Man versus Machine

What do you prefer?

Your answer might depend on the nature of work and anticipated action.

To chop a plank into 100 identical pieces, you might use machines.

But to share your worries, you would prefer to chat with a friend rather than a chatbot, right?

With developments in Artificial Intelligence taking over several industries, including banking, many of us are worried about the “so-called” encroachment of machines in human life.

Humans are perceived to be better than machines where cognitive response is expected.

But to drive in quick results as required and with needed precision, technology has proved to be an enabler. And when both human intervention and technology co-exists, it can do wonders.

Many engineering marvels seen across the world are an outcome of humans and machines working together. In the world of financial engineering and investing, too, today machines (backed by human intellect) are playing the role of an investment adviser.

Yes, you guessed it right; we are talking about robo-investing or robo-advisory platforms.

[Read here: All You Need To Know About Robo-Investing]

Many investors complain that human investment advisers often fail to pay us personal attention. For whatever reasons, human investment advisers take a longer time to respond to queries. And some even make blunders while advising, putting their interest instead of the investor’s at fore.

On the contrary, a robo-adviser backed by human intellect to select best mutual funds for your investment portfolio based on your risk profile, needs, financial goals, and investment time horizon, can do a better job. It is free of human errors and turnaround time to provide you pointed recommendations is far quicker.

But such fantastic robo advisers, too, have critics.

The general tone of resistance is: Personal finance and investing is such a crucial topic, that can’t be ‘outsourced’ to machines. I need someone responsible for handling my investment portfolio. One who can understand my expectations, worries and limitations as well.

But our question: Didn’t you express your unhappiness about human investment advisers as well?

A Robo-adviser is simply a financial adviser who provides automated investment solutions online. A robo-adviser crafts a portfolio and/or engage in financial planning sans human intervention. By determining your risk profile, your asset allocation is charted out and investment recommendations are provided.

[Read: How a Smart Robo-Adviser can Help You Chart Your Asset Allocation]

Unlike human investment advisers, you do not need to fix an appointment. You can use the services of a robo-advisory platform anytime and from anywhere.

You just need to signup, log in to your account, submit the necessary information for risk profiling, and recommendations based on a suitable asset allocation will appear on your screen within a few seconds.

It is for this convenience that robo-advisory platforms are attracting investors across all age groups today. With robo- advisory, your mode of investing can shift from signing and submitting paper forms to merely entering a transaction password.

Moreover, robo-advisory platforms are devoid of behavioural bias and help you track your investment portfolio efficiently and generate automated rebalancing signals for you.

How dependable are Robo-advisory platforms?

Robo-advisory platforms have made sensational debuts and there are many today. But how many of these are rendering valuable advice and added sense in investing, is the core question.

So, here are few questions you must seek answers to:

(Image source: publicdomainpictures.net)

-

Who are the people (founders/promoters) behind the robo-advisory platform and what's their experience in the field of personal finance -- their investment ideologies?

-

What are the services they offer –– whether only mutual fund related or a full-line, viz. financial planning and investment planning among others?

-

What is the technical competence of the team?

-

What are the processes and systems the robo-advisory platform follows to recommend mutual fund schemes?

-

What are the qualitative parameters used, if any?

-

Are they unbiased and independent, or working for commissions?

-

How transparent are they while charging you?

-

What is their track record?

Remember, a robo-advisory platform should put your interest at the fore. After all, you want effective recommendations and efficient service and not just a stylishly designed robo-advisory platform.

In addition, consider this:

Without any doubt, a robo-advisory platform makes your life easy, but that does not mean they will be transparent and more competent than human investment advisers.

Don't forget, machines have no cognitive abilities. It's the human being who feeds them. And the quality of the output depends on the quality of inputs.

Therefore, it is important to judge if a robo-advisory platform offers research-backed recommendations. After all, it is the question of your hard-earned money.

[Read: How To Judge If A Robo-Advisory Platform Is Competent To Offer Sound Advice]

Note that the boom in robo-advisory is attracting many fin-tech startups and mutual fund distributors’ too are launch their robo-investing platforms. But, as a prudent investor, you ought to judge who is really working in your interest.

