7 Steps to Ensure You Are Investing Right for Your Financial Goals

Ketki Jadhav

Jan 30, 2023 / Reading Time: Approx. 12 mins

My college friends Karan and Gauri, who got married a couple of years back, have several dreams and life goals. Some of the goals that they want to achieve in the next 10 years are:

-

Buy a penthouse

-

Buy an SUV car and a superbike

-

Create an education fund for their daughter's higher education

-

Have an annual international holiday

-

Have a luxurious second inning and many more

However, while discussing their finances and making financial plans towards these goals, they felt it was impossible to achieve them.

If you, too, feel achieving such goals is impossible, you have reached just the right place!

Yes, we have a solution that can help you achieve your financial goals within your target date if you follow the plan well.

We at PersonalFN believe that if you have set S.M.A.R.T. financial goals and are investing in them right, you can achieve them well before time. This article elucidates how to ensure you are investing right for your financial goals.

Before we go any further, get a reality check first!

While your dreams should not have any limits, you must differentiate your goal from your dreams. We all want to be rich, live a luxurious life, and buy everything we wish to have without any financial stress. However, you need to understand that your dreams are not your goals. While being rich and living a luxurious life can be a dream, it cannot be your financial goal.

Here are 7 steps to follow to ensure you are investing right for your financial goals:

1. Set S.M.A.R.T. Financial Goals:

Your financial goals should be Specific, Measurable, Achievable, Realistic, and Time-bound. So, in short, your financial goals should be S.M.A.R.T.

-

Specific (you should be specific and clear about what you want to achieve - I want to buy a car);

-

Measurable (your goal should be measurable so that you can track your progress and know when you have achieved it - the on-road price of the car is Rs 12 lakhs today);

-

Achievable (you should not set your expectations too high. Rather, it is best to know your potential and take small achievable steps - I can contribute Rs 3 lakhs in a lump sum and Rs 25,000 in a monthly SIP);

-

Realistic (know your current financial circumstances and recheck whether your goal is realistic to avoid giving up later - considering the inflation, I can generate adequate corpus with the investment I can comfortably make), and;

-

Time-bound (give your goal a time frame to accomplish so that you do not procrastinate and keep yourself accountable for the outcome - I want to buy the car in the next three years).

Your S.M.A.R.T. goals need not be common, like buying a house and a child's higher education; they can be unique, like opening a beach-side restaurant post-retirement. So, in this case, apart from the common goal of creating a retirement corpus, you also need to make sure you invest an adequate amount for your unique financial goal of opening a restaurant after retirement. The more relevant your goals are, the more you will be motivated to work towards achieving them. But any vagueness around the goals can become an obstacle to achieving them.

2. Prioritise Your Goals:

It will be easier if you have to address one financial goal at a time. However, as discussed, an individual may have to address several financial goals simultaneously. Hence, setting your financial goals right and prioritising them is important. So, creating an education fund for your children's education can be prioritised over an annual international holiday. When prioritising your goals, make sure you check the time frame you have given to the respective goals. This will ensure you have set the goals right and you accomplish them within the target date.

You can classify your financial goals into short-term, medium-term, and long-term goals. So, creating a contingency fund could be your short-term goal, whereas retirement could be your long-term goal. That said, be careful when classifying your goals, as buying a car could be a short-term or medium-term goal for many, but if your goal is to buy a BMW, it cannot be achieved unless you invest a big amount.

Image source: www.freepik.com

Image source: www.freepik.com

Join Now: PersonalFN is now on Telegram. Join FREE Today to get 'Daily Wealth Letter' and Exclusive Updates on Mutual Funds

3. Consider the Inflation:

You might already know that inflation hits your financial plan on multiple counts. Apart from impacting the real returns you will earn on your investments, it also impacts the way you plan your goals. When planning for your long-term financial goals, you should be aware of the cost of achieving the goals. Hence, it is crucial to consider the impact of inflation when planning your long-term goals, making long-term spending plans, and investing towards your long-term financial goals. So, if the inflation rate is 7%, you are required to invest in financial instruments that yield an additional 7% return. Investing in asset classes that have the potential to yield higher returns than the inflation rate, such as productive market-linked instruments like stocks and equity mutual funds, can help you generate inflation-beating returns and create wealth in the long term.

4. Understand the Risk-return Spectrum:

Choosing suitable investment avenues is a crucial step in financial planning. The time in hand to achieve your goals and your risk appetite largely decide how your asset allocation would look like.

It is important to understand that for every return you seek, there is a certain level of risk associated with it. Each asset class, such as equity, debt, real estate, and gold, or the category of mutual fund scheme you choose, comes with a certain level of risk-reward.

Unfortunately, as a country, we love to invest in fixed-income products like bank fixed deposits and recurring deposits, irrespective of the time in hand, to achieve our objectives. While fixed-income products like bank fixed deposits offer guaranteed returns and carry low risk, they generally yield lower returns than the inflation rate. Hence, it does not make sense to invest in such investment avenues for the long term. On the other hand, while market-linked financial instruments like stocks and equity mutual funds have the potential to generate inflation-adjusted returns and create wealth in the long term, they carry higher risks. However, in order to diversify the risk, you can consider allocating a small portion of your investment to safer financial instruments.

