The newly launched Union Value Discovery Fund is the first value fund from Union Mutual Fund. Having a history of little over 7 years, the fund house has limited number of schemes. Notably, Union Value Fund is the sixth equity scheme from the fund house. This fund aims to capture the potential of undervalued and out of favour sectors, and invest in companies available at discounted prices, across market capitalization.

A value fund is a sub-category of equity funds that follows a value investment strategy and is allowed to allocate 65% of its asset into equity stocks offering significant value.

[Read: What Is Value Investing And Why Invest In Value Funds]

Value stocks are usually priced lower than its intrinsic value in the market and have the potential to unlock the capital appreciation in medium to long-term period. Accordingly, value funds require a longer time to realise its potential and hence is ideal for investors who have a long-term investment horizon.

The downside risk is that since value funds generally invest in stocks available at discounted prices, they may have lower correlation to the overall market movement. Moreover, they may take longer than expected time to realise the full potential of the stocks. True value funds tend to underperform in a bull market, but outperform in bear market conditions.

Table1: NFO Details of UVDF

Type |

An open-ended equity scheme following a value investment strategy |

Category |

Equity - Value Funds |

| Investment Objective |

The investment objective of the scheme is to seek to generate long term capital appreciation by investing substantially in a portfolio of equity and equity related securities of companies which are undervalued (or are trading below their intrinsic value).

However, there can be no assurance that the investment objective of the scheme will be achieved. |

| Min. Investment |

Rs 5,000 and in multiples of Re 1 thereafter |

Face Value |

Rs 10 per unit |

| Plans |

• Regular

• Direct |

Options |

• Growth option (default)

• Dividend option

-

- Dividend Reinvestment Facility (default)

- Dividend Pay-out Facility

- Dividend Sweep Facility

|

| Entry Load |

Nil |

Exit Load |

1% if units are redeemed/switched out within 1 year from the date of allotment. Nil thereafter. |

| Fund Manager |

Vinay Paharia |

Benchmark Index |

S&P BSE 200 Index |

| Issue Opens |

November 14, 2018 |

Issue Closes: |

November 28, 2018 |

(Source: Scheme Information Document)

What is the Asset Allocation of Union Value Discovery Fund?

Under normal circumstances, the scheme’s asset allocation or asset distribution weight will be as under.

Table 2: UVDF’ Asset Allocation

Instruments |

Indicative Allocation

(% of Total Assets) |

Risk Profile |

| Minimum |

Maximum |

| Equities & Equity related instruments |

65 |

100 |

High |

|

Debt, money market instruments and Cash equivalent

|

0 |

35 |

Medium to Low |

(Source: Scheme Information Document)

The scheme information document also states that:

-

Investment in Securitized Debt - Nil

-

Investments in Derivatives – upto 50% of the net assets of the scheme

-

Investments in Securities Lending – upto 20% of its net assets of the scheme (where not more than 5% of the net assets of the scheme will be deployed in securities lending to any single counterparty).

[Read: Why You Should Not Ignore Personalized Asset Allocation While Investing]

What is the Investment Strategy of the Scheme?

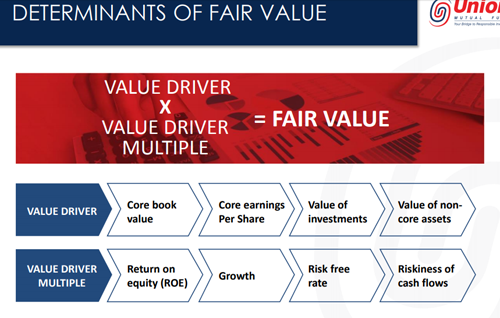

The investment team will follow an active strategy to manage the assets of the fund. Following value style of investing, the investment team shall also scan the market for opportunities based on quantitative ratios like Price to Earnings (P/E), Price to Book Value (P/B), Return on Capital Employed (ROCE), just to name a few; to determine the fair value of the stock as shown below:

Image1: Fair Value Determination

(Source: Union Value Discovery Fund Presentation)

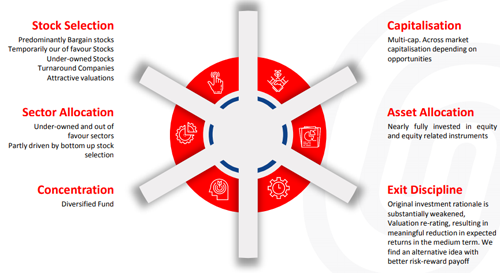

To achieve the objective of value-based capital appreciation the fund house will do analysis to pick stocks across market capitalisation. Also, the fund house states that, “At most times, major portion of the portfolio will be invested in companies with price to current intrinsic value less than that of Nifty”. And explained in its presentation the investment style:

-

Stock selection: based on intrinsic or fair valued stocks based on quantitative ratios.

