Top 5 Equity Mutual Funds with Low Expense Ratios in 2025

Mitali Dhoke

Mar 17, 2025 / Reading Time: Approx. 7 mins

Listen to Top 5 Equity Mutual Funds with Low Expense Ratios in 2025

00:00

00:00

Mutual fund investors look at return, the expertise of the fund manager, and the past performance of a scheme before investing. Yet, the one crucial consideration should not be overlooked is the expense ratio.

In these uncertain times, the expense ratio of mutual funds is something worth monitoring if one aims for steady returns. The expense ratio is defined as the portion of a fund's total assets dedicated to fund management, such as administrative fees, fund manager fees, and other charges.

Though this cost appears insignificant, it has a direct effect on your net returns, particularly in times of market uncertainty when each basis point matters. Funds that have a higher expense ratio need to beat their benchmark by a greater percentage to offset their expense, something that may be difficult during times of increased uncertainty.

[Read: Why Best Expense Ratio Matters When Investing in Mutual Funds]

Knowledge of this cost structure can make a big difference in your overall returns. This article discusses what an expense ratio is, how it is calculated, why it matters, and lists five equity mutual funds with the lowest expense ratios in the active funds category.

What is Expense Ratio in Mutual Funds?

Expense Ratio is the annual fee charged by the mutual fund company to manage your investments. It is expressed as a percentage of the fund's average Assets Under Management (AUM).

For example, if a mutual fund has an expense ratio of 1.2%, it means that Rs 1.20 will be deducted annually for every Rs 100 invested in the fund. This fee is automatically adjusted in the fund's Net Asset Value (NAV), meaning investors don't pay it separately.

How is Expense Ratio Calculated?

The calculation formula for the expense ratio is:

Expense Ratio=Total Expenses /Average AUM)* 100

To understand how this calculation works, consider the following example:

Suppose a mutual fund incurs total annual expenses of Rs 5 crore and has an average AUM (Assets Under Management) of Rs 500 crore during the same period. Using the formula:

(5 crore/500 crore) * 100 = 1%

This means that for every Rs 100 invested, Rs 1 is deducted annually as the fund's expense.

SEBI's Role in Capping Expense Ratios

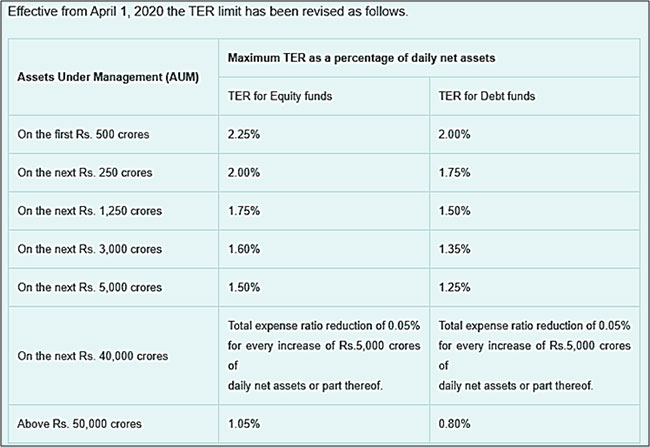

The Securities and Exchange Board of India (SEBI) brought out new guidelines on the Total Expense Ratio (TER) of mutual funds, applicable from April 1, 2020. The guidelines aimed to introduce more transparency and fairness in investor expenses. SEBI put a ceiling on the highest expense ratio chargeable by fund houses based on their Assets Under Management (AUM). The aim was to make sure that as the corpus of a fund increases, investors get benefited with lower costs.

Data as of March 17, 2025

Data as of March 17, 2025

(Source: AMFI)

According to SEBI's mandate, equity-oriented schemes can have a maximum TER of 2.25% for the initial Rs 500 crore of AUM. For larger AUM slabs, the allowed TER gradually decreases.

This regulatory move has increased cost competitiveness among mutual funds. Investors are now better placed to compare funds not only on the basis of performance but also by considering cost efficiency.

Why does Expense Ratio Matter In Mutual Funds Amid Volatility?