5. Understand Your Risk Profile:

Since all the asset classes and mutual fund schemes carry some investment risk, your investments should always be aligned with your risk appetite and its suitability to your financial goals. Hence, it is best to first understand your risk profile and the suitability of the investment avenue for your financial goal, then choose the suitable one.

Risk profiling determines your capacity and willingness to take a risk. It can be measured by considering various factors, such as your age, investment objective, time horizon, and knowledge of financial products, among others. Therefore, your investment decisions should not be based merely on the potential returns, and it is crucial to weigh your risk appetite against the risk involved in the respective investment avenue. Analysing your risk appetite and choosing the right asset classes based on your risk profile is an important step to ensure you are investing right for your financial goals.

6. Select the Right Mutual Funds:

As we understand from step number 4, investing in carefully selected rewarding mutual funds will help you achieve your goals as planned and create wealth in the long term. Understand that each category of mutual fund scheme has a distinct place on the risk-reward spectrum.

Source: PersonalFN Research

Source: PersonalFN Research

As shown in the above pyramid, large-cap funds are relatively stable and carry lower risk compared to their peers, but at the same time, sacrifice the return potential. Similarly, liquid funds carry low risk, whereas small and mid-cap funds are at the higher end of the risk-return spectrum.

When selecting the best-suited mutual funds, it is crucial to analyse several qualitative and quantitative factors. The qualitative factors include portfolio quality, fund management style, fund manager's experience, funds-to-fund manager ratio, portfolio ratios and concentration, turnover ratio, investment systems and processes at the fund house, assets under management, and so on. Whereas the quantitative parameters include the past performance of the scheme and risk-adjusted returns, among others.

7. Start Early:

The Systematic Investment Plan (SIP) route of mutual fund investment, with its sheer power of compounding and rupee cost averaging, makes the best choice for novice as well as seasoned investors to build a corpus steadily and generate inflation-beating returns over time. You can accomplish your envisioned goals by simply creating an SIP towards each of them.

The returns you fetch on your accrued returns are referred to as compounding of returns. These returns are calculated using the XIRR method, and it can help small investors grow and accumulate decent wealth in the long run.

To get the maximum benefit from the power of compounding, you need to start investing early so that you have more years in hand to compound your wealth. You can calculate compounded returns through SIP with the help of sophisticated and easy-to-use SIP calculators available on several financial websites. Remember, the earlier you start investing through SIP and the longer your stay invested, the higher will be your potential returns from compounding.

Final Thoughts:

Following these steps will ensure you are investing right for your financial goals. However, at PersonalFN, we understand that not everyone can have the expertise to do the required exercise and choose the best-suited mutual fund schemes. Many times, investors avoid investing in market-linked financial instruments due to the lack of market knowledge and struggle to deal with market volatility.

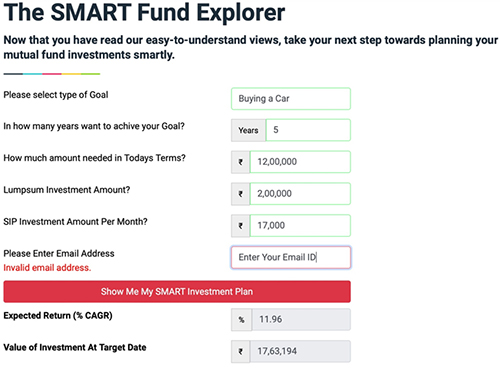

But now, PersonalFN's SMART Fund Explorer can help you achieve your objectives with a smartly done mutual fund investment.

All you need to do is state your S.M.A.R.T. financial goals (such as buying a house, child's education, retirement, etc.), determine the time in hand to achieve your goal (such as 5 years, 10 years, etc.), insert the amount you need in today's terms towards achieving your goal, and the lump sum and/or SIP investment you can afford to make. Once you enter all the required details, tap on "Show Me My SMART Investment Plan".

This is how the SMART Fund Explorer will look like after you have entered the details:

As you scroll down, you will see the two best-suited mutual fund investment plans (Plan A and Plan B) offered by SMART Fund Explorer. The plans specifically show the fund categories you should invest in, the asset allocation percentage, potential returns of each category, and weighted annual return contribution. You can choose any of the plans based on your risk appetite.

Moreover, you can get instant access to the list of best-suitable mutual fund schemes as per your selected plan by signing up for PersonalFN's SMART Fund Explorer. The list of smartly selected and recommended mutual funds by our research team will serve as an opportunity to begin your mutual fund investment journey smartly.

Happy investing!

KETKI JADHAV is a Content Writer at PersonalFN since August 2021. She is an MBA (Finance) and has over seven years of experience in Retail Banking. Ketki specialises in covering articles around banking, insurance, personal finance, and mutual funds and has been doing it for over three years now.