In a year that was filled with unexpected events, the only mutual fund category that outperformed all others in 2016 was debt funds. Easing inflation and falling interest rates sparked a rally in the bond markets. By September 2016, long-term debt schemes had already gained 9%-10% absolute from the beginning of the year. But, it didn't just end there. To top it off, the surge in liquidity post-demonetisation, drove yields down further. As the year ended, debt income schemes sat on gains in excess of 12%.

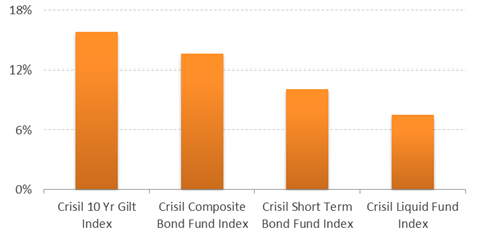

Performance of Debt Fund Indices in 2016

Note: Returns expressed on an absolute basis

(Source: ACE MF, PersonalFN Research)

But do not get taken up by the double-digit returns debt schemes offered, especially at a time when equity returns disappointed investors, as some advisers may try to convince you. Before you fall for the glib talk that interest rates may fall lower, extending the rally of debt schemes, take time to understand the risks involved.

What are the risks?

For those of you who are new to debt schemes, we will start with the basics…

Debt schemes invest in Government securities (G-Secs), corporate bonds, debentures, corporate deposits, commercial paper, etc. These underlying securities earn the scheme a regular interest. So, if a debt scheme invests in interest bearing securities, where does the volatility come from? Well, bonds are traded in the market. Therefore, apart from the interest income, any movement in price may result in a gain or loss for the scheme. This is known as mark-to-market, where the holdings are valued at their most recent market price. We will now look at what can affect the Net Asset Value (NAV) movement of debt funds or in other words, influence the volatility of the scheme.

Direction of interest rates

The movement of interest rates affects bonds prices. To simply put it, let’s say you bought a bond at face value with a coupon rate (interest) of 8%. The coupon of 8% is in line with the interest rate set by RBI. If the benchmark interest rate is reduced to 6%, soon there is a demand for higher interest bearing bonds, and thus the price of your bond increases. The rise in price is to the extent that the yield (compounded annualised return) to maturity of your bond, works out to near about 6%. Similarly, if interest rates rise, the price of your bond will fall.

To keep a vigil on inflation, the RBI as a part of its monetary policy revises interest rates regularly. Therefore, when you invest, you need to have a fair judgement of where interest rates in the economy are headed. If interest rates are on a decline, your debt investments will do well.

Average maturity of the fund

The extent of the rise and fall in bond price is determined by multiple factors. As you may know, all bonds mature after a fixed period. Longer is the years to maturity (or residual maturity) of the bond, the more sensitive it is to interest rate movements. For example, a 1% rise in interest rates may lead to decline of around 4-5% in the price of a bond with a residual maturity of 5 years. However, for a bond with a residual maturity of 10 years, the price may decline by 8%-9%. Clearly, long-term bonds will outperform in a falling interest rate environment. However, if interest rates move uphill, long-term bonds may not only deliver poor returns, but may even lead to a loss of capital when mistimed.

Therefore, unless you are making a tactical allocation to long-term debt funds, you have a longer investment horizon or you are in a scenario where interest rates are likely to fall, it is best to avoid schemes with a longer maturity profile.

Credit Rating of Securities

Since debt schemes also invest in corporate debt, there is a ‘default risk’. Therefore, it is essential to check if your fund is investing in high rate debt securities. Low rated debt securities offer a higher interest rate, but with higher risk. Credit opportunity funds that adopt an accrual strategy benefit from this with an increased credit risk to generate a higher yield. However, schemes that have a high concentration of low quality assets should be avoided. Liquidity too, is a cause of concern in low-rated debt securities. It can get worse if the credit rating deteriorates and the fund manager is unable to sell his holdings.

