Conversations in a typical Indian household majorly revolve around food, cricket, and politics. Last Sunday was no different.

It was India v/s Australia and after being 1-0 in a 3 match series with the second match cancelled due to rains, India had to win to level the series or in my fathers’ words “save their honour”.

My father, an ardent cricket fan, invited his “morning walk wale dost” to watch the match, and inadvertently the discussion shifted from the match to their favourite players.

As my father's friends had the control over the TV remote, I could do little else but sit with them and feign enthusiasm about cricket. Amid the cheer of a six-run by Dinesh Karthik, I had an epiphany, the behaviour that my father and his friends exhibit, is similar to their favourite cricketers.

My father, Mr Khude, (60), was like Rahul Dravid - always conservative and averse to taking unnecessary risks. He was content in making less returns as long as he made assured returns.

Mr Sharma, (61) was like Sachin Tendulkar - cautiously aggressive. He wanted both assured return as well as rewards for the risk taken.

Mr Agarwal, (61) was like Virat Kohli, too aggressive & always taking the long shot. He wanted to make money in the long term, and short term losses had no effect on him.

I wondered how differently each of them would handle their retirement and the idea of this case study struck.

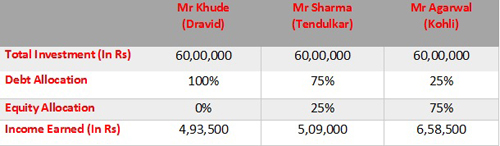

For illustration sake, let’s assume that they are to retire with Rs 60 Lakh each; this is how they would pace their innings.

Table 1: My Father- The Dravidian

My father would stick to assured traditional investments like senior citizen FD, senior citizens saving scheme, POMIS, etc., avenues that provided guaranteed returns and were largely secured. Even if he earned less returns, for him safety of principal is a must, just like Mr Dravids’ strategy of scoring ones and twos instead of getting out attempting a boundary.

So, my dad would be happy to earn Rs 4.93 Lakh assured per annum on an investment of Rs 60 Lakh, rather than take market risks and lose even a penny, even if his own daughter is the advisor!

[Read More: 7 Investment Avenues for Your Post-Retirement Portfolio]

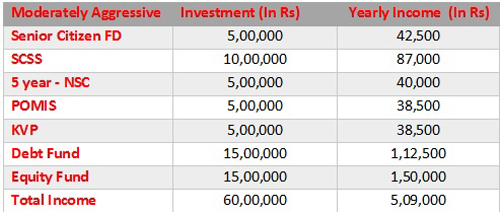

Table 2: Mr Sharma – The Tendulkarite

Note: Return on debt fund assumed @ 7.5%, while return on large-cap equity fund assumed @ 10%

Mr Sharma would go the Sachin Tendulkar way, score boundaries as well as singles. He would split his corpus 50% in assured investments, 25% in low risk debt funds, and 25% in large-cap oriented equity funds. His strategy will ensure a cash-inflow of Rs 5.09 Lakh on an investment of Rs 60 Lakh. In this way, not only would his returns increase, his investments would be diversified as per his risk taking capabilities.

Table 3: Mr Agarwal –The Virat Kohli

Note: Return on debt fund assumed @ 7.5%, while return on equity fund assumed @ 10%

Finally, Mr Agarwal, akin to Virat Kohli in the truest form, “go big or go home”, he always quoted. He would invest 75% of his corpus in equity mutual funds, and the remaining 25% in debt and assured return products. He was adept at absorbing the short term loss, if he would make a good buck in the long term.

A loud cheer brought me back to the present, India had won, saved their honour, and while Krunal Pandya was declared the man of the match, I wondered who the man of the match would be among my father, Mr Agarwal, & Mr Sharma.

Table 4: Dravid vs. Tendulkar vs. Kohli

The answer would be, all of them!

In all my years of being in the investment advisory business, I have realised that investing is a personal thing, and that there is no universal right or wrong. My father, Mr Agarwal, and Mr Sharma are correct in their approach as they have taken into account their risk appetite, and comfort with the risk factor. Therefore, they are content with their earnings.

Having said that, there are some pointers that can be taken from all of them and implemented in our investment planning:

-

Stay disciplined like Tendulkar: There was a time when the master blaster did not score runs. Everyone opined that he should retire, but he didn’t! The markets are in nature volatile, as long as you have good funds and are invested for the long term, market turning negative shouldn’t bother you. Like Sachin, don’t listen to the crowd, have belief in your funds and stay strong.

-

Investments need time – Dravid: Mr Rahul Dravid, aptly nicknamed the “wall” would, at times, take 100 balls to make 10 runs, but that does not mean that he is a bad batsman. In fact, he is simply aware that in a test match, you don’t try to hit boundaries off of every ball. Your investment tenure is like a test match, don’t expect to score 20% CAGR every year, pace your innings.

-

Be Aggressive – Kohli: If you have seen Virat Kohli bat, you would know that even if team India is in a bad spot, he still plays aggressively. When the markets are down, it is the perfect opportunity to add equities to your portfolio. That’s because they are available at attractive P/Es.

So, to conclude, there isn’t an ideal way of investing. Your ideal way might not work for me and vice-a-versa. This is why having a person who understands your unique way and money philosophy helps.

At PersonalFN, we take pride in our ability to understand the requirements and relationship with money of every client and then cater to their specific need. This has been one of the primary reasons for our strong 18+ years of financial planning success.

If you too are looking to work with a financial planner, who cares and understands and will give you and your financial goals the dedicated time and attention that it needs, look no further. Get in touch with PersonalFN’s financial guardian on 022-61361200 or write to info@personalfn.com. You may also fill in this form, and soon our experienced financial planners will reach out to you.

Till then Happy Investing!

Add Comments