-

Across market capitalisation: a multi-cap approach for better opportunities.

-

Sector allocation: bottom up approach to tap hidden potential of untapped sectors.

-

Asset allocation: heavy equity investments.

-

Concentrated portfolio: well diversified.

-

Exit strategy: reiterate valuations to ensure that the chosen stock is in-line with the objective, else will drop to choose another fair valued stock.

Image 2: Investment Style

(Source: Union Value Discovery Fund Presentation)

The team shall also evaluate the individual companies on their merits both quantitative and qualitative, leading to the bottom-up investment decision. The fund manager could use derivatives within the permissible limits actively in-addition to hedging and rebalancing the portfolio. The fund manager could also use active cash calls as a means to rebalance or hedge the portfolio up to the permissible limits.

Who will manage Union Value Discovery Fund?

The Scheme will be managed by Mr Vinay Paharia who is the Chief Investment Officer at Union Asset Management Company Pvt. Ltd. He is a Commerce Graduate with MMS to his credit and has around 15 years of experience in Fund Management.

Mr Vinay worked for 2 years with First Global Stockbroking Pvt Ltd as an Equity Research Analyst then joined K R Choksey Shares and Securities Pvt Ltd as an Equity Research Analyst and later was with DBS Cholamandalam AMC as an Equity Research Analyst for a year. Further he worked for more than 11 years at Invesco Asset Management (India) Private Ltd. as Fund Manager of Equity before joining Union Asset Management Company Pvt. Ltd as Chief Investment Officer.

Some of the funds he manages as a Fund Manager and Co-fund Manager includes Union Equity Fund, Union Asset Allocation Fund, Union Small Cap Fund, Union Equity Savings Fund, Union Balanced Advantage Fund, Union Capital Protection Oriented Fund – Series 7 Union Capital Protection Oriented Fund – Series 8.

The Outlook of Union Value Discovery Fund:

Union Value Discovery Fund, as mentioned earlier is a sub-type of equity fund that invests using a value investing strategy like the renowned investors Benjamin Graham and Warren Buffet for capital appreciation.

The rationale of value-based funds is to invest in stocks that are undervalued in terms of price, but possess superior fundamental characteristics. Although the investment approach of Union Value Discovery Fund is to tap value investing opportunities available across sectors and market caps, the performance will be based on how the portfolio is structured and the equity market sentiments. The true test for the fund manager will be in his ability to pick the right stocks at right valuations and steer the fund through the headwinds of the equity markets.

Value funds have the potential to offer decent returns and reward investors in the long run. But make sure you test your risk appetite and suitability before considering this fund for your investment portfolio.

[Read: Why Comparing Returns to Risk Is More Meaningful!]

Editor’s Note:

Believe it or not, unusual and lesser-known funds can generate big gains for you, the investor.

But any small sized fund will not do. After all, you do not want to pick lesser-known funds that have delivered a one-off performance.

If you are risk-taker and do not have the time and skill to do your own research, here’s how you can add some hidden gems to your mutual fund portfolio before the crowd discovers them. Want to know which are these ‘Undiscovered’ funds? Click here to read more…

© Quanutm Information Services Pvt. Ltd. All rights reserved.

Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the permission of PersonalFN is strictly prohibited and shall be deemed to be copyright infringement.

Disclaimer: Quantum Information Services Pvt. Limited (PersonalFN) is not providing any investment advice through this service and, does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. All content and information is provided on an 'As Is' basis by PersonalFN. Information herein is believed to be reliable but PersonalFN does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. PersonalFN and its subsidiaries / affiliates / sponsors or employees, personnel, directors will not be responsible for any direct / indirect loss or liability incurred by the user as a consequence of him or any other person on his behalf taking any investment decisions based on the contents and information provided herein. This is not a specific advisory service to meet the requirements of a specific client. Use of this information is at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. All intellectual property rights emerging from this newsletter are and shall remain with PersonalFN. This is for your personal use and you shall not resell, copy, or redistribute this newsletter or any part of it, or use it for any commercial purpose. The performance data quoted represents past performance and does not guarantee future results. As a condition to accessing PersonalFN's content and website, you agree to our Terms and Conditions of Use, available here.

Quantum Information Services Pvt. Ltd. Regd. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021 Corp. Office: 103, Regent Chambers, 1st Floor, Nariman Point, Mumbai - 400 021. Email: info@personalfn.com CIN: U65990MH1989PTC054667

SEBI-registered Investment Adviser. Registration No. INA000000680, SEBI (Investment Advisers) Regulation, 2013

Add Comments