In the past, JPMorgan India Short Term Income Fund and JPMorgan India Treasury Fund bore the brunt of its corporate debt holding in Amtek Auto. The Amtek Auto security was de-rated to junk status, which led to severe mark-to-market losses for the fund. Due to the lack of buyers, the fund was unable to sell its holding.

So, how should you approach debt schemes?

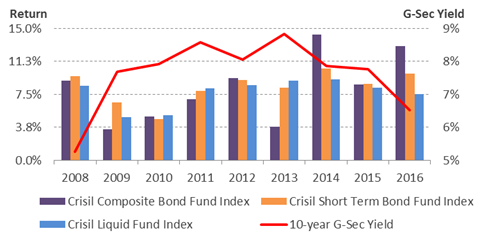

By now, you have understood that debt schemes can be risky. They do not offer guaranteed returns. In the chart below, we’ve compared the returns of the three benchmark debt indices to the movement of yields. Long-term income schemes are benchmarked to the Crisil Composite Bond Fund Index, while short-term schemes and liquid schemes are benchmarked to the Crisil Short Term Bond Fund Index and Crisil Liquid Fund Index respectively.

Performance of benchmark debt indices vis-à-vis G-Sec yield

Note: Returns expressed on an absolute basis

(Source: ACE MF, PersonalFN Research)

As seen in 2009-11 and 2013 – the period of rising rate scenario – the returns of long-term debt schemes suffered the most. However, when yields declined sharply, from around mid-2013 onwards, long-term debt schemes delivered returns in excess of 10%. Returns of liquid schemes and short-term debt schemes were more stable – ranging between 7.5%-9%, except for the period of the global financial crisis, and immediately after.

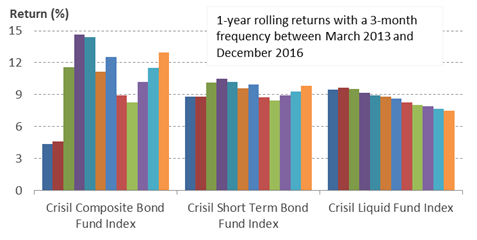

Long-term Debt Investments Are Volatile Over Short Periods

Note: Returns expressed on an absolute basis

(Source: ACE MF, PersonalFN Research)

Debt scheme are no different from any other market-linked investment avenue. Returns are extremely volatile over short time frames. The volatility reduces as your investment horizon increases (See chart above).

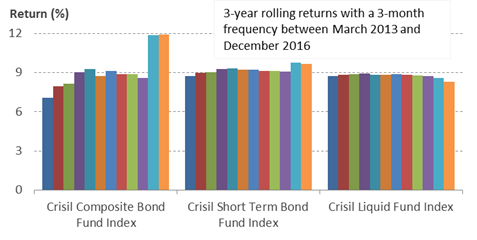

Volatility Reduces Over Longer Holding Periods

Note: Returns expressed on an absolute basis

(Source: ACE MF, PersonalFN Research)

On the other hand, as depicted by the chart above over the long-term, say 3 years, the returns are less volatile, and in case of short-term debt and liquid funds, the returns are more stable.

To conclude…

PersonalFN believes, when you invest in debt funds, top priority should be given to the risk management measures set out in the investment processes and systems followed by the fund house. Then the investment strategy the fund would adopt to build its portfolio to achieve its investment objectives should be carefully read.

If the scheme's investment objective will not address the financial goal(s) you've envisioned, clearly stay away. This will help you have only the appropriate schemes in your portfolio. Before choosing from liquid, short-term, medium-term and/or long-term debt funds, take cognisance of your investment horizon.

You should not invest in a debt scheme solely based on past returns. Pay attention to the quality of debt securities held by the scheme.

PersonalFN's DebtSelect research reports can help you select debt mutual fund schemes prudently and can be valuable guidance in the path to wealth creation. You can be rest assured about the unbiased nature of this service.

Add Comments

| Comments |

surindersinghahuja@ymail.com

Sep 06, 2018

Debt funds volatility comes from interest rate variation. But if papers are held to maturity, the volatility risk disappear. Then why should fund sell in the market if it causes loss.

|

1