Apart from research-backed recommendations, if a robo-advisory platform is really looking at your interest first, it should offer only Direct Plan to invest in mutual funds and not Regular Plan.

[Read: Everything You Need To Know About Direct Plan of Mutual Funds]

‘Direct Plans’ facilitate you to invest directly in a mutual fund scheme without routing the transaction via a mutual fund distributor, and is open for all categories of investors. A distinguishing feature about Direct Plan is the lower expense ratio (compared to a Regular Plan).

Hence, the NAV of a Direct Plan is higher than a Regular Plan. And do note that the portfolio is the same for a Direct Plan and for a Regular Plan of a mutual fund scheme.

Some of the benefits of opting for Direct Plans are:

-

You avoid the rampant mis-selling that goes on in the greed to earn more commissions.

-

The cost of investing in a Direct Plan is inexpensive owing to the lower expense ratio.

-

The lower expense ratio facilitates you to earn extra returns over the long run (see chart below).

[Read: How Even 1% Difference In Expense Ratio Can Make A Huge Difference To Your Investments]

Hence, if you wish to reap the sweet fruits of healthier returns with power of compounding, Direct Plans are for you. Both lump sum and SIP (Systematic Investment Plan) investments can be done in a Direct Plan of mutual fund schemes.

Honestly, every investor should opt for a Direct Plan to invest in mutual funds. They are best suited in the journey of wealth creation.

[Read: How To Create A Portfolio Of The Best Mutual Funds With Robo-Investing]

A robo-advisory platforms that offers Direct Plans to invest in mutual funds, work on a fee-based model The recommendations provided are uninfluenced by commisions and, hence, are unbiased; they put your interest at fore.

Finally, PersonalFN’s Ultra-Reliable Robo-Adviser, ‘PersonalFN Direct’, which offers only Direct Plans, is here…

It is backed by PersonalFN’s honest & unbiased research that has outperformed the S&P BSE-200 index in last 15 years by over 80 percent!

We are launching PersonalFN Direct, our highly awaited Robo Adviser, on the July 02, 2018.

You can sign up right away as a Founding Member of PersonalFN Direct and get over 80% discount on the first year subscription fee.

Also, if you take us up on this Founder Member offer right now, we have a special surprise for you.

Click Here to Know The Surprise.

Note that this offer is available till the 14th June or 1,000 sign ups, whichever is earlier. So, hurry and sign up right away!

5 Reasons to opt for PersonalFN Direct:

Reason #1: It offers only DIRECT PLANS

Reason #2: Offers customizable investment solutions based on your risk profiling

Reason #3:It brings outstanding research experience of over 15 years.

Reason #4: Minimal paperwork and ease of transacting

Reason #5:It comes at a pocket-friendly price

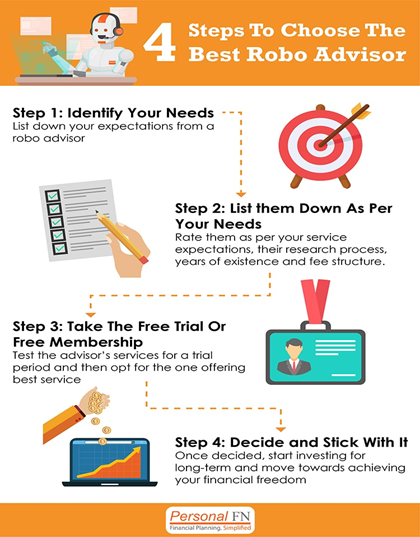

PersonalFN has consciously tried to keep the whole process simple. You just got to follow these simple steps:

✔ Complete the registration

✔ Submit the necessary documents to activate your investment account

✔ Assess your risk profile

✔ Get a recommended portfolio based on your inputs

✔ Invest with a single click

And if this isn’t simple enough, be rest assured that our dedicated representatives will handhold you through the process.

Your long wait for one of the best robo advisory platform will end soon.

So, seize this great opportunity to take your financial journey on a whole new level. Embrace the new financial technology in your life and start investing in an efficient manner.

Happy Investing!

Add Comments