Bank FD v/s Small Savings Schemes: Which One is a Better Choice?

Listen to Bank FD v/s Small Savings Schemes: Which One is a Better Choice?

00:00

00:00

I would like to reiterate this view and point out that the interest earned on bank fixed deposits is taxable under Income Tax Act. However, you cannot deny there are few good reasons to invest in a bank fixed deposit, the fixed assured returns, serves as a contingency reserve and offers a safety of principal.

[Read: Factors To Look At While Investing In Bank FDs]

But ever since the Reserve Bank of India has been consecutively slashing rates and retaining its stance on the monetary policy as "accommodative as long as it is necessary to revive growth and mitigate the impact of COVID-19 on the economy while ensuring that inflation remains within the target.", it is disheartening for risk-averse investors and senior citizens.

[Read: How to Protect Against the Downside Risk as the COVID-19 Booster Package Has Failed To Excite the Markets]

Table 1: Series of policy rate cuts in 2019-20 to address growth concerns

| Month |

Repo Policy Rate |

Policy rate cut (Basis points) |

Monetary Policy Stance |

| Feb-19 |

6.25% |

25 |

Neutral |

| Apr-19 |

6.00% |

25 |

Neutral |

| Jun-19 |

5.75% |

25 |

Accommodative |

| Aug-19 |

5.40% |

35 |

Accommodative |

| Oct-19 |

5.15% |

25 |

Accommodative |

| Dec-19 |

5.15% |

Status quo |

Accommodative |

| Feb-20 |

5.15% |

Status quo |

Accommodative |

| Mar-20 (an exceptional off cycle meeting) |

4.40% |

75 |

Accommodative |

| May-20 (an exceptional 2nd off cycle meeting) |

4.00% |

40 |

Accommodative |

| Total |

|

250 |

|

Data as of May 22, 2020

(Source: RBI)

For years banks 'remained sticky' to not lose out on fixed deposits; eventually, they gave in and are seamlessly and effectively passing it on to investors. Some of the leading banks like the SBI slashed its interest rates on term deposits.

So the finance ministry was reluctant to reduce rates since then because it holds the view that it offers better returns to senior citizens, who have most of their savings parked in bank FDs. Furthermore, it will help in infusing more funds in the economy and enable the government to avoid market borrowings.

Image by USA-Reiseblogger from Pixabay

Hence for the April to June 2020 quarter, the finance ministry decided to cut interest rates, except on savings deposits and for the current quarter, they have decided to retain it.

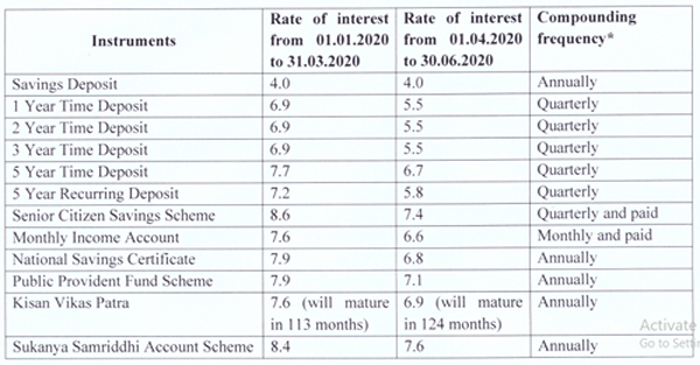

Table 2: Revised Interest rates on small saving schemes.

(Source: Department Of Economic Affairs)

However note that despite the reduction in rates, they are relatively higher than fixed deposit rates offered by various public and private sector banks as seen below.

Table 3: Term Deposit (FD) rates applicable for deposits below Rs 2 crore

| Banks |

FD Interest Rate (per annum) |

Senior Citizen FD Interest Rate (per annum) |

| Public Sector Banks |

| State Bank of India |

2.90% - 5.40% |

3.40% - 6.20% |

| Punjab National Bank |

3.25% - 5.40% |

4.00% - 6.15% |

| Bank of Baroda |

2.90% - 5.30% |

3.40% - 6.30% |

| Canara Bank |

3.50% - 5.45% |

3.50% - 5.95% |

| Bank of India |

3.50% - 5.55% |

3.50% - 6.30% |

| Private Banks |

| ICICI Bank |

2.75% -5.50% |

3.25% - 6.30% |

| HDFC Bank |

2.75% - 5.50% |

3.25% - 6.25% |

| Axis Bank |

3.25% - 5.75% |

3.25% - 6.25% |

| Kotak Mahindra Bank |

3.00% - 4.50% |

3.50% - 5.00% |

| IDFC First Bank |

4.00% - 7.25% |

4.50% - 7.75% |

Interest rate range for tenure of 7-45 days to 5-10 years

All figures in % per annum

(Source: Respective Bank website)

Besides, the higher interest rates offered, some of the small savings schemes are potent investment avenues for tax saving purpose as well. Senior Citizen Savings Scheme (SCSS), National Saving Certificate (NSC), and Public Provident Fund offer tax benefits under Income Tax Act.

Keep in mind that interest on the above mentioned schemes are on the downward trend in line with RBI's rate cut, but they still offer higher returns than Bank FDs. These schemes are backed by the government and, therefore, are deemed low-risk investments. You can consider investing in it to safeguard your deposit and generate regular income.

As an investor, before investing, consider your own requirements, risk profile, and investment returns linked to the investment avenue. Be mindful of what you choose.

[Read: Make Mindful Choices of Mutual Fund investments in Current times]

PS: Want to invest in top-rate mutual funds that can grow your wealth? Subscribe to PersonalFN's unbiased premium research service, FundSelect. At PersonalFN, we arrive at top rated funds using our SMART Score Model. If you are serious about investing in a rewarding mutual fund scheme, try it now! Additionally, as a bonus, you will get access to PersonalFN's popular debt mutual fund service, DebtSelect.

Warm Regards,

Aditi Murkute

Senior Writer

Join Now: PersonalFN is now on Telegram. Join FREE Today to get ‘Daily Wealth Letter’ and Exclusive Updates on Mutual Funds