6% |

10.3% |

7.8% |

11.0% |

9.0% |

Data as on December 6, 2016

Returns are on a rolling basis and those depicted over 1-Yr are compounded annualised.

(Source: ACE MF, PersonalFN Research)

We suggest don’t base your decision on myopic speculation, instead focus on the long-term. Stocks, more often than not, move up over the long term. Hence, such dips in the market may be a good time to invest a small portion of idle cash for the long term (i.e. five years +).

If you are investing for long-term goals, mid-cap funds can form part of your portfolio. The current fall in the market, makes it a good time to invest. When the market moves up, your investment would do well.

But gauge your risk appetite. The present market crash is an easy way to determine your risk appetite. If the sharp decline in mid-cap funds has left you worried, then

your risk appetite is perhaps not as high as you had previously imagined. This is a signal to tone down your mid-cap investments.

If you have appetite for high risk, you may invest a higher proportion of your equity portfolio in small-and-midcap funds.

If you are a ‘

very aggressive’ risk-taker, consider investing in small-and mid-cap schemes (or even micro-cap schemes). Your overall allocation to small-and-midcap funds can go up to 35-40% of your equity portfolio, while large- and multi-cap schemes can form the remaining part of the equity portfolio.

As an ‘

aggressive’ investor, you may invest upto 25-30% of your equity portfolio in mid-cap funds. Avoid small and microcap schemes. The remaining portion of your equity portfolio can be invested in large-cap and multi-cap schemes.

Likewise, if you’re an investor with

‘moderate’ risk appetite, best is to avoid investing in small-and-mid cap funds altogether.

Consult your

financial planner or investment adviser for a suitable allocation to small-and-midcap funds. As always, it is imperative that you consider

the long-term track record and analyse the potential of funds to generate higher risk-adjusted returns before investing in any mutual fund. No matter what your risk profile, in a volatile equity environment, it is best to stagger your investments. Opting for

Systematic Investment Plans (SIPs) would help you mitigate risk.

Add Comments

| Comments |

rishika.ahluwalia08@gmail.com

Dec 15, 2016

very well elaborated article. thanks for sharing this information. all the stats are really useful to make the investment decision |

1