The expense ratio directly impacts your investment returns. Funds with higher expense ratios may need to outperform their peers to deliver similar net returns. A lower expense ratio ensures that more of your returns stay invested and grow over time.

In an unpredictable market, choosing funds with a smaller expense ratio can assist investors in keeping more of their profits. Actively managed funds, which tend to come with higher costs, can find it difficult to beat the market consistently during periods of volatility.

On the other hand, passive offerings such as index funds or ETFs, whose expense ratios are typically lower, are a thrifty option during such situations. If one examines the expense ratio along with the fund performance and risk profile, he/she is better equipped to make rational investment decisions based on personal financial needs without incurring additional unwanted charges amid uncertain times of market fluctuation.

[Read: Direct vs Regular Plan: Can Expense Ratio Make Significant Difference to Your Mutual Fund Returns?]

Though it is a common practice to pursue high returns, shrewd investors realize that cost control with low expense ratios is also crucial. Even a 1% variation in expense ratio over a period of time can result in lakhs of rupees in terms of foregone returns, highlighting the importance of cost-effectiveness.

We have given a list of five actively managed equity mutual funds that have some of the lowest expense ratios in the equity fund space. These are cost-effective ways to get exposure to core indices and growth industries.

Top 5 Equity Mutual Funds with Low Expense Ratios

Data as on March 17, 2025

Past performance does not guarantee future results

The securities quoted are for illustration purpose and not recommendatory

(Source: ACE MF, data collated by PersonalFN Research)

1. Tata Small Cap Fund

With its comparatively low TER in the direct plan, this fund is an affordable option for investors who want exposure to small-cap stocks. As small-cap funds are themselves volatile, a lower expense ratio makes a positive difference in net returns, especially during a market fall. The higher TER of the regular plan, on the other hand, can erode returns in the long run.

2. Franklin India Multi Cap Fund

As a multi-cap fund, this scheme actively invests across large, mid, and small-cap stocks. While the direct plan's TER of 0.31% is relatively low, the regular plan's 1.83% is on the higher side compared to the industry TER limits. During volatile phases, minimizing expenses in a multi-cap fund can cushion returns, making the direct plan preferable for cost-conscious investors.

3. ITI Flexi Cap Fund

The flexi-cap segment provides choice to switch between market caps. Although the TER of the direct plan is substantially below the industry threshold, the 2.03% fee in the regular plan comes close to the top of the category for actively managed equity schemes. During turbulent markets, these higher charges can deduct from returns if the fund does not consistently beat its category average.

4. ITI Mid Cap Fund

Mid-cap funds by nature involve greater risk, and in turbulent markets, reducing costs is essential. The direct plan's 0.17% TER is a remarkable cost-saving measure, but the regular plan's 2.06% TER is high, which could have a dramatic effect on returns in uncertain times. Investors need to determine whether the fund's growth prospects can be worth this high cost.

5. ITI Multi Cap Fund

Like Franklin's multi-cap fund, the direct plan of the ITI Multi Cap Fund has a modest TER of 0.25%, which keeps cost leakages low. But 2.01% for the regular plan is higher comparatively and will expect consistent performance to cover up for the cost.

In conclusion, during uncertain market phases, investors may benefit by choosing direct plans with lower TERs to maximize returns. Funds with higher regular plan TERs may need to demonstrate superior performance to offset these costs. In volatile times, prioritizing lower-cost schemes can significantly improve long-term wealth creation.

As you build your portfolio, always analyse the expense ratio alongside other parameters such as fund performance, consistency, and risk factors to make informed investment decisions.

We are on Telegram! Join thousands of like-minded investors and our editors right now.

MITALI DHOKE is a Research Analyst at PersonalFN. She is an MBA (Finance) and a post-graduate in commerce (M. Com). She focuses primarily on covering articles around mutual funds including NFOs, financial planning and fixed-income products. Mitali holds an overall experience of 4 years in the financial services industry.

She also actively contributes towards content creation for PersonalFN’s social media platforms in the endeavour to educate investors and enhance their financial knowledge.

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

This article is for information purposes only and is not meant to influence your investment decisions. It should not be treated as a mutual fund recommendation or advice to make an investment decision in the above-mentioned schemes.